Funding An Llc With Personal Funds

Entrepreneurs often face a critical early decision: how to fund their new Limited Liability Company (LLC). While venture capital and loans are common avenues, many business owners choose to use their own personal funds, a practice that, while seemingly straightforward, has nuances and potential tax implications.

Funding an LLC with personal assets, often referred to as a capital contribution, is a widespread method for bootstrapping a new business. According to a recent survey by the Small Business Administration (SBA), approximately 75% of startups rely on personal savings and credit during their initial stages. This article will explore the process, considerations, and potential benefits and drawbacks associated with this funding strategy.

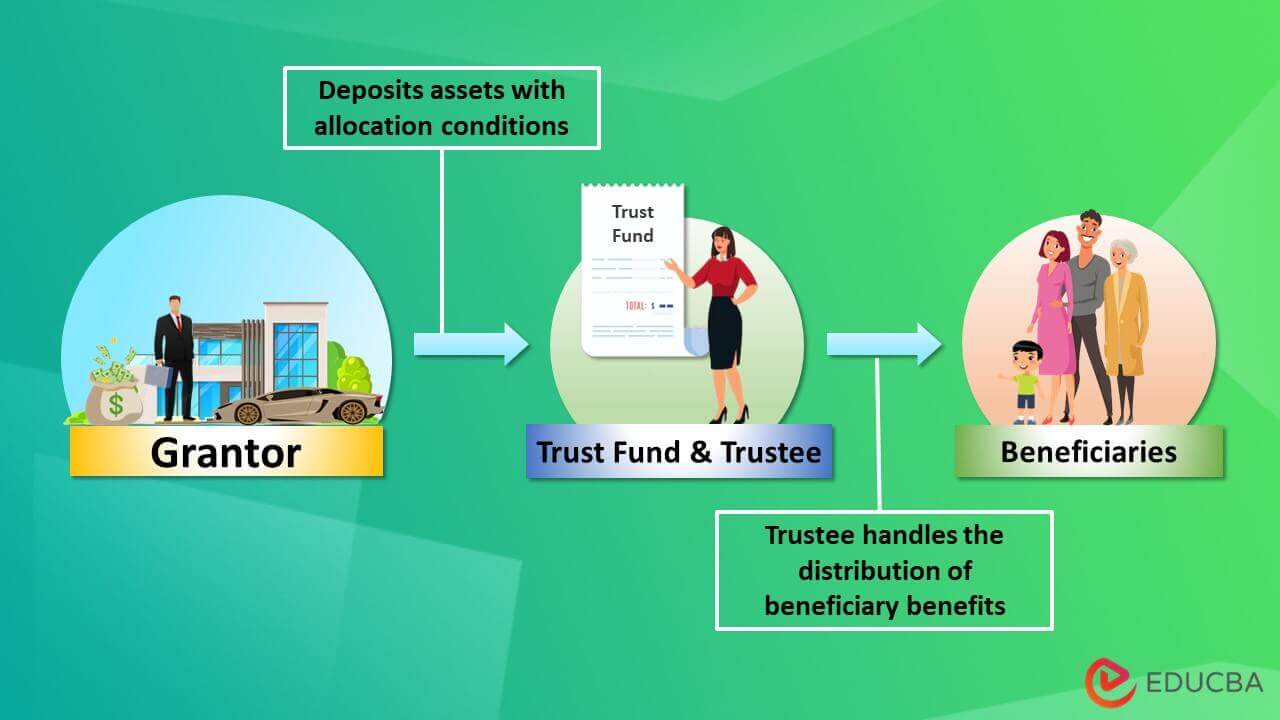

Understanding Capital Contributions

A capital contribution is the transfer of assets, typically cash, from the owner(s) of the LLC to the business itself. This contribution establishes the initial capital base for the LLC to operate and cover expenses.

Unlike a loan, a capital contribution does not typically require repayment, though the contributing member gains an increased ownership stake in the LLC. The specifics of ownership and equity are outlined in the LLC's operating agreement.

The Mechanics of Funding

The process begins with determining the amount of capital required to launch and sustain the LLC. This involves creating a detailed budget, forecasting expenses, and projecting revenue.

Once the funding amount is decided, the member(s) transfer the funds from their personal account to the LLC's business bank account. It’s crucial to document this transfer clearly as a capital contribution for accounting and tax purposes.

This documentation typically involves a written record stating the date, amount, and purpose of the transfer, along with any associated ownership changes.

Tax Implications

The IRS treats capital contributions differently than loans or income. Generally, capital contributions are not considered taxable income for the LLC.

However, the member's basis in their ownership interest increases by the amount of the contribution. This increased basis can impact future tax liabilities related to distributions, sale of the ownership interest, or losses.

It's important to consult with a tax professional to understand the specific implications for your LLC and individual circumstances.

Advantages of Using Personal Funds

One of the primary advantages is avoiding the need to secure external funding, such as loans, which can carry interest payments and restrictive covenants. This provides greater financial flexibility and control over the business.

Bootstrapping with personal funds demonstrates a strong commitment to the business, which can be attractive to potential investors or lenders in the future. Self-funding can also accelerate the launch process by eliminating lengthy application procedures.

Disadvantages and Risks

The most significant risk is the potential loss of personal assets if the business fails. Unlike a loan, a capital contribution is not guaranteed to be repaid.

Using personal funds can also strain personal finances, especially if the business encounters unexpected challenges or requires additional capital infusions. Careful planning and realistic projections are crucial.

Entrepreneurs should carefully consider the potential impact on their personal financial security before committing a substantial portion of their savings to an LLC.

Alternative Funding Options

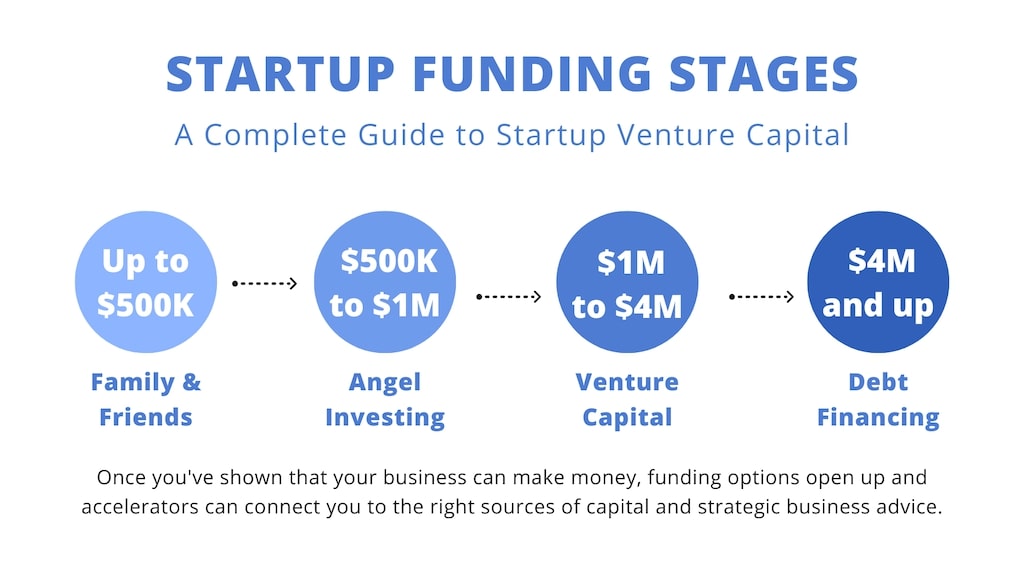

"While using personal funds is common, exploring alternative funding options is always advisable,"says Jane Doe, a business consultant at Acme Consulting Group.

She recommends considering options such as small business loans, lines of credit, crowdfunding, and angel investors. Each option has its own advantages and disadvantages in terms of cost, control, and risk.

Thoroughly researching and comparing different funding sources is a vital step in the business planning process.

Conclusion

Funding an LLC with personal funds is a common and often necessary step for new entrepreneurs. While it offers advantages such as financial independence and speed, it also carries risks to personal finances.

By understanding the mechanics, tax implications, and potential drawbacks, business owners can make informed decisions about how to best finance their ventures. Consulting with financial and legal professionals is strongly recommended to navigate the complexities of capital contributions and ensure compliance with all applicable regulations.