File Recovery Rebate Credit Turbotax

Taxpayers who used certain TurboTax products and were misled into paying for services that should have been free may be eligible for a payment from the File Recovery Rebate Credit program. The program stems from a 2022 settlement with all 50 states and the District of Columbia following investigations into Intuit's marketing practices.

This program aims to compensate those who were unfairly charged for tax filing services they were entitled to receive for free through the IRS Free File Program. The key point is understanding who qualifies, how to claim the rebate, and the potential impact on affected taxpayers.

The File Recovery Rebate Credit is available to eligible individuals who paid to file their federal income taxes using TurboTax for tax years 2016, 2017, and 2018. Eligibility criteria focuses on income levels: specifically, those who qualified for the IRS Free File Program but were instead directed to paid products.

Typically, this involved having an adjusted gross income (AGI) at or below a certain threshold, which varied by year. The specific AGI limits can be found on the IRS website for those tax years, but generally targeted low-to-moderate income filers.

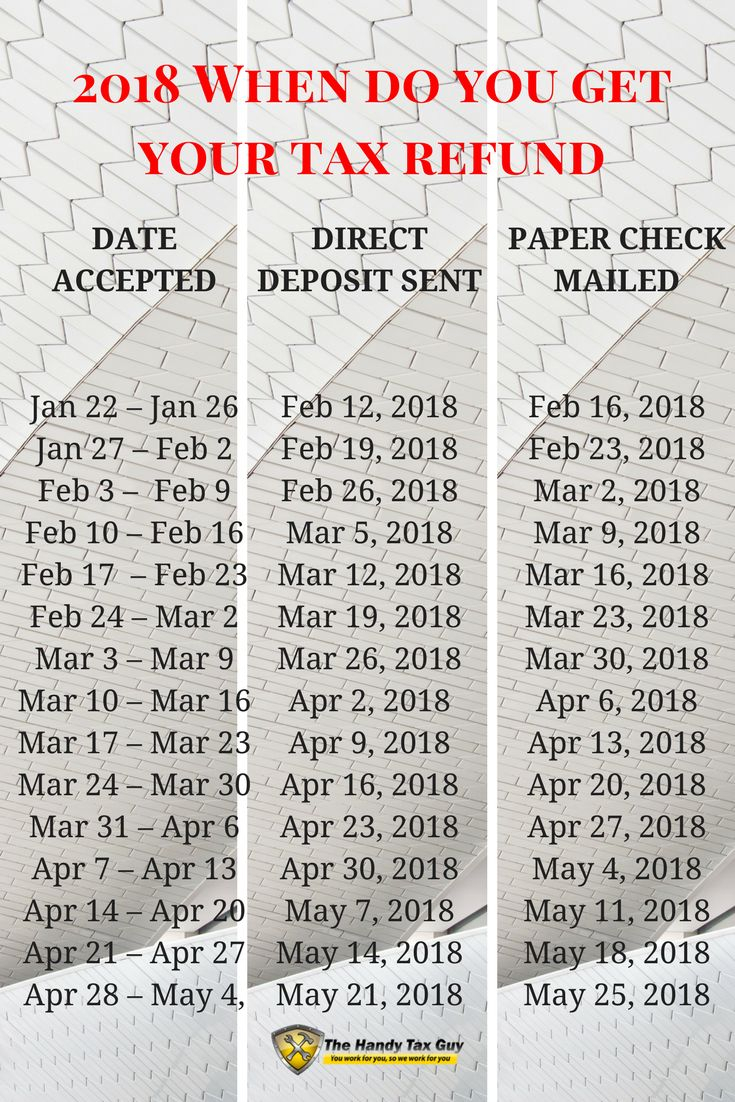

Checks are being distributed automatically to eligible individuals. This means that, in most cases, no action is required from recipients to receive their payment.

The payments are being sent by mail, and the amount varies depending on the number of tax years for which a person is eligible. The average payment is expected to be around $30, but some individuals may receive more or less depending on their specific circumstances.

The distribution process is being managed by a third-party administrator under the supervision of the state attorneys general who were involved in the settlement. They are using data provided by Intuit to identify and contact eligible taxpayers.

While most eligible individuals are receiving payments automatically, it's important to be aware of potential scams. Official communications about the File Recovery Rebate Credit will never ask for sensitive personal information like bank account details or Social Security numbers over the phone or via email.

If you receive a suspicious communication regarding the rebate, contact your state attorney general's office to verify its authenticity. You can also find information on the Federal Trade Commission's (FTC) website about avoiding scams.

The File Recovery Rebate Credit is significant because it represents a form of restitution for consumers who were misled. Intuit, the maker of TurboTax, was accused of using deceptive tactics to steer users away from the free filing options they were entitled to.

The settlement and subsequent rebate program highlight the importance of transparency and fair practices in the tax preparation industry. It also serves as a reminder that consumers have rights and recourse when companies engage in misleading or deceptive behavior.

Beyond the individual payments, the settlement also requires Intuit to reform its marketing practices. This includes being more transparent about the availability of free filing options and avoiding deceptive advertising.

The reforms are designed to prevent similar situations from occurring in the future. They aim to ensure that eligible taxpayers are aware of and can easily access the free tax filing services they deserve.

For those who believe they may be eligible but haven't received a payment, it's advisable to check the official settlement website. While direct claims are not possible, the website might provide additional information and resources.

The File Recovery Rebate Credit program offers a measure of justice for taxpayers affected by Intuit’s past practices. It also underscores the importance of consumer protection and ethical business conduct in the tax preparation market.

Ultimately, this situation serves as a reminder to all taxpayers to carefully research their options and understand their rights when filing their taxes. Be sure to explore all available free filing resources before paying for tax preparation software or services.