High Yield Savings Account Chase Bank

In an increasingly competitive market for savings accounts, Chase Bank has recently adjusted its High Yield Savings account offerings, prompting both customer interest and industry analysis. The changes reflect the bank's strategy to balance attracting deposits with maintaining profitability in a dynamic economic environment. These adjustments impact both new and existing customers, influencing their savings strategies and potentially affecting the broader financial landscape.

The core question surrounds how Chase's revisions to its High Yield Savings account will affect consumers seeking competitive returns on their savings. Understanding the specifics of these changes, the reasons behind them, and their potential consequences is crucial for individuals and financial observers alike. This article will explore these aspects, providing a clear and objective overview of the situation.

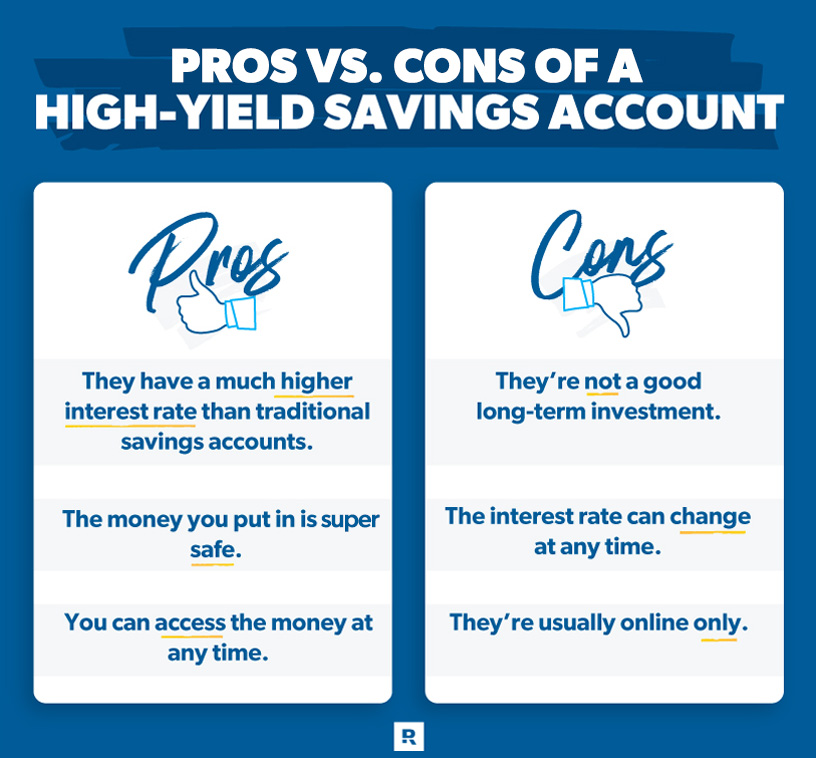

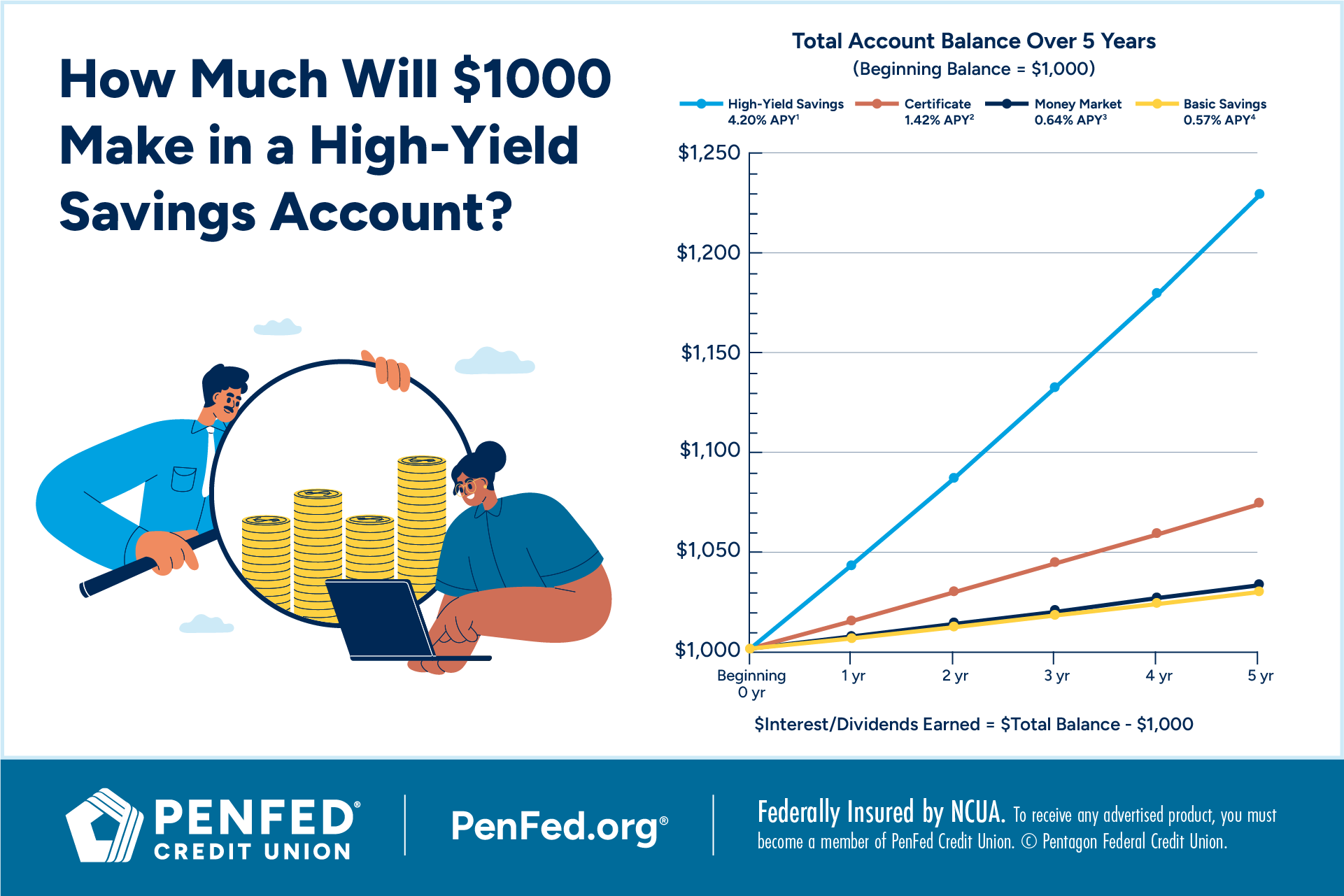

Chase Bank has announced several key changes to its High Yield Savings account, specifically adjusting the annual percentage yield (APY) offered to customers. The APY is the percentage of interest earned on a savings account over one year, and it's a critical factor for savers. While the specifics of the APY can vary based on account balance and promotional periods, the overall trend has been a recalibration in response to market conditions.

These adjustments are primarily driven by the broader economic climate, specifically the Federal Reserve's monetary policy. The Fed's decisions regarding interest rates directly impact the rates that banks offer on savings accounts. With recent fluctuations in the federal funds rate, banks like Chase are adapting their savings account yields to maintain profitability and competitiveness.

For existing Chase High Yield Savings account holders, the changes in APY may lead to adjustments in their earned interest. Customers are encouraged to review their account statements and online dashboards to understand the current APY and project their potential earnings. Some may find their returns slightly decreased, while others, particularly those with larger balances, might see marginal improvements depending on the specific tiering structure of the account.

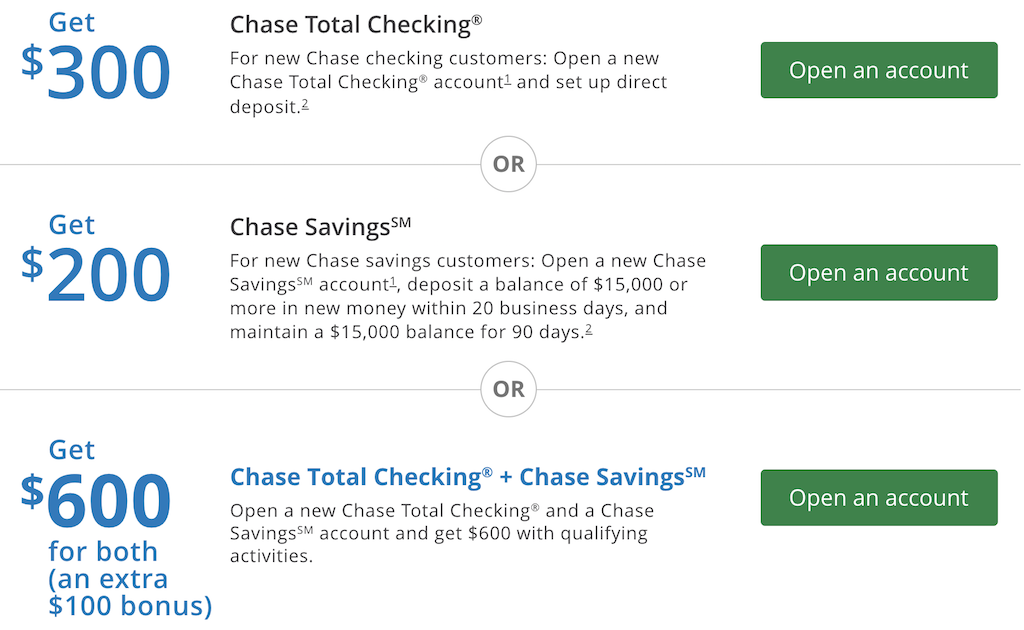

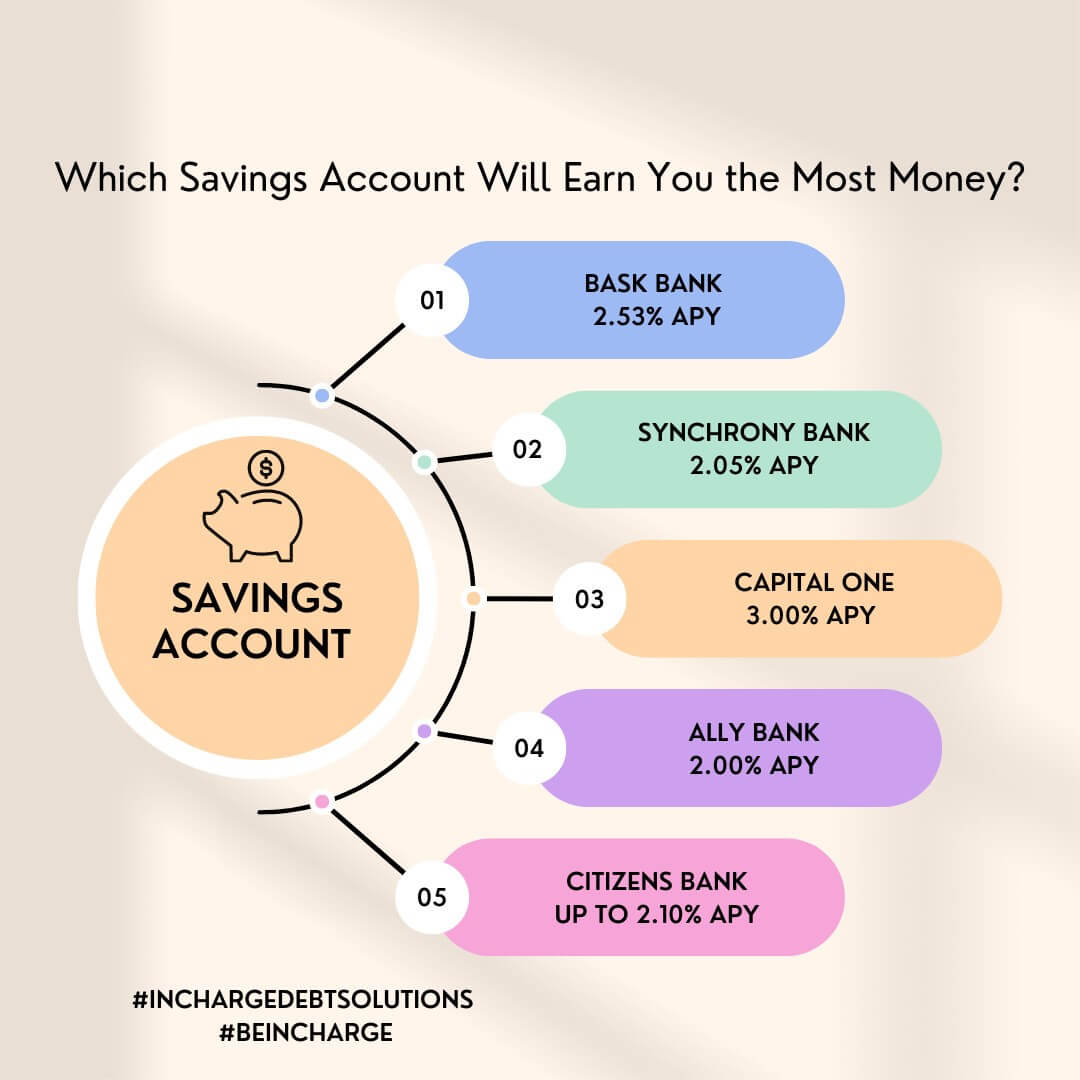

New customers considering a Chase High Yield Savings account should carefully evaluate the current APY and compare it to offerings from other banks and financial institutions. Factors to consider include minimum balance requirements, monthly fees (if any), and the overall convenience and accessibility of the bank's services. Promotional periods often offer higher introductory rates, so it’s important to understand the long-term yield after the promotional period ends.

"We regularly review our product offerings to ensure they align with market conditions and customer needs," said a Chase Bank spokesperson in a recent statement. "Our goal is to provide competitive rates while maintaining the stability and security our customers expect."This statement highlights Chase's perspective on the changes, emphasizing their commitment to balancing customer value with responsible financial management.

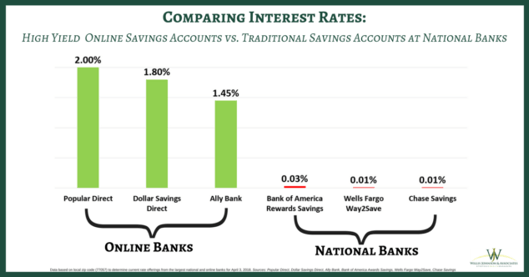

The impact extends beyond individual savers, potentially influencing deposit flows within the banking sector. If Chase's rates become less competitive, some customers may choose to move their funds to other banks or investment vehicles offering higher yields. This movement of funds can impact Chase's overall deposit base and potentially affect its lending capacity.

Furthermore, this adjustment puts pressure on other major banks to re-evaluate their own High Yield Savings account rates. The competitive landscape in the banking industry often leads to a ripple effect, where changes at one institution prompt similar adjustments at others. Consumers ultimately benefit from increased transparency and awareness, as they are encouraged to shop around for the best rates.

Human Interest Angle

Consider Sarah, a young professional who opened a Chase High Yield Savings account to save for a down payment on a home. The fluctuating APY directly affects her savings timeline and requires her to actively monitor her account and explore alternative investment options. This highlights the real-world impact of these changes on individuals striving to achieve their financial goals.Expert Opinion

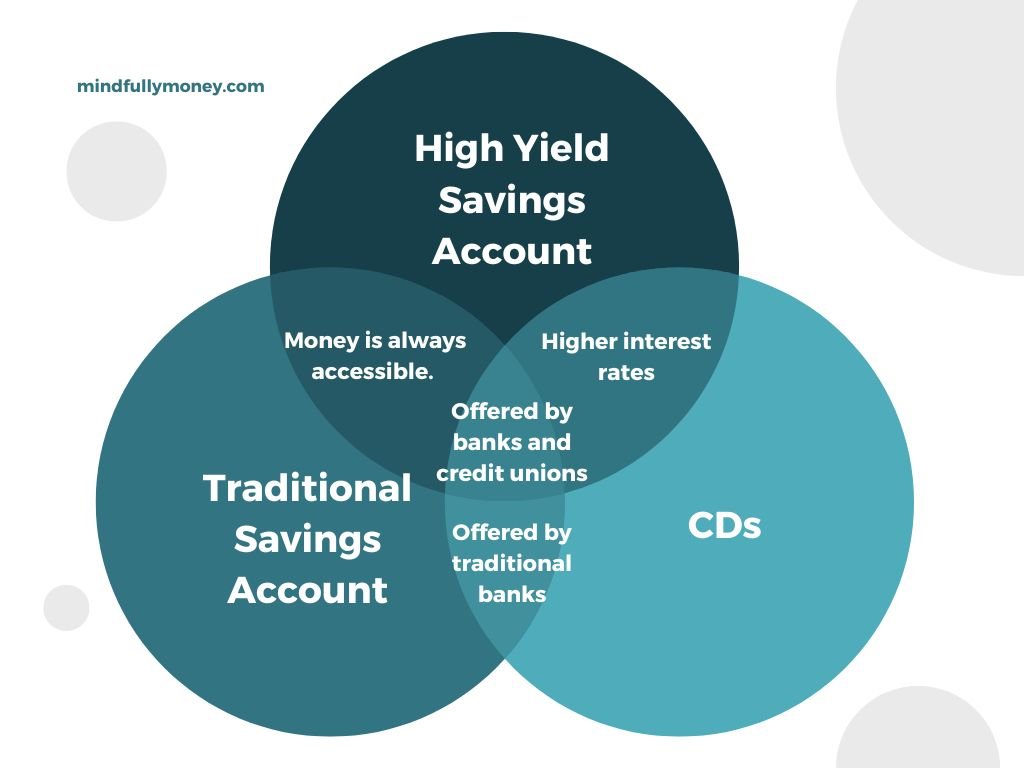

Financial analysts suggest that consumers should diversify their savings strategies to mitigate the impact of fluctuating interest rates. Exploring options such as certificates of deposit (CDs) or money market accounts can provide greater stability and potentially higher returns depending on the investment horizon.In conclusion, Chase Bank's adjustment to its High Yield Savings account reflects the ongoing interplay between market forces, monetary policy, and consumer demand. While the changes may have varying impacts on individual savers, they underscore the importance of actively managing one's finances and staying informed about the evolving banking landscape. By carefully evaluating their options and diversifying their savings strategies, consumers can navigate these changes effectively and achieve their financial objectives.

:max_bytes(150000):strip_icc()/how-to-open-a-high-yield-savings-account-4770631-final-c7f448b5c0bc48658a3c6a4c7afa0a3d.jpg)