Gross Profit Is Also Called Gross Margin.

A seemingly simple semantic difference in the financial world often leads to confusion, particularly among those new to business or finance. The terms gross profit and gross margin, though frequently used interchangeably, represent distinct yet closely related concepts, each offering a unique perspective on a company's financial performance.

Understanding their subtle nuances is crucial for accurate financial analysis and informed decision-making.

This article delves into the intricacies of both terms, clarifying their relationship and highlighting the importance of proper interpretation in the context of business health.

Understanding the Nut Graf

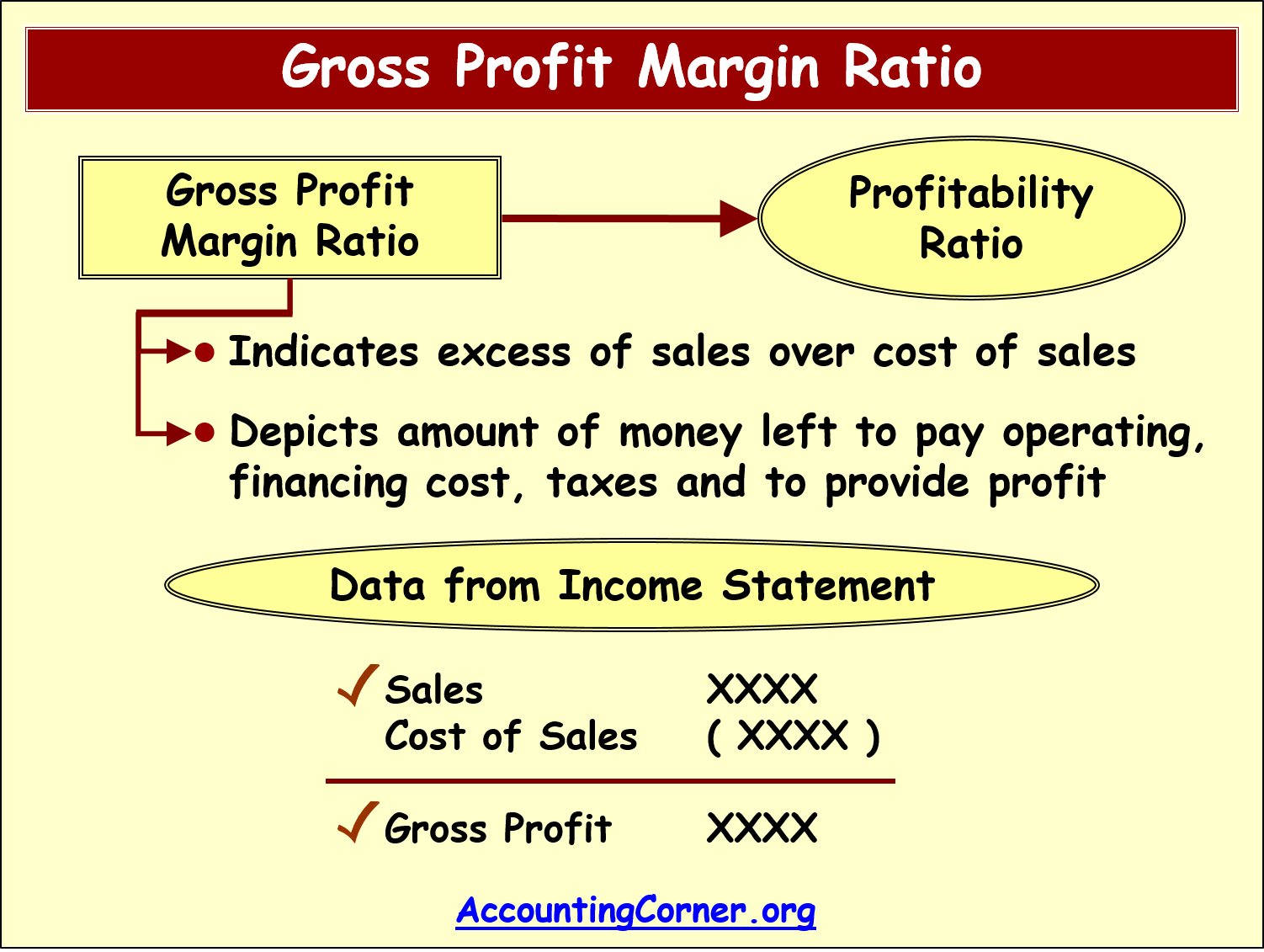

At its core, the confusion stems from the shared starting point: Gross Profit. It represents the revenue a company retains after deducting the direct costs associated with producing and selling its goods or services – also known as the Cost of Goods Sold (COGS).

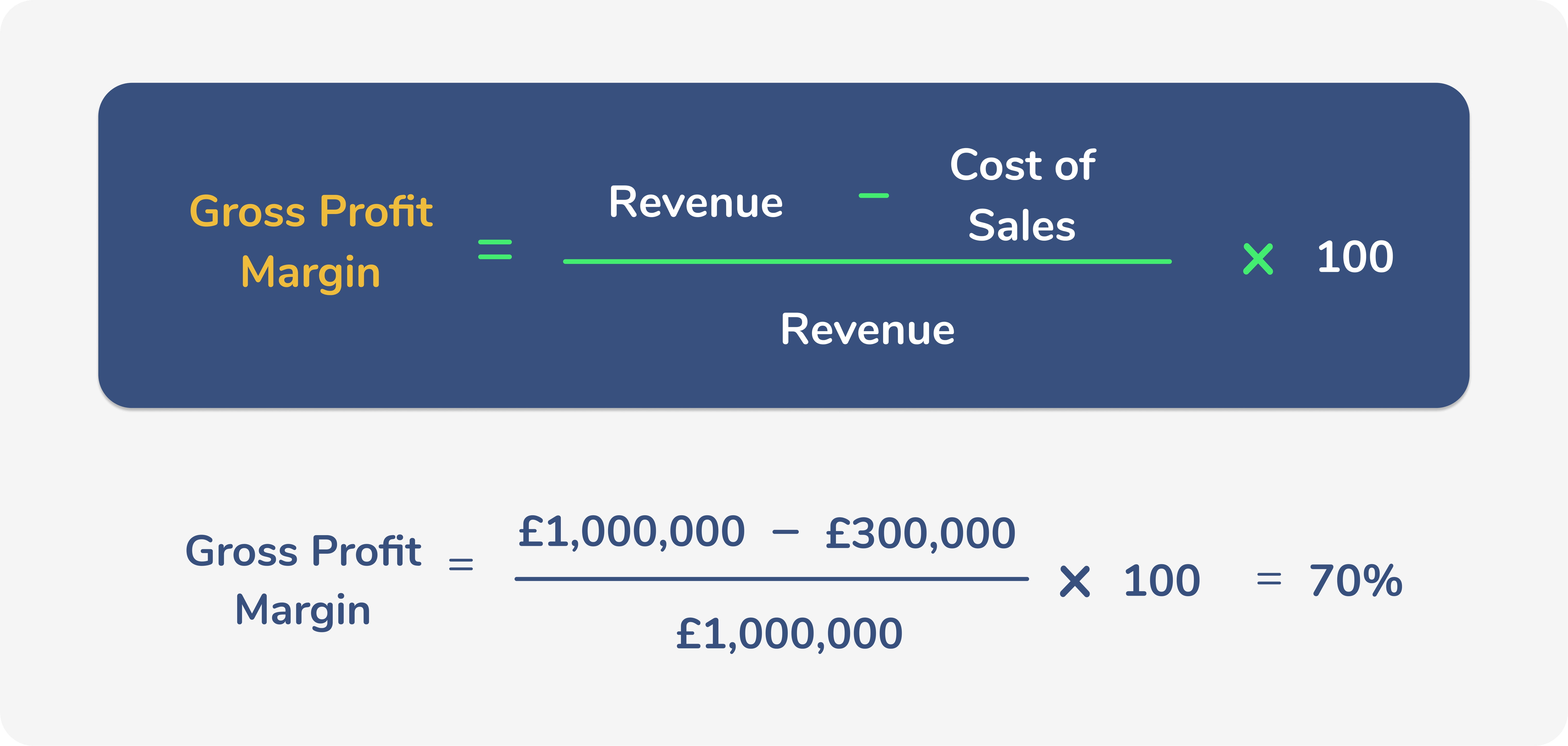

However, Gross Margin takes this a step further, expressing the gross profit as a percentage of revenue. This conversion to a percentage allows for easier comparison of profitability across different time periods, companies, or industries, neutralizing the impact of scale.

Knowing when and how to use each term is essential to grasping the full financial picture.

Gross Profit: The Foundation

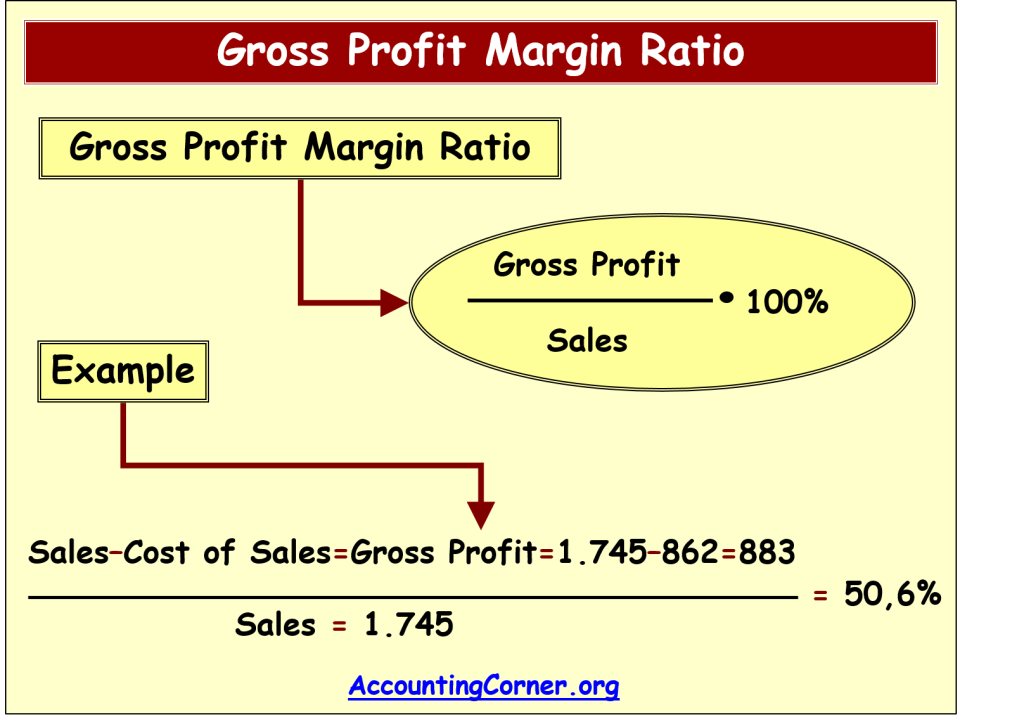

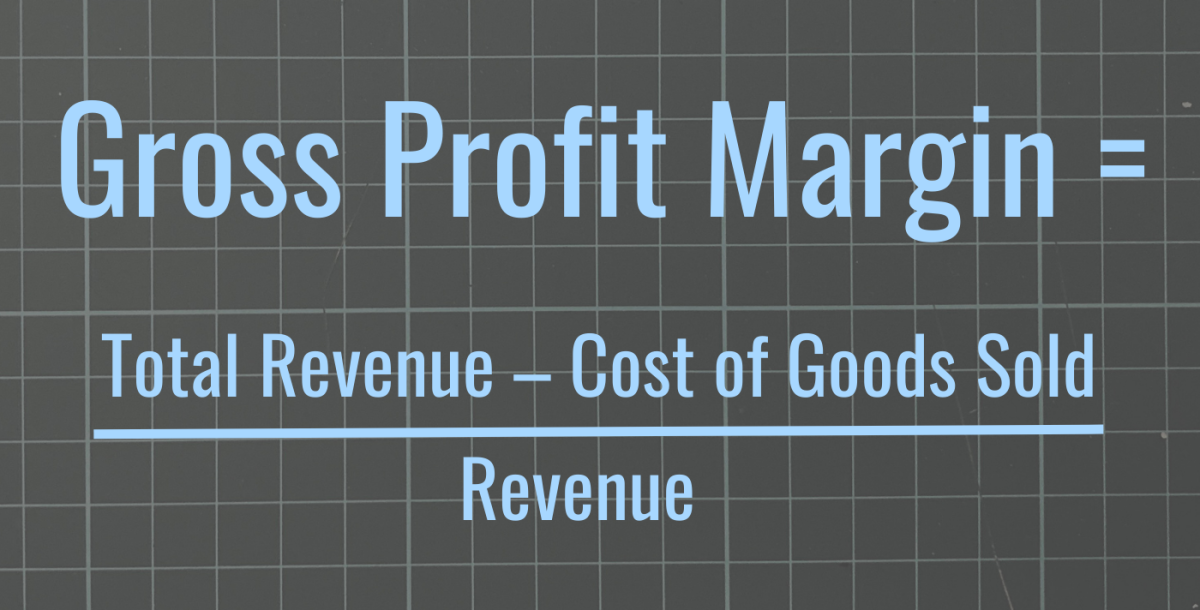

Gross profit is a dollar amount, calculated by subtracting the Cost of Goods Sold (COGS) from total revenue (Sales Revenue - COGS = Gross Profit). COGS typically includes direct labor, direct materials, and other direct costs directly attributable to production.

It provides a straightforward measure of the profit earned from a company's core operations, before considering other expenses like administrative, marketing, or financing costs. A rising gross profit generally indicates increased efficiency or pricing power, while a declining gross profit suggests potential challenges in managing costs or competitive pressures.

Investors and analysts often examine gross profit trends to assess a company’s ability to generate profits from its core business activities.

Gross Margin: A Comparative Tool

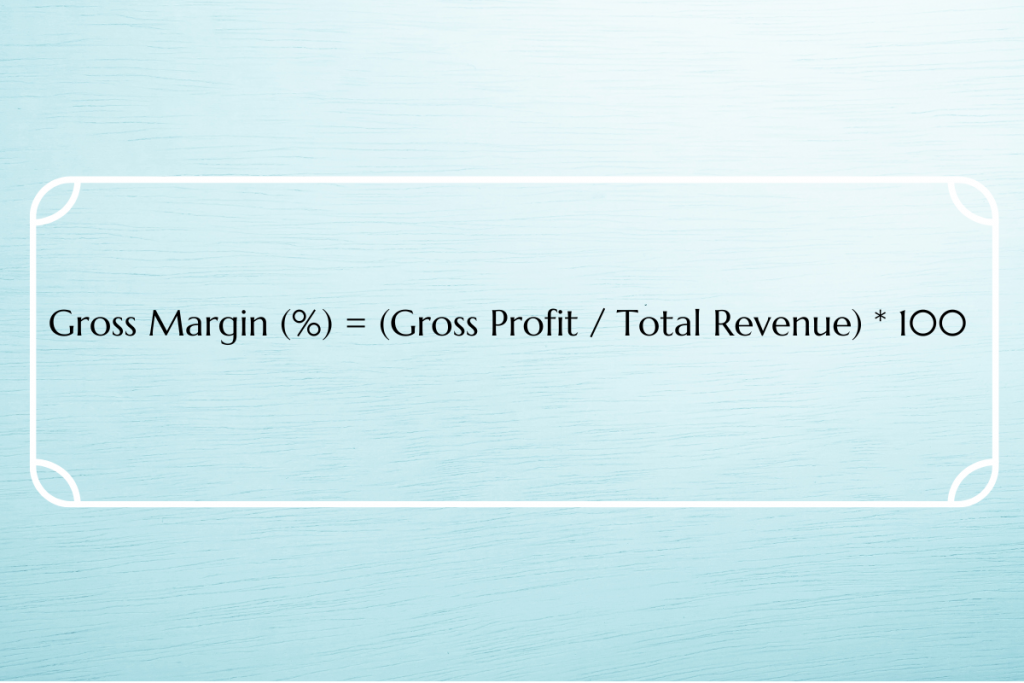

Gross margin, on the other hand, is a percentage, calculated by dividing gross profit by total revenue (Gross Profit / Sales Revenue = Gross Margin). Expressing the profit as a percentage offers a standardized way to compare profitability.

A higher gross margin suggests greater efficiency in converting revenue into profit, while a lower margin may indicate higher production costs or pricing pressures. Unlike gross profit, gross margin enables meaningful comparisons between companies of different sizes or those operating in different industries.

For example, comparing the gross margins of a small boutique shop to a large department store provides a clearer picture of their relative profitability compared to simply looking at their gross profit, where the sheer scale difference would be misleading.

Why the Confusion?

The interchangeable use of the terms likely arises from their close relationship and the fact that gross margin is derived directly from gross profit. Some may view "gross profit" as an intermediate step in calculating "gross margin."

However, the crucial difference lies in the unit of measurement: dollars versus percentage. Using the wrong term in a financial report or analysis can lead to misinterpretations and flawed conclusions.

It's important to clarify which metric is being discussed, particularly when communicating financial information to stakeholders.

The Importance of Context

The most informative metric depends on the context. If evaluating the overall magnitude of profit from core operations, gross profit offers a clear picture.

However, if the goal is to compare profitability relative to sales or benchmark performance against competitors, gross margin is the preferred measure. A company with a high gross profit might still have a low gross margin if its sales volume is significantly high, indicating potential inefficiencies in cost management.

Conversely, a company with a lower gross profit but a higher gross margin might be more profitable in the long run if it can scale its operations effectively.

Expert Opinions and Industry Standards

Financial professionals stress the importance of using the terms accurately. According to GAAP (Generally Accepted Accounting Principles), while both terms are acceptable in financial reporting, it is paramount to be consistent and transparent in their usage.

Accountants often emphasize that while calculating gross margin relies on gross profit, they answer different questions about a company's financial health. Experts from organizations like the CFA Institute highlight the need for a thorough understanding of these metrics for effective investment analysis.

They advocate for clear definitions in financial reports to avoid ambiguity and ensure accurate interpretation.

Future Trends and Implications

As businesses become increasingly global and complex, the need for clear and consistent financial communication grows. The rise of digital accounting tools and automated reporting systems is likely to further refine the use of these metrics.

These tools can provide real-time analysis of gross profit and gross margin, enabling businesses to make faster, more informed decisions. Moreover, the increasing emphasis on data-driven decision-making will likely drive greater awareness and accuracy in the use of these and other financial metrics.

Ultimately, a proper understanding and application of both concepts are vital for building financially sustainable and competitive businesses.

Conclusion

While gross profit and gross margin are intrinsically linked, they provide distinct insights into a company's financial performance. Gross profit showcases the absolute dollar amount earned from core operations, while gross margin offers a comparative percentage to assess profitability relative to sales.

By understanding these differences, stakeholders can gain a more nuanced understanding of a company's financial health and make more informed business decisions. Embracing accuracy and clarity in financial reporting remains paramount for fostering trust and promoting sound economic growth.

Moving forward, consistent and precise usage of these terms is crucial for promoting informed decision-making within the business world.