Financial Statements Are Prepared Directly From The

Imagine a world where financial clarity isn't a month-end scramble, but a real-time reflection of your business's pulse. A world where insights emerge directly from the lifeblood of your company – its daily transactions. This vision, once a distant dream, is rapidly becoming a tangible reality for businesses embracing the power of integrated systems and streamlined data flows.

At the heart of this transformation lies the concept of financial statements being prepared directly from the source. This paradigm shift, driven by technological advancements, promises increased accuracy, efficiency, and agility for businesses of all sizes. It moves away from manual data entry and error-prone spreadsheets toward a more automated and reliable financial reporting process.

The Evolution of Financial Reporting

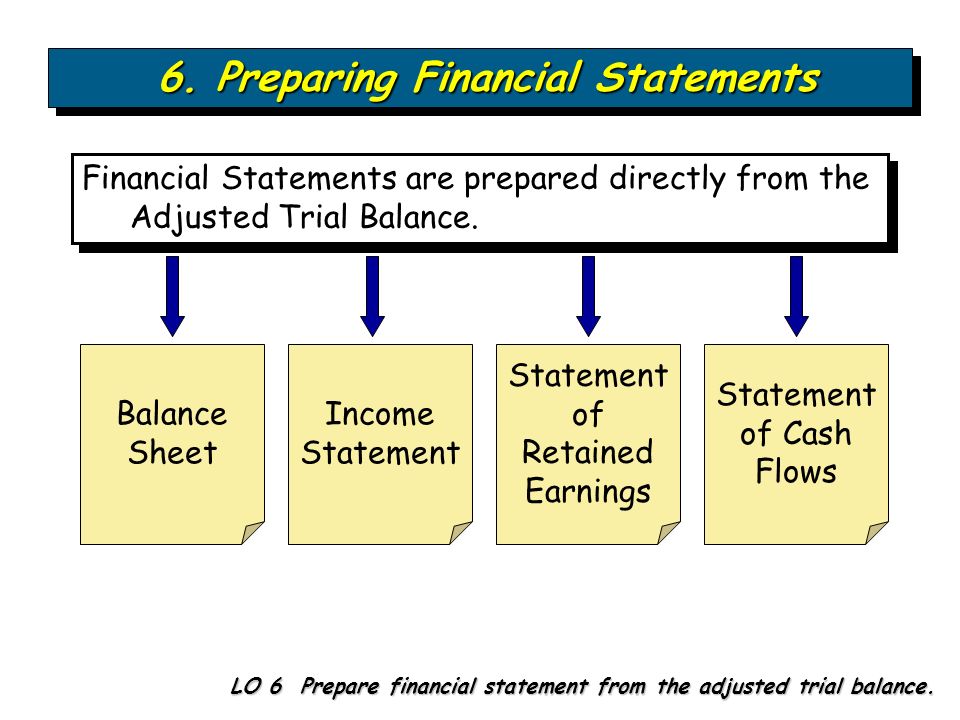

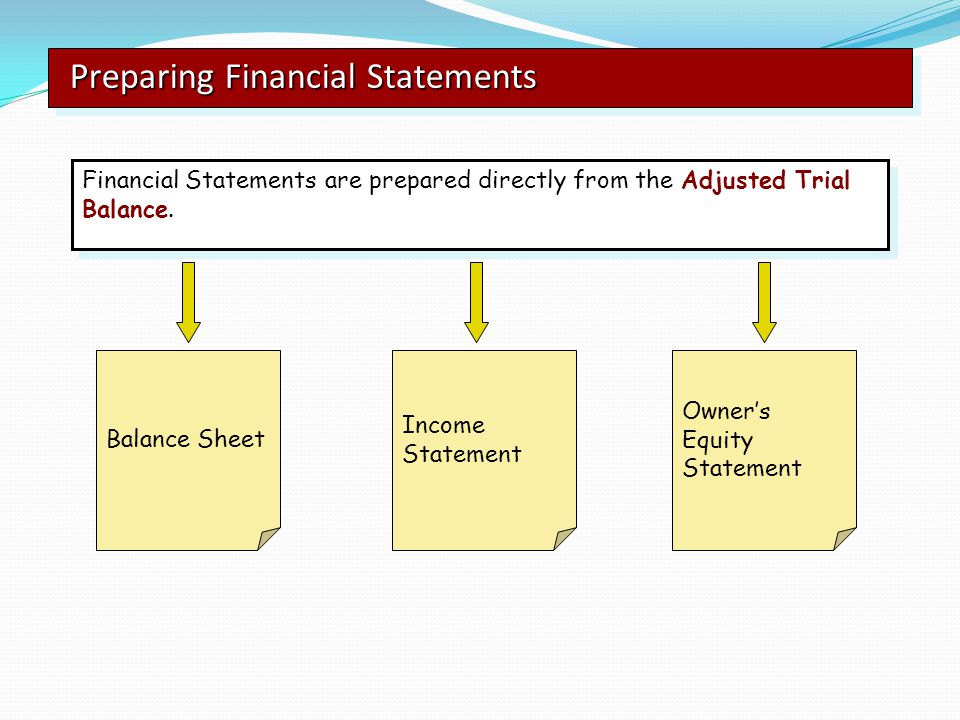

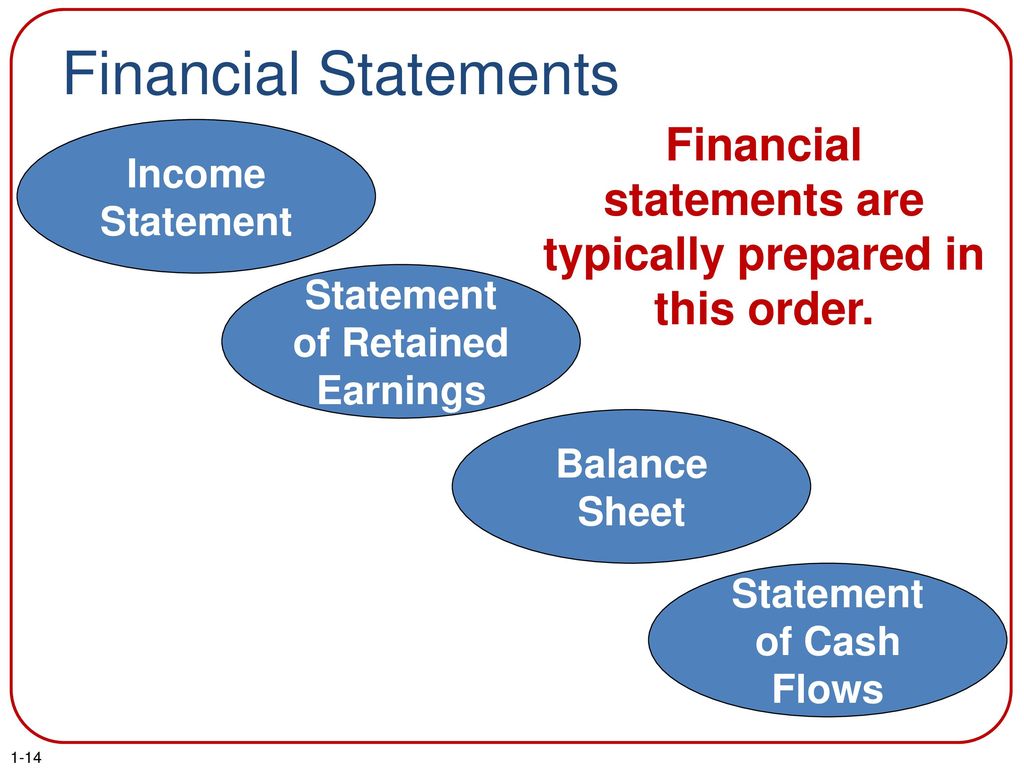

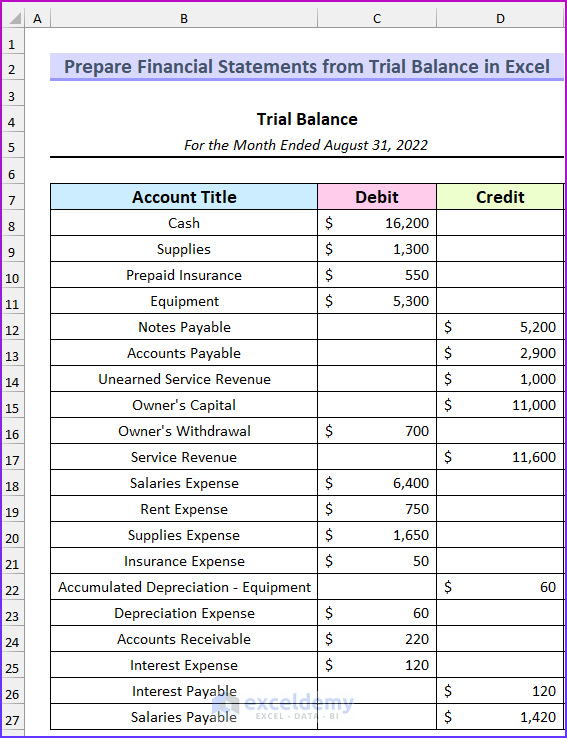

The traditional financial reporting process has often been a laborious, time-consuming affair. Data from various departments – sales, purchasing, payroll – would be collected, often manually, and consolidated into spreadsheets. This information would then be used to prepare the key financial statements: the balance sheet, income statement, and cash flow statement.

This process was prone to errors, delays, and inconsistencies. It also provided a limited, backward-looking view of the company's financial health. Many businesses grappled with the challenge of generating timely and accurate reports, hindering their ability to make informed decisions.

The Rise of Integrated Systems

The advent of Enterprise Resource Planning (ERP) systems marked a significant step forward. These systems integrate various business functions, such as finance, human resources, and supply chain, into a single platform. This integration allows for a more seamless flow of data across departments.

The crucial element is that transactions are recorded in real time, eliminating the need for manual data entry into financial statements. ERPs began to automate the creation of financial statements, providing a more accurate and up-to-date picture of the company's financial position.

Cloud-based accounting software represents another leap. They offer even greater flexibility and accessibility, empowering businesses to manage their finances from anywhere in the world. Companies like Xero, QuickBooks Online, and NetSuite are at the forefront, giving direct preparation of financial statements to small and medium-sized businesses.

How It Works: Direct Financial Statement Preparation

The core principle is that financial statements are generated directly from the transactional data captured within the accounting system. Every sale, purchase, payment, and receipt is recorded and classified according to the relevant accounting principles.

The system then automatically aggregates this data and organizes it into the format required for each financial statement. This eliminates the need for manual calculations and reduces the risk of human error. Furthermore, the software can be configured to handle complex accounting rules and regulations, ensuring compliance.

The beauty of this approach lies in its ability to provide real-time insights. Businesses can access up-to-date financial reports at any time, allowing them to monitor their performance and identify potential problems quickly. This agility is crucial in today's rapidly changing business environment.

The Benefits Unveiled

The benefits of preparing financial statements directly from source data are manifold. These extend far beyond simply saving time and reducing errors.

Improved Accuracy: Automation minimizes the risk of human error, ensuring that financial statements accurately reflect the company's financial performance.

Enhanced Efficiency: Automating the financial reporting process frees up finance professionals to focus on more strategic activities, such as financial analysis and planning. This is a monumental difference from traditional methods.

Timely Insights: Real-time access to financial data allows businesses to make faster, more informed decisions.

Better Compliance: Automated systems can be configured to comply with relevant accounting standards and regulations, reducing the risk of penalties.

Increased Transparency: Direct access to source data allows for greater transparency and auditability. This is vital for maintaining stakeholder confidence.

Challenges and Considerations

While the benefits are clear, there are also challenges to consider. Implementing an integrated system requires careful planning and execution. Data migration and system configuration can be complex, and it's important to ensure that employees are properly trained to use the new system.

Data security is also a critical consideration. Businesses must implement appropriate security measures to protect sensitive financial information. Choosing the right software is pivotal.

It's crucial to select a system that meets the specific needs of the business. A thorough assessment of requirements and a careful evaluation of different software options are essential.

Looking Ahead

The trend toward direct financial statement preparation is set to continue, driven by advancements in technology and increasing demand for real-time insights. Artificial intelligence (AI) and machine learning (ML) are expected to play an increasingly important role in automating the financial reporting process and providing even more sophisticated analysis.

For example, AI can be used to detect anomalies in financial data, identify potential fraud, and forecast future financial performance. This level of insight would have been unimaginable just a few years ago.

As businesses embrace these technologies, they will be able to transform their finance departments from reactive scorekeepers to proactive strategic partners. The future of finance is about data-driven decision-making, and directly prepared financial statements are a key enabler of this transformation.

A Final Thought

The journey toward automated financial statement preparation may seem daunting, but the rewards are substantial. By embracing technology and streamlining their financial processes, businesses can unlock greater efficiency, accuracy, and agility. This will allow them to compete more effectively in today's dynamic marketplace.

As we look ahead, the convergence of accounting and technology promises a future where financial insights are not just a historical record, but a compass guiding businesses toward sustainable growth and success. The ability to access real-time information changes the game and levels the playing field for businesses of all sizes.

Ultimately, it's about empowering businesses to make smarter decisions, drive innovation, and create lasting value. The era of directly prepared financial statements is not just about accounting; it's about unlocking the full potential of data to shape a brighter future for business.

.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

:max_bytes(150000):strip_icc()/financialstatements-final-d1268249b5284b3989c979ee82f2869e.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)