Financial Accounting Provides Information Primarily To

Financial+Accounting+Information.jpg)

The intricate world of finance relies heavily on information. Specifically, financial accounting serves as a critical source of data that informs decisions impacting everything from investment strategies to regulatory oversight.

Understanding who the primary users of this information are is crucial to grasping the purpose and scope of financial accounting itself. This article explores the diverse range of individuals and entities that rely on financial accounting data, examining their unique needs and the impact this information has on their actions.

The Landscape of Financial Accounting Users

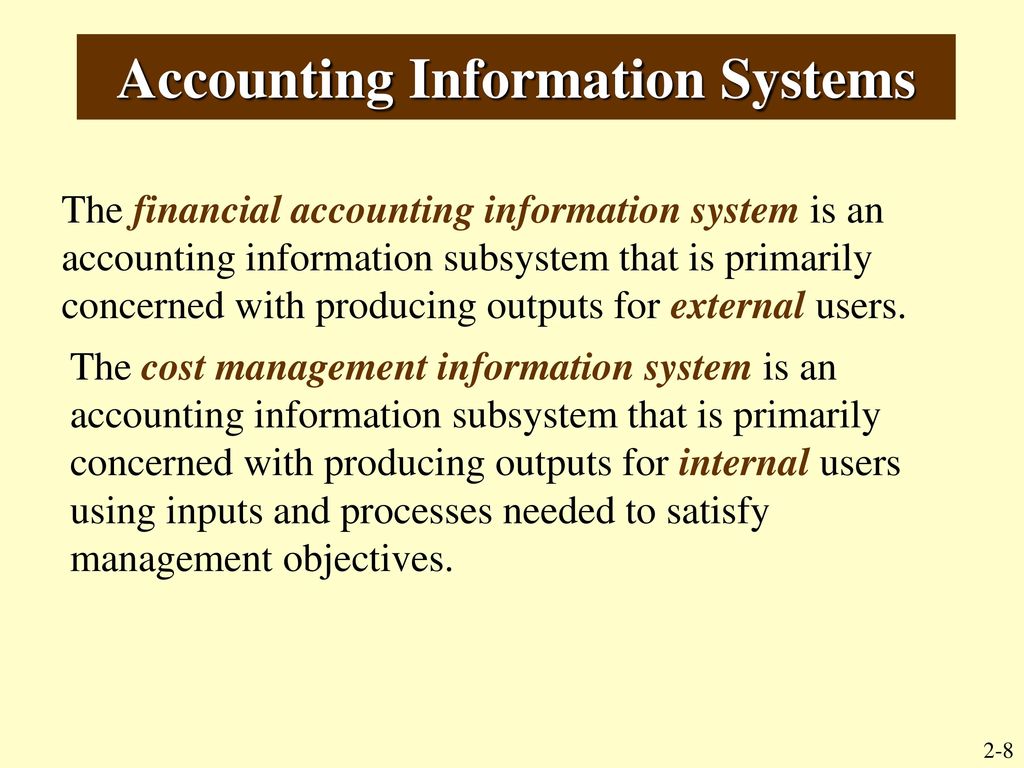

Financial accounting, at its core, aims to provide a standardized and transparent view of an organization's financial performance and position. This information is not just for internal use; it's designed to be accessible and useful to a wide range of external stakeholders.

Investors: Seeking Return and Managing Risk

Perhaps the most prominent group of users are investors, both current and potential. They scrutinize financial statements to assess the profitability, solvency, and overall financial health of a company before committing capital.

Key metrics like earnings per share (EPS), return on equity (ROE), and debt-to-equity ratios are closely analyzed to gauge future investment returns and manage risk.

For instance, a potential investor might examine a company's balance sheet to determine its asset base and liabilities, forming an opinion on its financial stability.

Creditors: Evaluating Creditworthiness

Creditors, including banks and bondholders, represent another crucial user group. They rely on financial accounting data to assess a company's ability to repay its debts and obligations.

Ratios like the current ratio and quick ratio are particularly important, as they provide insights into a company's short-term liquidity and its capacity to meet immediate financial obligations.

A bank considering a loan application will carefully examine a company's income statement and cash flow statement to understand its revenue streams and its ability to generate cash.

Regulatory Agencies: Ensuring Compliance and Protecting the Public

Regulatory bodies, such as the Securities and Exchange Commission (SEC) in the United States, use financial accounting information to ensure companies comply with established accounting standards and regulations.

The SEC mandates that publicly traded companies file regular financial reports, including the 10-K (annual report) and 10-Q (quarterly report), allowing the agency to monitor compliance and identify potential fraud or misreporting.

This oversight is essential for maintaining market integrity and protecting investors from misleading financial information. A fraudulent accounting practice can mislead the investor and the public.

Employees: Gauging Job Security and Potential Growth

While often overlooked, employees also have a vested interest in a company's financial health. Strong financial performance typically translates to increased job security, potential for promotions, and profit-sharing opportunities.

Employees may monitor a company's financial performance to assess the stability of their employment and the prospects for future growth within the organization.

For example, employees might be more inclined to stay with a company demonstrating consistent profitability and strong cash flow. This is very important to both employees and employer.

Customers and Suppliers: Assessing Long-Term Viability

Customers and suppliers may also review financial information to assess the long-term viability of a company.

Customers want to ensure that a company will be around to honor warranties or provide ongoing support, while suppliers need assurance that they will be paid for their goods and services.

A supplier might hesitate to extend credit to a company with a history of losses or a high level of debt.

Management: Internal Decision-Making and Performance Evaluation

Although the focus is often on external users, it's important to acknowledge that management itself relies heavily on financial accounting data. This information is crucial for internal decision-making, performance evaluation, and strategic planning.

Management uses financial accounting information to track performance against budgets, identify areas of inefficiency, and make informed decisions about resource allocation.

For example, management might use financial statements to determine whether to invest in new equipment, expand into new markets, or restructure operations.

The Impact on Society

The widespread use of financial accounting information has a profound impact on society. By promoting transparency and accountability, it fosters trust in the financial markets and facilitates the efficient allocation of capital.

Reliable financial information allows investors to make informed decisions, creditors to assess risk accurately, and regulators to monitor compliance effectively. This is important for the society to function properly.

Ultimately, this contributes to economic growth and stability.

The standardized nature of financial accounting, driven by generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS), ensures comparability across companies and industries, further enhancing its usefulness.

Conclusion

Financial accounting provides information primarily to a diverse range of users, each with their own unique needs and objectives.

From investors seeking returns to regulators ensuring compliance, the information derived from financial statements plays a critical role in decision-making across various sectors.

Understanding the needs of these users is essential for appreciating the significance of financial accounting and its contribution to a transparent and well-functioning economy.