H And R Block Peace Of Mind Cost

The aroma of freshly brewed coffee mingled with the quiet hum of computers as Sarah, a busy freelance graphic designer, sat across from her tax preparer at H&R Block. Sunlight streamed through the window, illuminating the stacks of receipts and forms spread across the table. This year, like many others, she opted for the Peace of Mind extended service, hoping to navigate the complexities of self-employment taxes with an extra layer of security. But as the final bill came, Sarah, like many others, wondered if the cost truly delivered on its promise.

The H&R Block Peace of Mind extended service aims to offer taxpayers reassurance by covering certain costs if errors are found on their returns. This includes assistance with audits and covering penalties and interest charges up to a specified limit. However, the actual value and whether it's a worthwhile investment for taxpayers is a subject of ongoing debate and depends heavily on individual circumstances.

Understanding the H&R Block Peace of Mind Service

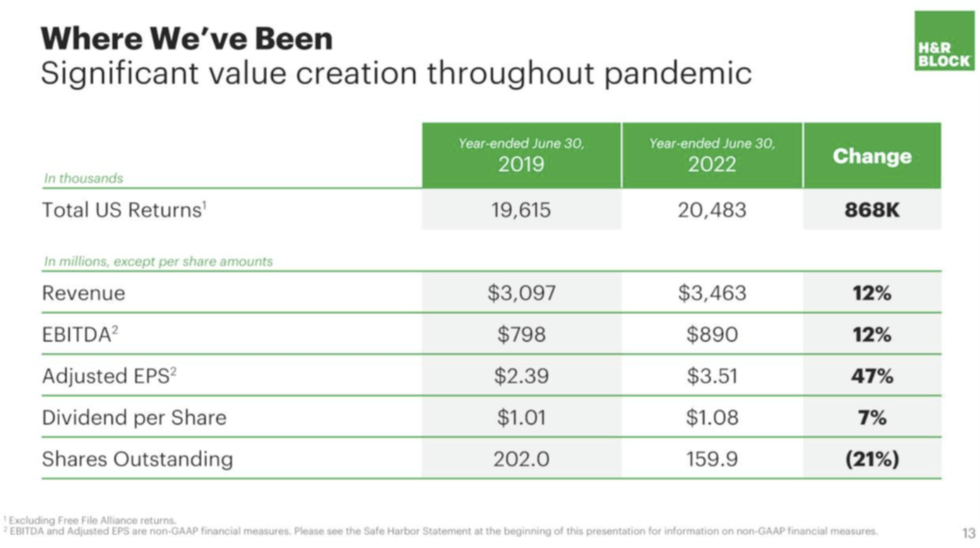

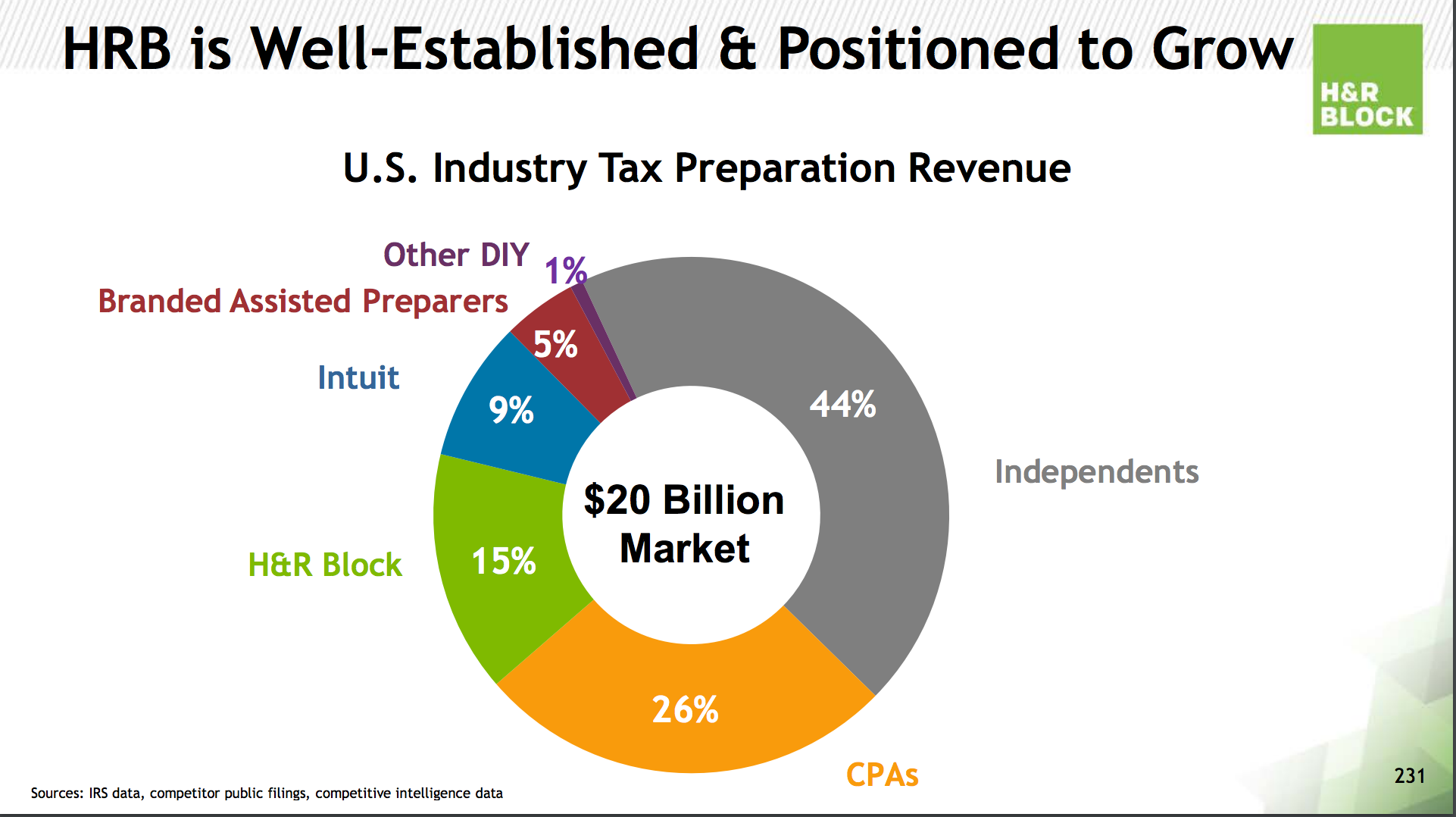

H&R Block is one of the most recognizable names in tax preparation, serving millions of clients each year. The company offers various services, from basic tax filing to more complex tax planning and preparation for individuals and businesses. Peace of Mind is an optional add-on service designed to provide clients with audit assistance and potential reimbursement for penalties and interest related to errors on their returns.

What Does Peace of Mind Cover?

The core benefit of Peace of Mind is audit assistance. If the IRS or a state tax agency audits a return prepared by H&R Block, the service provides support, including guidance and representation during the audit process. It also promises to cover certain penalties and interest assessed due to errors made by H&R Block, subject to specific terms and limitations.

The coverage usually extends to a defined dollar amount, which can vary based on the complexity of the return and the specific offering at the time of purchase. There are also exclusions, such as intentional misrepresentation or fraud, meaning the service will not cover issues arising from deliberate inaccuracies.

The Cost Factor: Is It Worth It?

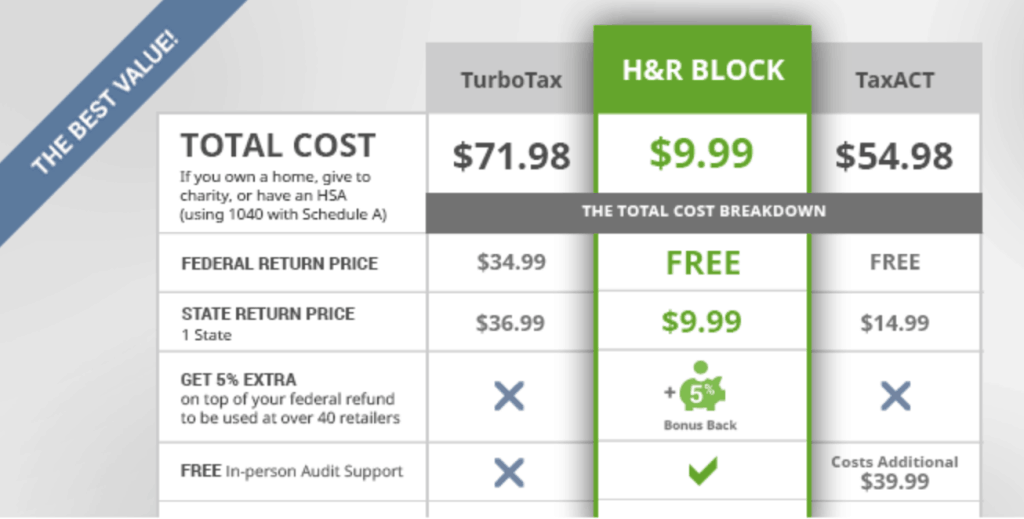

The cost of Peace of Mind varies based on the complexity of the tax return and the specific H&R Block office or online service used. Generally, it adds a percentage to the base tax preparation fee. While the added cost may seem small initially, it can add up and become a significant expense for some taxpayers.

Determining whether the cost is worthwhile often comes down to assessing individual risk tolerance and the complexity of one's tax situation. For those with relatively simple tax returns, relying solely on standard tax preparation services might be more cost-effective.

The Perspective of Tax Professionals

Tax professionals often offer varied perspectives on the value of extended services like Peace of Mind. Some argue that it provides valuable peace of mind to clients, especially those who are risk-averse or have complex financial situations.

Others suggest that taxpayers should focus on ensuring the accuracy of their returns through careful record-keeping and working with qualified tax preparers. This approach, they argue, can minimize the likelihood of errors and the need for such extended services.

"Ultimately, the best defense against tax issues is accurate and thorough preparation,"emphasized a CPA with over 20 years of experience.

Real-World Experiences and Testimonials

Customer experiences with Peace of Mind can be mixed. Some clients have expressed satisfaction with the assistance they received during audits, praising the service for its responsiveness and expertise. They feel the cost was justified by the support provided during a stressful time.

However, other clients have been disappointed, citing limitations in coverage or difficulties in getting claims approved. Some have found the process of submitting documentation and navigating the terms and conditions to be cumbersome. These mixed experiences highlight the importance of carefully reading and understanding the terms and conditions before purchasing the service.

Alternatives to Peace of Mind

Taxpayers seeking similar protection can explore other options. Tax audit insurance is offered by some companies, providing coverage for audit defense costs. Additionally, some tax professionals offer their own audit support services as part of their standard fees or as a separate add-on.

Another important strategy is maintaining accurate and organized financial records. This includes keeping all relevant documents, such as receipts, invoices, and statements, in a systematic way. Proper documentation can significantly reduce the chances of errors and simplify the tax preparation process.

Making an Informed Decision

Choosing whether to purchase H&R Block's Peace of Mind or a similar service requires careful consideration of personal circumstances, risk tolerance, and financial situation. It's crucial to assess the complexity of one's tax return and the likelihood of errors or an audit.

Reading the fine print and understanding the terms and conditions is essential to avoid any surprises later on. Taxpayers should also compare the cost of the service with the potential benefits and explore alternative options to ensure they are making the best choice for their needs.

The Bigger Picture: Taxpayer Education and Empowerment

Beyond the specific cost and benefits of Peace of Mind, the broader issue is taxpayer education and empowerment. Equipping individuals with the knowledge and resources to understand their tax obligations can reduce reliance on extended services and promote financial literacy.

Organizations like the IRS offer free resources and educational materials to help taxpayers navigate the complexities of the tax system. By taking advantage of these resources, taxpayers can become more confident in their ability to prepare accurate returns and manage their tax affairs effectively.

Ultimately, the decision to invest in H&R Block's Peace of Mind rests on whether the perceived benefit of added security outweighs the cost. Like Sarah, many taxpayers weigh these factors each year, seeking the optimal balance between cost-effectiveness and peace of mind in the often-turbulent waters of tax season.