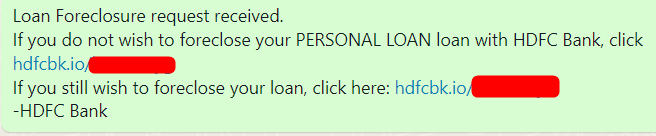

Hdfc Personal Loan Closure Branch In Gurgaon

Gurgaon residents seeking to close their HDFC personal loans face unexpected hurdles as the designated branch for loan closures experiences operational shifts. Long queues, processing delays, and reports of inconsistent information have left many borrowers frustrated and concerned about potential impacts on their credit scores.

The crux of the issue centers around the HDFC Bank branch located in Gurgaon, which has reportedly been the primary point of contact for personal loan closures in the region. This sudden shift in operational efficiency and information dissemination has triggered concerns among loan holders aiming for timely closures. The situation warrants a closer examination of the factors contributing to these challenges and their broader implications for customers.

The Bottleneck: Closure Processing and Customer Experience

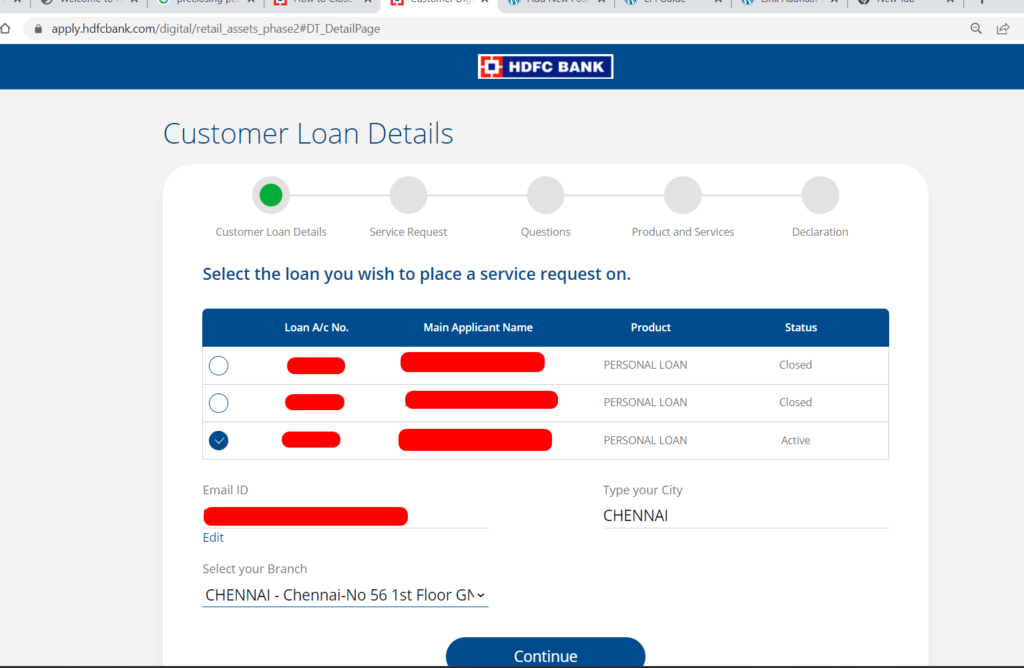

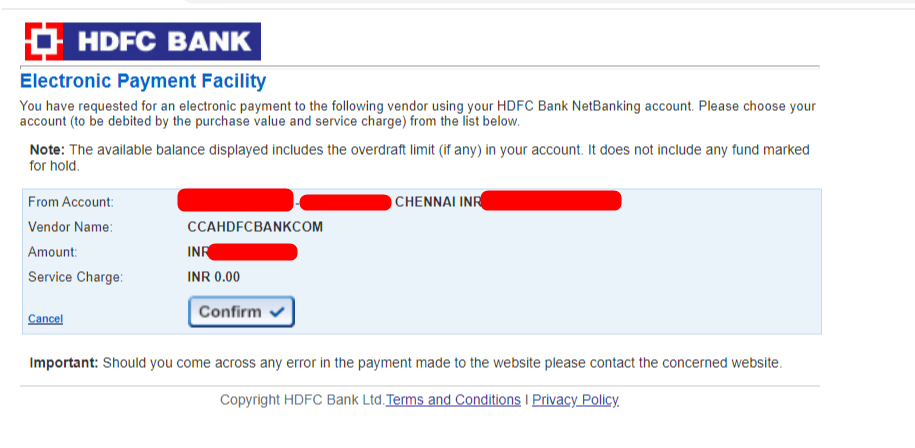

Borrowers have reported spending hours waiting in line at the designated branch, only to encounter delays in processing their loan closure requests. Some customers allege that they've received conflicting information regarding the outstanding balance or the necessary documentation for closure. These inconsistencies create confusion and hinder the loan closure process.

“I waited for over four hours to submit my closure request, and then I was told I needed additional documents not previously mentioned," recounts Ramesh Kumar, a Gurgaon resident attempting to close his personal loan. "This has already impacted my plans and is causing undue stress."

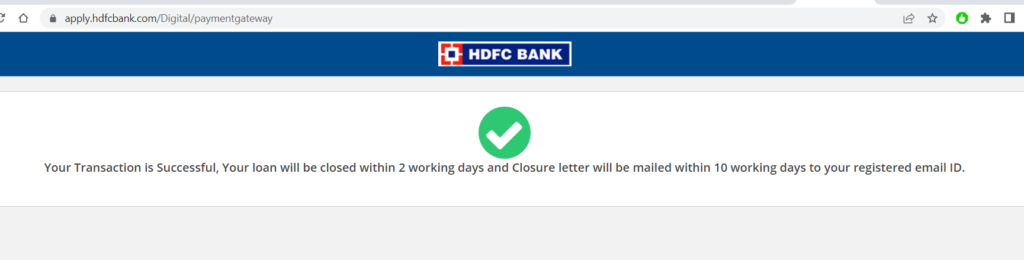

Another common grievance revolves around the perceived lack of transparency regarding the post-closure procedures. Many borrowers are unsure about when they will receive their No Objection Certificate (NOC) and the updated credit report reflecting the closed loan. This lack of clarity can create apprehension about potential negative impacts on their creditworthiness.

Contributing Factors and HDFC Bank's Response

While the exact reasons for the operational challenges remain unclear, several factors could be contributing to the current situation. Increased loan volumes, staffing issues, or system upgrades could be straining the branch's resources and slowing down processing times. This speculation is based on observations made by customers and informal discussions within the banking community.

When contacted for comment, a representative from HDFC Bank acknowledged the increased customer traffic at the designated branch. They stated that the bank is taking steps to address the situation, including deploying additional staff and streamlining the closure process. They also encouraged customers to use online banking services or contact the customer care helpline for assistance.

However, some customers argue that online channels are not always sufficient, particularly for complex closure requests or when dealing with discrepancies in loan statements. They believe a more proactive and transparent approach is needed to resolve the underlying issues and restore customer confidence.

Impact on Borrowers and Credit Scores

The delays and inconsistencies in loan closure processing can have significant consequences for borrowers. A prolonged delay in receiving the NOC can prevent them from accessing new credit or loans. This can disrupt their financial plans and potentially impact their ability to make timely payments on other obligations.

Furthermore, if the credit report is not updated promptly to reflect the closed loan, it could negatively impact their credit score. A lower credit score can make it more difficult and expensive to obtain credit in the future. This highlights the importance of efficient and accurate loan closure processes.

Looking Ahead: Recommendations for Improvement

To mitigate the current challenges and prevent similar issues in the future, HDFC Bank could consider implementing several key improvements. This could include increasing staffing levels at the designated branch, providing better training to customer service representatives, and improving the clarity and accessibility of information regarding loan closure procedures.

Additionally, the bank could explore alternative closure options, such as allowing customers to submit their requests and documentation online or through designated drop-off points. This would help to alleviate congestion at the branch and provide greater convenience for borrowers. These alternatives might also streamline the process.

Ultimately, restoring customer confidence requires a commitment to transparency, efficiency, and responsiveness. By addressing the underlying issues and implementing proactive solutions, HDFC Bank can ensure a smoother and more satisfactory loan closure experience for its customers in Gurgaon and beyond. This is important for the bank's reputation and the financial well-being of its customers.

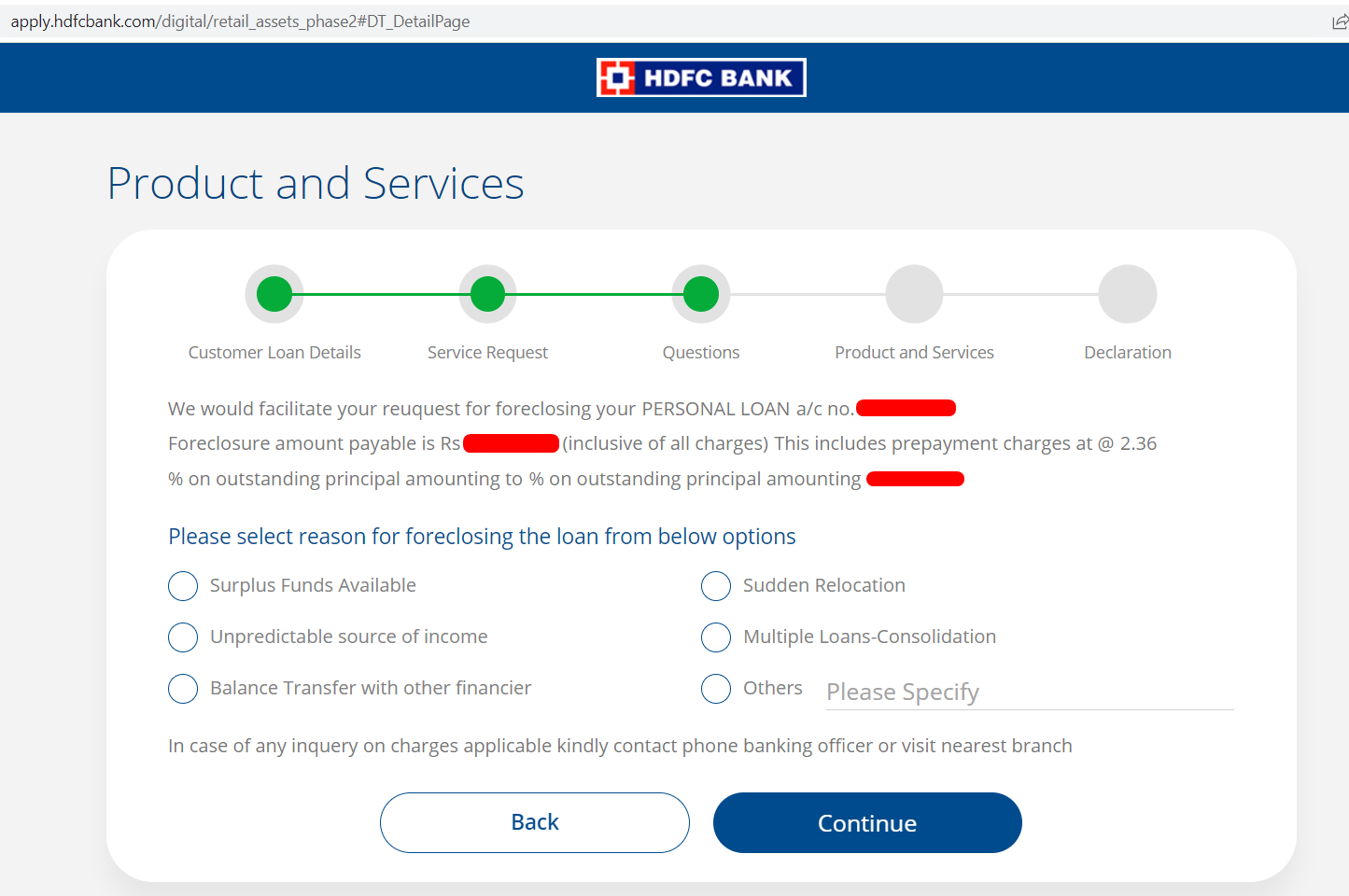

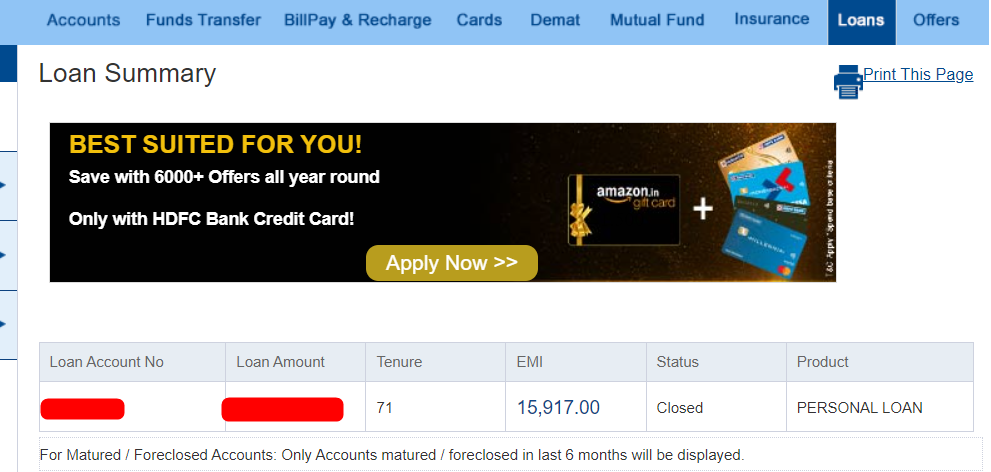

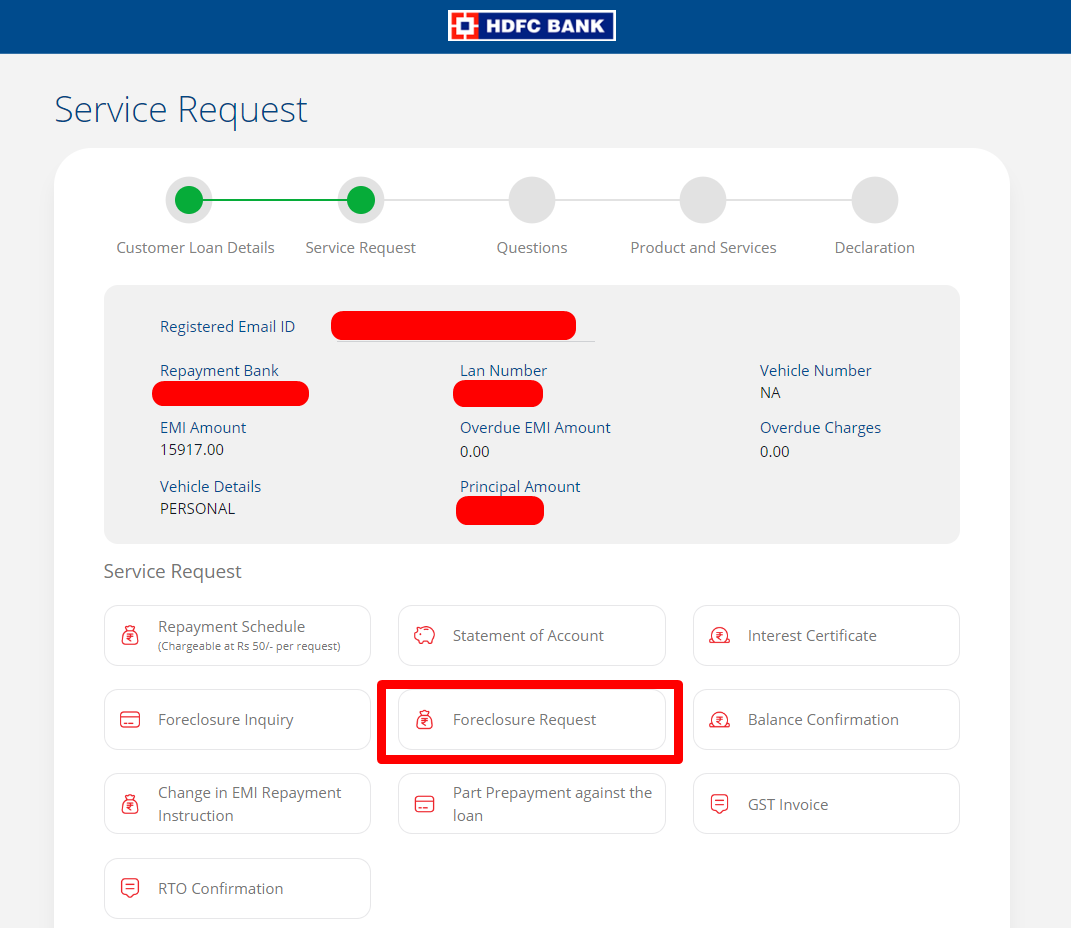

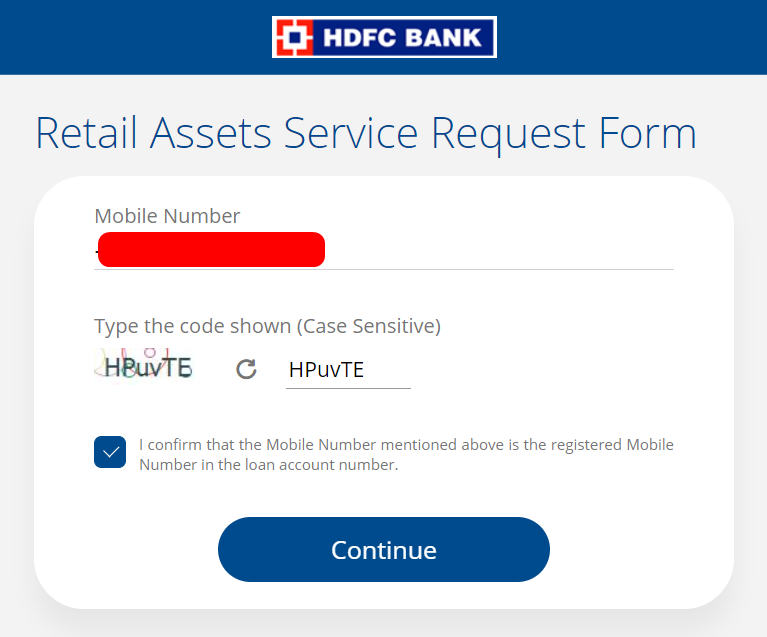

![Hdfc Personal Loan Closure Branch In Gurgaon 3 Examples on HDFC Personal Loan Preclosure Charges [2024] | SR Academy](https://sracademyindia.com/wp-content/uploads/2024/04/HDFC-Personal-Loan-Preclosure-Charges-1024x576.jpg)

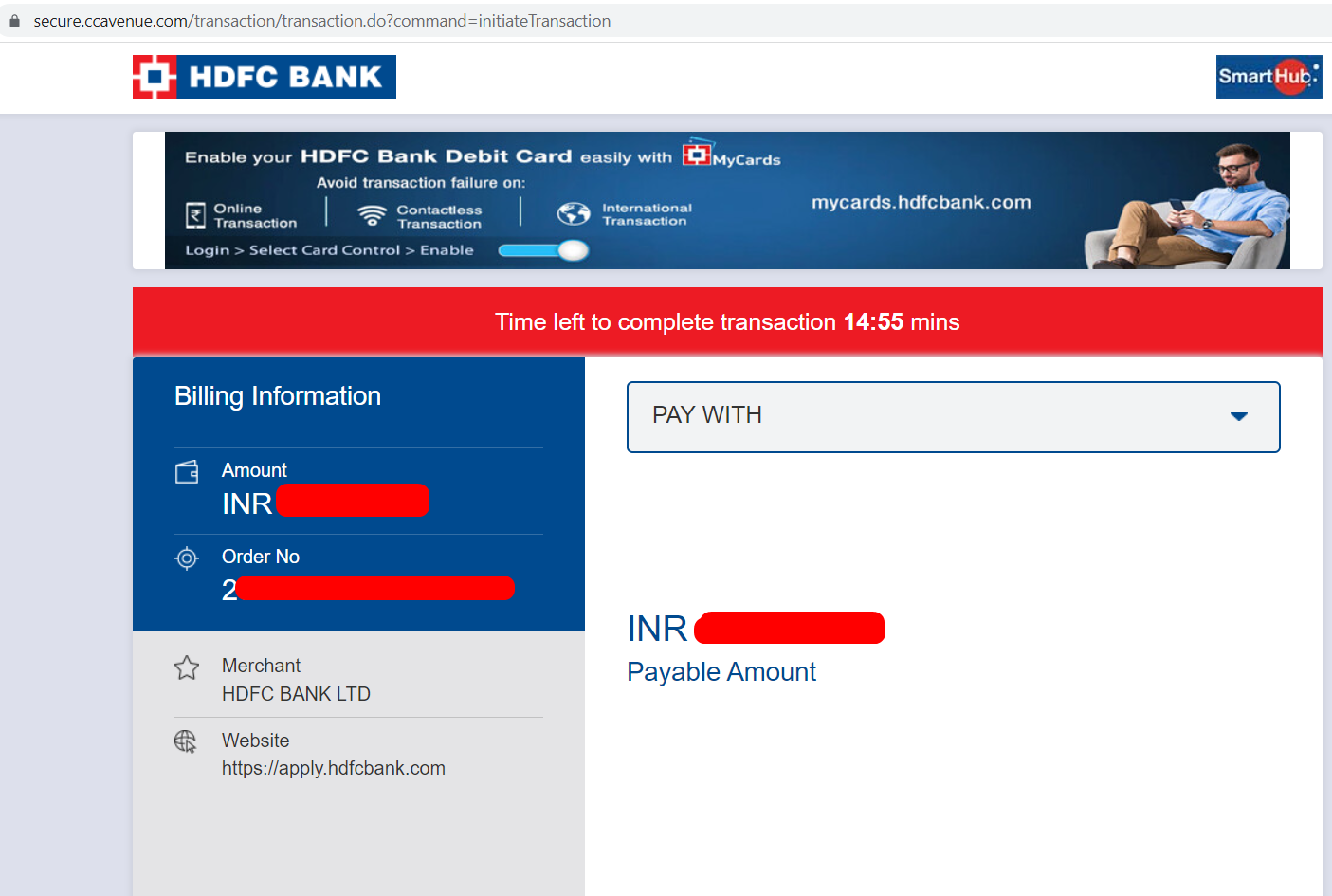

![Hdfc Personal Loan Closure Branch In Gurgaon 3 Examples on HDFC Personal Loan Preclosure Charges [2024] | SR Academy](https://www.sracademyindia.com/wp-content/uploads/2024/04/01-1024x466.jpg)