Fico Score For Citibank Credit Card

Citibank credit card holders are increasingly focused on understanding how their FICO Scores impact their financial well-being and credit card terms. A growing demand for transparency has led to heightened scrutiny regarding how Citibank provides and utilizes this crucial information.

The ability to access and understand your FICO Score has become an essential tool for consumers aiming to manage their credit effectively. This article delves into Citibank's policies and practices regarding FICO Scores, exploring accessibility, usage, and the impact on cardholder experience, ultimately providing clarity for those seeking to navigate the intricacies of credit management with Citibank.

Accessing Your FICO Score with Citibank

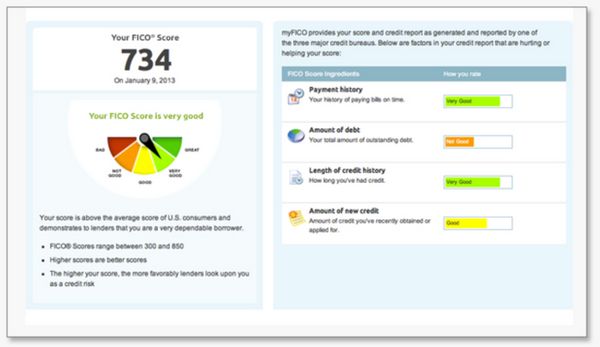

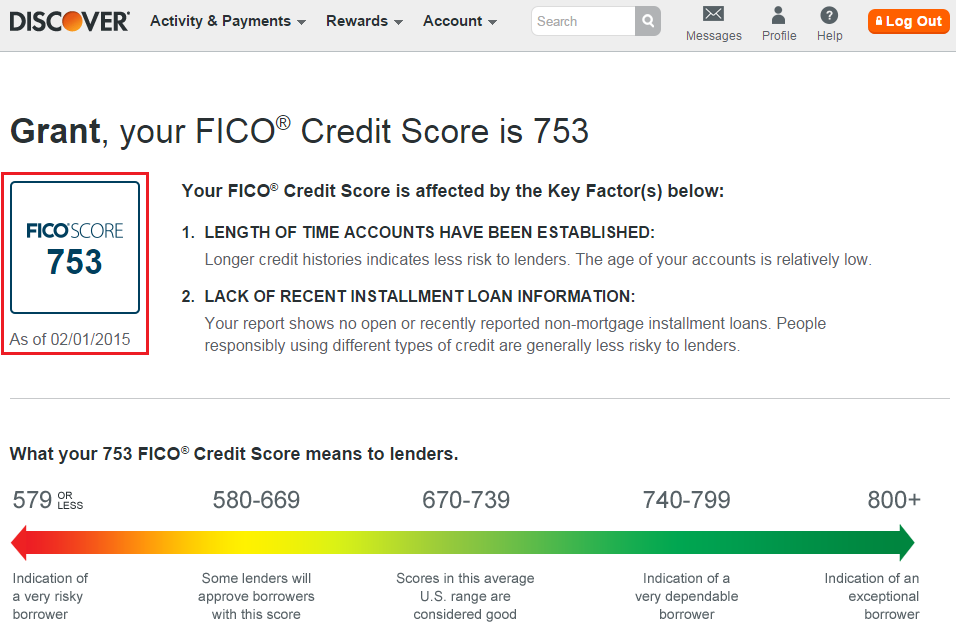

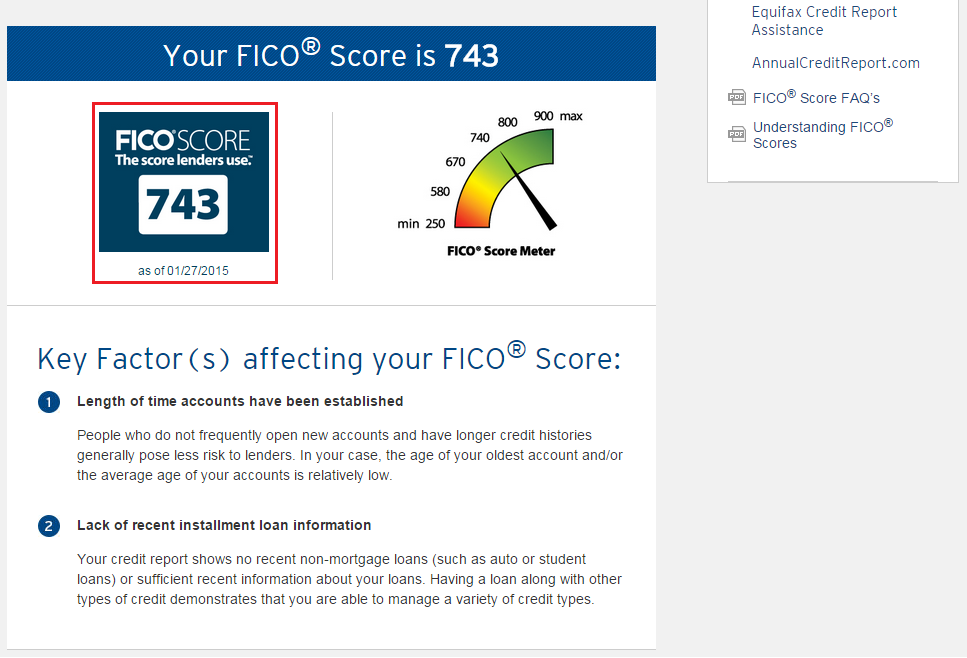

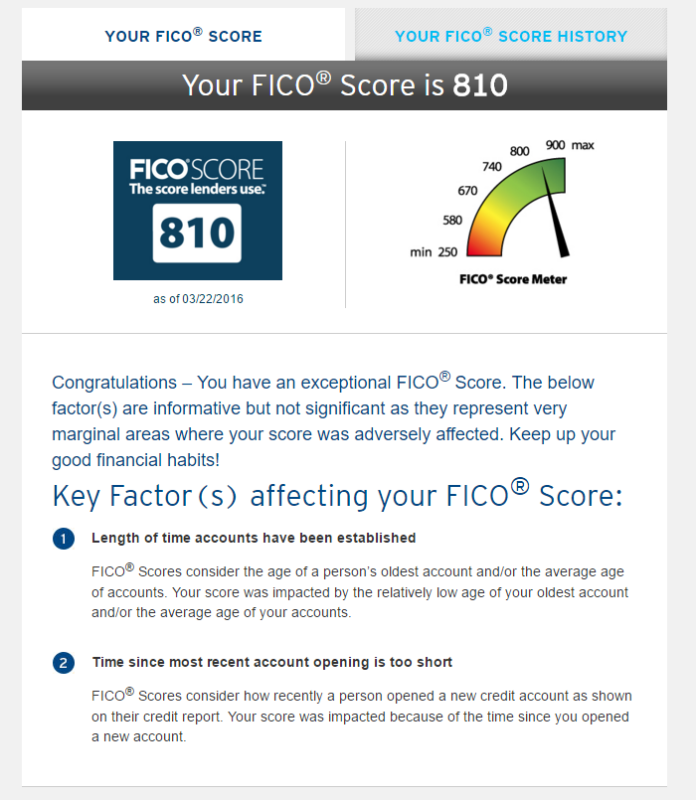

Citibank, like many major credit card issuers, provides cardholders with access to their FICO Score as a complimentary benefit. This service is typically offered through Citibank's online portal or mobile app, allowing customers to easily monitor their creditworthiness.

The FICO Score provided by Citibank is usually updated monthly, offering a consistent snapshot of a cardholder's credit health. The specific FICO Score version used by Citibank may vary, but it's generally a widely used model like the FICO Score 8.

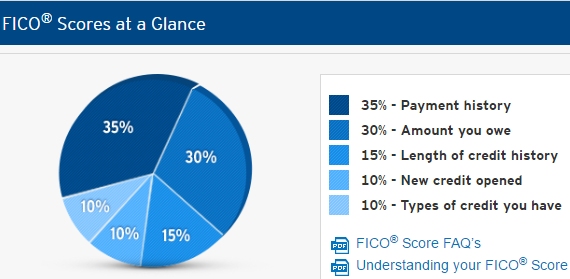

How Citibank Uses Your FICO Score

Citibank utilizes FICO Scores for various purposes, primarily in managing and assessing risk associated with its credit card portfolio. These scores play a significant role in decisions ranging from credit line increases to interest rate adjustments.

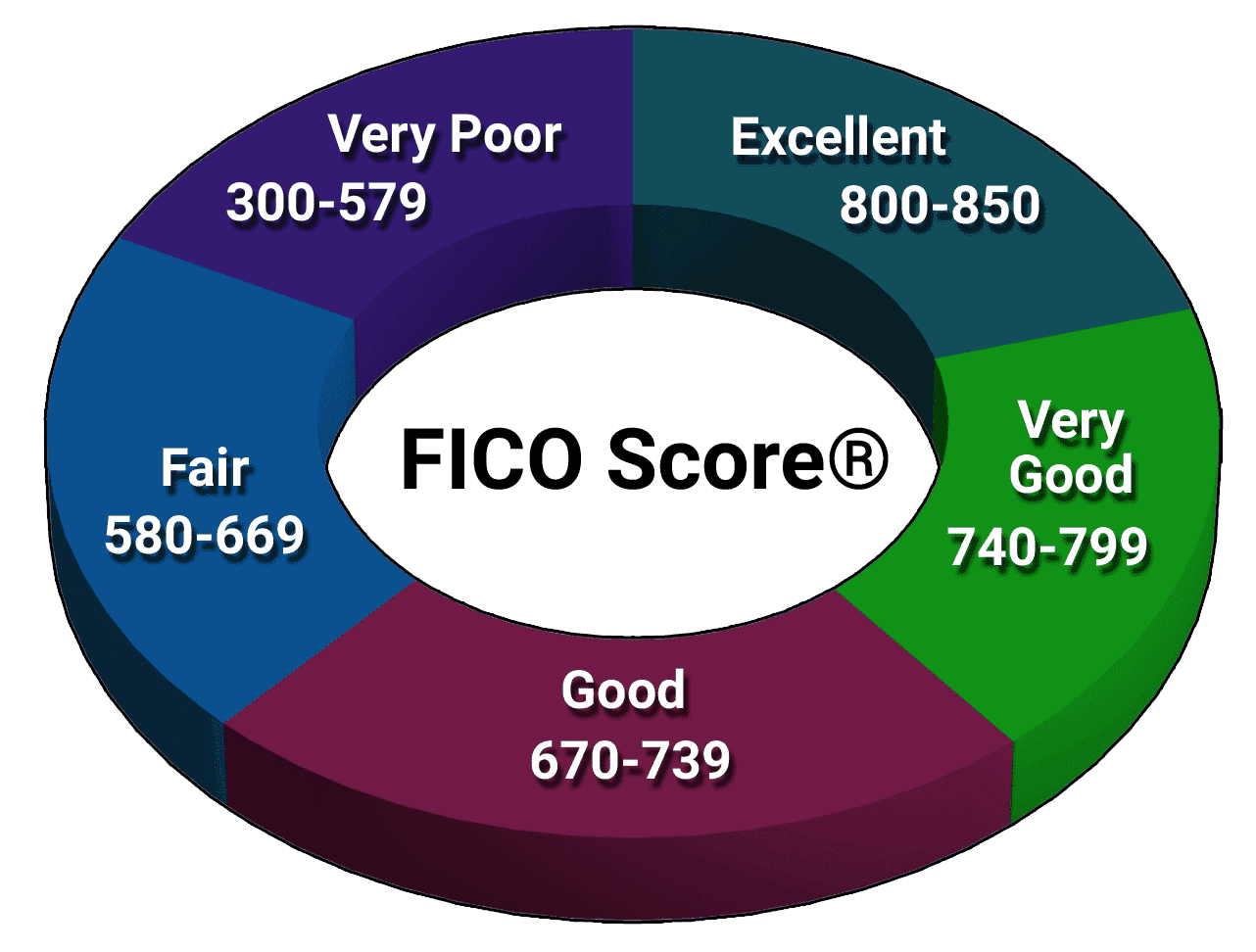

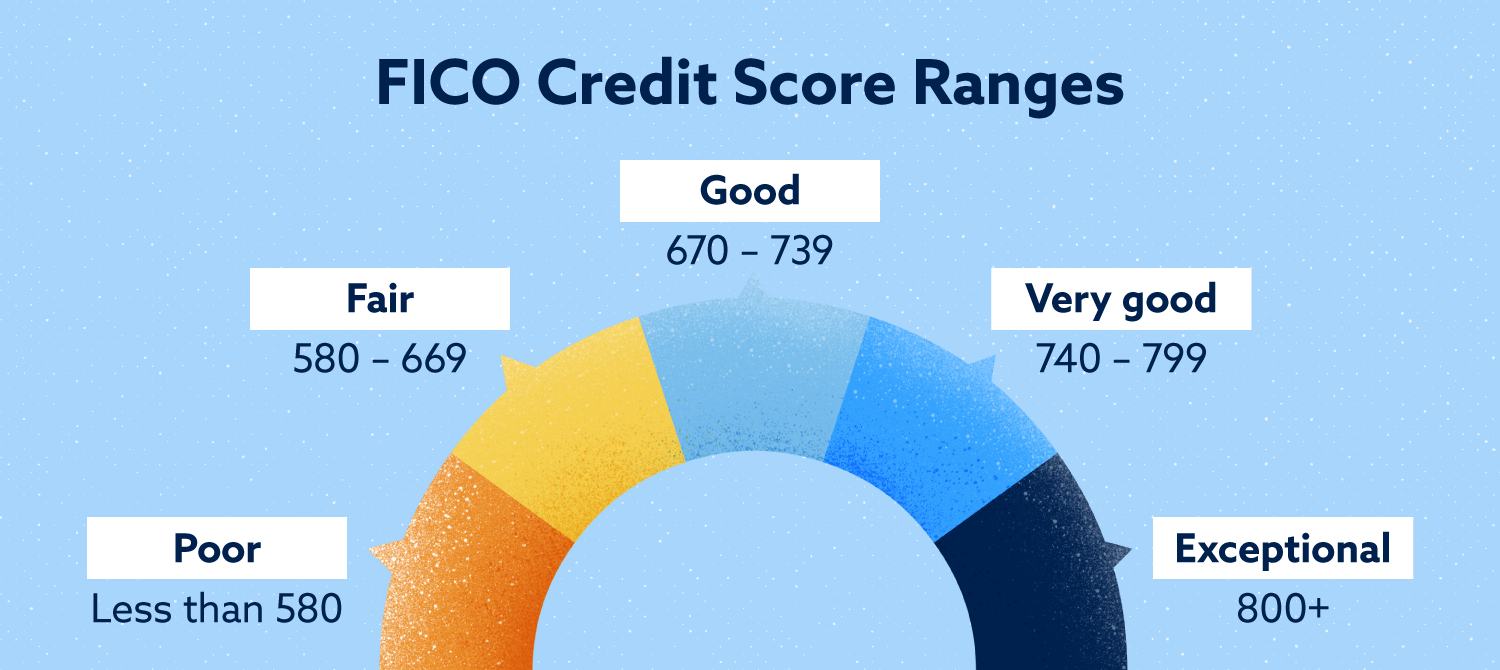

A higher FICO Score generally indicates lower risk, potentially leading to more favorable terms and offers. Conversely, a lower score could result in higher interest rates or a limited credit line.

It's important to remember that while FICO Score influences these decisions, it isn't the sole factor. Citibank also considers other elements such as income, payment history, and overall credit utilization.

Impact on Cardholder Experience

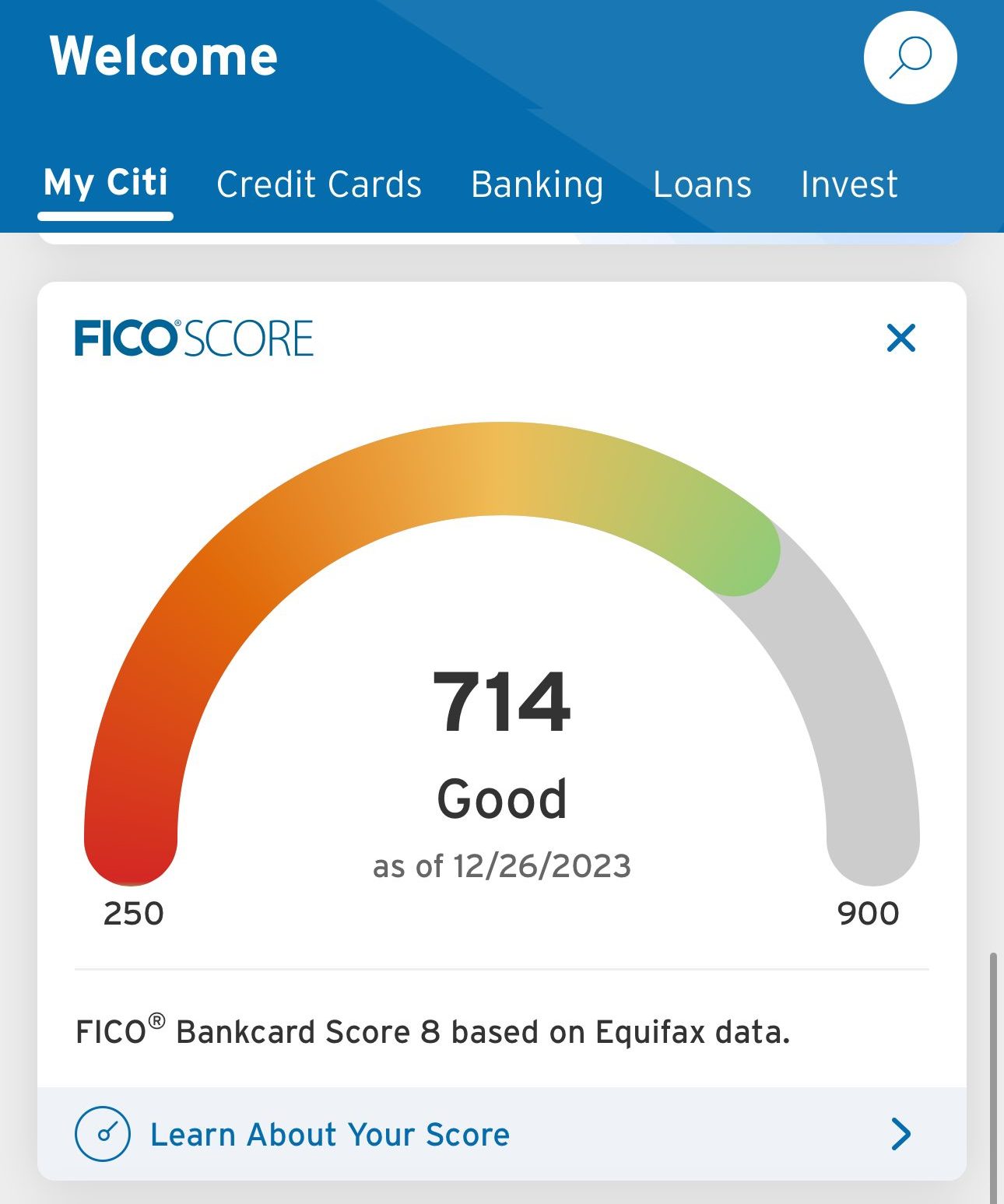

The availability of free FICO Scores has significantly enhanced the cardholder experience. Customers can proactively monitor their credit health, identify potential issues, and take steps to improve their scores.

Understanding the factors that influence their FICO Score empowers cardholders to make informed financial decisions. This knowledge can lead to better credit management and improved financial well-being.

However, some users express concerns about the score’s accuracy or its relevance to specific lending decisions. It's essential to remember that the FICO Score provided is an estimate, and individual lenders may use different scoring models.

Transparency and Disclosure

Citibank is generally transparent about its use of FICO Scores, providing information on its website and through customer service channels. Cardholders can typically find details about the FICO Score version used and how it's calculated.

However, some consumer advocacy groups have called for even greater transparency. They advocate for clearer explanations of how FICO Scores impact specific credit card terms and conditions.

The Consumer Financial Protection Bureau (CFPB) has also emphasized the importance of credit score transparency, encouraging lenders to provide clear and accurate information to consumers.

Expert Perspectives

According to Ted Rossman, a senior industry analyst at CreditCards.com, providing free access to FICO Scores is a valuable service for consumers. "It’s a great way to keep tabs on your credit and potentially catch errors," Rossman states.

John Ulzheimer, a credit expert and former employee of FICO, notes that understanding your FICO Score is crucial, but it's also essential to understand the underlying factors that influence it. "Knowing your score is just the first step," Ulzheimer explains. "You need to know why your score is what it is."

Looking Ahead

The trend toward greater FICO Score transparency is likely to continue. As consumers become more financially savvy, they will increasingly demand clear and accessible information about their creditworthiness.

Citibank and other credit card issuers will need to adapt to these evolving expectations. This may involve providing more detailed explanations of how FICO Scores are used and offering personalized advice on improving credit health.

Ultimately, empowering consumers with knowledge about their FICO Scores benefits both cardholders and lenders. It promotes responsible credit management and helps to build a more transparent and equitable financial system.

![Fico Score For Citibank Credit Card Guide to Credit Monitoring From Credit Card Companies [2024]](https://upgradedpoints.com/wp-content/uploads/2024/08/Citi-FICO-score.png?auto=webp&disable=upscale&width=1200)