High Yield Savings Vs Brokerage Account

As interest rates fluctuate and investment options proliferate, individuals face the ongoing challenge of determining the optimal place to park their savings. The age-old question of whether to choose a high-yield savings account or a brokerage account remains a crucial decision, particularly in today's economic climate.

The choice hinges on individual financial goals, risk tolerance, and time horizon. Understanding the nuances of each option is paramount to making an informed decision that aligns with one's specific circumstances.

High-Yield Savings Accounts: Safety and Liquidity

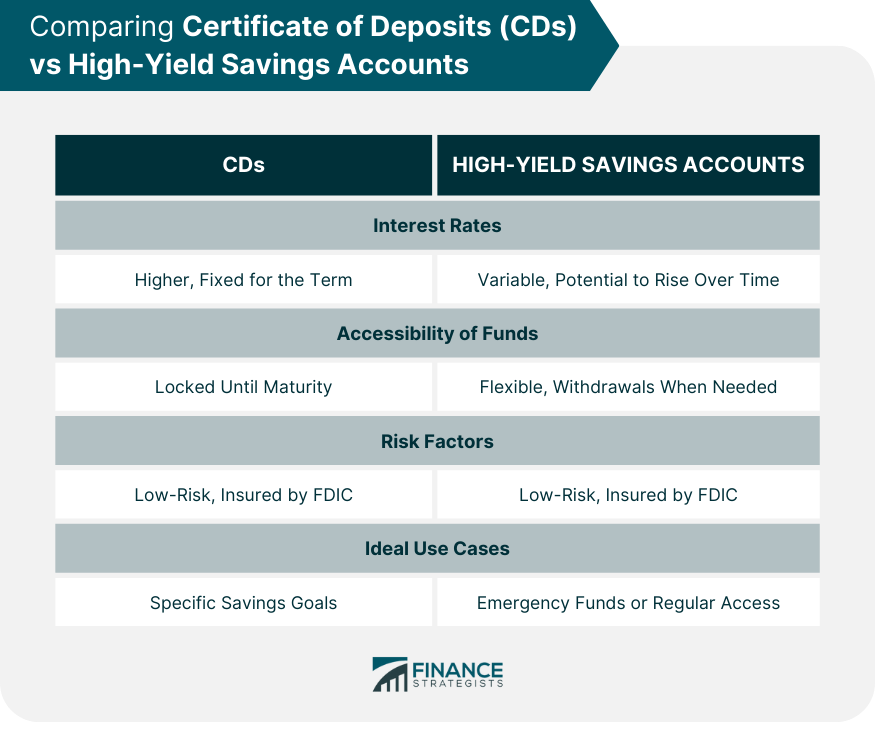

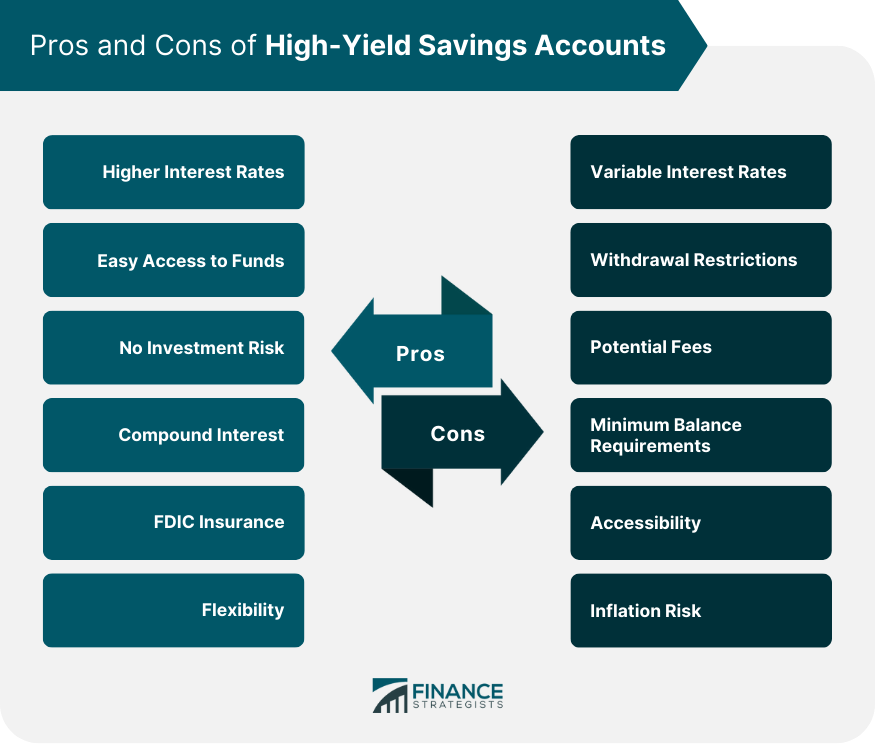

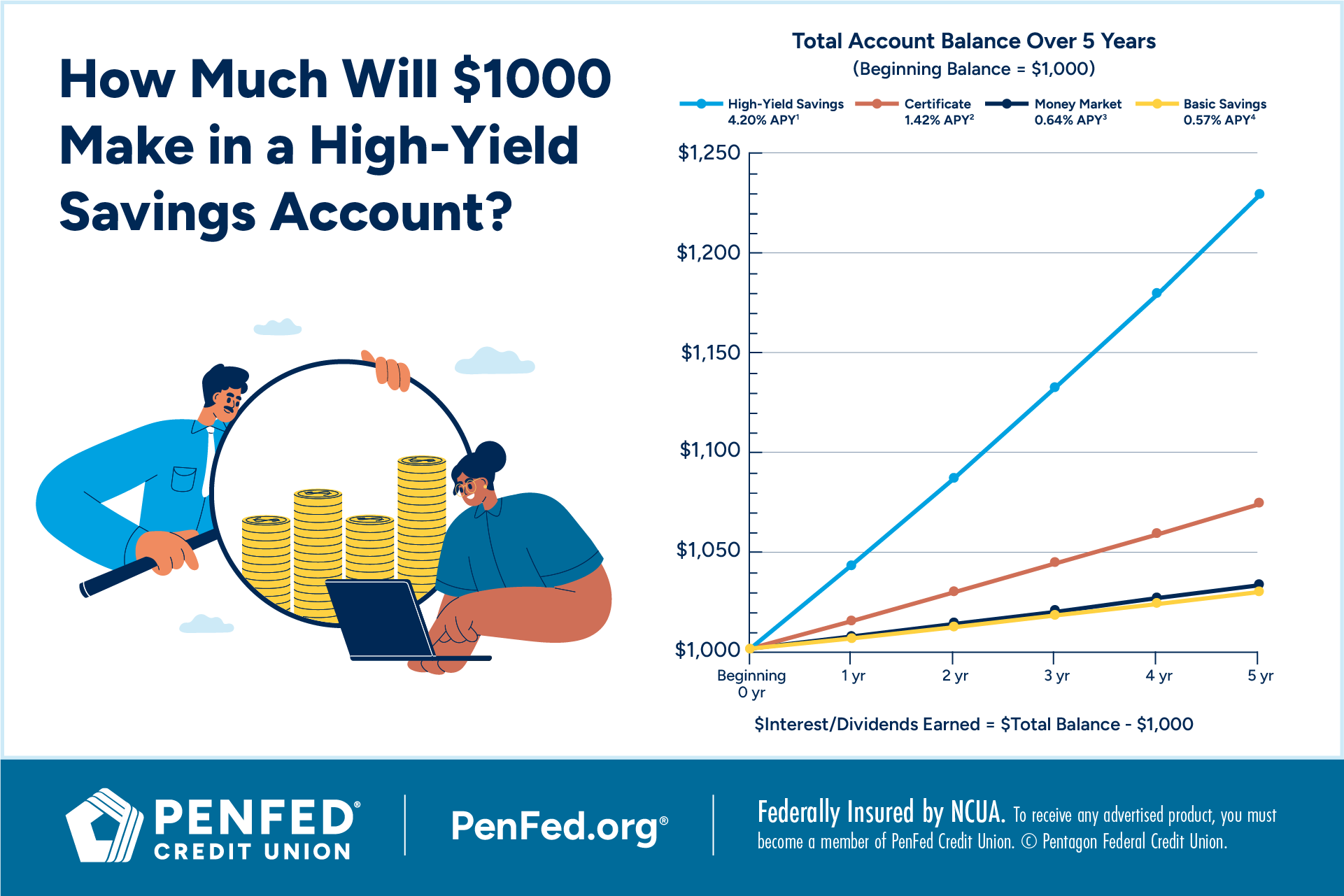

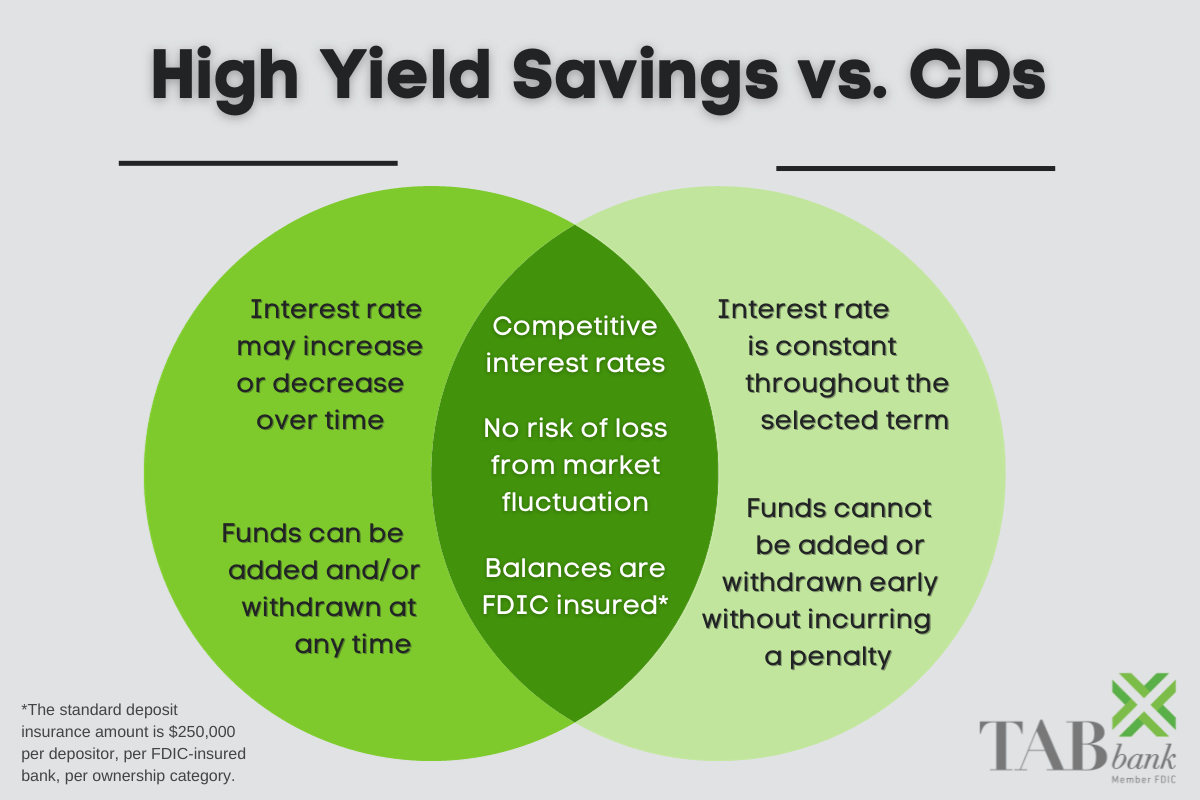

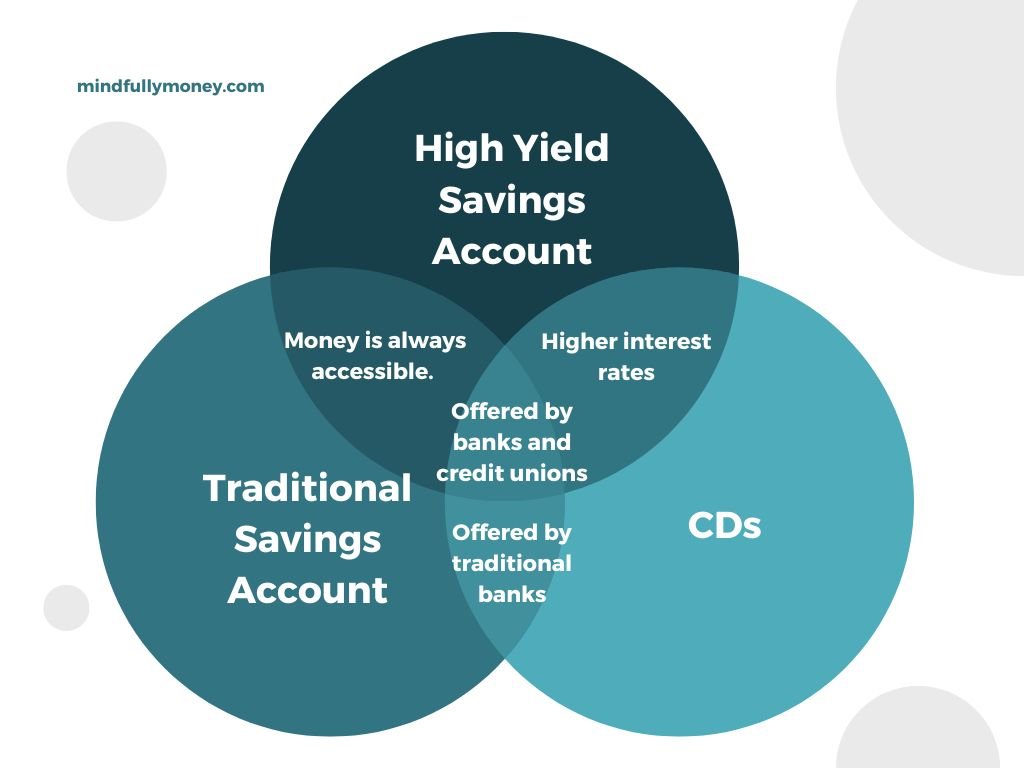

High-yield savings accounts, offered by banks and credit unions, provide a safe haven for cash while offering significantly higher interest rates than traditional savings accounts. These accounts are typically insured by the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Administration (NCUA), protecting deposits up to $250,000 per depositor, per insured bank.

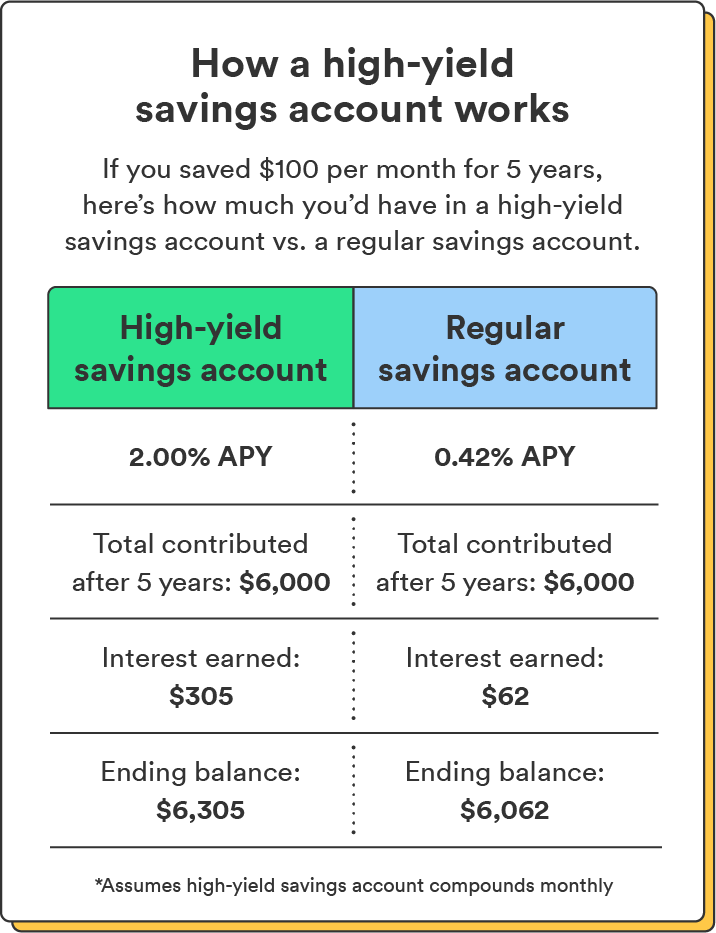

The primary appeal of high-yield savings accounts is their low-risk nature and easy accessibility. Funds are readily available for withdrawal, making them ideal for short-term savings goals, emergency funds, or simply maintaining a liquid cash reserve.

Interest rates on these accounts are subject to change, often mirroring fluctuations in the federal funds rate set by the Federal Reserve. Data from the FDIC indicates that average high-yield savings account rates have seen considerable volatility in recent years, reflecting the broader economic landscape.

Brokerage Accounts: Potential for Growth, Increased Risk

Brokerage accounts, on the other hand, offer access to a wide range of investment vehicles, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). This allows investors to potentially achieve higher returns than those offered by savings accounts, but also exposes them to greater risk.

Unlike savings accounts, brokerage accounts are not FDIC-insured. However, they are typically covered by the Securities Investor Protection Corporation (SIPC), which protects investors against the loss of cash and securities held by a brokerage firm that becomes insolvent, up to certain limits.

The potential for growth in a brokerage account is directly tied to the performance of the chosen investments. This makes them suitable for long-term financial goals, such as retirement savings or funding a child's education. However, market fluctuations can lead to losses, especially in the short term.

Tax Implications

A significant factor to consider is the tax implications of each option. Interest earned on high-yield savings accounts is generally taxable as ordinary income. Investments held in a brokerage account may generate capital gains or losses when sold, which are also subject to taxation.

Furthermore, dividends earned on stocks or mutual funds within a brokerage account are also taxable. Understanding the tax consequences is crucial for optimizing investment strategies and minimizing tax liabilities. Consulting a tax professional is highly recommended.

Real-Life Scenarios

Consider Sarah, a young professional saving for a down payment on a house in the next two years. A high-yield savings account would likely be a more suitable option for her, given her short time horizon and need for easy access to her funds.

In contrast, David, who is in his early 30s and primarily focused on long-term retirement savings, might benefit more from a diversified portfolio within a brokerage account. He can potentially weather market volatility to achieve a higher return over several decades.

Ultimately, the best choice depends on individual circumstances. Experts often advise diversifying across both types of accounts to balance risk and reward.

The decision between a high-yield savings account and a brokerage account is not a one-size-fits-all answer. A thorough understanding of one's financial goals, risk tolerance, and time horizon, coupled with professional financial advice, will empower individuals to make informed decisions that best serve their long-term financial well-being.