Finance To Purchase An Existing Business

Urgent action is needed as funding opportunities dwindle. Entrepreneurs face mounting pressure to secure financing for existing business acquisitions before rates climb further.

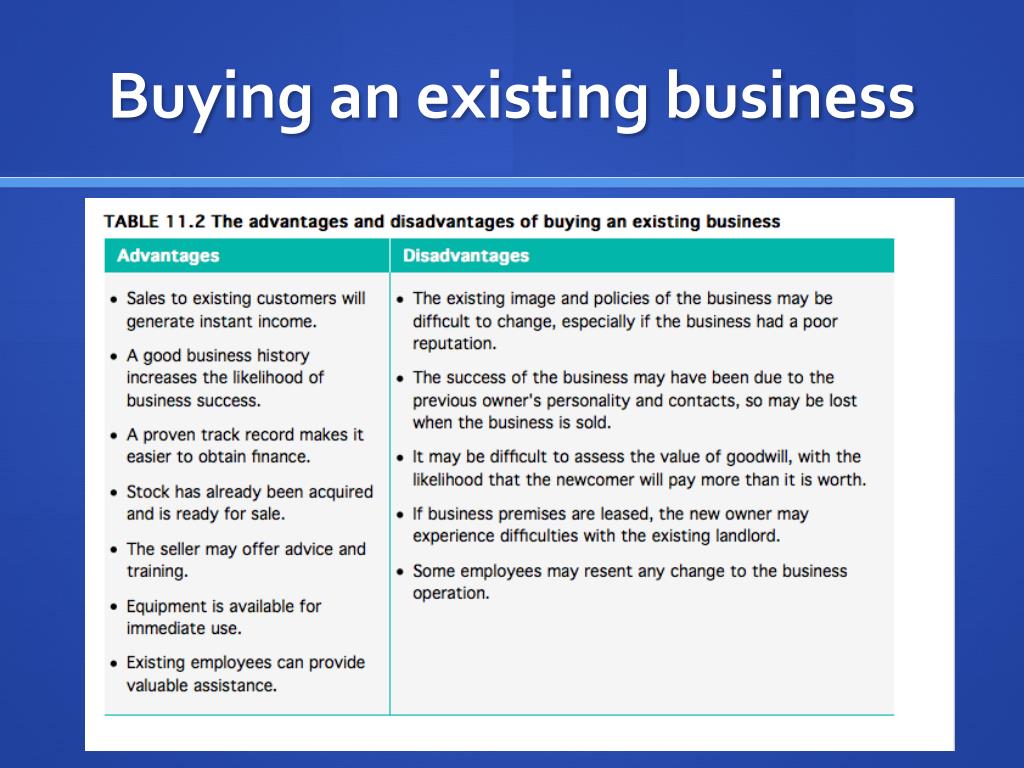

Acquiring an existing business presents immediate revenue potential but requires navigating complex financial landscapes. Securing sufficient capital is now a race against time due to evolving economic headwinds.

Funding Options Face Scrutiny

Traditional bank loans remain a primary source, yet approvals are tightening. Lenders demand rigorous due diligence and substantial collateral. SBA loans, particularly the 7(a) program, offer government-backed guarantees, attracting borrowers seeking lower down payments and extended repayment terms. However, application processes are lengthy and competitive.

Alternative lenders, including online platforms and private credit funds, provide expedited financing. These options typically come at higher interest rates reflecting increased risk. Asset-based lending unlocks capital tied up in inventory and equipment, presenting another avenue. But it might not fully cover the acquisition cost.

Key Considerations for Financing

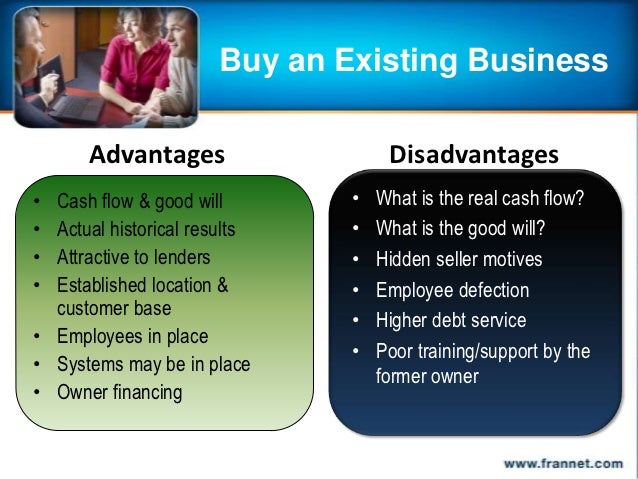

Down payment requirements vary based on the lender and the perceived risk. Banks commonly seek 20-30% equity injection. Seller financing, where the previous owner finances a portion of the purchase price, can bridge the gap. These arrangements depend on negotiation and seller confidence in the business's future performance.

A comprehensive business plan is non-negotiable. It must detail financial projections, market analysis, and management expertise. Ignoring due diligence is a recipe for disaster. Thoroughly investigate the business's financials, legal compliance, and customer base before committing.

Loan covenants are contractual requirements imposed by lenders. They restrict the borrower's actions to protect their investment. Breaching these covenants can trigger default and jeopardize ownership.

Impact of Rising Interest Rates

The Federal Reserve's continued interest rate hikes pose a significant threat. Borrowing costs are already escalating, shrinking profit margins. Variable-rate loans expose borrowers to unpredictable repayment schedules. Fixed-rate options, while offering stability, come with premiums, creating a dilemma.

According to a recent National Federation of Independent Business (NFIB) report, 41% of small business owners cited rising interest rates as their biggest concern. This directly impacts acquisition financing, making deals more expensive and less attainable.

Navigating the Financing Process

Consulting with a financial advisor is crucial. They can assess your financial standing and identify suitable funding sources. Engaging a legal professional ensures that all agreements are legally sound and protect your interests.

Negotiate aggressively with lenders and sellers. Shop around for the best terms and explore creative financing structures. Consider bootstrapping strategies, such as phased acquisitions or leveraging existing assets.

Maintain transparent communication with all stakeholders. Building trust and providing accurate information fosters positive relationships.

Next Steps

Prospective buyers must act decisively to secure financing amidst the evolving economic conditions. Monitor interest rates and credit market trends closely. Proactive planning is the only way to avoid missing opportunities.