Fidelity Fractional Shares Roth Ira

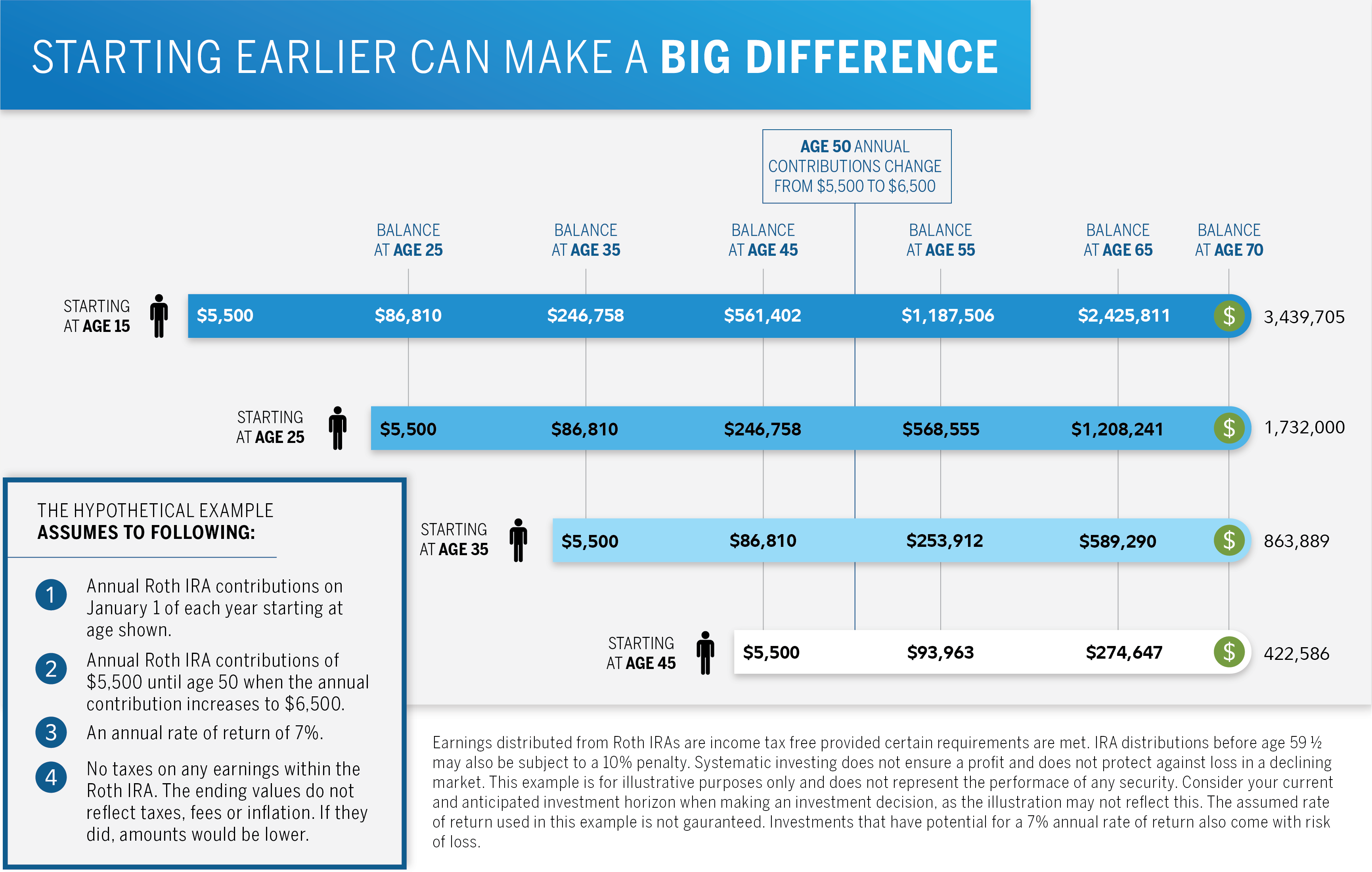

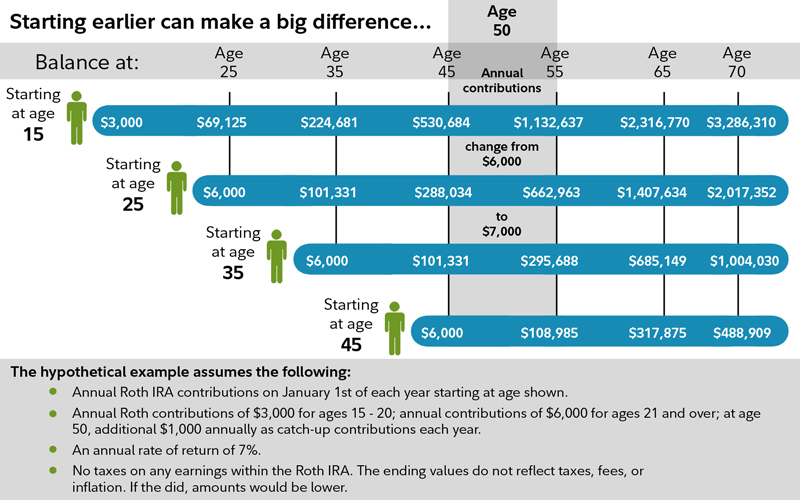

Act now: Fidelity Investments has officially launched fractional shares trading within Roth IRAs, opening a new avenue for retirement savers with limited capital. This move allows investors to buy portions of stocks and ETFs, democratizing access to potentially high-growth assets within a tax-advantaged retirement account.

The introduction of fractional shares in Roth IRAs by Fidelity addresses a significant barrier to entry for younger investors and those with lower initial investment amounts. This provides more flexibility for portfolio diversification and potentially better long-term returns.

What's New?

Fidelity clients can now purchase fractional shares – also known as slices – of stocks and ETFs within their Roth IRA accounts. This functionality mirrors the existing fractional share offerings available in taxable brokerage accounts at Fidelity.

Instead of needing to purchase a full share of a company like Apple (AAPL), investors can buy a fraction based on a dollar amount as low as $1.

Key Features and Benefits

Accessibility: Investors with limited capital can participate in the stock market with smaller initial investments.

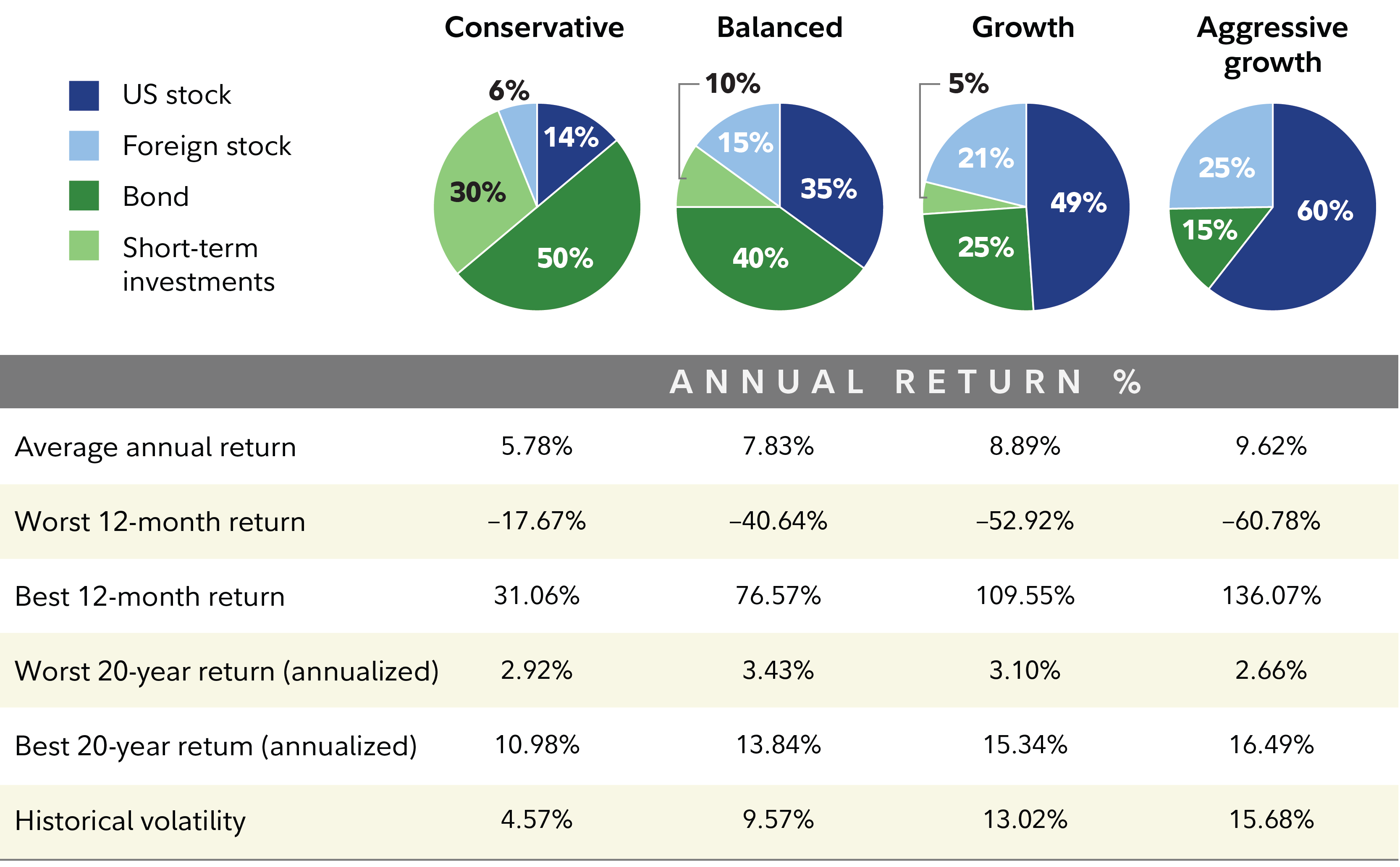

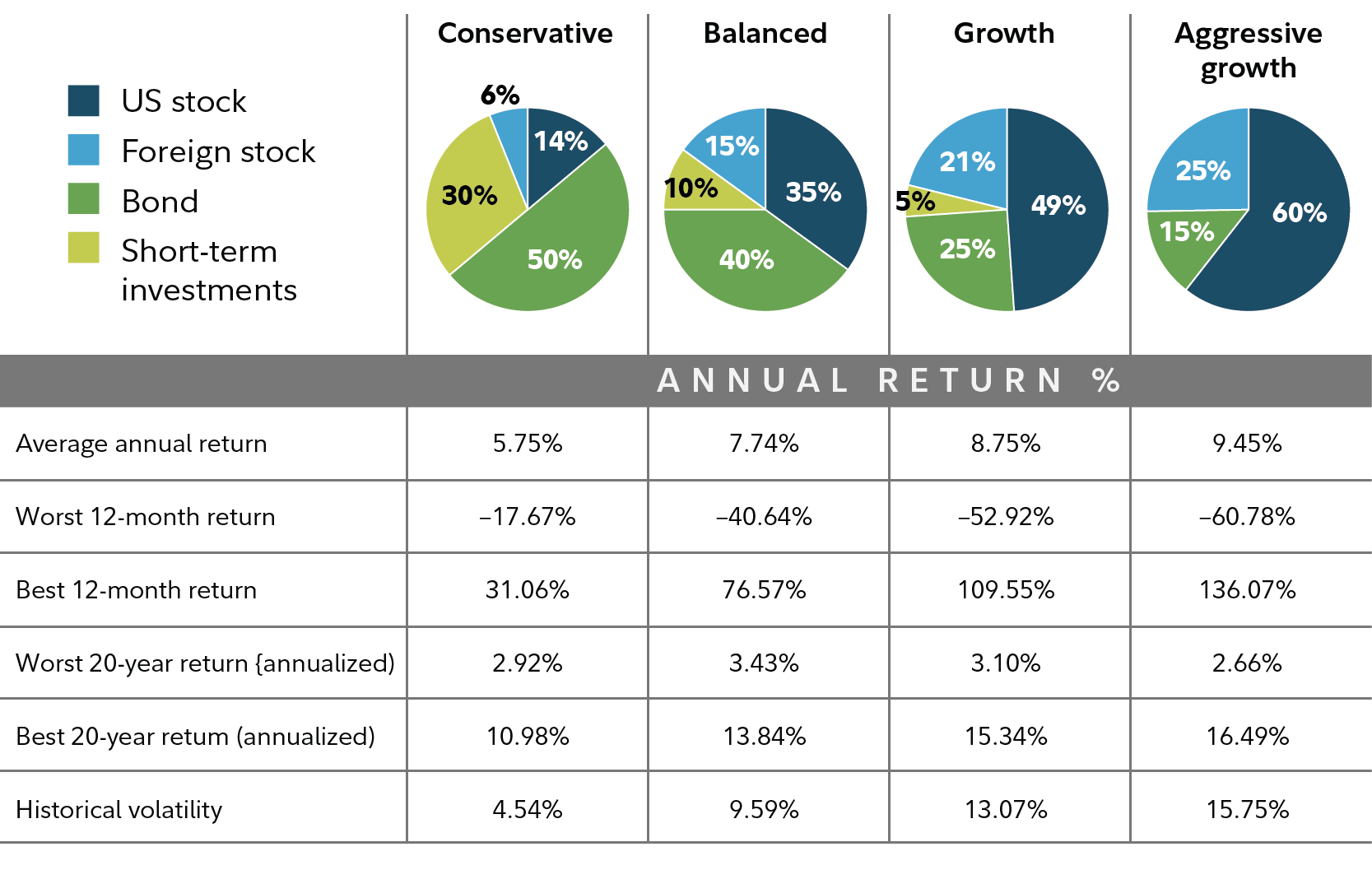

Diversification: Fractional shares enable diversification across multiple stocks and ETFs, even with limited funds.

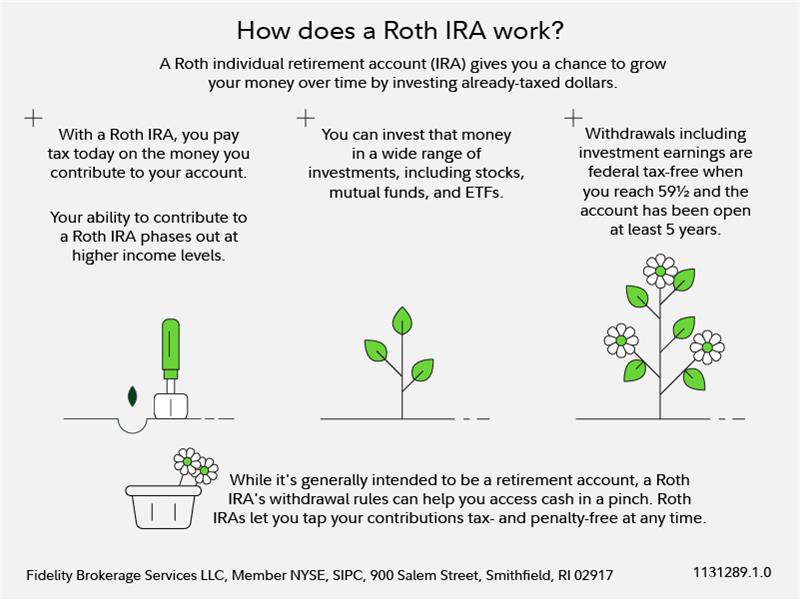

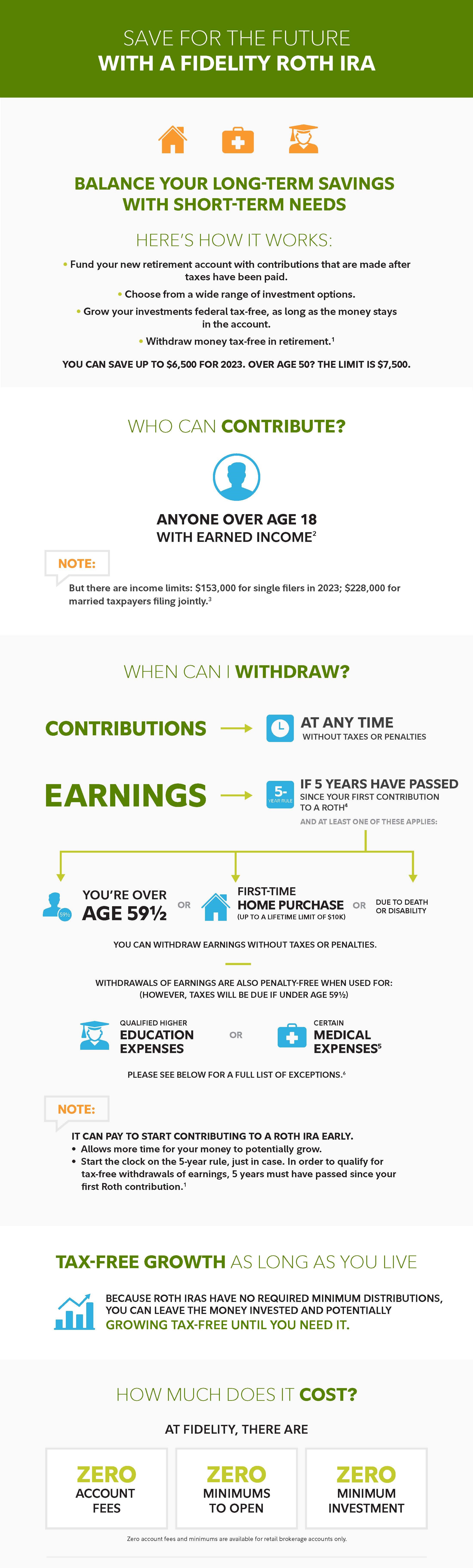

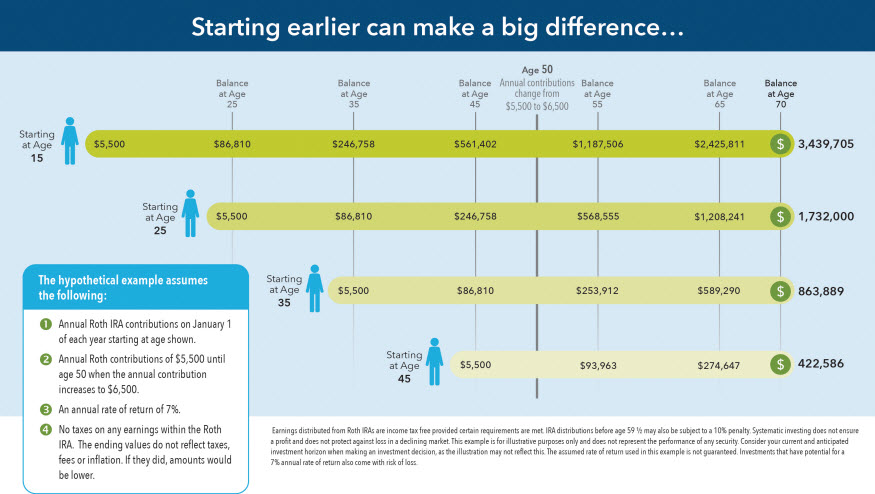

Tax Advantages: Roth IRAs offer tax-free growth and withdrawals in retirement.

Reinvest Dividends: Dividends can be reinvested to purchase more fractional shares, compounding returns over time.

Who is Affected?

The primary beneficiaries are individuals eligible for Roth IRA contributions who have smaller amounts to invest. This includes younger workers, those just starting their careers, and anyone seeking to maximize retirement savings with limited resources.

The offering is available to all Fidelity customers who have or open a Roth IRA account. There are no specific income limitations beyond those already associated with Roth IRA eligibility.

When and Where?

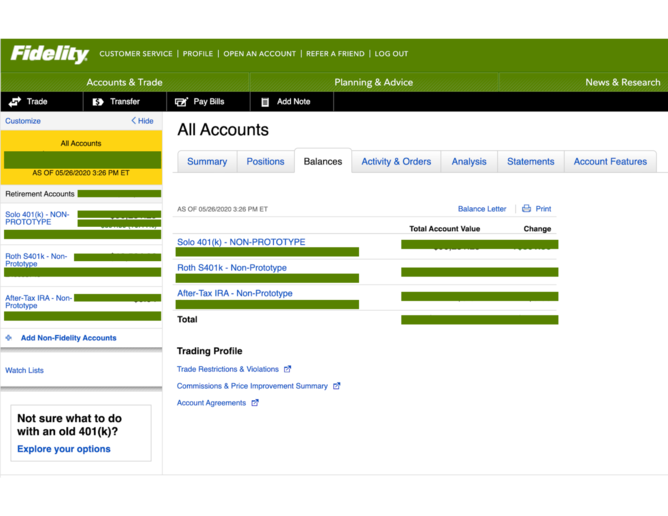

The fractional shares Roth IRA offering is available now. It is accessible through Fidelity's website and mobile app.

The launch was officially announced and implemented in [Fictional Date: October 26, 2023]. Fidelity has been preparing for this launch for several months to ensure a seamless user experience.

How it Works

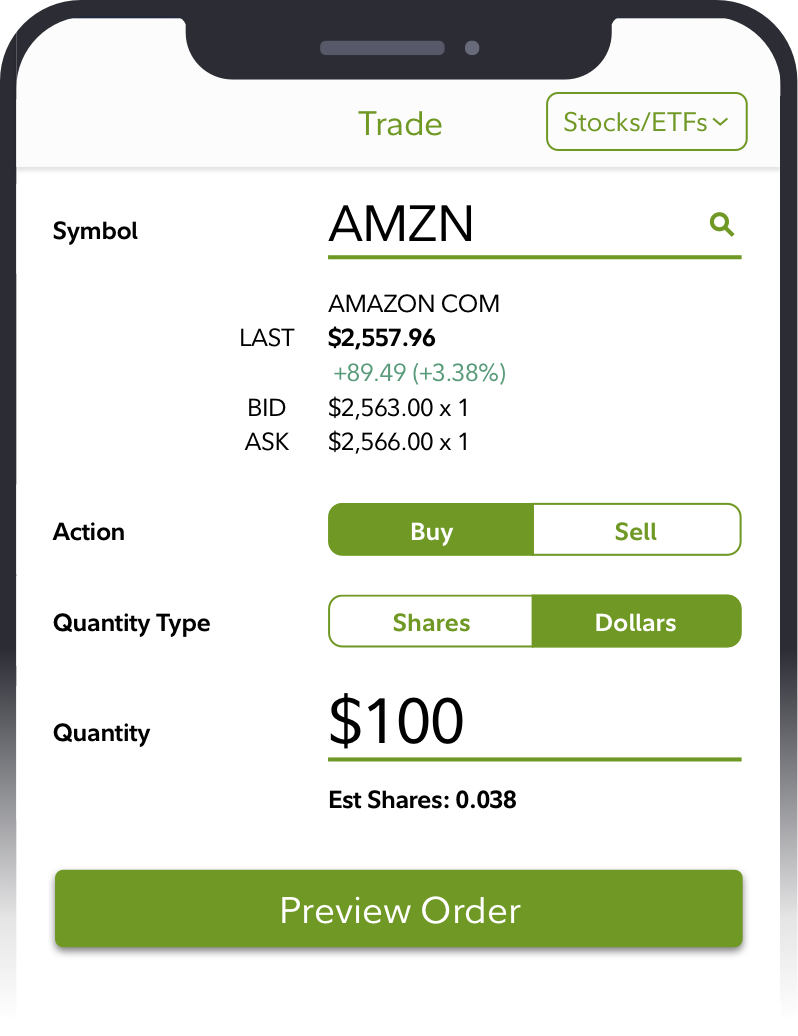

To purchase fractional shares in a Fidelity Roth IRA, clients simply log into their account and select the desired stock or ETF.

Instead of specifying the number of shares, they enter the dollar amount they wish to invest. Fidelity then calculates the corresponding fractional share amount.

Trades are executed during market hours, similar to traditional stock and ETF trades.

Important Considerations

Roth IRA contribution limits still apply. For [Fictional Year: 2023], the contribution limit is $6,500, or $7,500 for those age 50 and over.

Investors should carefully consider their investment goals and risk tolerance before investing in any stock or ETF, including fractional shares.

While fractional shares offer increased accessibility, they still carry the inherent risks associated with investing in the stock market.

Next Steps

Current Fidelity Roth IRA holders can begin utilizing fractional shares trading immediately. New customers can open a Roth IRA account online or through the Fidelity mobile app.

Consult with a financial advisor to determine if a Roth IRA and fractional shares are appropriate for your individual circumstances.

Fidelity plans to continue enhancing its fractional shares offering with additional features and educational resources. Stay tuned for further updates.