H And R Block Emerald Advance Qualifications

For millions of Americans facing immediate financial needs during tax season, the H&R Block Emerald Advance line of credit has offered a potential solution. But navigating the qualification requirements can be complex. This article breaks down the criteria and key considerations for those seeking this financial product.

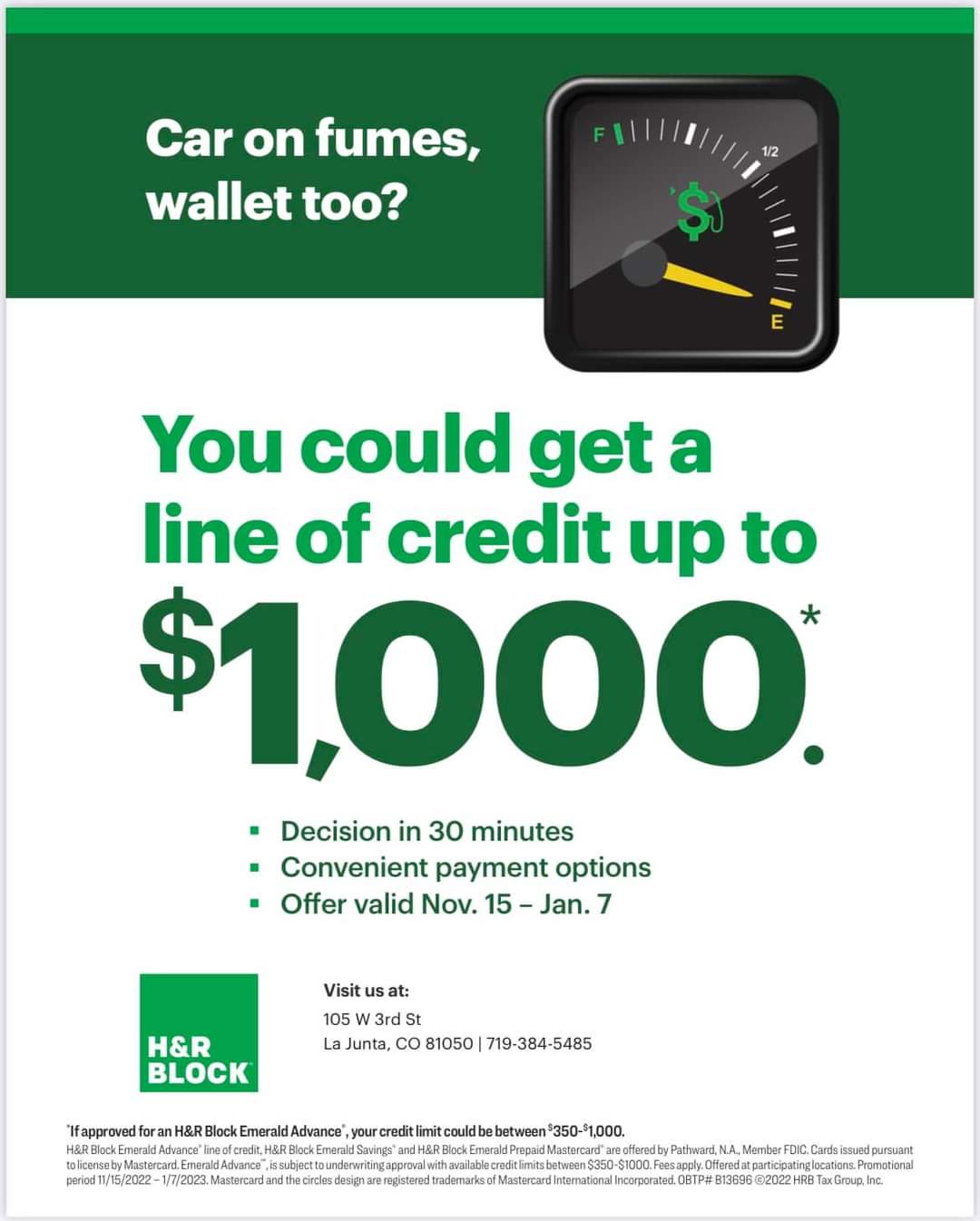

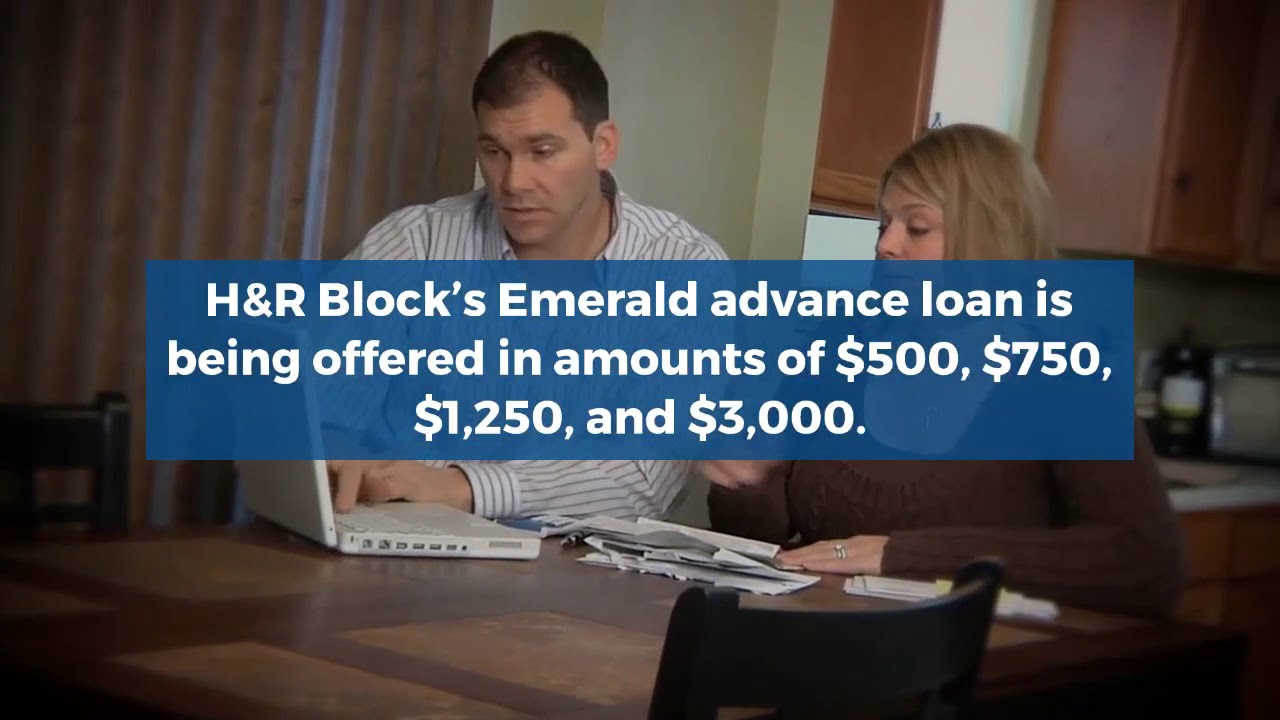

The Emerald Advance, offered by H&R Block through Pathward, N.A., is a line of credit available during the tax season, typically from November to February. Understanding the requirements is crucial for determining eligibility and managing expectations.

Eligibility Requirements: A Closer Look

Several factors influence approval for the Emerald Advance. These include credit score, past repayment history with H&R Block and other lenders, and income verification.

Credit Score and History

A good credit score is a significant factor. While H&R Block doesn’t publicly disclose the exact minimum score required, a higher score generally improves the chances of approval and potentially a higher credit limit.

Past credit behavior, including bankruptcies, late payments, and defaults, will be carefully reviewed. A history of responsible credit management significantly increases the likelihood of being approved.

Income Verification

Applicants must demonstrate sufficient income to repay the borrowed funds. This usually involves providing documentation such as pay stubs, W-2 forms, or other proof of income.

The amount of income required will vary based on the requested credit limit and other factors. H&R Block assesses the applicant's ability to repay the debt based on their income and expenses.

Past H&R Block Relationship

Previous experiences with H&R Block can play a role. Applicants with a positive history of filing taxes through H&R Block and repaying any prior loans or advances may have an advantage.

Conversely, negative experiences, such as outstanding debts or issues with previous tax filings, could negatively impact the approval process.

Other Considerations

Beyond credit score and income, H&R Block may consider other factors. These include the applicant’s debt-to-income ratio and overall financial stability.

Applicants must also be at least 18 years old and a U.S. citizen or permanent resident with a valid Social Security number. Identification verification is also a standard step in the process.

The Application Process

Applying for the Emerald Advance typically involves an in-person visit to an H&R Block office. During the visit, applicants will complete an application form and provide the necessary documentation.

H&R Block's tax professionals can assist with the application process and answer any questions. It is important to provide accurate and complete information to avoid delays or denial.

Important Terms and Conditions

The Emerald Advance is a line of credit with associated interest rates and fees. Applicants should carefully review the terms and conditions before applying.

Understanding the interest rates, repayment schedule, and potential fees is crucial for making an informed decision. Failure to repay the loan on time can negatively impact credit scores and lead to additional charges.

Potential Impact on Consumers

The Emerald Advance can provide a quick source of funds for unexpected expenses or to cover costs before receiving a tax refund. However, it is essential to use this financial tool responsibly.

Consumers should carefully consider their ability to repay the borrowed funds before applying. Relying on short-term loans with high interest rates can lead to a cycle of debt.

Alternatives to the Emerald Advance

Consumers facing financial challenges should explore alternative options before resorting to short-term loans. These include exploring options such as personal loans from banks or credit unions, or seeking assistance from local charities or non-profit organizations.

Financial planning and budgeting can also help individuals manage their finances and avoid the need for emergency loans. Consulting with a financial advisor can provide valuable guidance and support.

Official Statements

While H&R Block doesn't publish precise formulas for approval, they emphasize responsible lending practices. They encourage applicants to carefully evaluate their financial situation before applying.

"We are committed to providing our clients with access to financial products that meet their needs,"said an H&R Block representative in a past statement regarding their financial service offerings. "We also want to ensure that our clients are making informed decisions about their finances."

Pathward, N.A., the issuer of the Emerald Advance, also stresses the importance of responsible borrowing.

Conclusion

The H&R Block Emerald Advance can be a useful tool for some consumers. But it is crucial to understand the qualification requirements, terms, and conditions before applying. Responsible borrowing and careful financial planning are essential for managing debt and avoiding financial difficulties.