H And R Block Loan On Taxes

For millions of Americans, tax season is often synonymous with financial stress. The prospect of a large tax bill can be daunting, leading many to seek immediate solutions. H&R Block, a leading tax preparation company, offers loan products tied to tax refunds, but these options have ignited a debate about their benefits and potential drawbacks, particularly for vulnerable taxpayers.

This article delves into the intricacies of H&R Block's tax-related loan offerings. We will scrutinize their structure, associated fees, and the potential impact on borrowers, drawing on official statements, consumer advocacy reports, and independent analyses. This exploration aims to provide a balanced perspective on these financial tools, examining both their convenience and potential risks.

Understanding H&R Block's Tax-Related Loan Products

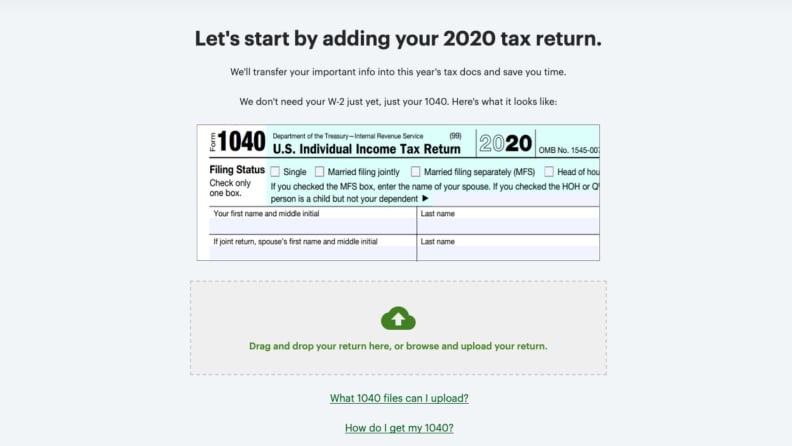

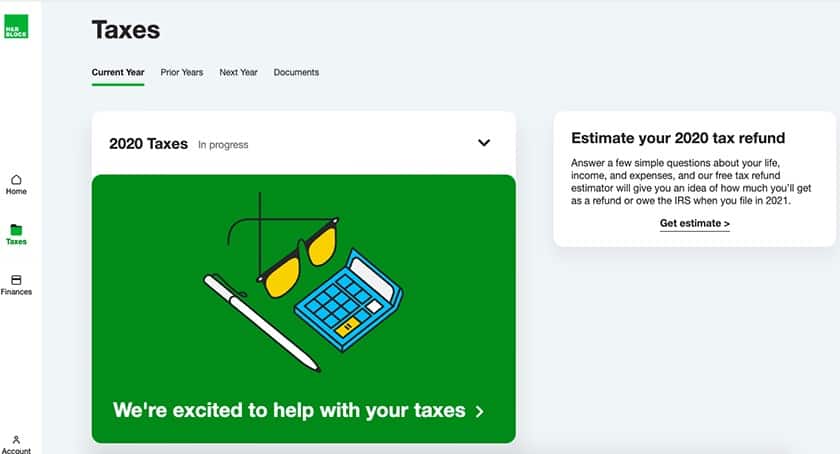

H&R Block offers several loan options linked to tax refunds, including Refund Advance loans. These loans allow taxpayers to access a portion of their anticipated refund within 24-48 hours of filing their taxes. The loan amount is then deducted from the actual refund once it's processed by the IRS.

The allure of these loans lies in their speed and accessibility. They appeal to individuals who need immediate cash to cover pressing expenses. These expenses can range from rent and utilities to car repairs and medical bills.

How Refund Advance Loans Work

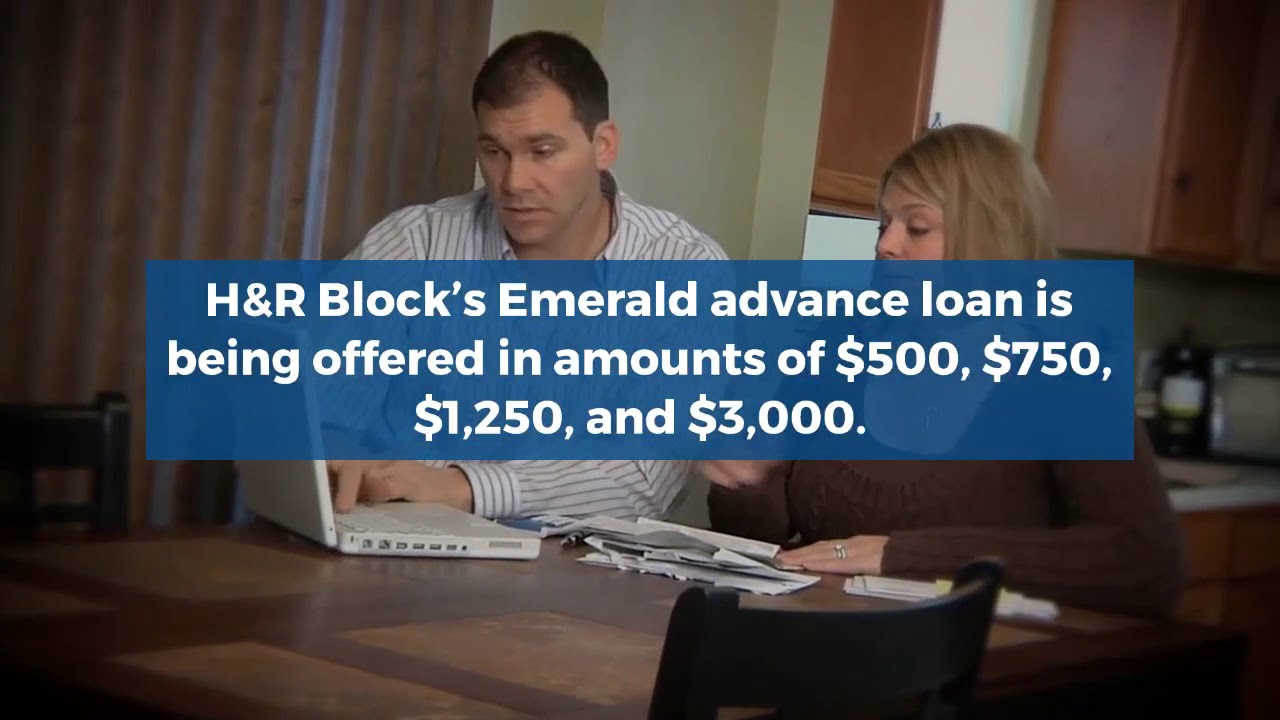

Refund Advance loans are typically offered during the tax season, generally from January to February. H&R Block partners with financial institutions to provide these loans, with loan amounts often ranging from a few hundred to several thousand dollars. Approval is usually based on the expected refund amount and creditworthiness, although some loans are offered with no credit check.

The loans are structured as short-term advances, with a fixed repayment date tied to the expected IRS refund date. Upon receiving the refund, the IRS directly deposits the funds into the lender's account, and the loan is repaid.

Notably, some Refund Advance loans are advertised as having 0% interest or no finance charges. This seemingly attractive feature can mask other potential fees and costs associated with the loan process.

The Debate: Convenience vs. Cost

While the prospect of immediate access to funds is appealing, the true cost of these loans is a subject of ongoing debate. Consumer advocates argue that even "free" loans can lead to indirect costs and potentially trap vulnerable taxpayers in a cycle of debt.

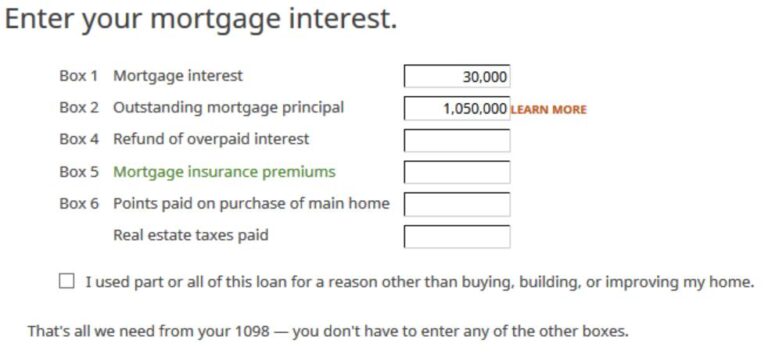

One concern is the requirement to file taxes through H&R Block to qualify for the loan. This means paying their tax preparation fees, which can be substantial, especially for those with complex tax situations. Even if other tax preparation services are cheaper, taxpayers might feel compelled to use H&R Block to access the loan.

Another factor is the potential for inaccurate refund estimations. If the IRS reduces the refund amount due to errors or discrepancies, the borrower is still responsible for repaying the full loan amount. This can create a financial strain if the actual refund falls short of expectations.

Potential Hidden Costs

Beyond the tax preparation fees, other indirect costs can arise. These include fees for opening a new bank account to receive the loan, or fees for using a prepaid debit card to access the funds. While these costs might seem small individually, they can add up and reduce the overall benefit of the loan.

Furthermore, the availability of these loans can sometimes encourage taxpayers to overestimate their deductions or claim credits they are not entitled to. This can lead to audits and penalties from the IRS, further compounding their financial problems. It's important to note that H&R Block encourages and expects accurate tax filings.

Consumer advocacy groups like the National Consumer Law Center have raised concerns about the marketing tactics used to promote these loans. They argue that the advertisements often focus on the immediate benefits while downplaying the potential risks and costs involved.

H&R Block's Perspective

H&R Block defends its Refund Advance loans as a valuable service that provides immediate financial relief to taxpayers in need. The company argues that these loans offer a transparent and convenient way to access funds without incurring high interest rates or hidden fees.

In official statements, H&R Block emphasizes that its tax professionals work closely with clients to ensure accurate tax filings and help them understand the terms and conditions of the loan. They also provide resources and tools to help taxpayers manage their finances effectively.

The company also highlights the benefits of its tax preparation services, such as error checking and audit support, which can help taxpayers avoid costly mistakes and potential penalties from the IRS. These services, they argue, add value beyond the loan itself.

Alternatives to Tax-Related Loans

Before opting for a tax-related loan, it's crucial to explore alternative options. These include applying for a personal loan from a bank or credit union, using a credit card for short-term expenses, or seeking assistance from local charities and non-profit organizations.

Another option is to adjust withholding allowances on Form W-4 to receive more money in each paycheck throughout the year. This can help avoid the need for a large refund and the temptation to take out a loan to access those funds prematurely.

For those struggling with debt, credit counseling services can provide guidance on budgeting, debt management, and negotiating with creditors. These services are often available for free or at a low cost.

Looking Ahead: Regulation and Consumer Education

The debate surrounding tax-related loans is likely to continue, with increasing scrutiny from regulators and consumer advocacy groups. There is a growing call for greater transparency and stronger consumer protections to ensure that taxpayers are fully informed about the costs and risks associated with these financial products.

Consumer education is also crucial. Taxpayers need to understand their options and make informed decisions about how to manage their finances during tax season. This includes understanding the potential costs and benefits of tax-related loans and exploring alternative solutions.

Ultimately, the goal is to empower taxpayers to make sound financial decisions that will benefit them in the long run. Whether H&R Block's loan products contribute to that goal remains a complex and evolving issue.