Form 5498 Not Available Until May

Imagine the sun streaming through your window on a bright April morning, a cup of coffee warming your hands, and the satisfying feeling of finally tackling your taxes. You've diligently gathered your W-2s, 1099s, and charitable donation receipts, ready to input those numbers and hopefully see a refund heading your way. But wait, where's that crucial Form 5498 for your IRA? It's not in the pile. A sense of slight panic begins to set in.

The annual tax season dance comes with its own set of predictable steps, but this year, many IRA holders are finding themselves momentarily paused. The ubiquitous Form 5498, which details contributions made to and the fair market value of Individual Retirement Arrangements (IRAs), might not arrive in your mailbox or appear in your online portal until May. This delay, while not a cause for major alarm, necessitates a slight adjustment to your tax filing strategy.

The Form 5498: A Key Player in Your Tax Game

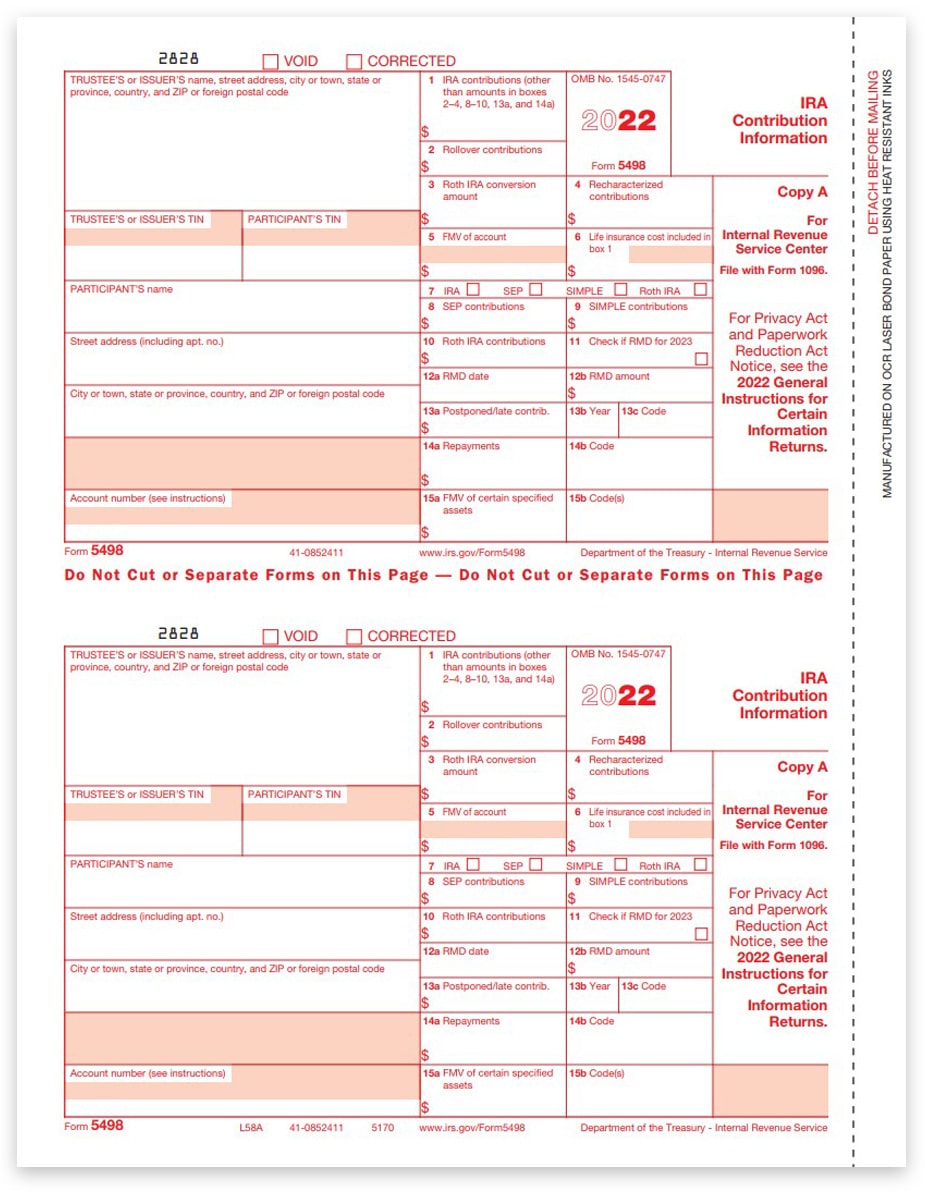

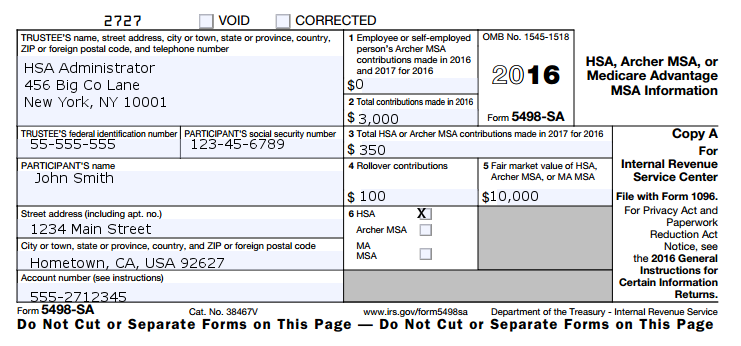

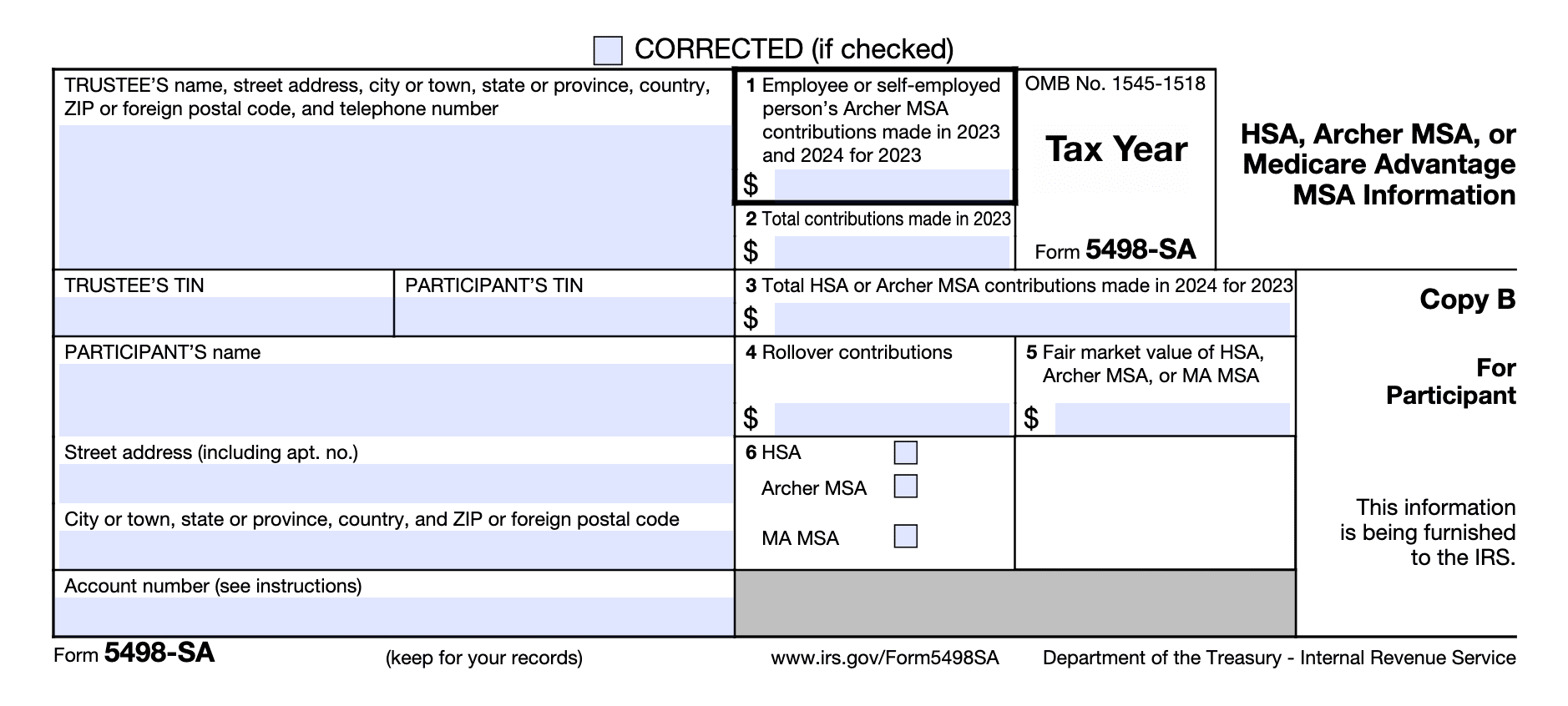

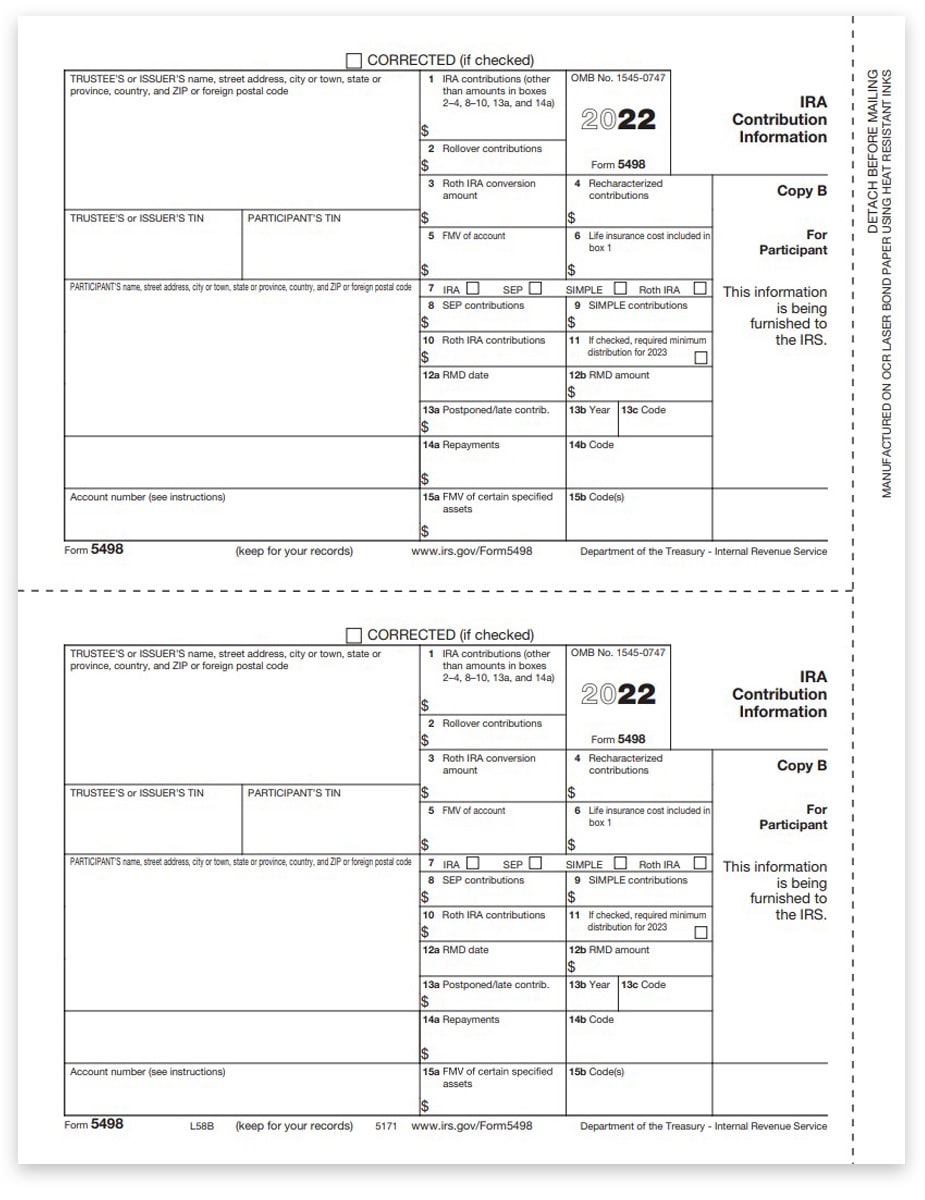

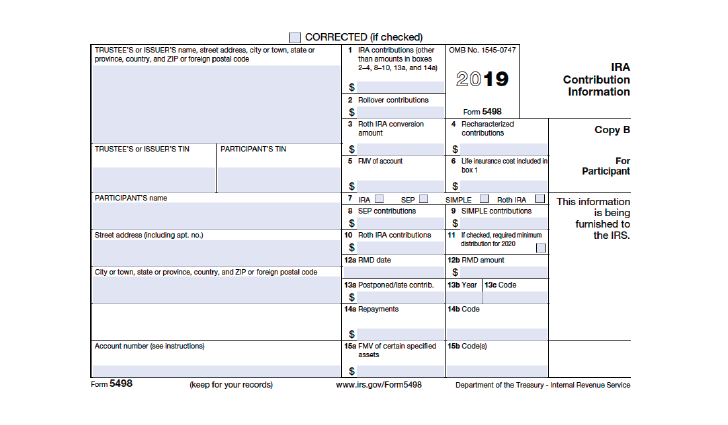

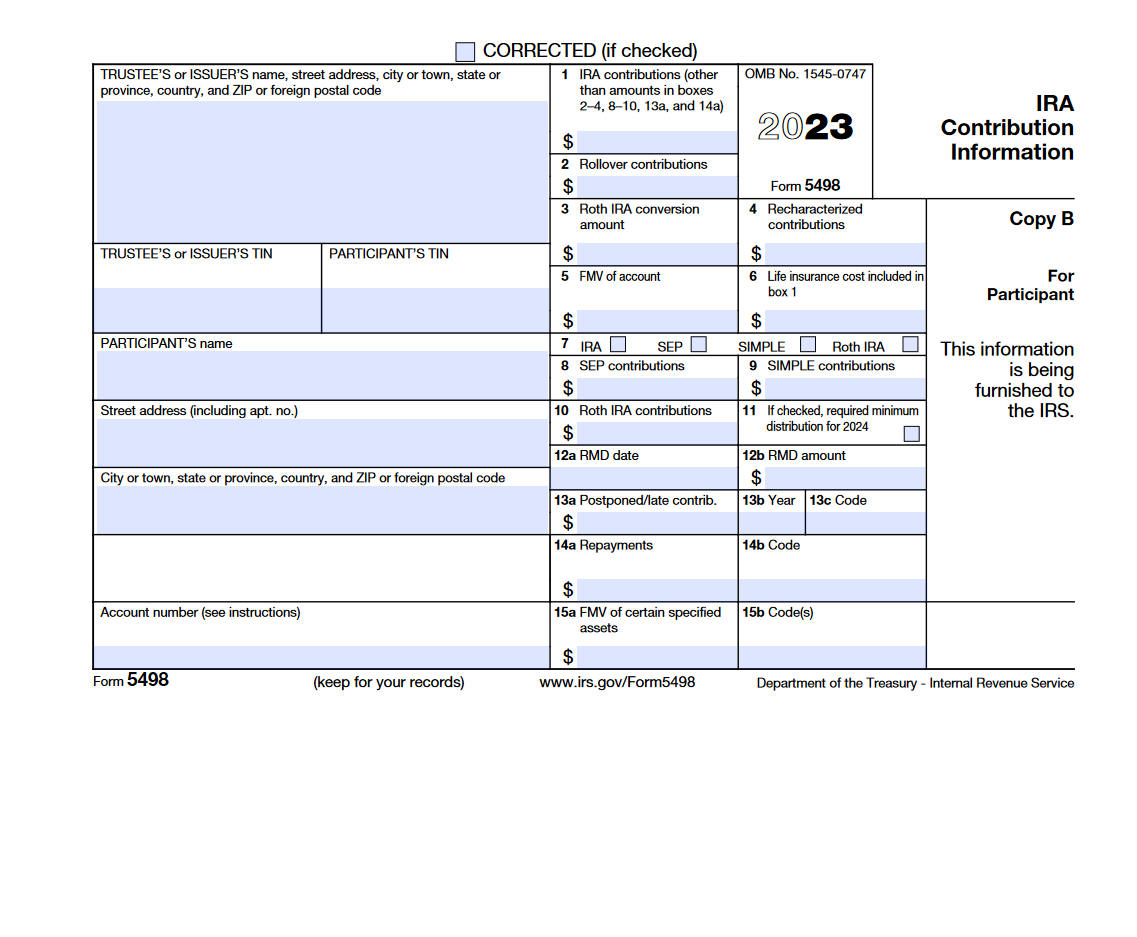

At its core, Form 5498 is an informational document. It's issued by IRA trustees or custodians (like banks or brokerage firms) to both the IRA holder and the IRS. It reports several important pieces of information, including the total contributions made to the IRA for the tax year, rollovers, and the fair market value of the IRA as of December 31st.

Understanding its purpose is crucial. While you typically don't need Form 5498 to file your taxes if you're simply reporting traditional IRA contributions (which may be deductible) or Roth IRA contributions (which are not), it becomes relevant in specific situations. For instance, if you've made a rollover from one retirement account to another, or if you’re taking required minimum distributions (RMDs).

Why the Delay?

The reason for the delayed availability of Form 5498 often stems from the extended deadline for making IRA contributions. Individuals have until the tax filing deadline (typically April 15th, unless extended) to make contributions that count towards the previous tax year. Financial institutions therefore need to wait until after this deadline to finalize and issue the forms accurately.

This is a standard practice, allowing individuals the flexibility to maximize their retirement savings. However, it's important to be aware of this timing to avoid unnecessary anxiety when preparing your taxes.

What This Means for Your Tax Filing

The good news is, in most cases, the delay in receiving Form 5498 won't significantly impact your tax filing process. If you haven't made any IRA contributions for the tax year, the form primarily serves as a record of your IRA's year-end value.

If you *have* made contributions, it's essential to have a strategy. If you are confident in the accuracy of your records of IRA contributions, you can proceed with filing your taxes. Ensure that the amounts you report on your tax return match your own records.

If you're unsure about the exact amount of your contributions or rollovers, or if you suspect any discrepancies, it's prudent to wait for Form 5498 to arrive. Filing an accurate return is always better than rushing and potentially making errors.

Options for Handling the Delay

For those who prefer to wait for Form 5498 before filing, there are a couple of options available. First, you can file for an extension. This gives you until October 15th to file your tax return. However, it's important to remember that an extension to *file* is not an extension to *pay*. You still need to estimate your tax liability and pay it by the original April deadline to avoid penalties and interest.

Alternatively, you can file your return without the Form 5498 if you're confident in your own records, and then amend your return if necessary once you receive the form. This approach requires a little more effort, but it allows you to avoid requesting an extension if you prefer to file sooner.

Contacting your IRA custodian directly can also be beneficial. Many financial institutions now offer online access to tax forms, and you may be able to download a copy of Form 5498 from their website before it arrives in the mail.

Looking Ahead: Planning for Future Tax Seasons

The annual dance of tax season can feel overwhelming at times, but with a little planning and preparation, it can be managed with relative ease. Keeping accurate records of your income, deductions, and contributions throughout the year is paramount. Utilize spreadsheets, tax software, or even a simple notebook to track your financial activity.

Familiarize yourself with key tax deadlines and forms. Understanding the purpose of Form 5498 and its role in your tax filing process can alleviate stress and ensure accuracy.

Consider consulting with a qualified tax professional. A tax advisor can provide personalized guidance based on your individual financial situation and help you navigate the complexities of the tax code. They can ensure that you are taking advantage of all available deductions and credits.

A Moment of Reflection

While the delayed arrival of Form 5498 might present a minor inconvenience, it also serves as a reminder of the importance of proactive financial planning. Taking the time to understand your retirement accounts and tax obligations can empower you to make informed decisions and secure your financial future.

So, take a deep breath, review your records, and perhaps use this extra time to double-check other aspects of your financial life. The tax season, like life itself, is a journey, not a race. Embrace the process, stay informed, and remember that you're not alone in navigating these financial waters.

Ultimately, the slight delay in receiving this particular form underscores the importance of maintaining organized financial records and understanding the intricacies of retirement planning. It's a chance to pause, review, and approach your taxes with a sense of calm and informed confidence.

![Form 5498 Not Available Until May Instructions to Fill Out a Tax Form 5498 [Step-by-Step Guide] - EaseUS](https://pdf.easeus.com/images/pdf-editor/en/resource/fill-5498-form-box-7-15b.png)

![Form 5498 Not Available Until May Instructions to Fill Out a Tax Form 5498 [Step-by-Step Guide] - EaseUS](https://pdf.easeus.com/images/pdf-editor/en/resource/fill-5498-form-box-1-7.png)

:max_bytes(150000):strip_icc()/ScreenShot2020-01-28at4.05.10PM-aaa74c7b441b4609ad379a16d4d624bf.png)