Financial Planning For Small Business Owners

Imagine Sarah, owner of a blossoming local bakery, "Sweet Surrender." The aroma of freshly baked bread and the cheerful chatter of customers fill her days, but beneath the surface, a quiet worry simmers: the financial future of her business and her family. Like many small business owners, Sarah pours her heart and soul into her venture, often neglecting the crucial task of financial planning.

This article explores the essential aspects of financial planning tailored for small business owners. It provides practical guidance to navigate the complexities of managing both business and personal finances effectively. Learning how to secure a stable and prosperous future becomes more accessible for entrepreneurs.

The Foundation: Separating Business and Personal Finances

One of the first and most critical steps is establishing a clear separation between business and personal finances. This involves opening a separate business bank account and obtaining a business credit card.

According to the Small Business Administration (SBA), this separation not only simplifies accounting and tax preparation. But it also provides crucial protection for personal assets in case of business liabilities.

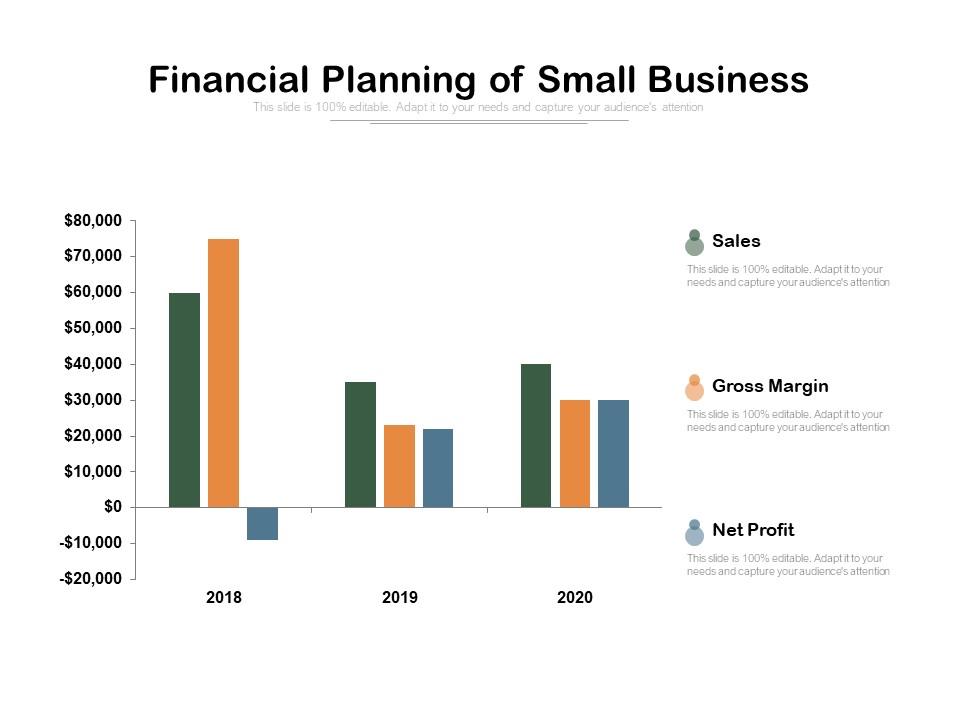

Building a Business Budget and Cash Flow Management

A robust budget is the cornerstone of sound financial planning. It allows owners to track income and expenses, identify areas where costs can be reduced, and make informed decisions about investments and growth.

Careful cash flow management ensures that there's enough money to cover day-to-day operations. This includes paying suppliers, employees, and other essential expenses.

Tools like budgeting software or spreadsheets can be invaluable in this process.

Tax Planning: Minimizing Liabilities, Maximizing Savings

Tax planning is often perceived as a daunting task, but it's essential for maximizing profitability. Understanding available deductions and credits, such as the Qualified Business Income (QBI) deduction, can significantly reduce tax liabilities.

Consulting with a qualified tax professional is highly recommended. They can provide personalized advice and help navigate the complex tax landscape. The IRS provides resources and publications to help small business owners understand their tax obligations.

Retirement Planning: Securing Your Future

Many small business owners reinvest the majority of their profits back into their companies. While that strategy can foster growth, it's equally important to prioritize personal retirement savings.

Options like SEP IRAs, SIMPLE IRAs, and Solo 401(k)s offer tax advantages and allow owners to build a nest egg for their future. Starting early and contributing consistently is key to achieving long-term financial security.

Risk Management: Protecting Your Assets

Insurance is an integral part of risk management. It protects your business and personal assets from unforeseen events.

This encompasses business liability insurance, property insurance, and possibly key person insurance. Adequate coverage can provide a financial safety net in the event of accidents, lawsuits, or other unexpected challenges.

Debt Management: Balancing Growth and Financial Stability

Debt can be a powerful tool for growth, but it must be managed carefully. Avoid taking on more debt than the business can realistically handle.

Consider seeking advice from a financial advisor before making major borrowing decisions. Prioritize paying down high-interest debt to improve cash flow and reduce financial strain.

Financial planning is not a one-time event. It's an ongoing process that requires regular review and adjustments. As the business evolves, so too should the financial plan.

Back at "Sweet Surrender," Sarah realized the weight of this knowledge and scheduled a meeting with a financial advisor. She learned about the options for managing her business and personal finances and began to feel more secure about her future.

The path to financial well-being for small business owners may have its challenges, but with a thoughtful plan and proactive approach, entrepreneurs like Sarah can bake up both a thriving business and a secure future.