Great Companies To Invest In Right Now

The market is volatile, but opportunities abound. Expert analysis points to several companies poised for significant growth, offering investors a chance to capitalize now.

This article cuts through the noise to deliver actionable insights on the top investment prospects. We present a focused overview, providing the essential details for informed decision-making.

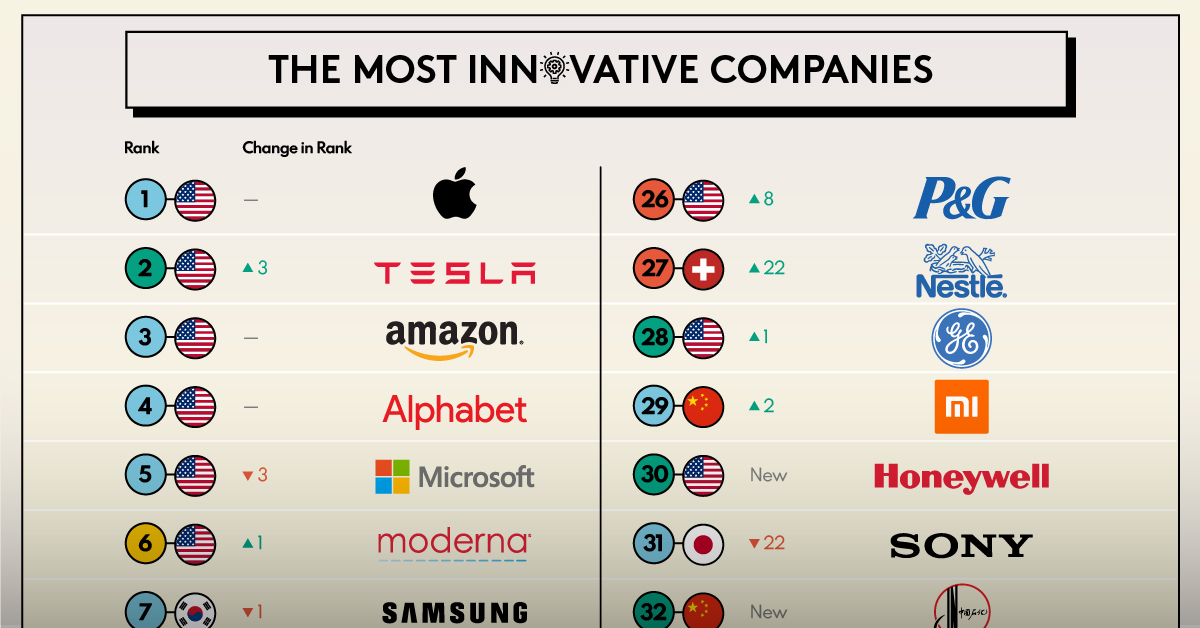

Tech Sector: Innovation and Growth

Advanced Micro Devices (AMD)

AMD continues to challenge Intel in the CPU market. Their strong performance in gaming and data centers drives revenue growth.

Analysts at Bank of America recently upgraded AMD to a "Buy" rating. The increased target price reflects confidence in their long-term potential.

NVIDIA (NVDA)

NVIDIA dominates the GPU market and is a key player in AI. Their technology powers advancements in self-driving cars and cloud computing.

Demand for their products remains high, despite supply chain challenges. This positions NVIDIA for continued success.

Renewable Energy: A Green Future

NextEra Energy (NEE)

NextEra Energy is a leading provider of clean energy solutions. They invest heavily in wind and solar power generation.

Government incentives and growing demand for renewables fuel their expansion. Expect to see significant growth in this sector.

Reports indicate that NEE is well-positioned to benefit from the Inflation Reduction Act.

Healthcare: Innovation and Resilience

UnitedHealth Group (UNH)

UnitedHealth Group is a diversified healthcare company. They provide insurance and healthcare services.

Their large scale and efficient operations contribute to consistent profitability. This is a safe bet for long term gain.

According to a recent Goldman Sachs report, UNH demonstrates strong financial resilience.

Consumer Staples: Reliable Returns

Procter & Gamble (PG)

Procter & Gamble offers a portfolio of essential consumer products. These includes brands like Tide and Pampers.

Their established brand recognition and consistent demand provide stability. They maintain pricing power even in inflationary times.

PG consistently pays dividends to shareholders, making it an attractive option for income investors.

Financial Sector: Recovering Gains

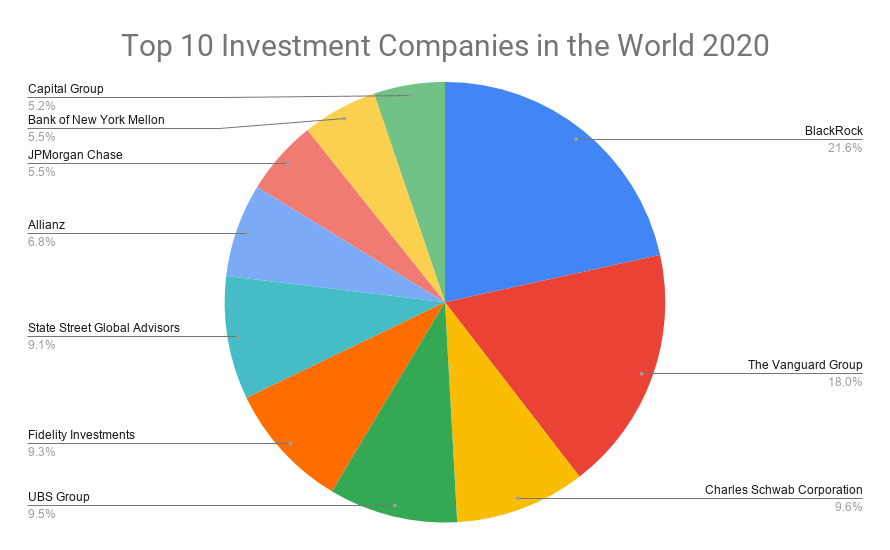

JPMorgan Chase & Co. (JPM)

JPMorgan Chase is a global leader in financial services. They navigate market conditions with expertise.

They offer wealth management and investment banking services. Their diversified revenue stream provides stability.

Despite recent market volatility, analysts at Morgan Stanley remain optimistic about JPM's long-term prospects.

Conclusion: Act Now

These companies represent a diverse range of sectors with strong growth potential. Conduct thorough research and consult a financial advisor before making any investment decisions.

Monitor market trends and company performance regularly to adjust your portfolio as needed. The window of opportunity is now.