Financial Statements Generally Include All Of The Following Except

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)

The bedrock of financial transparency lies in standardized reporting. Investors, creditors, and regulators rely heavily on these documents to assess a company's health and future prospects.

But understanding what isn't included in these statements is just as critical as knowing what is. A common question that surfaces is: Financial statements generally include all of the following except what?

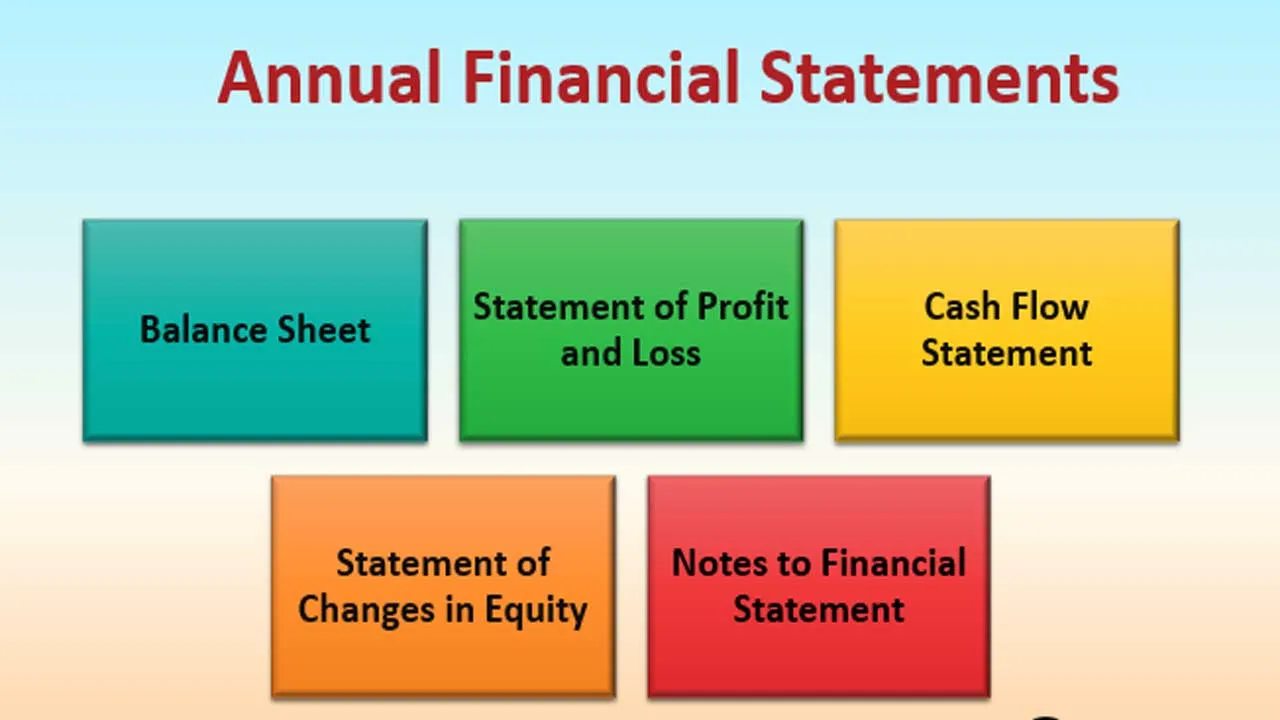

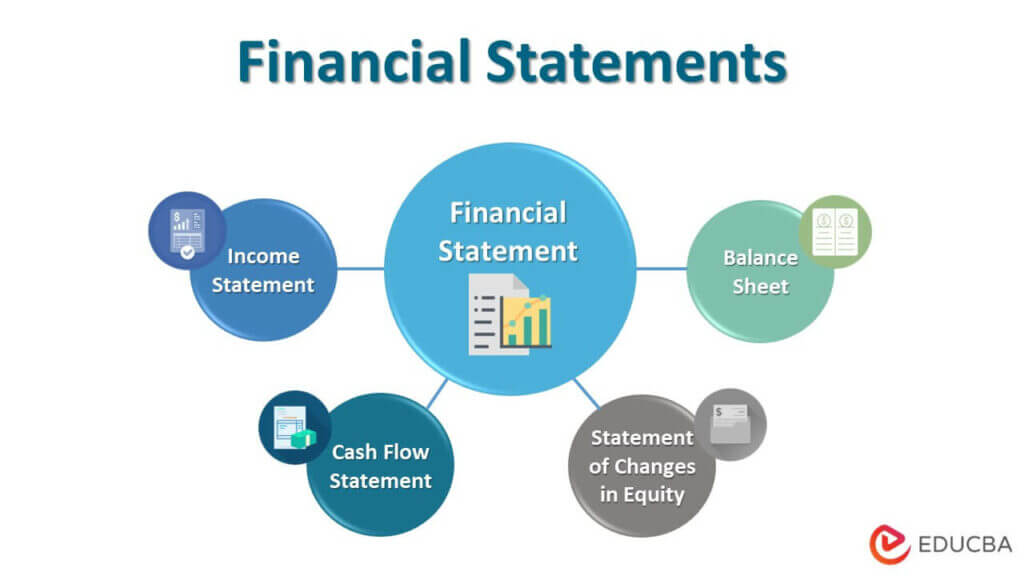

Core Components of Financial Statements

Financial statements are designed to provide a comprehensive overview of a company's financial performance and position.

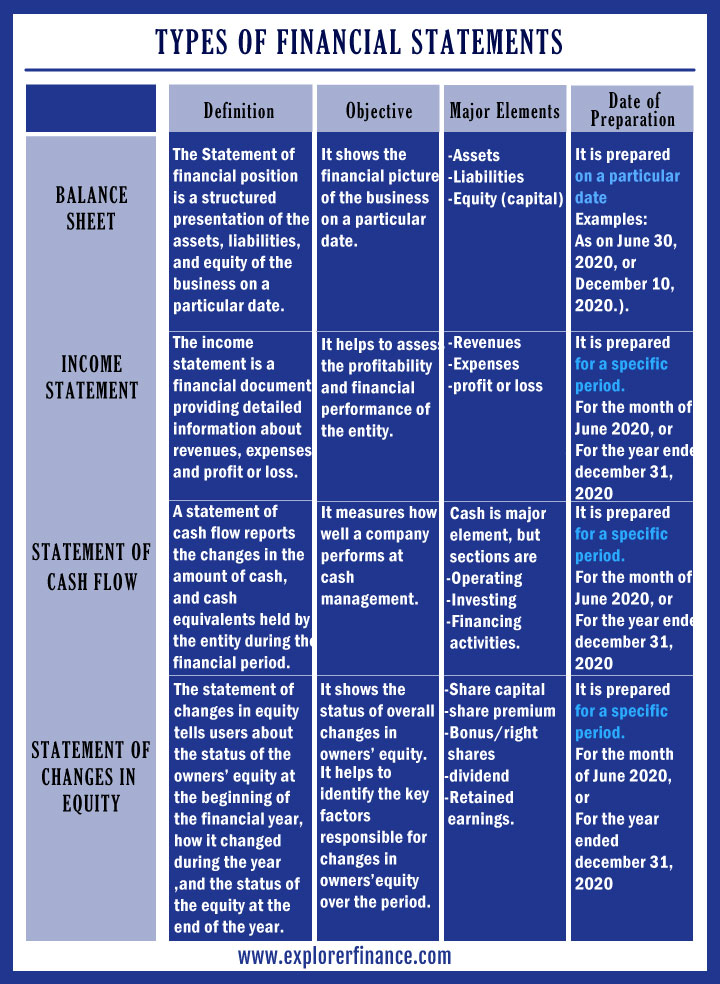

These statements typically consist of four key documents: the balance sheet, the income statement, the statement of cash flows, and the statement of retained earnings (or statement of changes in equity). Each serves a distinct purpose.

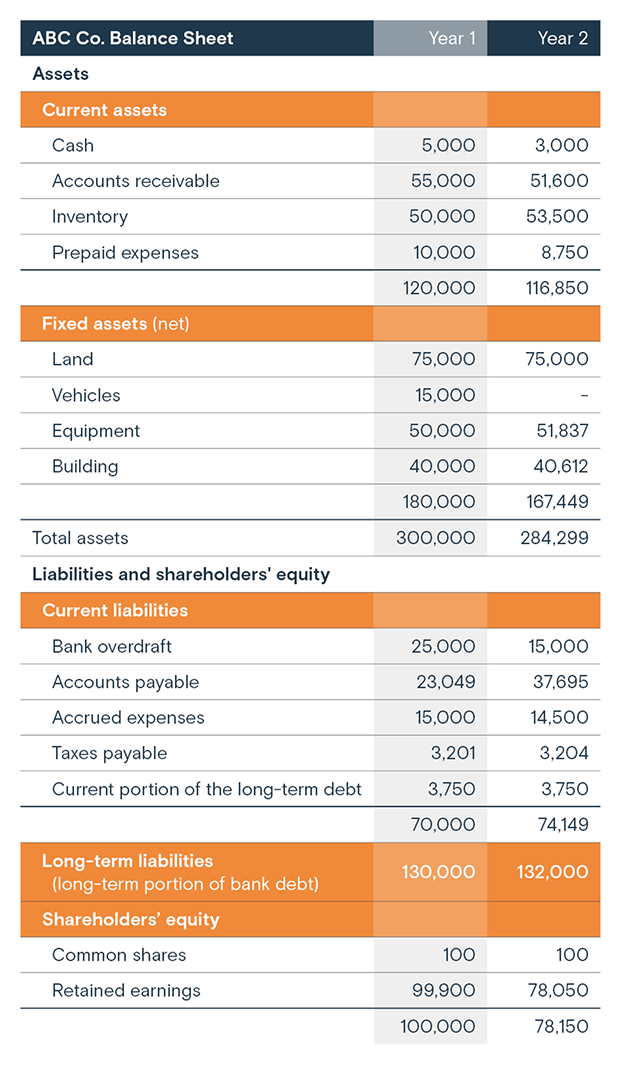

The Balance Sheet

Often called the "statement of financial position," the balance sheet is a snapshot of a company's assets, liabilities, and equity at a specific point in time. It follows the basic accounting equation: Assets = Liabilities + Equity.

Assets represent what a company owns, such as cash, accounts receivable, inventory, and property, plant, and equipment (PP&E). Liabilities are what a company owes to others, including accounts payable, salaries payable, and debt.

Equity represents the owners' stake in the company, calculated as the difference between assets and liabilities. It provides a clear picture of a company's financial structure and solvency.

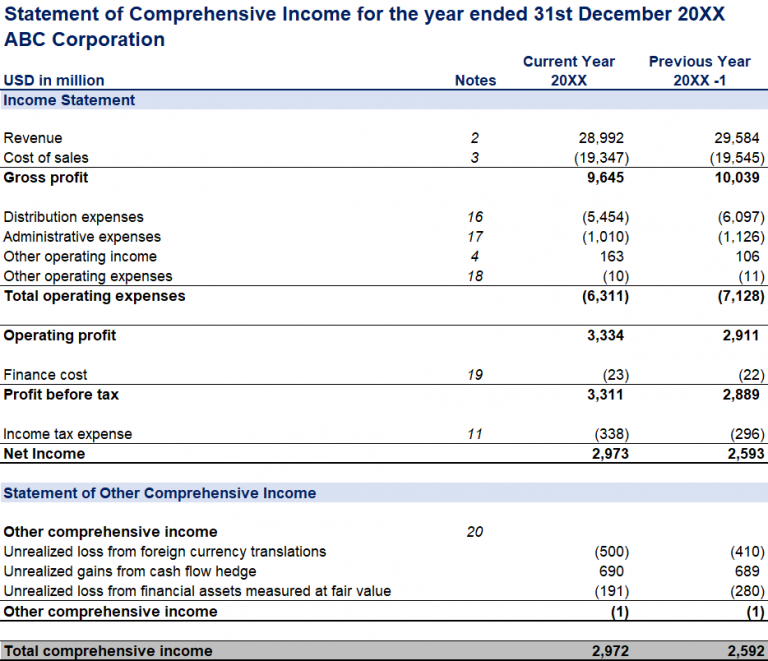

The Income Statement

The income statement, also known as the profit and loss (P&L) statement, reports a company's financial performance over a period of time. It shows revenues, expenses, and ultimately, net income or net loss.

Revenues represent the income generated from a company's primary business activities. Expenses are the costs incurred to generate those revenues, such as cost of goods sold (COGS), operating expenses, and interest expense.

Net income is calculated by subtracting total expenses from total revenues, providing a measure of a company's profitability. It highlights whether a business is operating at a profit or incurring losses.

The Statement of Cash Flows

This statement tracks the movement of cash both into and out of a company during a specific period. It categorizes cash flows into three main activities: operating, investing, and financing.

Operating activities involve the cash flows generated from the normal day-to-day operations of the business. Investing activities relate to the purchase and sale of long-term assets, such as PP&E and investments.

Financing activities involve transactions related to debt, equity, and dividends. It is a key indicator of a company’s liquidity and ability to meet its short-term obligations.

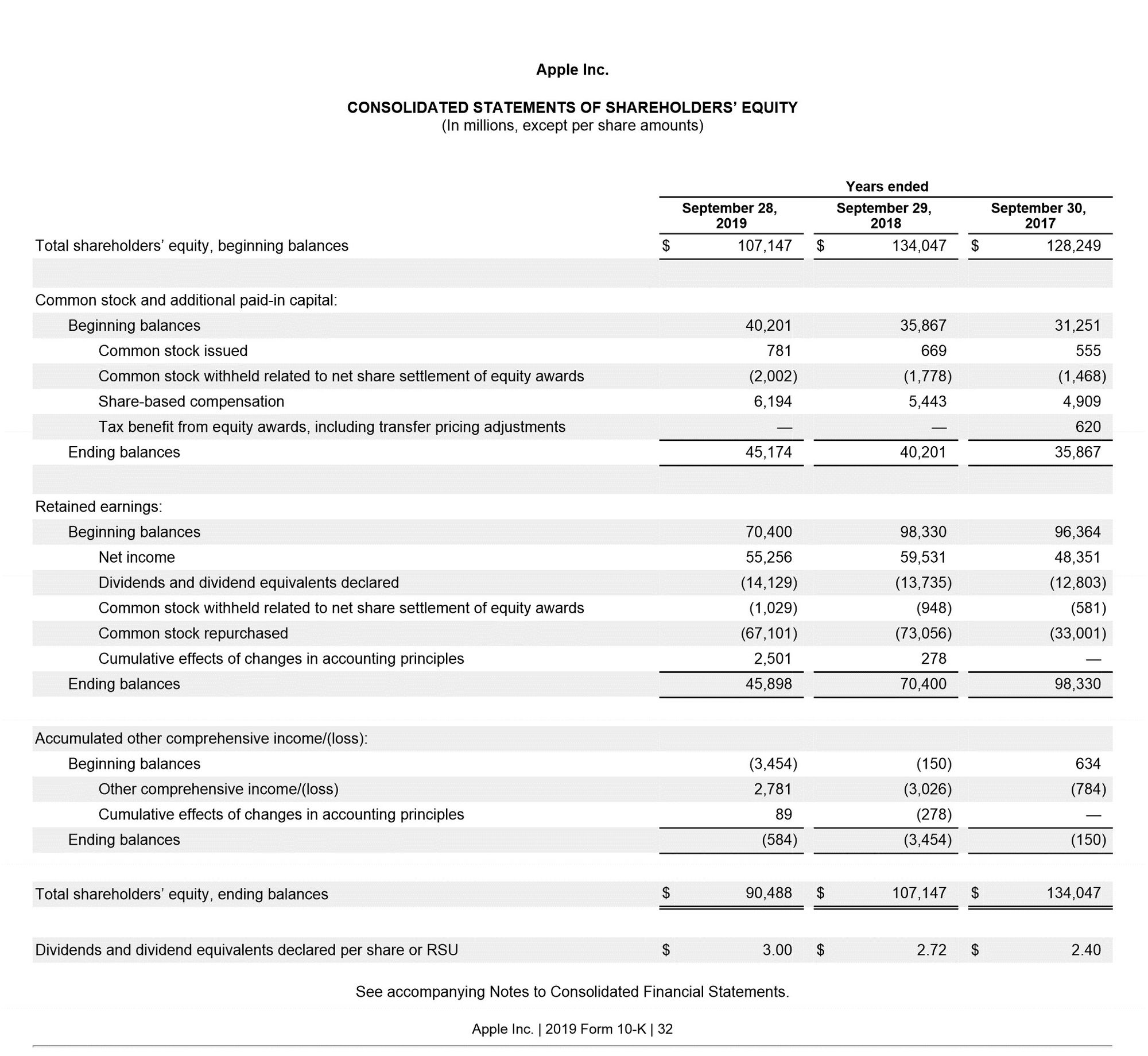

The Statement of Retained Earnings

The statement of retained earnings (or statement of changes in equity) summarizes the changes in a company's retained earnings (or overall equity) over a period. It starts with the beginning balance of retained earnings.

It then adds net income (or subtracts net loss) and subtracts any dividends paid to shareholders. The result is the ending balance of retained earnings, which is carried forward to the balance sheet.

This helps investors understand how a company is using its profits – whether it's reinvesting them back into the business or distributing them to shareholders.

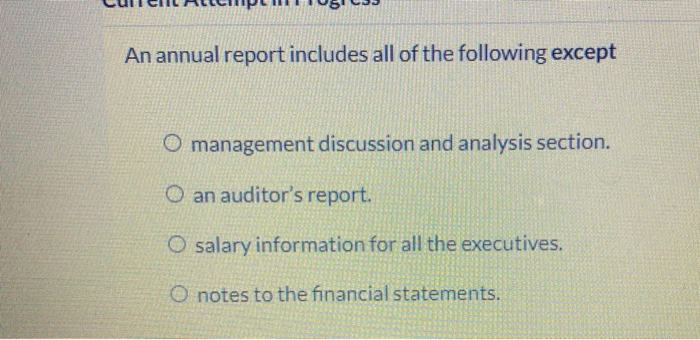

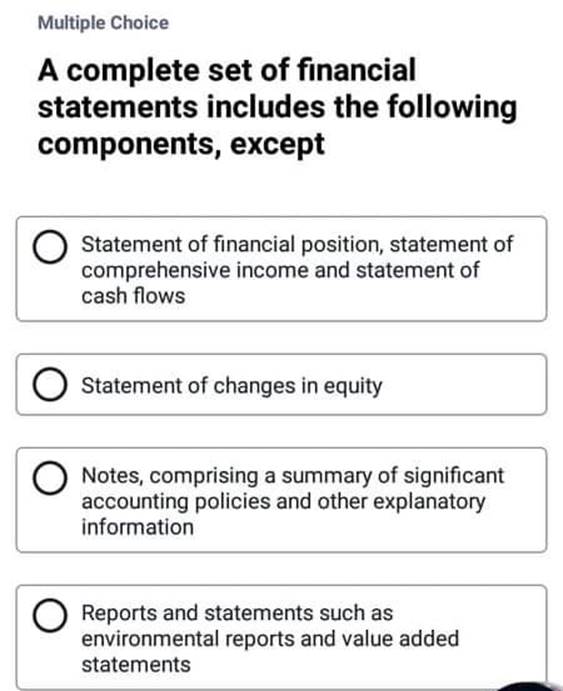

What's Typically Excluded?

While financial statements offer a wealth of information, they don't include everything. One notable omission is non-financial information or qualitative data, although this is increasingly changing with more emphasis on integrated reporting.

This includes information like employee morale, customer satisfaction, brand reputation, or management quality. While these factors are crucial for a company's success, they are difficult to quantify and therefore not typically included in the main financial statements.

Additionally, detailed operational data, such as production statistics or sales by region, are also generally excluded. These items, although informative, are considered supplemental information and are often found in management's discussion and analysis (MD&A) section of the annual report.

Significance and Implications

Understanding the limitations of financial statements is crucial for making informed decisions. Relying solely on the numbers without considering qualitative factors can lead to a skewed perception of a company's true value.

Investors should supplement their analysis of financial statements with other sources of information, such as industry reports, news articles, and independent research. This will allow them to develop a more comprehensive understanding of the company.

Regulators, such as the SEC, are continually working to improve the quality and transparency of financial reporting. This includes exploring ways to incorporate more non-financial information into company disclosures to provide a more holistic view of performance and value.

The Evolving Landscape of Financial Reporting

The world of financial reporting is constantly evolving in response to changing business practices and investor needs. There is increasing pressure to include environmental, social, and governance (ESG) factors into financial reporting.

ESG factors are gaining prominence as investors become more concerned about the long-term sustainability and ethical impact of their investments. Frameworks are being developed to standardized the reporting of ESG information.

Ultimately, a comprehensive understanding of both what is included and what is excluded from financial statements is crucial for anyone making financial decisions. Integrating financial data with qualitative analysis is the key to successful investing.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.39.54AM-4a117e7e494c422ca6480746c97612a8.png)