H And R Block Loan Qualifications

The scent of freshly sharpened pencils hangs in the air, mingling with the faint aroma of coffee. Fluorescent lights hum above a neat row of desks, each adorned with stacks of forms and the familiar green and black logo. Outside, the world rushes by, oblivious to the quiet intensity within where individuals are charting their financial course, often with the help of a tax refund loan.

Understanding the qualification criteria for loans offered through H&R Block and its partner lenders is crucial for anyone seeking short-term financial assistance during tax season. These loans, often marketed as Refund Advance loans, can provide a much-needed financial boost, but it's essential to know if you are likely to qualify before applying.

Understanding H&R Block's Role

H&R Block itself doesn't directly issue these loans.

Instead, it partners with financial institutions to offer these products to its clients.

Typically, MetaBank, or similar banking partners, act as the actual lenders.

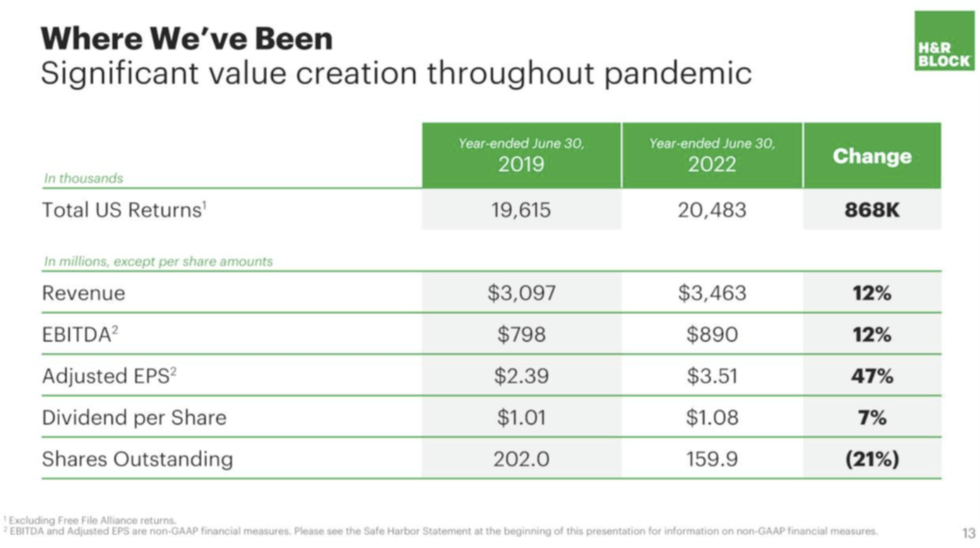

A History of Tax-Time Loans

Tax refund-related loans have a history rooted in the desire to bridge the gap between filing taxes and receiving the refund.

In the past, Refund Anticipation Loans (RALs) were common but often came with high fees and interest rates.

Today's Refund Advance loans offered through H&R Block are structured differently, generally with no interest or finance charges.

Key Qualification Requirements

Several factors determine eligibility for a Refund Advance loan through H&R Block.

These criteria are established by the lending partner and aim to assess the applicant's ability to repay the loan from their expected tax refund.

Meeting these requirements doesn't guarantee approval, but significantly increases the chances.

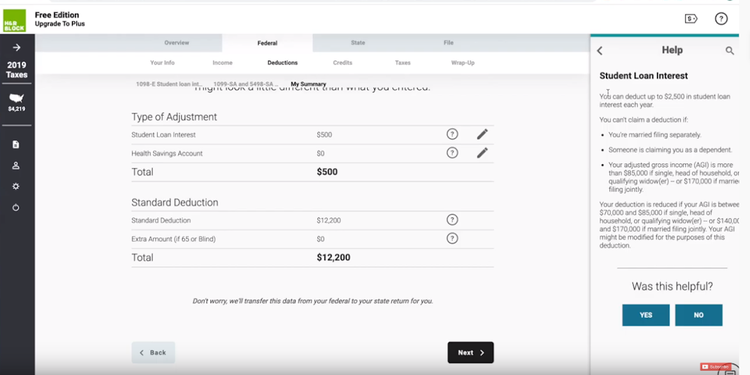

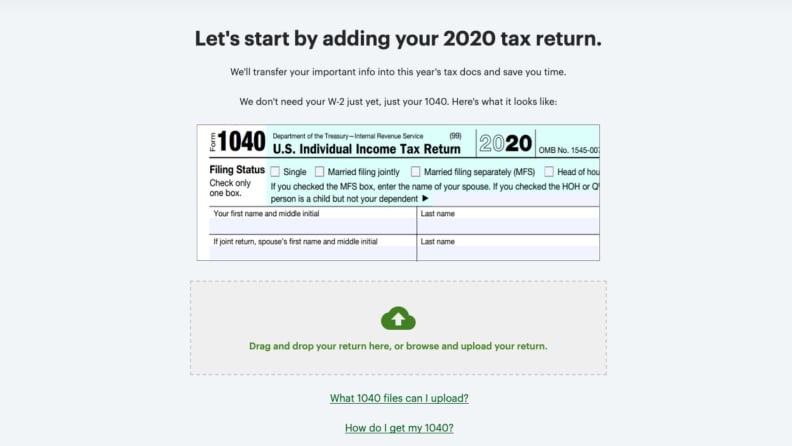

Filing Taxes with H&R Block

A primary requirement is filing your taxes with H&R Block.

The loan is tied to the anticipated refund calculated by their tax professionals or software.

This allows the lender to have direct access to the information necessary to evaluate your refund amount and eligibility.

Expected Refund Amount

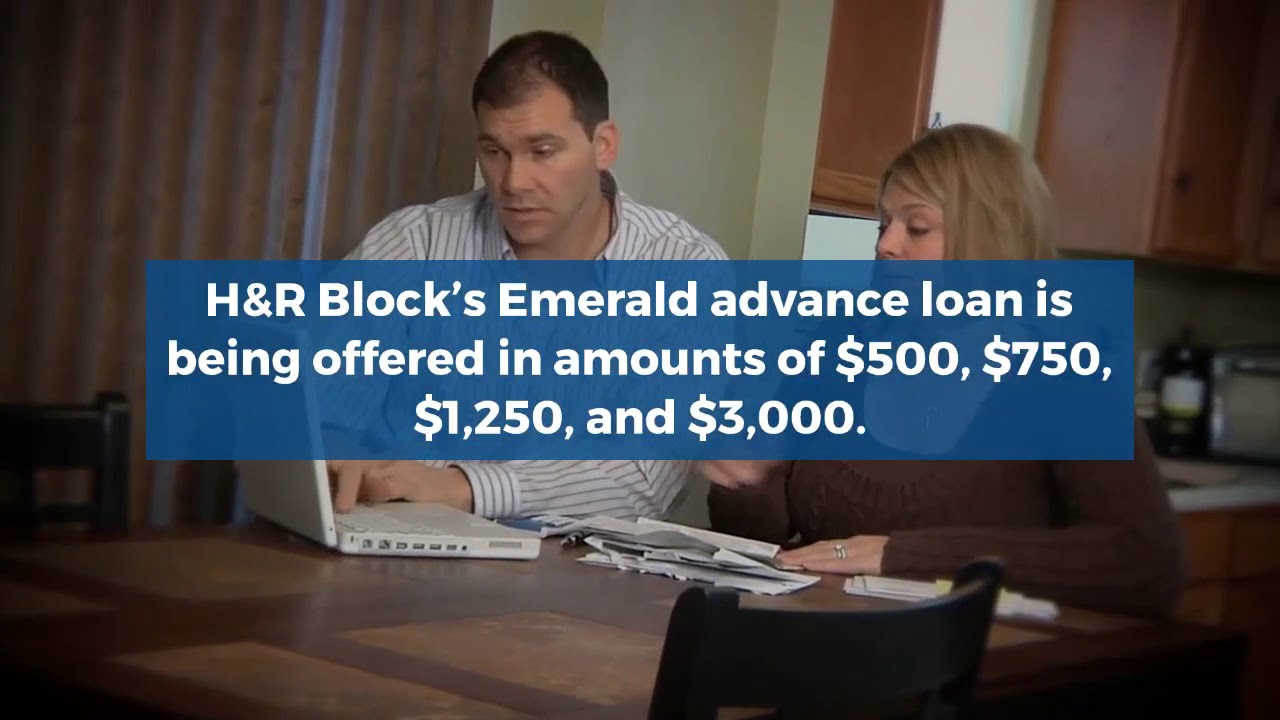

The size of your expected refund is a crucial determinant.

The lender needs assurance that the refund will be sufficient to cover the loan amount.

Minimum and maximum refund amounts may be set by the lender, influencing the loan amount you can qualify for.

Credit History

While these loans are often marketed as accessible even with limited credit, credit history still plays a role.

The lender will likely perform a credit check to assess your creditworthiness.

A poor credit score may not automatically disqualify you, but it can impact the loan amount or approval decision.

Income and Identification Verification

Verifying your income and identity is a standard requirement.

You'll need to provide documentation to confirm your identity, such as a driver's license or passport.

Proof of income, such as W-2 forms or pay stubs, is also necessary to validate your financial situation.

Debt-to-Income Ratio

Lenders may consider your debt-to-income ratio (DTI).

This is the percentage of your monthly income that goes towards debt payments.

A high DTI could indicate a higher risk of default and may affect your loan eligibility.

Reviewing Loan Terms and Conditions

Carefully reviewing the loan terms and conditions is essential.

Understand the loan amount, repayment schedule, and any associated fees.

Although these loans typically have no interest, it's important to confirm this and be aware of any potential penalties for late repayment.

The Application Process

The application process typically involves completing an application form either online or in person at an H&R Block office.

You will need to provide the required documentation and consent to a credit check.

Once the application is submitted, the lender will review the information and make a decision.

Alternative Financial Solutions

Consider other financial options before opting for a Refund Advance loan.

Explore options like personal loans, credit cards, or lines of credit.

Compare the costs and terms of different options to make an informed decision that aligns with your financial goals.

The Importance of Financial Literacy

Understanding financial products and their implications is crucial for making informed decisions.

Resources such as the Consumer Financial Protection Bureau (CFPB) offer valuable information on loans, credit, and financial planning.

Enhancing your financial literacy empowers you to navigate the financial landscape with confidence.

Impact on Communities

Refund Advance loans can significantly impact communities, particularly those with limited access to traditional financial services.

These loans can provide immediate funds for essential needs, such as paying bills or covering unexpected expenses.

However, it's crucial to use these loans responsibly and avoid relying on them as a long-term financial solution.

"We strive to provide our clients with access to financial solutions that meet their individual needs," said a representative from H&R Block. "Our Refund Advance loans offer a convenient way to access funds, but we encourage our clients to carefully consider their options and make informed decisions."

Looking Ahead

The market for tax refund-related financial products continues to evolve.

Fintech companies and traditional lenders are exploring new ways to provide access to funds during tax season.

Staying informed about these developments can help you make the best financial choices for your situation.

Conclusion

Qualifying for an H&R Block Refund Advance loan hinges on a blend of factors, primarily your expected tax refund, credit history, and income verification.

While these loans can offer a temporary financial lifeline, remember that responsible financial planning and exploring all available options are key.

Ultimately, the goal is to make informed decisions that pave the way for a secure and thriving financial future, with or without the aid of a tax-time loan.