H And R Block Early Advance

The scent of pine needles hung in the air, a comforting aroma battling the sterile fluorescence of the H&R Block office. Outside, snowflakes danced a gentle waltz, blanketing the town in a serene hush. Inside, Maria clutched her W-2s, a knot of anxiety tightening in her stomach. Christmas had been tighter than usual, and January loomed, a month of bills and financial recalibration. She wasn't just here for tax preparation; she was exploring the possibility of an Early Advance.

H&R Block's Early Advance program offers eligible taxpayers the opportunity to access a portion of their anticipated tax refund as a loan, providing a financial cushion during the early months of the year. This article explores the nuances of the program, its potential benefits and drawbacks, and its significance in the landscape of tax-related financial products.

The Evolution of Tax Refund Advances

The concept of tax refund advances isn't new. For years, various financial institutions have offered similar products, often targeting low-to-moderate income individuals who rely on their tax refunds for significant financial needs. These advances address a critical gap for those who may not have access to traditional credit or emergency savings.

H&R Block, a recognizable name in tax preparation, entered this arena with the Early Advance. Their involvement brought a level of legitimacy and accessibility to a service often associated with less reputable lenders.

H&R Block's Approach

H&R Block's Early Advance distinguishes itself by being a 0% interest loan. This is a significant advantage compared to some predatory lending practices often found in the payday loan industry.

The loan is offered through a partnership with a financial institution, and the amount is based on the anticipated refund amount. According to H&R Block's official website, there are eligibility requirements and approval is subject to the lender's review.

Understanding the Mechanics

The process begins with filing your taxes through H&R Block. This can be done in person, online, or through their mobile app.

During the filing process, you'll be informed about your eligibility for the Early Advance. The amount you can borrow depends on factors such as your expected refund and creditworthiness.

If approved, the loan is typically loaded onto an H&R Block Emerald Prepaid Mastercard®. You can then use this card to make purchases, withdraw cash, or pay bills.

When your tax refund is processed by the IRS, the loan amount is automatically deducted to repay the advance. The remaining portion of your refund is then deposited onto your Emerald Card or sent to you via your preferred method.

The Appeal and the Considerations

For many, the Early Advance offers a lifeline. It can provide immediate access to funds for urgent needs like rent, utilities, or car repairs.

Families who qualify for the Earned Income Tax Credit (EITC) or the Child Tax Credit (CTC) often see larger refunds, making them prime candidates for the Early Advance. These funds can be crucial for catching up on bills or making necessary purchases.

However, it's essential to approach the Early Advance with caution. While the 0% interest is a major benefit, there are still potential fees associated with the Emerald Card.

Furthermore, it's crucial to accurately estimate your tax refund. If your refund is lower than expected, you may be responsible for repaying the difference. This is an important point that taxpayers must consider before committing to the Early Advance.

Potential Drawbacks

Over-reliance on tax refunds can create a cycle of dependence. Using the Early Advance year after year may indicate a need for better financial planning and budgeting strategies.

While H&R Block itself doesn't charge interest on the loan, Emerald Card fees can still add up if the card is used frequently for ATM withdrawals or other transactions.

It's also important to remember that receiving an Early Advance effectively reduces the size of your tax refund. While the funds are available sooner, you'll ultimately receive less when your refund is processed.

Weighing the Options

The decision to pursue an Early Advance should be based on a careful assessment of your financial situation. Consider your needs, your ability to repay the loan, and any associated fees.

Explore alternatives such as emergency savings, credit cards, or borrowing from friends or family. Compare the costs and benefits of each option before making a decision.

Consulting with a financial advisor can provide valuable insights into your financial situation and help you make informed decisions about managing your money and preparing for tax season.

The Broader Significance

The popularity of tax refund advances underscores the financial vulnerability of many Americans. It highlights the need for increased access to financial literacy resources and affordable banking services.

Programs like H&R Block's Early Advance can play a role in bridging the gap for those who need immediate access to funds. However, they should be viewed as a short-term solution rather than a long-term financial strategy.

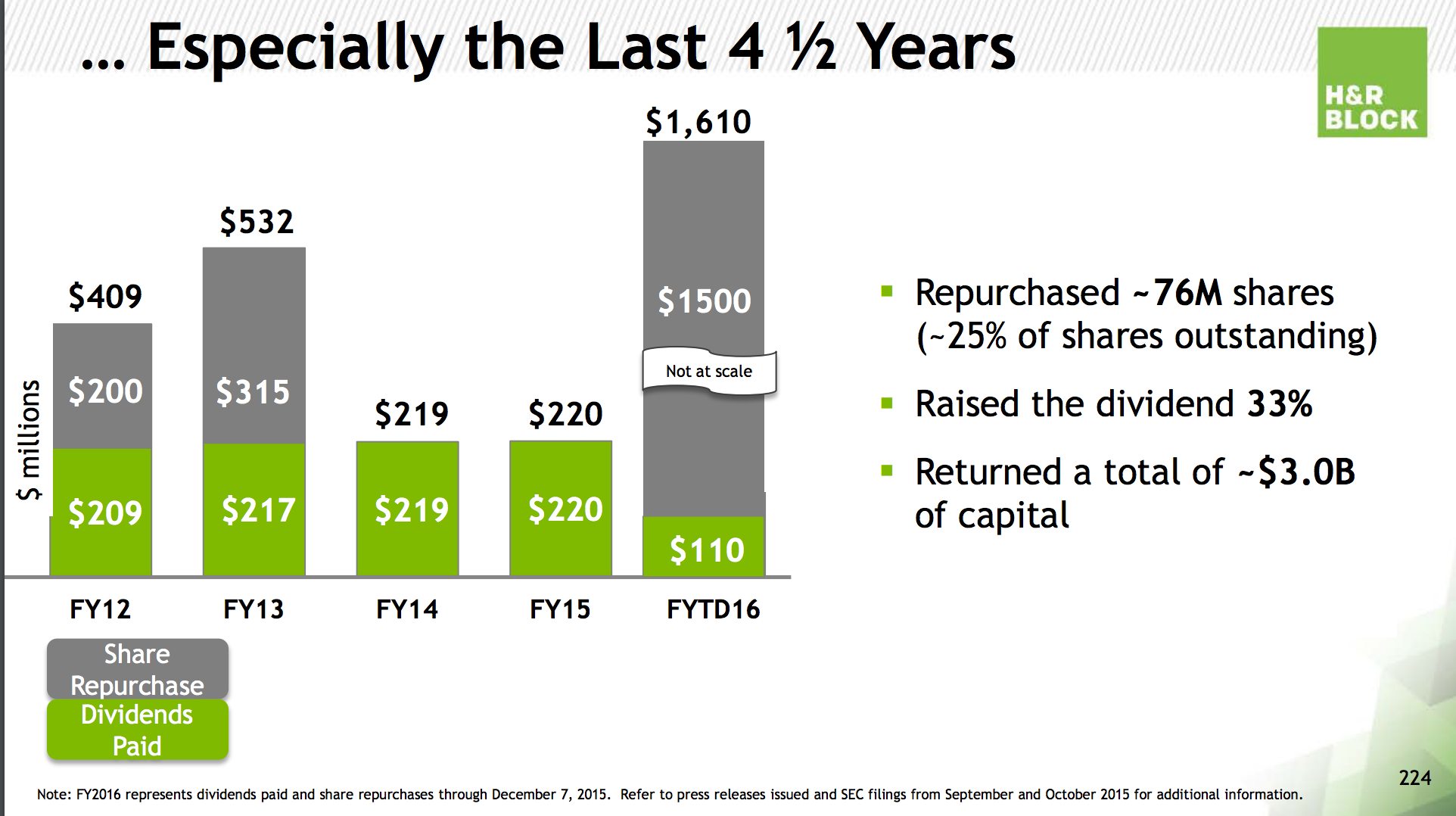

By providing a zero-interest option, H&R Block contributes to a more responsible approach to tax-related lending. This is significant, as it demonstrates a commitment to helping taxpayers navigate their finances without succumbing to predatory practices.

A Path Forward

As Maria sat across from the H&R Block representative, she listened intently to the explanation of the Early Advance. She carefully weighed the pros and cons, considering her immediate needs and the potential implications.

The decision was hers alone, but she felt empowered with the information she had gathered. Whether she chose to pursue the Early Advance or not, she knew she was taking a proactive step towards managing her finances and facing the new year with greater confidence.

Ultimately, the value of the Early Advance lies in its ability to provide temporary relief and empower individuals to navigate their financial challenges. As long as it's approached responsibly and with a clear understanding of its terms, it can be a useful tool for those who need it most.