Glancy Prongay & Murray Llp Announces Investigation

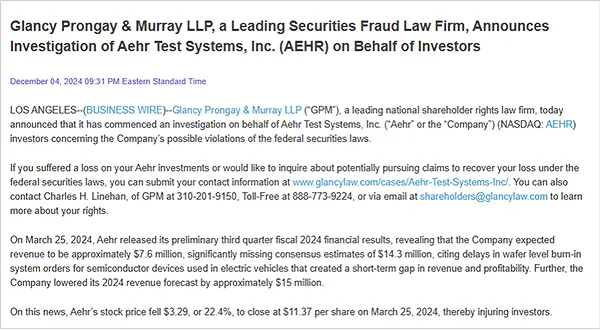

Los Angeles-based law firm Glancy Prongay & Murray LLP (GPM) has announced that it is initiating an investigation into potential securities law violations related to [Insert Company Name Here], a [Insert Company Industry Here] company. The announcement, released earlier today, focuses on alleged inaccurate or misleading statements and/or omissions concerning the company's business operations and financial prospects.

The investigation, although preliminary, could have significant implications for investors and shareholders of [Insert Company Name Here]. The outcome might influence the company’s stock valuation and potentially lead to legal action, impacting the broader market confidence in [Insert Company Industry Here].

GPM’s statement outlined the scope of the investigation, focusing specifically on statements released by [Insert Company Name Here] between [Start Date] and [End Date]. The law firm is encouraging investors who have suffered losses to contact them.

The Investigation's Focus

The investigation centers on whether [Insert Company Name Here] violated federal securities laws. This involves analyzing public statements, financial reports, and other disclosures made by the company during the specified period.

The core allegation revolves around claims that [Insert Company Name Here] made misleading statements or failed to disclose crucial information regarding [Specific Issue, e.g., product safety, sales figures, regulatory compliance]. Such actions, if proven, could constitute a violation of securities laws.

GPM is examining whether these alleged misrepresentations artificially inflated the company’s stock price. This would have harmed investors who purchased shares during the period in question.

Glancy Prongay & Murray LLP's Role

Glancy Prongay & Murray LLP is a nationally recognized law firm specializing in securities class actions and shareholder rights litigation. The firm has a history of representing investors in cases against companies accused of securities fraud.

By launching this investigation, GPM is taking the first step towards potentially filing a class action lawsuit against [Insert Company Name Here]. This could be on behalf of investors who believe they have been financially harmed.

The firm’s expertise in securities law and its track record of successful litigation lend credibility to this investigation. It also gives investors a potential avenue for seeking redress.

Potential Impact on Investors and [Insert Company Name Here]

The investigation could significantly impact [Insert Company Name Here]. The immediate effect may be a decline in the company's stock price. This reflects investor uncertainty and concerns about potential legal liabilities.

If the investigation uncovers evidence of securities law violations, [Insert Company Name Here] could face substantial financial penalties. These can include fines, restitution to investors, and reputational damage.

Shareholders may experience further losses depending on the outcome of the investigation. The long-term impact on the company's market position and investor confidence remains to be seen.

How the Investigation Will Proceed

GPM’s investigation will involve a thorough review of relevant documents. This includes SEC filings, company communications, and internal records.

The firm will also conduct interviews with former employees, industry experts, and other individuals who may have knowledge of the alleged misconduct. This comprehensive approach aims to gather sufficient evidence to determine whether legal action is warranted.

Depending on the findings, GPM may file a class action lawsuit on behalf of affected investors.

"We are committed to protecting the rights of investors who have been harmed by corporate misconduct,"stated a representative from Glancy Prongay & Murray LLP.

A Human-Interest Angle: The Impact on Individual Investors

For individual investors, news of this investigation may bring both anxiety and hope. Some may have invested a significant portion of their savings in [Insert Company Name Here]. They are now facing potential losses due to the alleged misconduct.

These investors are relying on the legal system to hold companies accountable for their actions. They hope to recover some or all of their losses through the potential class action lawsuit.

The outcome of this investigation will have a direct impact on the financial well-being of numerous individuals. It underscores the importance of transparency and ethical conduct in the corporate world.

Looking Ahead

The investigation by Glancy Prongay & Murray LLP is ongoing. It is still in its early stages, and no definitive conclusions have been reached. Further developments are expected in the coming weeks and months.

Investors of [Insert Company Name Here] should closely monitor the progress of the investigation. They should seek professional financial and legal advice if they have concerns about their investments.

This case serves as a reminder of the risks associated with investing in the stock market. It underscores the importance of due diligence and informed decision-making.