Federal Home Loan Bank Of Des Moines Rates

The Federal Home Loan Bank of Des Moines (FHLB Des Moines) has announced significant adjustments to its advance rates, impacting member institutions and potentially influencing mortgage markets across its district.

These changes, effective immediately, alter the cost and availability of funding for banks, credit unions, and other financial institutions, ultimately affecting borrowers and the housing sector.

Immediate Rate Adjustments

FHLB Des Moines' decision reflects ongoing shifts in the broader economic landscape, particularly in response to persistent inflation and the Federal Reserve's monetary policy tightening.

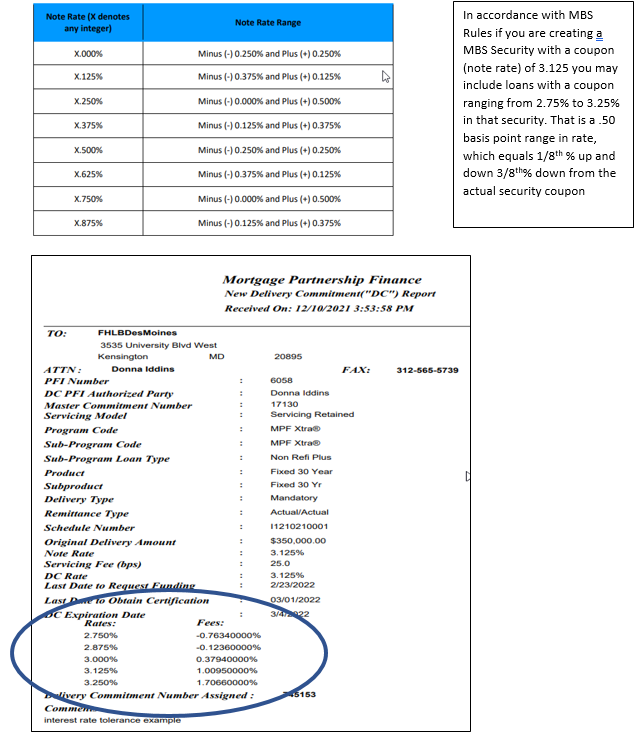

The specific changes target both short-term and long-term advances, with rate increases ranging from 10 to 50 basis points depending on the type and maturity of the advance.

Details of the Rate Changes

Specific Advance Types Impacted: The rate adjustments directly affect advances secured by residential mortgages, commercial real estate, and agricultural loans.

Short-term advances, frequently used for liquidity management, experienced a more pronounced rate hike to discourage excessive borrowing in a high-inflation environment.

Longer-term advances, crucial for funding mortgage origination, also saw increases, potentially raising mortgage rates for consumers.

Impact on Member Institutions: Member banks and credit unions are facing increased funding costs, which may translate into higher interest rates on loans offered to their customers.

This could lead to a slowdown in lending activity and a cooling effect on the housing market as borrowing becomes more expensive.

Institutions with a higher reliance on FHLB advances will feel the impact more acutely, potentially requiring them to re-evaluate their lending strategies.

Statements from FHLB Des Moines

"These rate adjustments are a necessary response to the current economic conditions and are intended to ensure the long-term stability and effectiveness of the FHLB Des Moines,"stated a bank spokesperson in a press release.

The bank emphasized its commitment to supporting its members while maintaining its financial soundness in a volatile market.

The announcement also included assurances that the FHLB Des Moines will continue to monitor economic developments and adjust its policies accordingly.

Regional Economic Implications

The FHLB Des Moines serves a district encompassing several Midwestern states, including Iowa, Minnesota, Missouri, North Dakota, and South Dakota.

The rate changes will have a disproportionate effect on these regions, influencing local housing markets and overall economic activity.

Agricultural lending, a significant component of the region's economy, could also be affected, potentially impacting farmers' access to capital.

Mortgage Rate Impact

While not a direct correlation, the increased cost of funds for lenders borrowing from FHLB Des Moines will likely put upward pressure on mortgage rates.

Prospective homebuyers may face higher monthly payments, reducing affordability and potentially dampening demand in the housing market.

Refinancing activity may also slow down as higher rates make it less attractive for homeowners to refinance existing mortgages.

What's Next

Member institutions are actively assessing the impact of these rate changes on their operations and developing strategies to mitigate any adverse effects.

FHLB Des Moines will continue to monitor market conditions and communicate any further adjustments to its policies.

Borrowers are advised to consult with their lenders to understand how these changes may affect their loan options and borrowing costs.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PQNS43RMVZEPDFI7BY5YWNQH7Q.png)