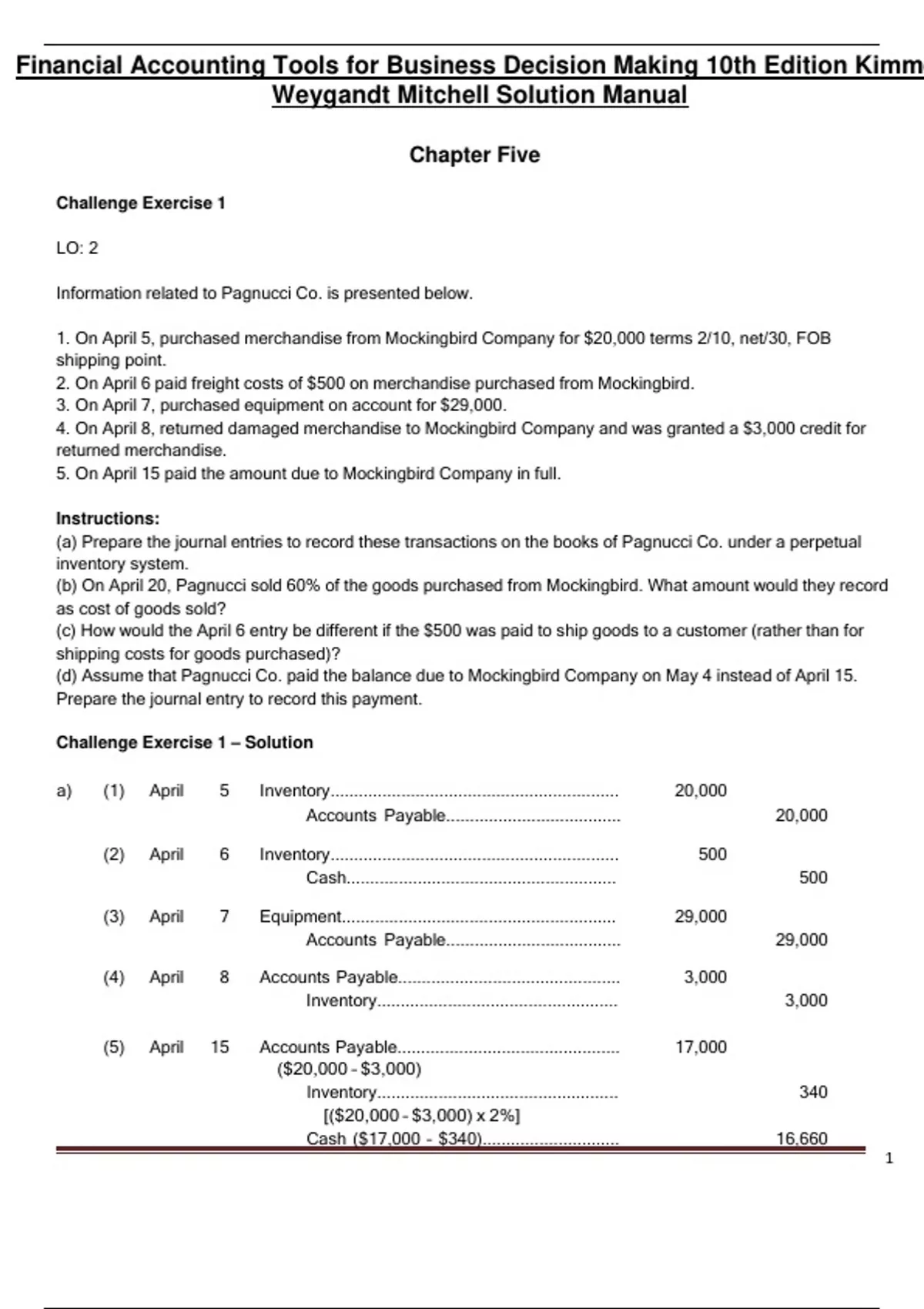

Financial Accounting Tools For Business Decision Making

In today's complex business environment, making sound decisions requires more than just intuition. Businesses are increasingly relying on financial accounting tools to gain insights, manage resources, and chart a course for sustainable growth.

These tools, once seen as the domain of accountants, are now essential for managers, entrepreneurs, and investors alike. They provide a framework for understanding a company's financial health and predicting future performance.

Understanding the Nut and Bolts

Financial accounting tools encompass a variety of methods and techniques used to analyze and interpret financial data. These tools include financial statement analysis, budgeting, cost accounting, and performance metrics.

They enable stakeholders to assess profitability, liquidity, solvency, and efficiency.

Financial statement analysis is at the heart of many business decisions. This process involves scrutinizing the income statement, balance sheet, and cash flow statement to identify trends, compare performance against industry benchmarks, and evaluate the overall financial position of a company.

Key ratios, such as the current ratio, debt-to-equity ratio, and profit margin, provide valuable insights into a company's ability to meet its short-term obligations, manage its debt, and generate profits.

Budgeting is a crucial tool for planning and controlling financial resources. It involves creating a detailed plan that outlines expected revenues, expenses, and investments over a specific period.

By comparing actual results against the budget, businesses can identify variances and take corrective action.

Cost accounting helps businesses understand the cost of producing goods or services. This involves tracking direct costs, such as materials and labor, as well as indirect costs, such as overhead.

Understanding cost structures is essential for pricing decisions, profitability analysis, and identifying areas for cost reduction. Activity-based costing (ABC) is one method to achieve this.

Performance metrics are used to measure and track key performance indicators (KPIs). These metrics can be financial, such as revenue growth and return on investment (ROI), or non-financial, such as customer satisfaction and employee turnover.

By monitoring KPIs, businesses can identify areas of strength and weakness, and make data-driven decisions to improve performance.

The Significance of Financial Accounting Tools

The adoption of financial accounting tools has profound implications for businesses of all sizes. It enhances decision-making by providing a clear and objective view of financial performance.

It helps in identifying potential risks and opportunities, and enabling more informed strategic planning. Moreover, effective use of these tools improves resource allocation.

Businesses can prioritize investments based on ROI, optimize spending, and improve cash flow management.

Beyond internal benefits, financial accounting tools enhance transparency and accountability. Investors, creditors, and other stakeholders rely on accurate and reliable financial information to make informed decisions.

By adhering to established accounting principles and standards, businesses can build trust and credibility.

The use of these tools helps ensure that financial statements are prepared in accordance with Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), which are globally recognized accounting frameworks.

Impact and Real-World Application

The impact of financial accounting tools extends beyond the balance sheet, influencing everything from product development to marketing strategies.

For example, a company using cost accounting might discover that a particular product is not profitable and decide to discontinue it or find ways to reduce its production costs.

Similarly, financial statement analysis could reveal that a company is overleveraged, prompting management to reduce debt or raise equity.

Case Study: A Small Business Success Story

Consider a small, family-owned bakery struggling to stay afloat. By implementing budgeting and cost accounting techniques, the bakery owner gained a clear understanding of their expenses and profit margins.

They identified several areas where they could reduce costs, such as renegotiating supplier contracts and reducing food waste.

As a result, the bakery was able to improve its profitability and secure a loan to expand its operations.

"The use of these tools was a game-changer for us," said the owner. "We were able to make informed decisions based on real data, rather than just gut feeling."

Challenges and Considerations

Despite the benefits, implementing financial accounting tools can be challenging. It requires investment in software, training, and expertise.

Businesses must also ensure that their data is accurate and reliable.

Data quality is vital to make appropriate decisions. Further, small business might not have enough resources.

Another challenge is keeping up with evolving accounting standards and regulations. The accounting landscape is constantly changing, and businesses must stay informed to ensure compliance.

Consulting with experienced accountants and financial advisors can help businesses overcome these challenges and maximize the value of their financial accounting tools.

The Future of Financial Accounting

The future of financial accounting is being shaped by technology. Automation, artificial intelligence (AI), and cloud computing are transforming the way businesses collect, analyze, and report financial data.

AI-powered accounting software can automate tasks such as data entry, reconciliation, and fraud detection.

Cloud computing provides businesses with access to financial data anytime, anywhere. These technologies allow businesses to focus on strategic decision-making, rather than manual tasks.

As technology continues to evolve, financial accounting tools will become even more powerful and accessible, empowering businesses to make smarter decisions and achieve greater success.

By embracing these tools and adapting to the changing landscape, businesses can gain a competitive edge and thrive in the 21st century.