Funding To Buy An Existing Business

Small business acquisition just got easier: a new $5 million fund aims to fuel the dreams of aspiring entrepreneurs ready to take the reins of existing, profitable ventures. The initiative will provide critical capital for qualified buyers looking to bypass the startup grind.

This funding addresses the growing need for accessible financing in the business acquisition space, particularly for those seeking to acquire established, revenue-generating companies. The fund offers a significant boost to local economies and preserves valuable businesses within communities.

Who is involved?

The fund, officially named the "Legacy Builders Acquisition Fund," is a joint venture between Venture Forge Capital and Community First Bank.

Venture Forge Capital, a private equity firm specializing in small business investments, will manage the fund's deployment. Community First Bank is the primary lender, providing the initial capital injection.

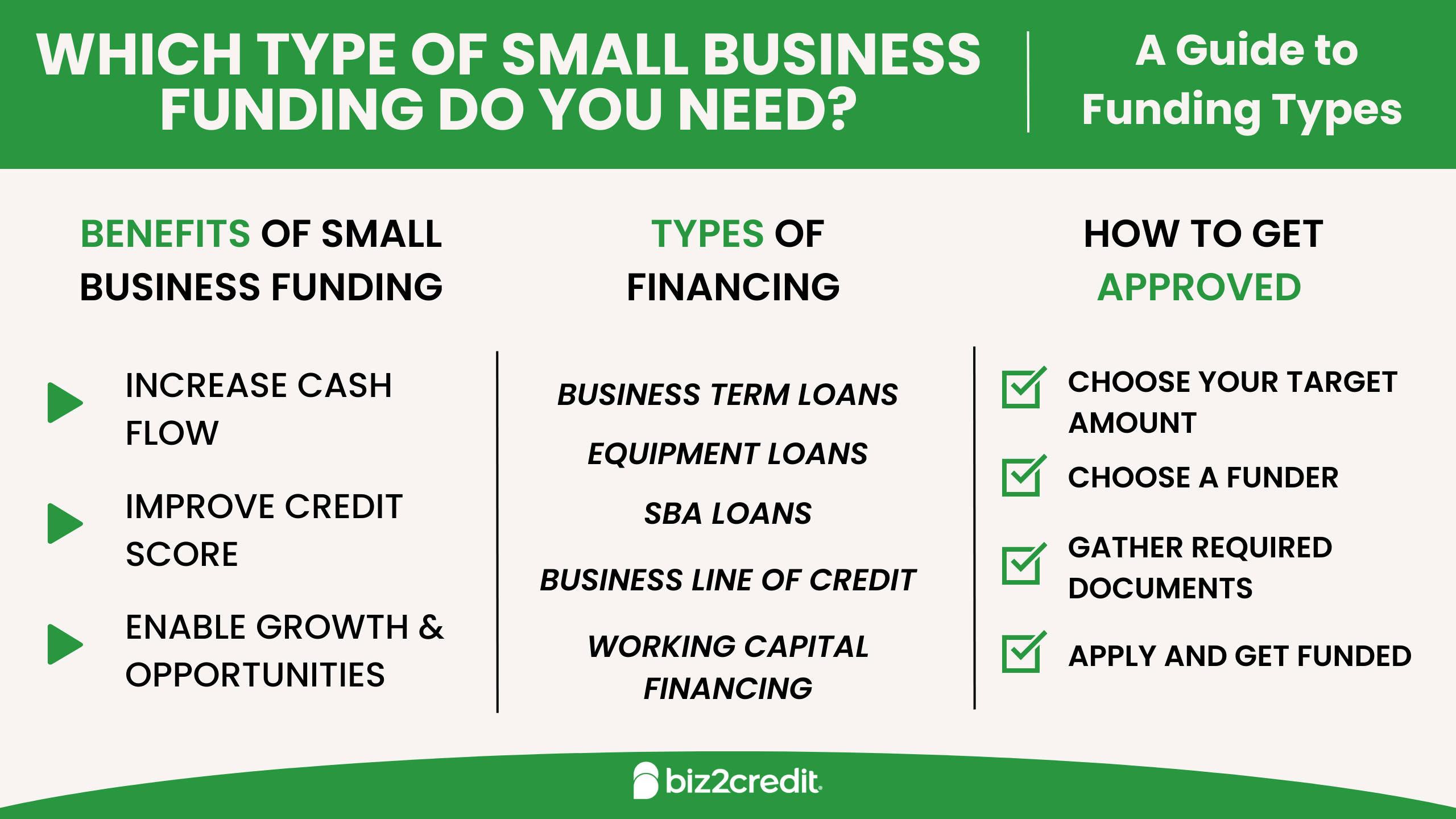

What is being funded?

The Legacy Builders Acquisition Fund provides loans specifically for the purchase of existing small businesses with a proven track record of profitability.

Funding can cover up to 80% of the acquisition cost, including working capital needs for the first year of operation. The loans feature competitive interest rates and flexible repayment terms, designed to support long-term business sustainability.

Where and When is this happening?

The fund is focused on businesses located within the tri-county area of Summit, Portage, and Stark counties in Northeast Ohio.

Applications are being accepted immediately, with the first round of funding expected to be disbursed by the end of the current quarter. The fund has a five-year investment horizon, with plans for potential expansion based on initial success.

How to Apply?

Interested buyers are encouraged to visit the Venture Forge Capital website to download the application packet.

Eligibility criteria include a thorough business plan, evidence of managerial experience, and a satisfactory credit history. The acquired business must demonstrate a consistent history of profitability for at least three years.

"We are committed to empowering the next generation of business owners," says Sarah Jenkins, CEO of Venture Forge Capital. "This fund provides the financial backing and support needed to successfully transition ownership and ensure the continued success of these vital businesses."

Impact and Future Outlook

The Legacy Builders Acquisition Fund is projected to facilitate the acquisition of at least 20 small businesses over the next five years.

This will translate into the preservation of hundreds of jobs and the infusion of millions of dollars into the local economy. The initiative is designed to address the challenges of succession planning faced by many small business owners reaching retirement age.

Ongoing developments include plans to partner with local business incubators and mentorship programs to provide additional support to fund recipients.