Financial News Story About Cash Flow Management 2024

:max_bytes(150000):strip_icc()/cashflowstatement-recirc-blue-777721714b8f49a5b5103337a8510653.jpg)

Businesses across sectors are facing a critical cash flow crunch in Q2 2024, prompting widespread concerns about solvency and operational stability. Immediate action is imperative to navigate these turbulent financial waters.

This article delves into the current cash flow crisis, exploring contributing factors, affected industries, and strategies businesses must implement to survive. The focus is on actionable insights and real-time data to inform immediate decision-making.

The Cash Flow Squeeze: A Perfect Storm

Multiple factors are converging to create the current cash flow crisis. Inflation remains stubbornly high, squeezing profit margins.

Rising interest rates are making debt more expensive, and consumer spending is showing signs of slowing down. This creates a triple whammy for businesses of all sizes.

Key Contributing Factors:

Inflationary pressures: The Consumer Price Index (CPI) remains elevated, with core inflation rates exceeding targets set by the Federal Reserve.

Interest rate hikes: The Federal Reserve's aggressive interest rate hikes to combat inflation have increased borrowing costs for businesses, impacting their ability to manage debt and invest in growth.

Supply chain disruptions: While easing, lingering supply chain issues continue to impact inventory management and lead times, tying up capital.

Decreased consumer spending: Consumer confidence is wavering, leading to reduced spending on non-essential goods and services.

Industries at the Brink

Certain sectors are particularly vulnerable to the cash flow squeeze. Retail, hospitality, and construction are among the hardest hit.

These industries are characterized by high operating costs, low margins, and reliance on consumer discretionary spending. Data from the National Federation of Independent Business (NFIB) reveals that small businesses are increasingly concerned about their ability to meet their financial obligations.

"The number of small businesses reporting that it is harder to obtain credit has jumped significantly in the past quarter," says NFIB Chief Economist Bill Dunkelberg.

Retail Sector:

Retailers are struggling with inventory gluts and decreased foot traffic.

Many are resorting to deep discounts, further eroding their profit margins. Brick-and-mortar stores are particularly challenged, with online sales offering little respite.

Hospitality Sector:

The hospitality industry faces rising labor costs and fluctuating demand.

While travel has rebounded, occupancy rates remain below pre-pandemic levels in many regions. Food costs are also soaring, placing additional strain on restaurants and hotels.

Construction Sector:

The construction industry is grappling with high material costs and labor shortages.

Rising interest rates are also dampening demand for new construction projects. Many contractors are facing payment delays, exacerbating their cash flow problems.

Strategies for Survival: Immediate Actions Required

Businesses must take immediate and decisive action to manage their cash flow effectively. Procrastination is not an option.

Several key strategies can help businesses weather the storm.

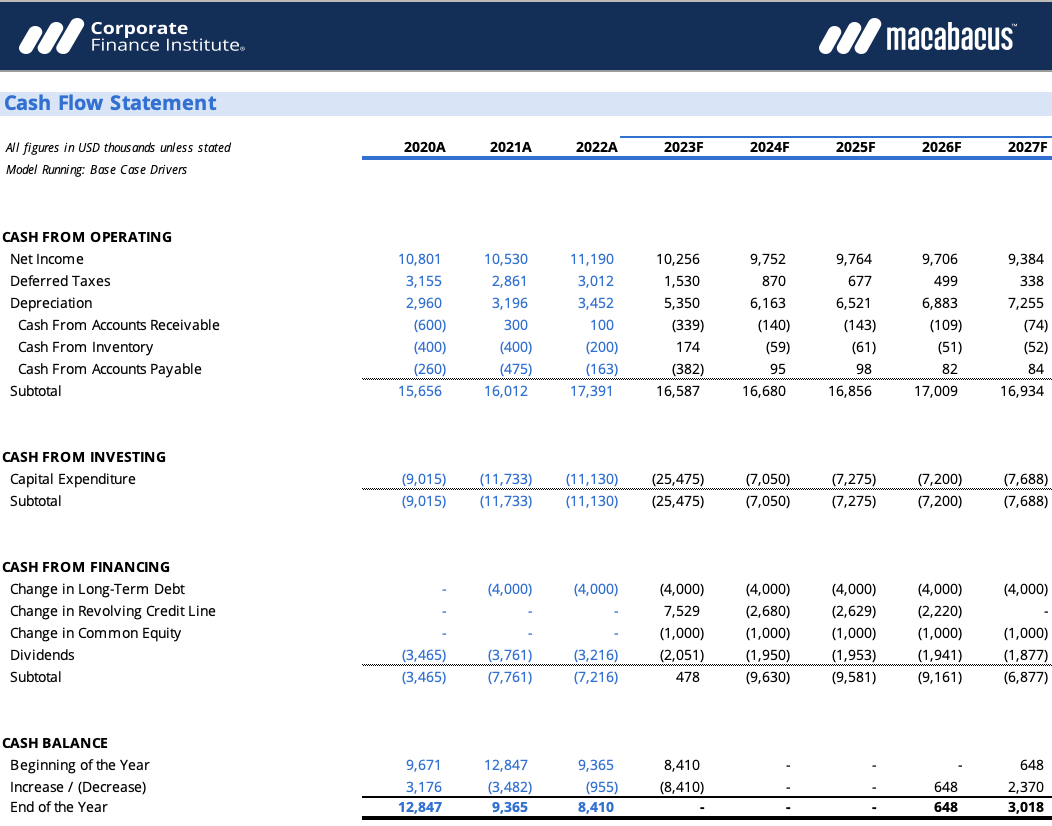

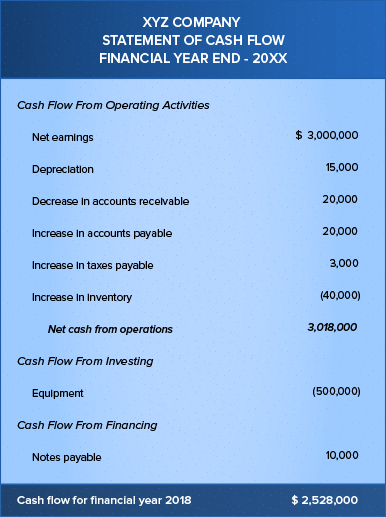

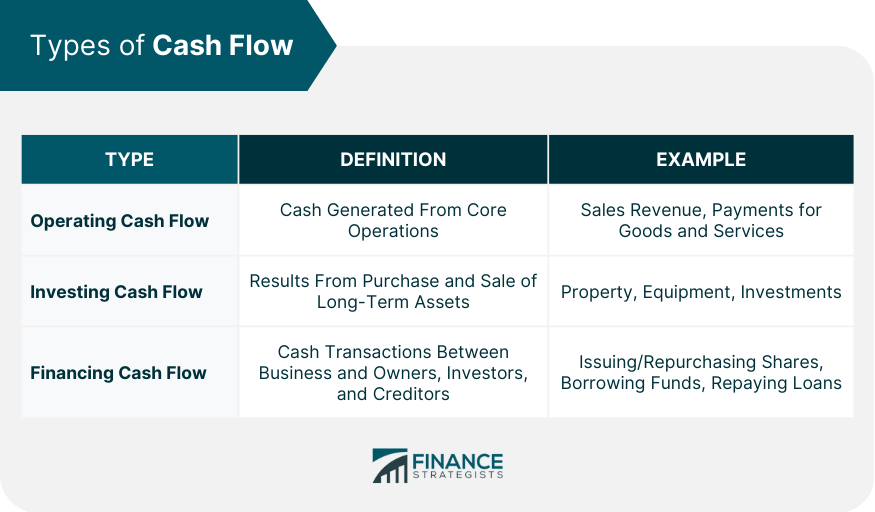

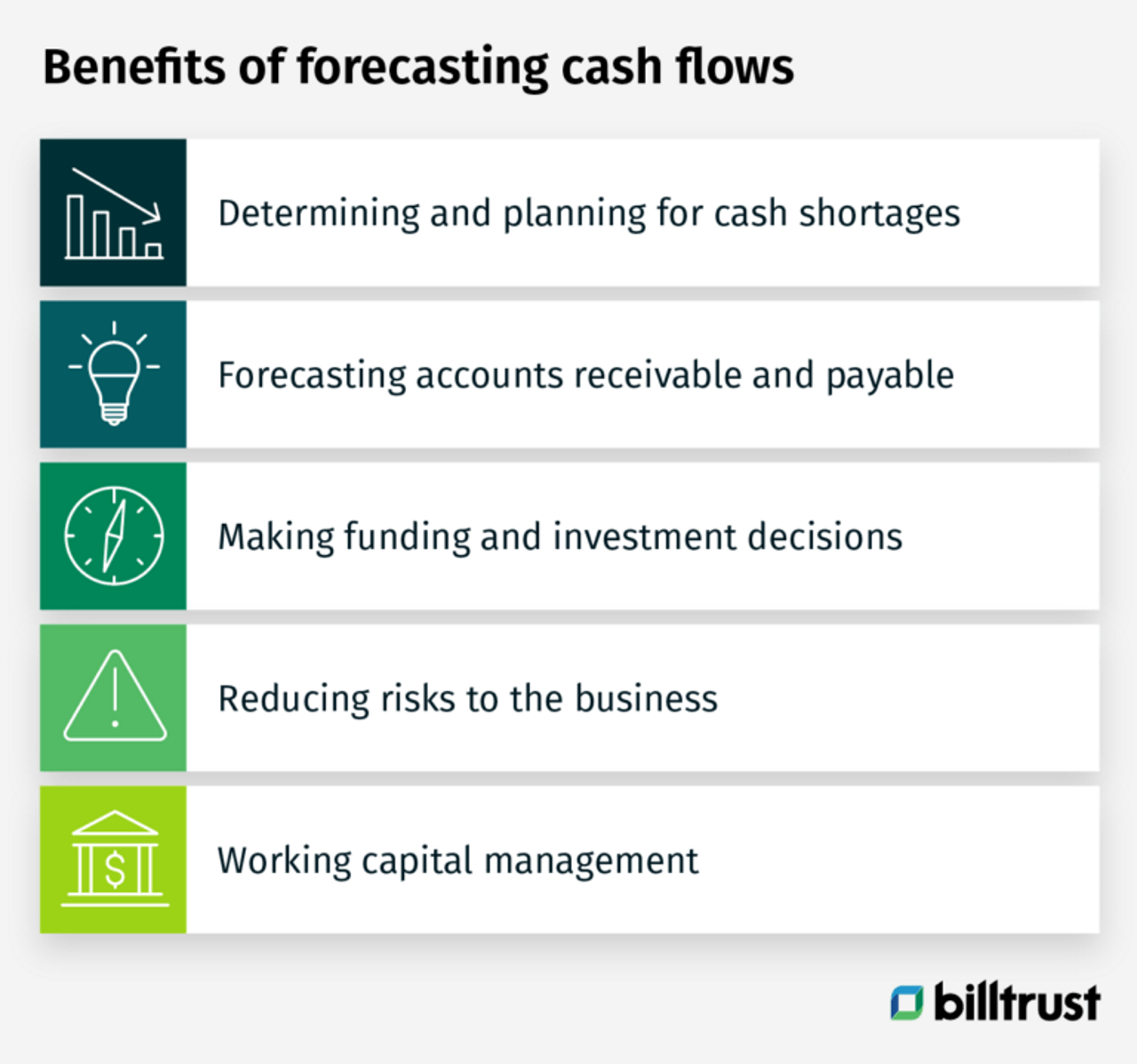

Cash Flow Forecasting:

Develop a detailed cash flow forecast that projects inflows and outflows for the next 3-6 months.

Identify potential shortfalls and develop contingency plans. Regularly update the forecast based on real-time data.

Expense Management:

Scrutinize all expenses and identify areas for cost reduction.

Negotiate with suppliers, reduce discretionary spending, and consider delaying non-essential investments.

Accounts Receivable Management:

Accelerate collections by offering early payment discounts.

Implement stricter credit terms and consider factoring invoices. Regularly monitor outstanding invoices and follow up promptly on overdue payments.

Inventory Optimization:

Reduce inventory levels to free up cash. Implement just-in-time inventory management techniques.

Consider liquidating excess inventory through sales or promotions. Avoid overstocking slow-moving items.

Debt Restructuring:

Explore options for debt restructuring or refinancing to lower interest rates and extend repayment terms. Communicate proactively with lenders.

Consider alternative financing options such as asset-based lending or invoice financing.

Government Assistance Programs:

Investigate available government assistance programs and tax credits.

Many programs offer grants, loans, or tax breaks to help businesses cope with financial challenges. Seek professional advice to navigate the application process.

The Road Ahead: Uncertainty and Adaptation

The economic outlook remains uncertain, and businesses must be prepared for continued volatility. Adaptability and resilience are essential for survival.

Monitoring key economic indicators and staying informed about industry trends are crucial. Businesses that proactively manage their cash flow and adapt to changing conditions will be best positioned to navigate the current crisis.

Ongoing developments, including further Federal Reserve policy decisions and shifts in consumer behavior, will continue to shape the financial landscape. Regular updates and analysis will be provided as the situation evolves. Businesses must remain vigilant and proactive.

:max_bytes(150000):strip_icc()/Understanding-the-Cash-Flow-Statement-Color-fc25b41daf7d45e3a63fd5f916fbf9ee.png)