H & R Block Emerald Advance

H&R Block's Emerald Advance line of credit is facing increased scrutiny due to concerns over high interest rates and limited usability. Borrowers are urged to understand the terms before applying.

The Emerald Advance, marketed as a quick source of funds during tax season, has drawn criticism for potentially trapping users in a cycle of debt. This article breaks down the facts borrowers need to know.

What is the H&R Block Emerald Advance?

The Emerald Advance is a line of credit offered by H&R Block through its banking partner, Axos Bank.

It's designed to provide clients with access to funds before their tax refund arrives.

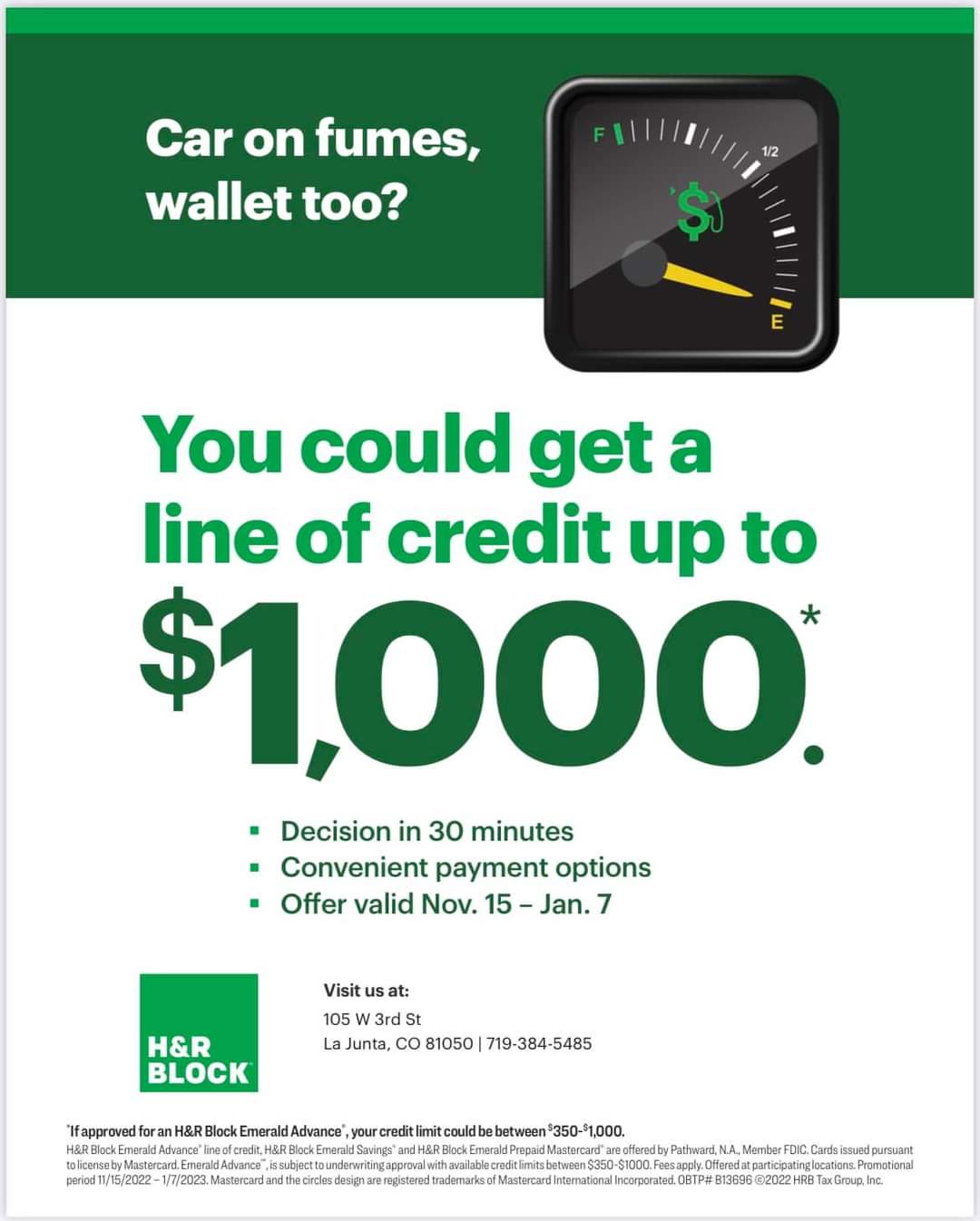

The loan amounts available typically range from $300 to $1,000, although some sources indicate potentially higher amounts for returning customers.

Who is Affected?

This primarily impacts H&R Block customers seeking immediate access to funds during tax season.

Those with low credit scores who may struggle to qualify for traditional loans are particularly vulnerable.

First-time applicants and returning customers alike need to carefully review the current terms and conditions.

Where is it Offered?

The Emerald Advance is offered at participating H&R Block locations nationwide.

The application process typically begins in person at a branch, although some aspects may be managed online.

Availability can vary by location, so confirming with a local H&R Block office is crucial.

When is it Available?

The Emerald Advance application period typically opens in November and runs through February.

This aligns with the peak tax preparation season.

Availability is subject to change, so checking with H&R Block for the exact dates each year is vital.

The Key Concerns: High Interest Rates

The most significant concern surrounding the Emerald Advance is the high interest rate.

While the actual APR can vary, reports and customer feedback suggest it can be extremely high, potentially exceeding 30%.

This high APR significantly increases the overall cost of borrowing, especially if the balance isn't repaid quickly.

Limited Usability and Fees

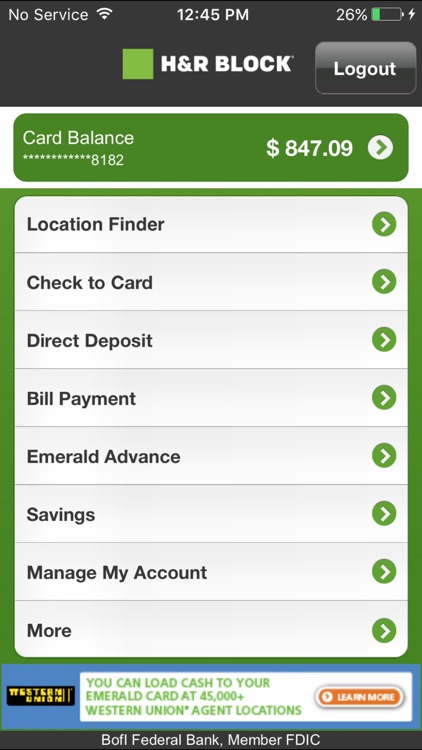

The Emerald Advance funds are typically loaded onto an Emerald Card, a prepaid debit card.

This card may come with various fees, such as ATM withdrawal fees, transaction fees, and inactivity fees.

The limited usability of the card compared to cash or a standard credit card can also be a drawback for some borrowers.

Alternatives to the Emerald Advance

Consider exploring alternative options before resorting to the Emerald Advance.

These alternatives include secured credit cards, personal loans from banks or credit unions, and tax refund advances offered by other financial institutions.

Comparing the terms and costs of each option is essential to make an informed decision.

H&R Block's Response

H&R Block maintains that the Emerald Advance provides a valuable service to clients who need immediate access to funds.

They emphasize the importance of understanding the terms and conditions before applying.

The company offers resources and tools to help clients manage their finances and repay their balances.

Ongoing Developments and Scrutiny

Consumer advocacy groups continue to scrutinize the Emerald Advance and similar financial products.

There are ongoing efforts to increase transparency and protect consumers from predatory lending practices.

Stay informed about any regulatory changes or legal actions related to these types of loans.

Next Steps for Borrowers

Carefully review the terms and conditions of the Emerald Advance before applying.

Compare the costs and benefits with other available financial options.

Contact H&R Block directly for any questions or clarifications regarding the loan and its associated fees.