Goodwill Is Recorded Only At Time Of Purchase

.jpg)

Imagine a bustling marketplace, vibrant with energy. Merchants displaying their wares, each a unique tapestry of value and potential. Every exchange is a story, an agreement on what something is worth at that precise moment in time. But what about the intangible whisper of reputation, the echo of brand loyalty, the promise of future growth that clings to some businesses like morning mist? This, in the world of finance, is goodwill.

Goodwill, that elusive asset reflecting a company's brand recognition and customer loyalty, is only recorded at the moment a business is acquired. This accounting practice, while seemingly straightforward, carries profound implications for how companies are valued and how investors perceive their performance. Understanding this principle is crucial for navigating the complexities of the modern business world.

The Essence of Goodwill: An Intangible Asset

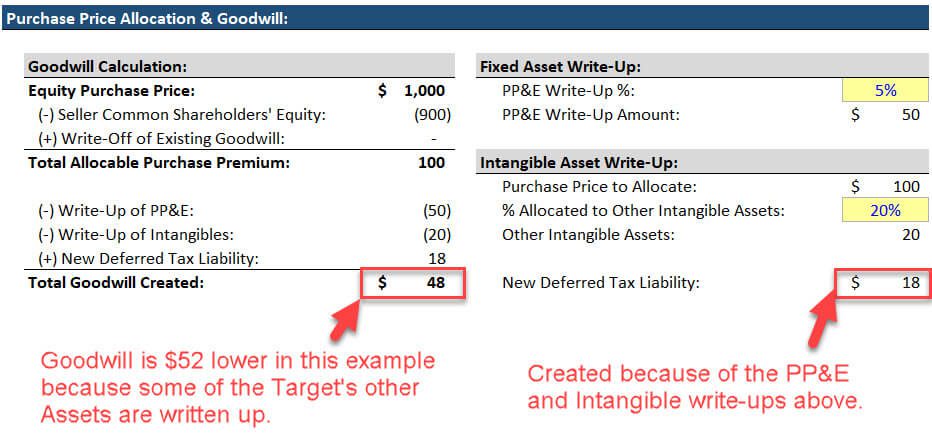

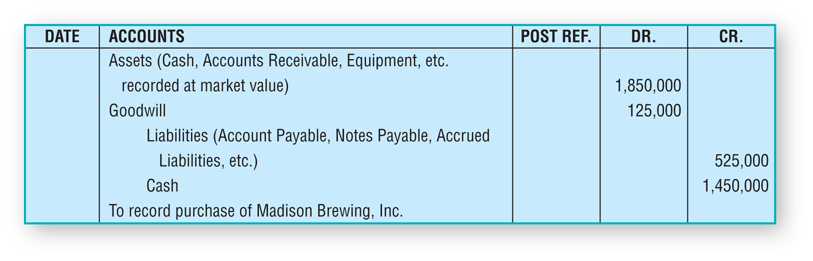

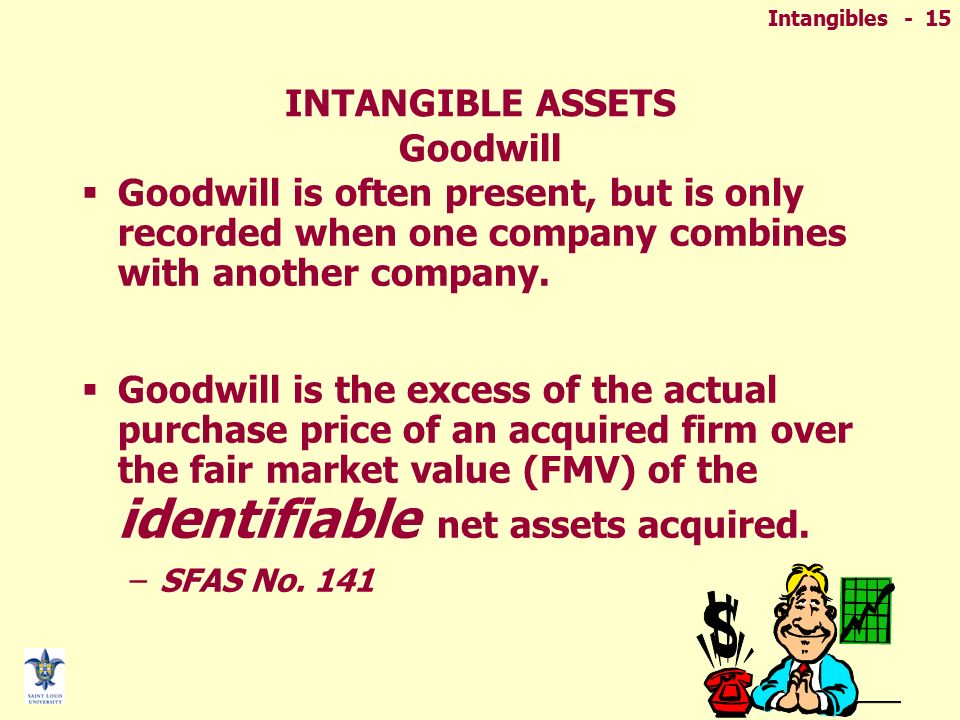

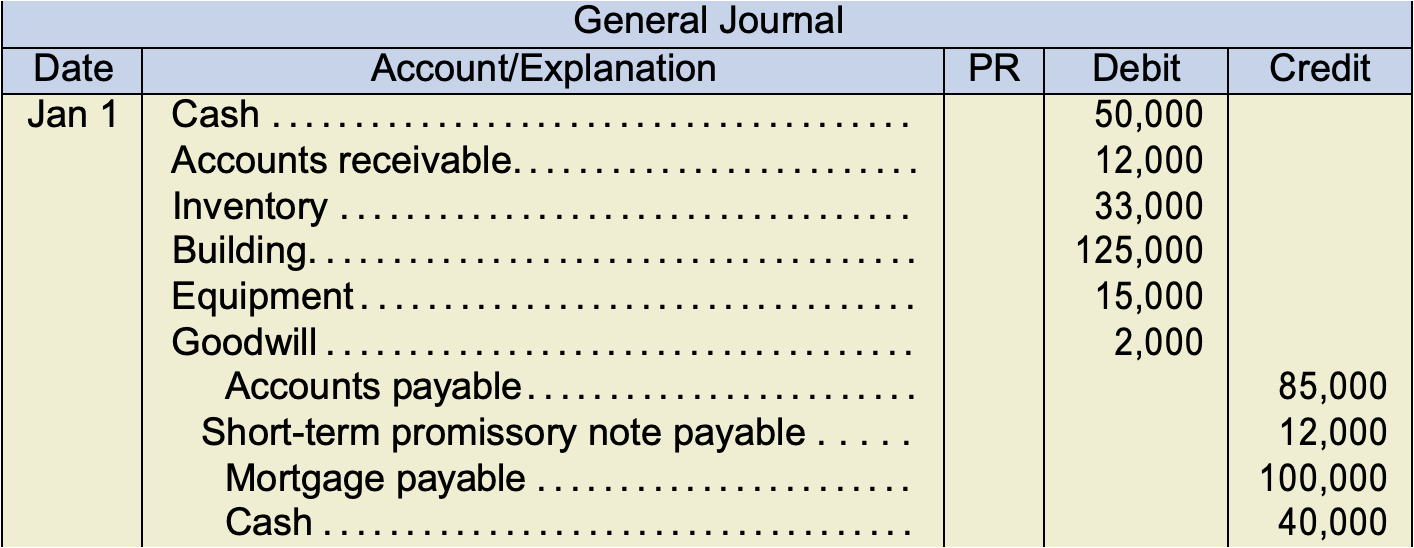

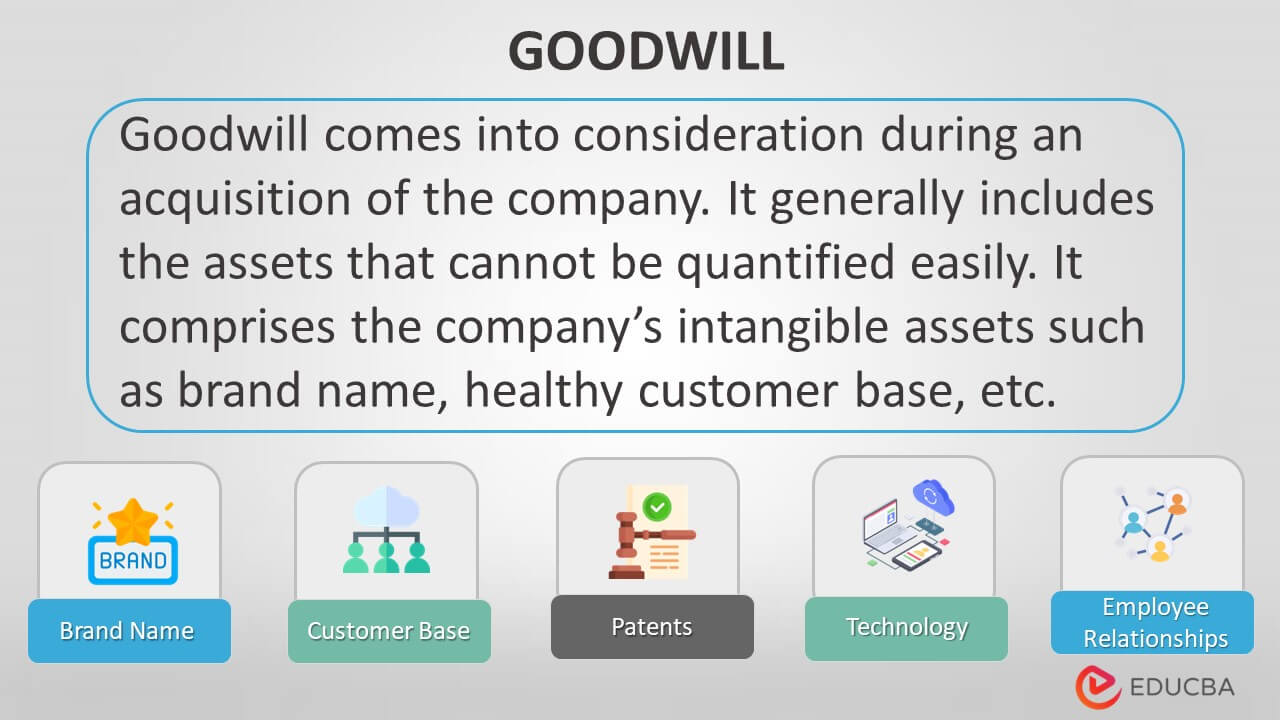

Goodwill, at its core, represents the excess of the purchase price of a company over the fair value of its identifiable net assets. These "identifiable net assets" are the tangible things you can easily point to: buildings, equipment, inventory, and so on. It's the premium paid for the name, the reputation, the existing customer base - the intangible qualities that contribute to future profitability.

Think of a local bakery known for its delectable pastries and friendly service. A larger chain might be willing to pay more than the value of its ovens and recipes. That extra money reflects the bakery's strong local reputation - its goodwill.

The Accounting Standard: Purchase Accounting

The reason goodwill is only recorded upon acquisition lies in the principles of purchase accounting. According to Generally Accepted Accounting Principles (GAAP), companies must use purchase accounting when acquiring another business. This mandates that the acquiring company records all assets and liabilities of the acquired company at their fair market value on the date of acquisition.

It is important to note that the standard governing goodwill accounting is ASC 350, Intangibles – Goodwill and Other, issued by the Financial Accounting Standards Board (FASB). The ASC 350 provides detailed rules and guidance on how to account for goodwill, including how to test it for impairment.

Because goodwill cannot be easily separated from the acquired business and sold independently, it's not recognized outside of a business combination. Goodwill is seen as inseparable from the entity that owns it.

Why Only At Purchase? A Matter of Objectivity

The decision to record goodwill only at the time of purchase is rooted in the need for objectivity and verifiability in financial reporting. Determining the value of goodwill is inherently subjective. If companies were allowed to record goodwill they created internally, the risk of inflated asset values and manipulated financial statements would be significant.

Imagine a company constantly adding "goodwill" to its balance sheet based on management's optimistic projections of future growth. This would make comparing different companies extremely difficult. It could also mislead investors about the true financial health of the business.

The Challenge of Internally Generated Goodwill

While a company can undoubtedly build brand loyalty and improve its reputation, quantifying these achievements in a reliable and objective way is extremely difficult. Think about Coca-Cola. How do you put a precise dollar amount on the feeling of nostalgia and familiarity associated with that iconic brand?

This subjectivity is why accounting standards lean towards a verifiable event, such as an acquisition, to recognize goodwill. When a company pays a premium for another, that premium provides a concrete, market-based assessment of the target's intangible value.

Implications for Investors and Companies

The "goodwill only at purchase" rule has several important implications. For investors, it means that balance sheets may not fully reflect a company's underlying brand strength or competitive advantage if that goodwill was organically built.

Investors should carefully analyze a company's financial statements and look beyond just the numbers. They should focus on brand recognition, customer loyalty and other qualitative factors to assess the company's true value.

For companies, the rule creates an incentive to grow through acquisitions. This is because acquiring another business allows them to recognize goodwill on their balance sheet. This can potentially boost their reported assets. However, companies need to be extremely careful to make sure they are not overpaying for acquisitions just to inflate goodwill.

Goodwill Impairment: The Other Side of the Coin

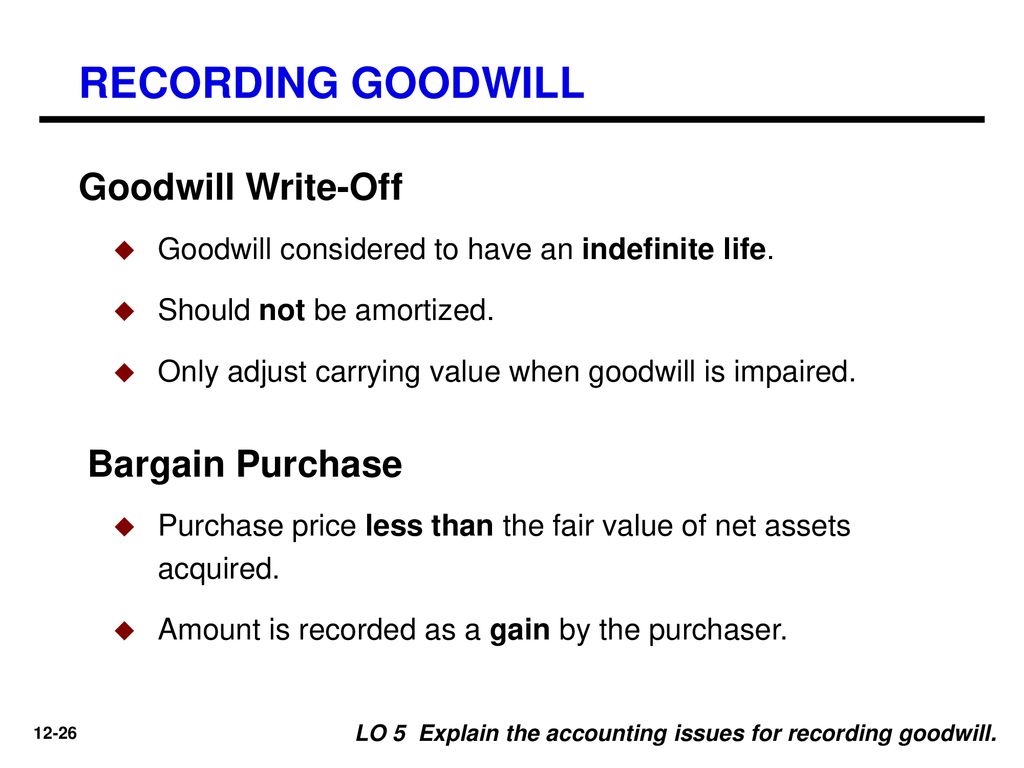

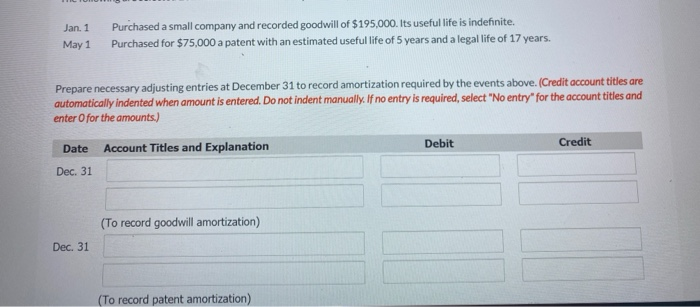

While goodwill is initially recorded at the time of purchase, it is not amortized like other assets. Instead, it is subject to an annual impairment test. If the fair value of the reporting unit (the acquired business) falls below its carrying amount, including goodwill, an impairment loss is recognized.

Impairment signifies a decline in the value of goodwill, meaning the acquired business is not performing as well as expected. It can be a significant hit to a company's earnings, and often signals deeper problems within the acquired entity.

Real-World Examples: Acquisitions and Goodwill

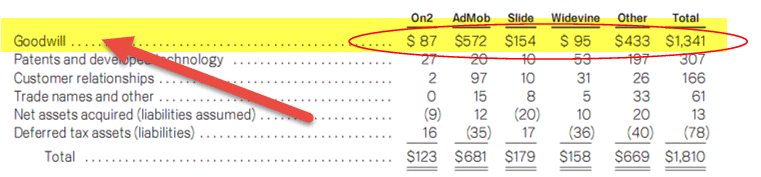

Consider the acquisition of WhatsApp by Facebook (now Meta). Facebook paid a substantial premium for WhatsApp, resulting in a significant amount of goodwill recorded on its balance sheet. This goodwill reflected WhatsApp's large user base and future growth potential.

Another example is the acquisition of Whole Foods Market by Amazon. The premium paid by Amazon resulted in goodwill reflecting Whole Foods' brand reputation and established customer base. Amazon recognized the market power of Whole Foods.

These examples illustrate how acquisitions can lead to the recognition of goodwill. They also highlight the importance of monitoring the performance of acquired businesses to ensure that the goodwill remains justified.

The Debate Continues: Is the Current System Flawless?

The current accounting treatment of goodwill is not without its critics. Some argue that it doesn't provide a complete picture of a company's value. They question whether the failure to account for internally generated goodwill undervalues companies that have cultivated strong brands and loyal customer bases through their own efforts.

Others suggest that the impairment test is too subjective and often delayed. It allows companies to postpone recognizing losses on impaired goodwill. This delay could potentially mislead investors.

Exploring Alternative Approaches

Possible alternative approaches include allowing for some form of recognition of internally generated intangibles, albeit with strict safeguards against manipulation. Another approach could be to require amortization of goodwill over a defined period, providing a more consistent and predictable expense.

These are complex issues with no easy solutions. The FASB constantly reviews and updates accounting standards to ensure that they reflect the evolving realities of the business world.

Looking Ahead: A Constant Evolution

The world of accounting is not static; it's a living, breathing entity that evolves alongside the ever-changing landscape of business and finance. The treatment of goodwill, while seemingly set in stone, is subject to ongoing scrutiny and debate.

Understanding that goodwill is recorded only at the time of purchase is a crucial piece of the puzzle. To truly understand a company's worth, investors must look beyond the balance sheet. They need to consider its brand, its reputation, and its potential for future growth, all of which contribute to the elusive and invaluable asset that is goodwill.