Fast Credit Repair In 30 Days

Credit scores are crucial for financial stability. Many people seek rapid solutions to improve their creditworthiness.

This article examines the promises and realities of "fast credit repair," specifically the claim of achieving significant results in just 30 days. It will analyze what's fact, fiction, and the potential pitfalls involved.

The Allure of Quick Fixes

The promise of fast credit repair preys on financial anxieties. Companies marketing these services suggest they can swiftly remove negative items and boost scores within a month.

But is this achievable? And more importantly, is it legitimate?

Understanding Credit Repair Basics

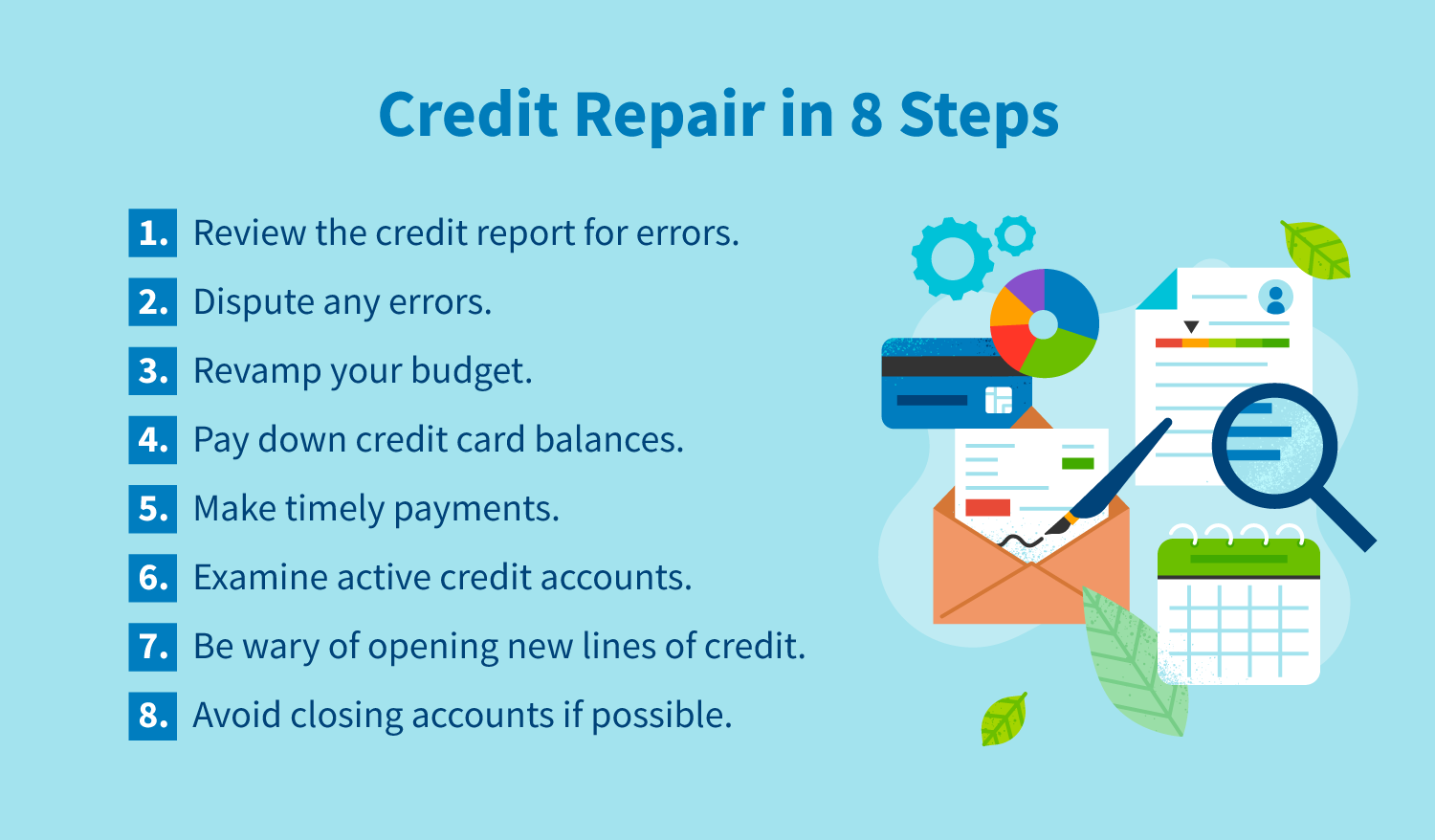

Credit repair fundamentally involves challenging inaccurate, outdated, or unverifiable information on your credit reports. This process is governed by the Fair Credit Reporting Act (FCRA).

Under the FCRA, you have the right to dispute errors with the credit bureaus: Equifax, Experian, and TransUnion. They are then obligated to investigate and correct any proven inaccuracies.

What Can Be Disputed?

Legitimate disputes can include accounts that aren't yours due to identity theft. It can also be debt amounts that are incorrect or accounts reported beyond the statute of limitations.

Disputing accurate, verifiable negative information will not result in its removal.

The 30-Day Myth: Reality Check

While the credit bureaus typically have 30 days to investigate a dispute, this doesn't guarantee resolution in that timeframe. Complex cases might take longer.

Moreover, even if an error is corrected, the impact on your credit score isn't immediate. Credit scoring models consider various factors beyond just the presence or absence of negative items.

Therefore, promising significant credit score improvement in 30 days is often misleading.

The Dangers of "Fast Credit Repair" Companies

Many companies offering "fast credit repair" employ questionable tactics. These can include submitting generic dispute letters without tailoring them to your specific situation.

Some even encourage you to dispute accurate information, which is unethical and potentially illegal.

The Federal Trade Commission (FTC) has cracked down on numerous fraudulent credit repair companies. The FTC has sued companies for charging upfront fees, which is illegal under the Credit Repair Organizations Act (CROA).

Self-Repair vs. Hiring a Company

You have the right to repair your credit yourself, free of charge. You can obtain your credit reports from AnnualCreditReport.com.

Carefully review your reports and identify any inaccuracies. Then, file disputes directly with the credit bureaus.

The Role of Credit Counseling

If you're struggling with debt management, consider seeking guidance from a reputable credit counseling agency. These agencies can offer budget advice and debt management plans.

Look for non-profit organizations affiliated with the National Foundation for Credit Counseling (NFCC).

Beware of These Red Flags

Be wary of companies that demand upfront fees before performing any services. Also avoid companies that guarantee specific score increases.

Do not trust companies that advise you to create a new credit identity by obtaining an Employer Identification Number (EIN) from the IRS.

Finally, avoid those that instruct you to withhold information from creditors or the credit bureaus.

Real Credit Improvement: A Long-Term Strategy

True credit improvement requires a sustained effort. Focus on paying your bills on time, keeping your credit utilization low, and avoiding new debt.

These steps have a tangible impact on your credit score over time.

Legal Recourse for Victims of Fraud

If you've been a victim of a fraudulent credit repair scheme, report it to the FTC and your state's Attorney General. You may also have legal recourse under the Credit Repair Organizations Act.

Further Investigation

The FTC continues to monitor and prosecute companies engaged in deceptive credit repair practices. Consumers are advised to remain vigilant and informed.

The key takeaway is that genuine credit repair is a marathon, not a sprint. Be wary of any company promising instant results.

Next steps involve thoroughly researching any credit repair service before engaging. Consider seeking advice from a qualified financial advisor.