Gaap Accounting For Legal Settlement Expense

The shadow of legal settlements looms large over corporate balance sheets, demanding careful scrutiny of accounting practices. How companies account for these often substantial expenses can significantly impact their reported earnings, influencing investor confidence and overall financial health. The complexities inherent in Generally Accepted Accounting Principles (GAAP) as they relate to legal settlement expenses necessitate a clear understanding for stakeholders to accurately assess a company's financial position.

This article delves into the intricacies of GAAP accounting for legal settlement expenses. It explores the specific rules governing when and how these expenses are recognized, the potential for manipulation or misinterpretation, and the implications for financial reporting. By examining the current standards and considering expert perspectives, we aim to provide a comprehensive overview of this crucial aspect of corporate finance.

GAAP and Legal Settlement Expenses: A Deep Dive

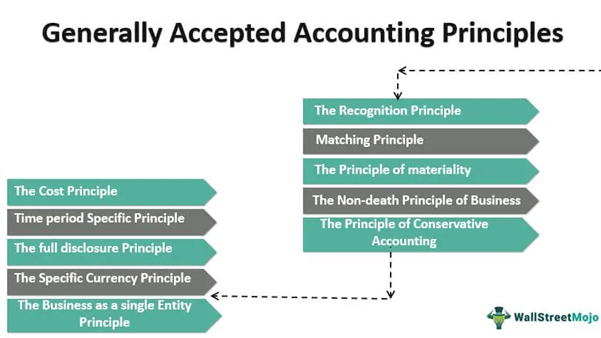

GAAP, the cornerstone of financial reporting in the United States, provides a framework for consistent and transparent accounting practices. However, the application of GAAP to legal settlements can be nuanced, depending on the nature of the settlement and the timing of the events leading up to it. The primary guidance comes from ASC 450, Contingencies, which addresses the accounting for loss contingencies.

Understanding Loss Contingencies

ASC 450 defines a loss contingency as an existing condition, situation, or set of circumstances involving uncertainty as to possible loss to an entity that will ultimately be resolved when one or more future events occur or fail to occur. Legal disputes invariably fall under this definition. A key aspect is determining the probability of the loss occurring and the ability to reasonably estimate the amount of the loss.

GAAP dictates that a loss contingency should be accrued by a charge to income if both of the following conditions are met: information available before the financial statements are issued indicates that it is probable that a liability has been incurred at the date of the financial statements; and the amount of the loss can be reasonably estimated. If only one, or neither, of these conditions are met, a liability is not recognized. If the reasonable possible loss exceed the accrued liability, a disclosure in the footnotes should be included in the financial statement.

The "Probable" Threshold

The term "probable" in GAAP has a specific meaning: the future event or events are likely to occur. This threshold requires considerable judgment and often relies on the advice of legal counsel. Determining when a loss becomes probable can be a point of contention, as companies may be reluctant to recognize a liability that could negatively impact their financial performance.

Reasonable Estimation: A Challenge

Even if a loss is deemed probable, accurately estimating the amount of the settlement can be challenging. Legal proceedings are inherently unpredictable. Factors such as the strength of the plaintiff's case, the potential for reputational damage, and the company's risk tolerance all influence settlement negotiations. Estimating potential attorney fees and other related costs can further complicate the process.

Accounting for Specific Settlement Types

The specific accounting treatment may vary depending on the nature of the legal settlement. For example, a settlement related to a product liability claim will be accounted for differently than a settlement related to an environmental remediation issue.

Product Liability Settlements

Settlements stemming from product liability lawsuits are generally expensed as incurred. This is because the underlying liability arises from the sale of the product and the alleged harm it caused. Companies typically accrue for these liabilities when it is probable that they will have to pay out settlements and the amount can be reasonably estimated. The determination of probable can often rely on historical trends in similar lawsuits and expert analysis.

Environmental Remediation Settlements

Environmental remediation settlements, on the other hand, may involve a different accounting approach. These settlements often require companies to clean up contaminated sites or reimburse government agencies for remediation costs. The accounting for these liabilities is governed by ASC 410, Asset Retirement and Environmental Obligations. The key is to recognize the liability when the company is obligated to perform the remediation work, regardless of when the actual cleanup occurs.

Securities Class Action Settlements

These settlements are particularly sensitive. They often lead to greater scrutiny from investors. The settlements typically involve allegations of misrepresentation or fraud. Companies must carefully assess the merits of the claims and the potential financial exposure before accruing a liability. Any disclosure of the settlement must be precise and avoid admitting guilt.

Transparency and Disclosure

GAAP emphasizes the importance of transparency in financial reporting. Companies are required to disclose information about their legal contingencies, even if they do not meet the criteria for accrual. These disclosures typically appear in the footnotes to the financial statements and provide investors with valuable insights into the company's potential legal liabilities.

The disclosures should include a description of the nature of the contingency, an estimate of the possible loss or range of loss, or a statement that such an estimate cannot be made. Failure to adequately disclose legal contingencies can result in regulatory scrutiny and damage to the company's reputation.

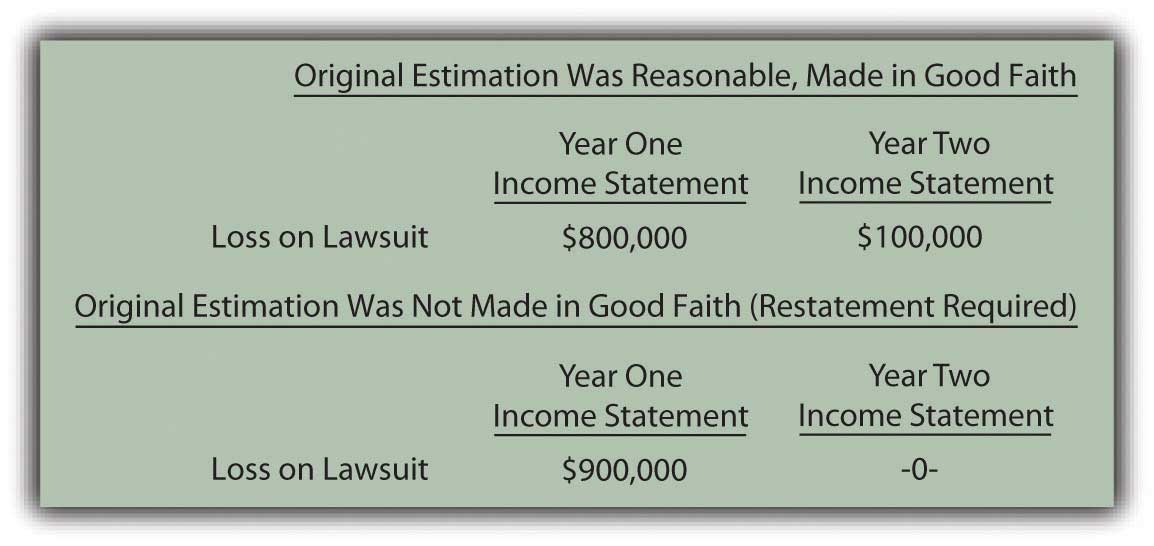

Potential for Manipulation

The subjective nature of GAAP accounting for legal settlements creates the potential for manipulation. Companies may be tempted to delay recognizing a liability until it is absolutely unavoidable, or to underestimate the amount of the potential loss. Such practices can distort a company's financial picture and mislead investors.

Aggressive accounting practices related to legal settlements have been the subject of scrutiny by the Securities and Exchange Commission (SEC). The SEC has the authority to investigate companies that fail to comply with GAAP and to take enforcement actions against those that engage in fraudulent financial reporting.

Looking Ahead

The accounting for legal settlement expenses remains a complex and evolving area. As legal and regulatory landscapes shift, companies must stay abreast of the latest developments and adapt their accounting practices accordingly. The Financial Accounting Standards Board (FASB), the organization responsible for setting GAAP, periodically updates its standards to address emerging issues and improve the quality of financial reporting.

Going forward, investors and other stakeholders should carefully scrutinize companies' disclosures related to legal contingencies. A thorough understanding of the underlying legal risks and the accounting policies used to measure and report these risks is essential for making informed investment decisions.

Ultimately, the accurate and transparent accounting for legal settlement expenses is crucial for maintaining investor confidence and ensuring the integrity of the financial markets. By adhering to GAAP and providing clear and informative disclosures, companies can demonstrate their commitment to ethical and responsible financial reporting.

+matched+to+accounting+period+and+fiscal+year..jpg)