Global Dividend Growth Split Corp. Key Debates

Imagine a bustling marketplace, filled with vendors hawking their wares. But instead of fruits and vegetables, these merchants are offering slices of the future – specifically, shares in a company designed to provide a steady stream of income through dividends. This is the world of split corporations, and one name often pops up in discussions: Global Dividend Growth Split Corp. (GDV). Yet, beneath the surface of attractive yields, a complex debate brews regarding its structure and long-term sustainability.

At the heart of the discussion surrounding GDV lies its unique structure as a split corporation. This structure creates both potential benefits and potential risks for investors. Understanding the mechanics and the ongoing debates is crucial for anyone considering investing in this vehicle, and to get insight into the broader world of dividend-focused investment strategies.

Understanding Global Dividend Growth Split Corp.

Global Dividend Growth Split Corp. is a publicly traded investment fund. It is structured as a split share corporation.

Split corporations are designed to provide investors with different risk and return profiles. This is achieved by dividing the company's capital structure into two main types of shares: preferred shares and class A shares.

The Two Pillars: Preferred and Class A Shares

Preferred shares, often considered the more conservative option, aim to provide a fixed dividend income stream. GDV's preferred shares are typically designed to offer a stable yield with lower volatility.

Class A shares, on the other hand, represent a more leveraged investment. They receive the residual value of the portfolio after the preferred shareholders have been paid, potentially offering higher capital appreciation, but also carrying greater risk.

This division allows investors to choose an investment that aligns with their specific financial goals and risk tolerance. Some seek the stability of preferred shares, while others pursue the growth potential of Class A shares.

The Key Debates: A Closer Look

The split share structure of GDV, while innovative, has attracted scrutiny and sparked debates among financial analysts and investors. Concerns center on its dependence on the performance of the underlying portfolio. These concerns also center on its vulnerability to market downturns, and the potential impact on both preferred and Class A shareholders.

Sustainability of Dividends

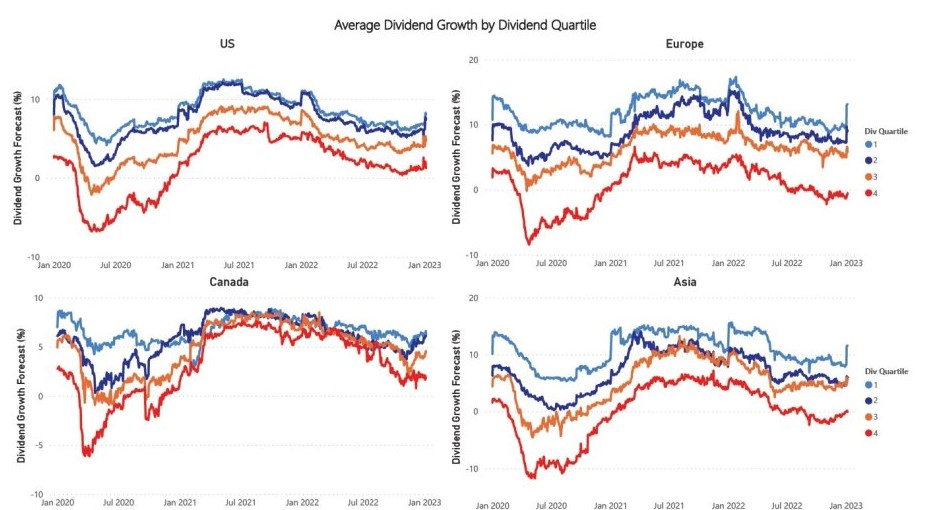

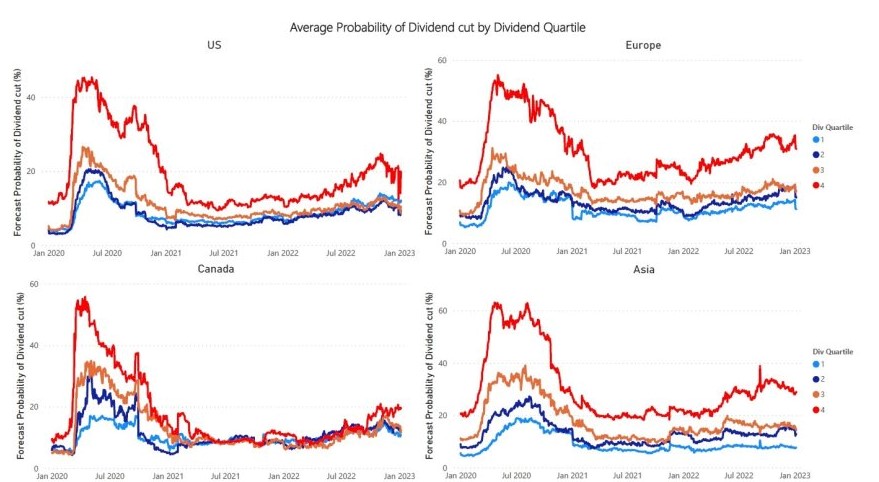

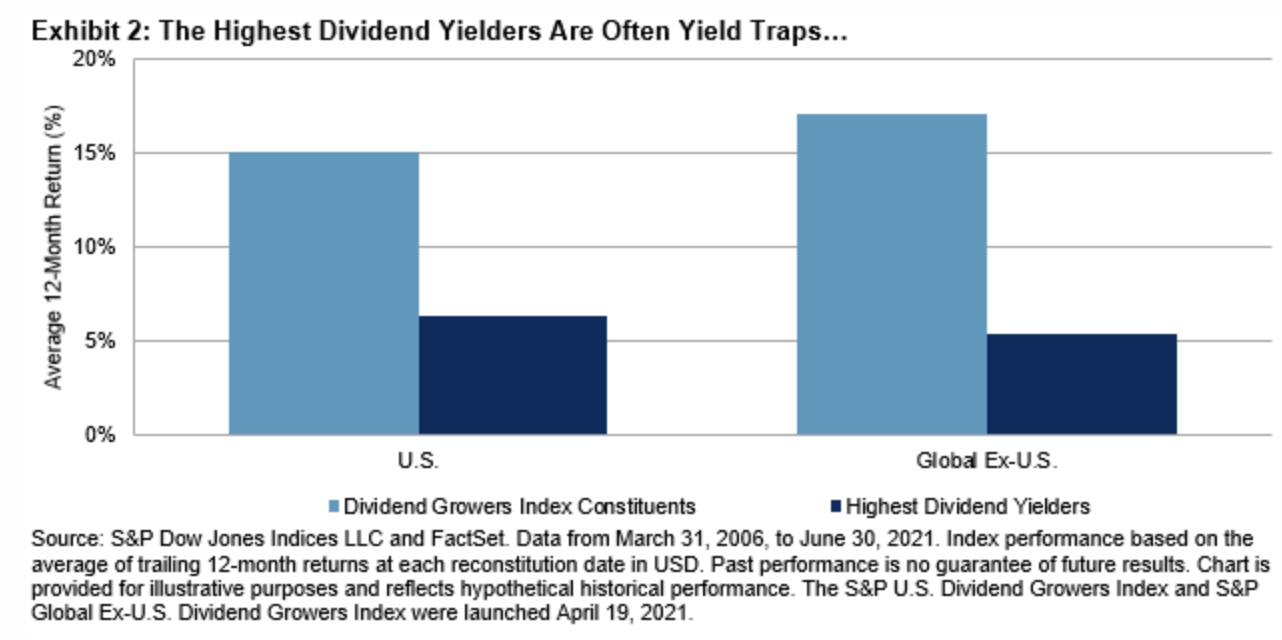

A primary debate revolves around the sustainability of the dividend payouts, particularly for the preferred shares. GDV needs to generate sufficient income from its investment portfolio to cover these dividends.

Critics question whether the portfolio can consistently generate enough yield to meet the dividend obligations. They also wonder if the dividend payments are sometimes being funded by returns of capital, rather than from genuine investment income. Returns of capital distributions are not considered sustainable over the long term.

Conversely, proponents argue that the portfolio is carefully managed to generate a stable income stream. They emphasize the fund's active management team that is responsible for adapting to changing market conditions.

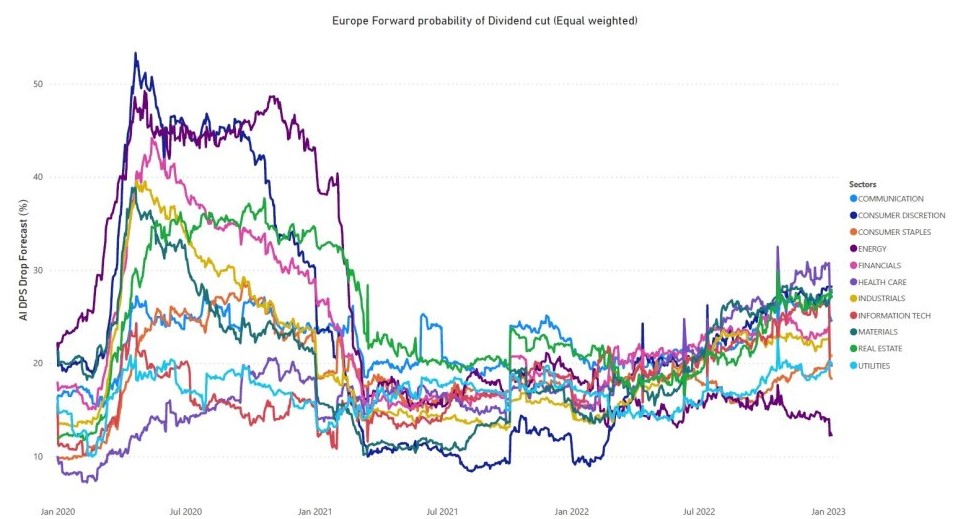

Impact of Market Volatility

Market volatility poses a significant risk to split share corporations. A downturn in the market can erode the value of the underlying portfolio.

This erosion can jeopardize the ability to pay dividends to preferred shareholders and severely impact the value of the Class A shares. The leverage inherent in the structure amplifies both gains and losses.

Bearish investors highlight the potential for a 'death spiral' scenario. In this scenario, declining asset values trigger further selling pressure, which then leads to even lower valuations and dividend cuts.

The Role of Active Management

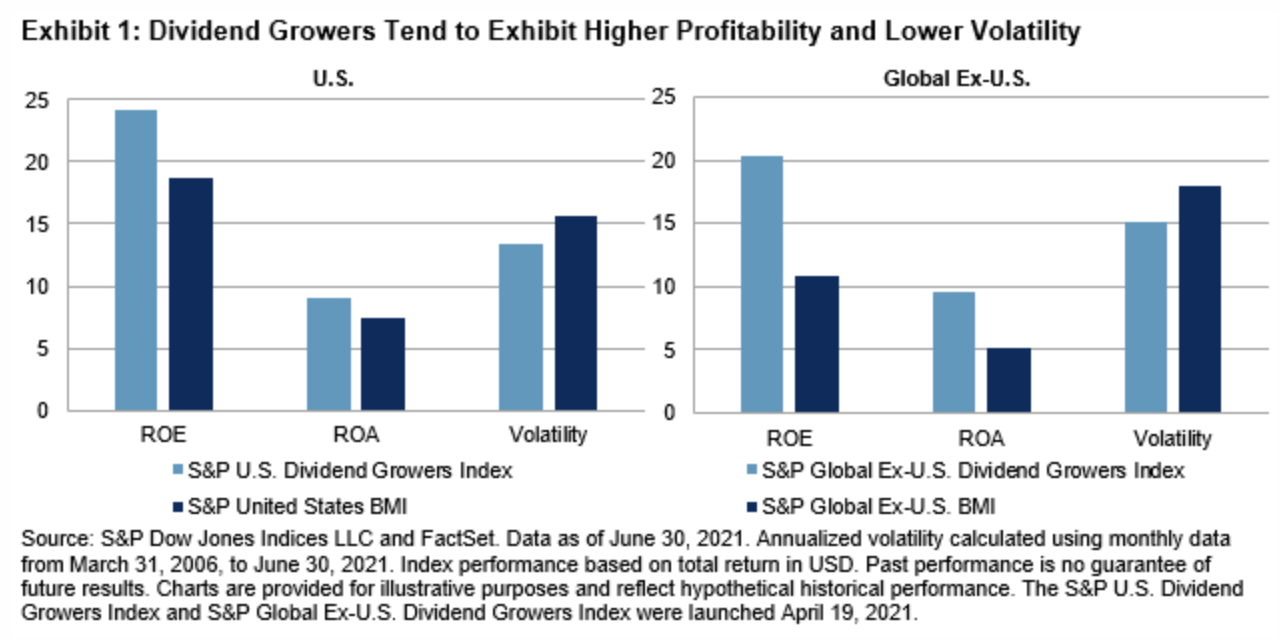

The success of GDV hinges on the ability of its active management team to make sound investment decisions. They must identify and select dividend-paying stocks that can consistently generate income while preserving capital.

The effectiveness of this active management is a point of contention. Some argue that the fees associated with active management outweigh the benefits. Others believe the expertise of the managers is crucial in navigating complex market conditions and ensuring dividend sustainability.

Furthermore, the specific investment strategy employed by the management team can influence the risk profile of the fund. A more aggressive strategy may offer higher potential returns but also carries greater downside risk.

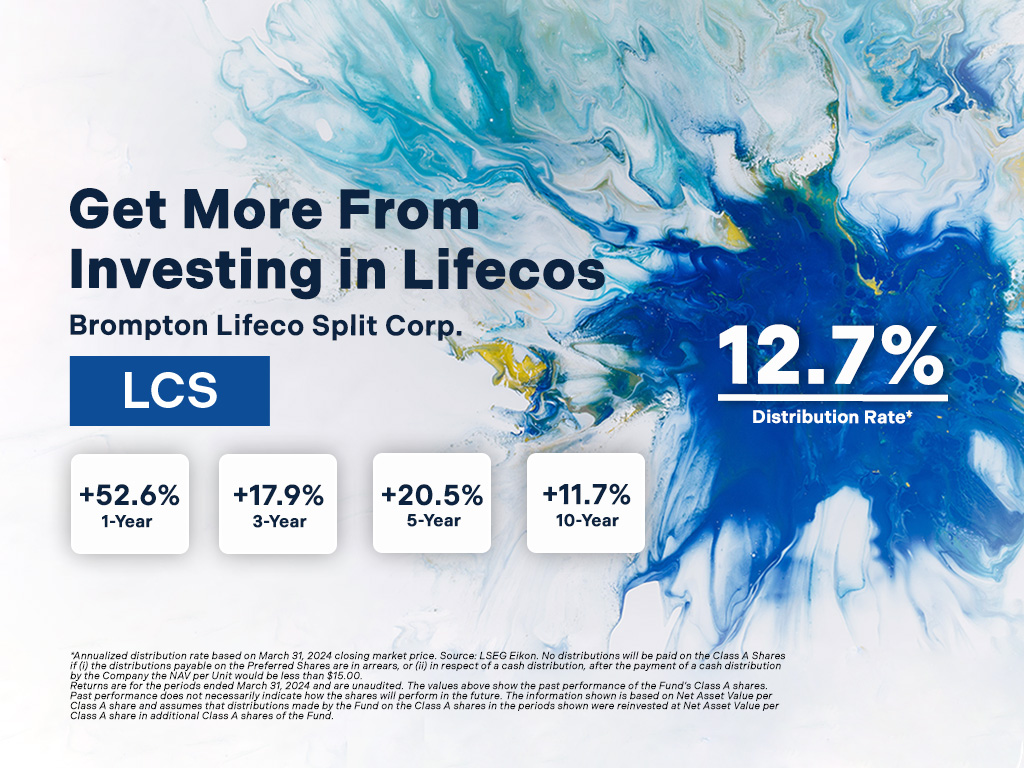

Data and Performance

Examining historical performance data provides valuable insights into GDV's track record. Investors often scrutinize dividend yields, total returns, and share price volatility.

Analyzing performance during periods of market stress can reveal the fund's resilience. It can also reveal its vulnerability to adverse market conditions.

Comparing GDV's performance against relevant benchmarks, such as dividend-focused ETFs or other split share corporations, helps to assess its relative strengths and weaknesses. This comparative approach is crucial for making informed investment decisions.

Perspectives from Industry Experts

Financial analysts offer varying perspectives on GDV, often highlighting the nuances of the split share structure. Some express caution, emphasizing the inherent risks associated with leverage and market volatility.

Others acknowledge the potential benefits of the fund for income-seeking investors. However, they also stress the importance of thorough due diligence and a clear understanding of the risks involved.

Independent research reports and financial publications provide valuable insights into the views of industry experts. Staying informed about these perspectives is crucial for navigating the complexities of split share corporations.

The Investor's Dilemma

Ultimately, the decision to invest in GDV or any split share corporation depends on individual circumstances. These circumstances include risk tolerance, investment goals, and time horizon.

Investors seeking a relatively stable income stream may be attracted to the preferred shares. Those with a higher risk appetite might consider the Class A shares for their potential capital appreciation.

However, it is crucial to carefully assess the potential risks and rewards. It is important to consider consulting with a qualified financial advisor before making any investment decisions.

Conclusion: Navigating the Dividend Landscape

Global Dividend Growth Split Corp. presents a compelling case study in the world of dividend investing. Its unique structure as a split corporation offers both opportunities and challenges for investors.

The ongoing debates surrounding its sustainability, volatility, and management highlight the importance of informed decision-making. A clear understanding of the risks and rewards is essential for navigating the complex landscape of dividend-focused investments.

As the market continues to evolve, the future of GDV and other split share corporations will depend on their ability to adapt. It will also depend on their ability to deliver consistent value to shareholders in a sustainable and responsible manner.

.png)