How Accurate Is Capital One Pre Qualified Auto Loan

Urgent alert for car buyers! Capital One's pre-qualified auto loan offers may not guarantee the rates and terms you see.

This article breaks down the accuracy of Capital One's pre-qualification process, revealing what factors influence your final loan agreement and how to avoid potential pitfalls. Understanding these nuances could save you thousands.

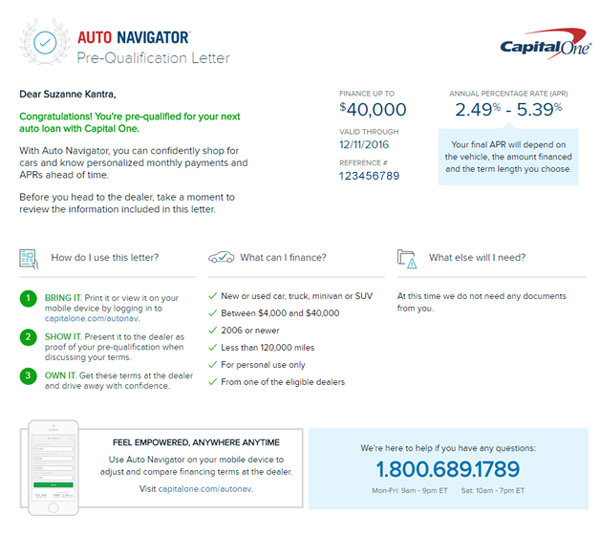

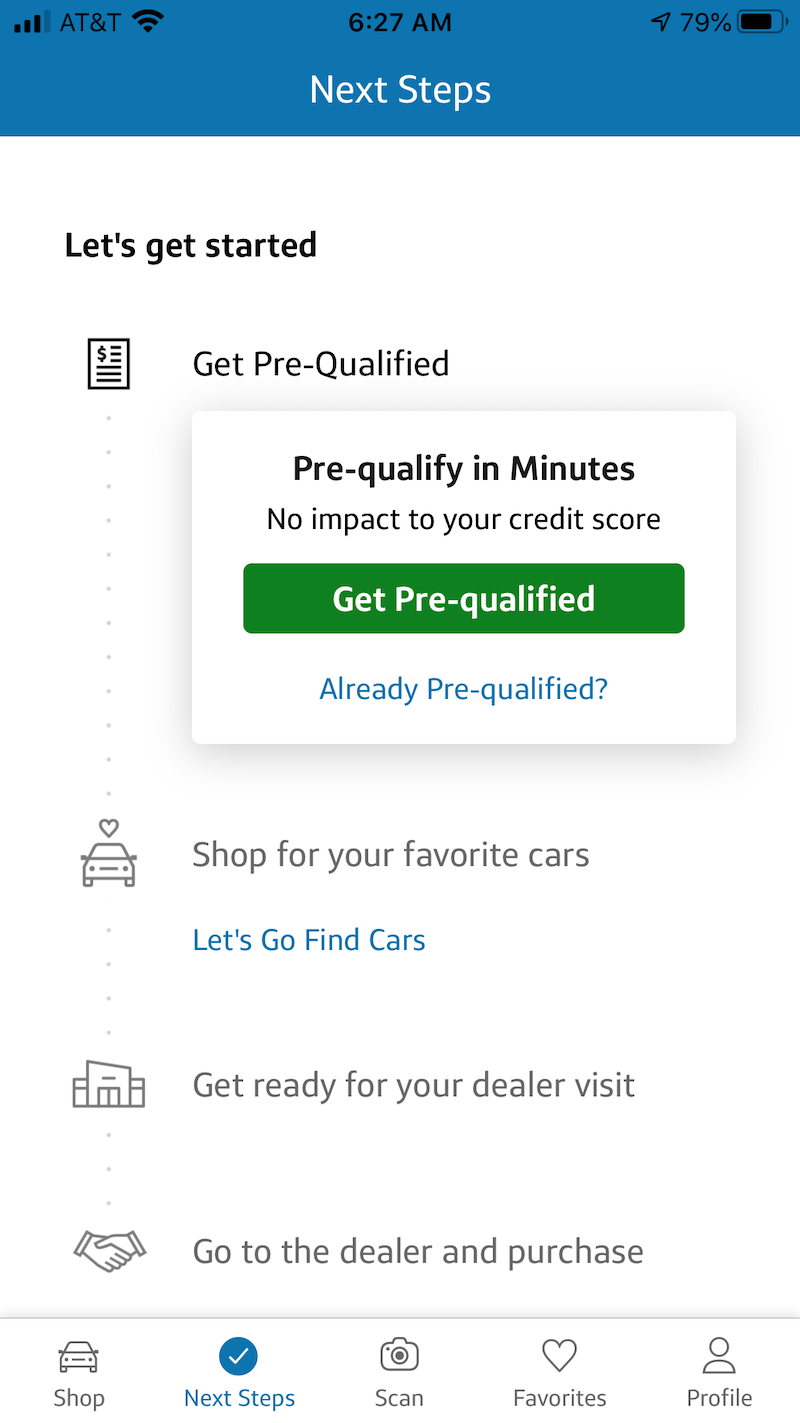

Pre-Qualification: A Starting Point, Not a Guarantee

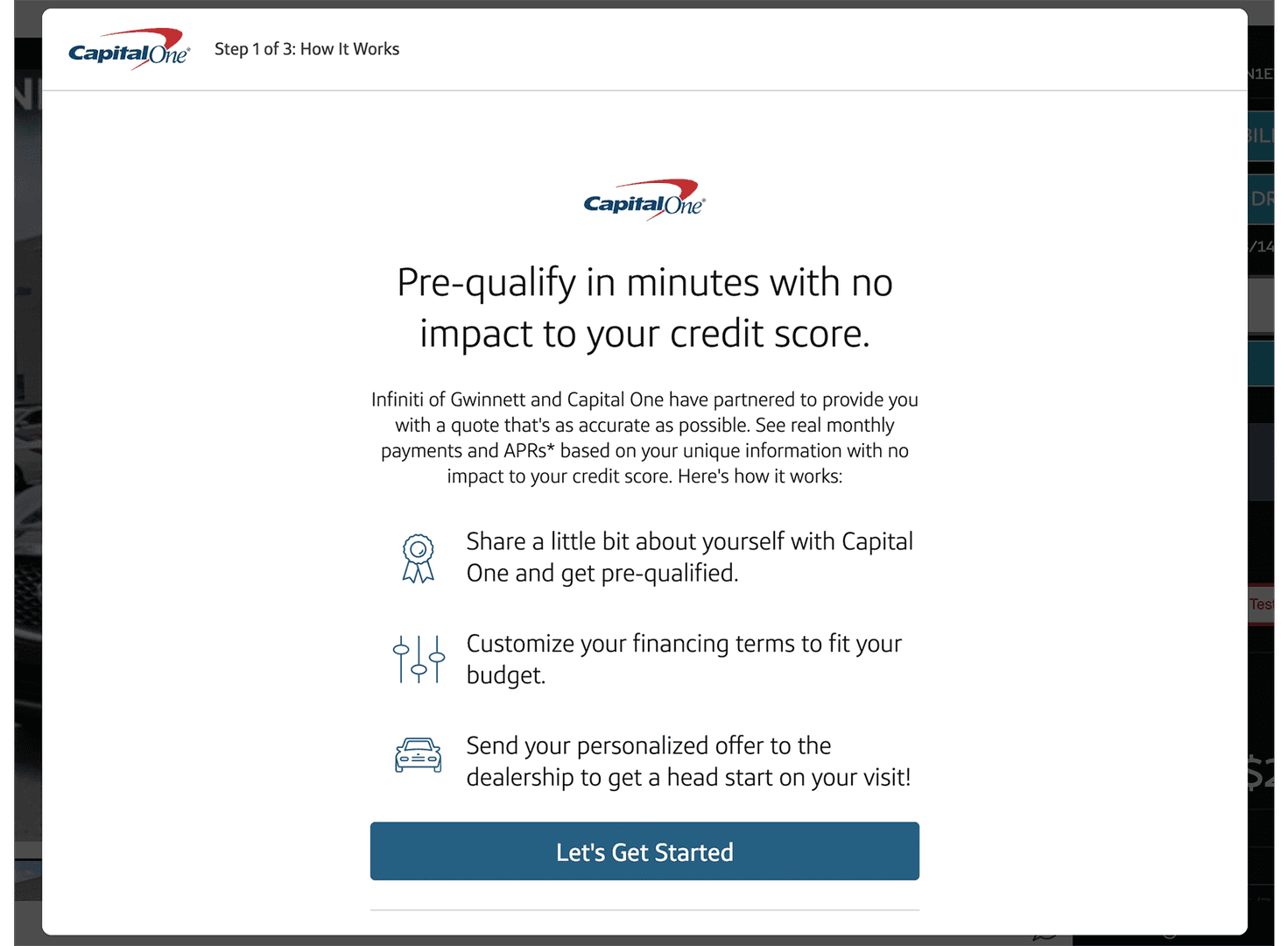

Capital One's pre-qualification tool provides an estimated loan amount, interest rate, and monthly payment. It's based on the limited information you provide and a soft credit inquiry, which doesn't affect your credit score.

However, this is not a loan approval. Think of it as a preliminary assessment.

According to Capital One's website, "Pre-qualification is based on information you provide and a review of your credit report. It does not guarantee that you will be approved for a loan or that, if approved, you will receive the estimated rates and terms."

Factors Affecting Final Loan Terms

Several factors can cause a discrepancy between the pre-qualified offer and the final loan terms. A crucial factor is the verification of information you initially provided.

Inaccuracies in your reported income, employment history, or address can lead to adjustments. A full credit check during the application process digs deeper into your credit history.

This reveals additional debts, missed payments, or other financial obligations that weren't apparent during the pre-qualification stage. The specific vehicle you choose also matters.

Loan terms can vary based on the car's age, mileage, and overall condition. These details are generally not included during the pre-qualification stage.

"Pre-qualification is a useful tool for gauging your potential borrowing power, but it's crucial to understand its limitations," says John Smith, a financial advisor.

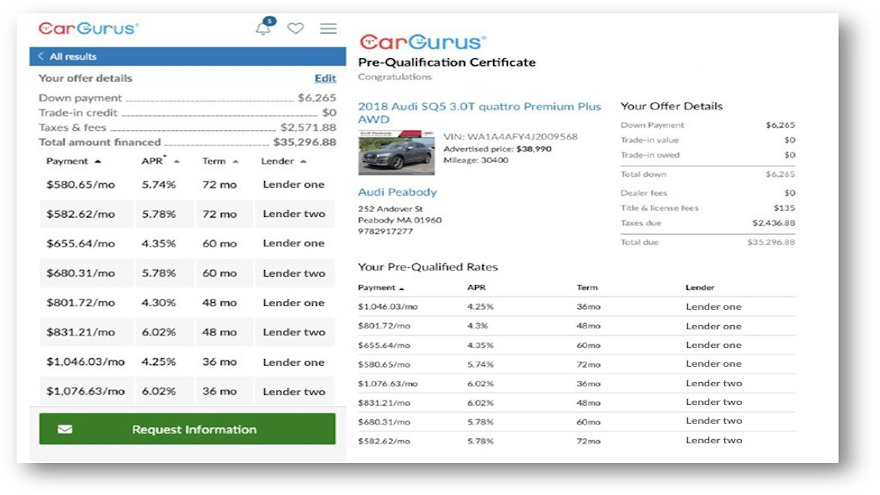

Consumer Experiences and Reported Discrepancies

Online forums and consumer review sites frequently host discussions about discrepancies between pre-qualified offers and final loan terms from Capital One. Some users report receiving significantly higher interest rates or lower loan amounts than initially estimated.

Others experienced no issues, highlighting the variability of the process. This shows that a pre-qualification doesn't always turn into an actual approval with the same conditions.

A recent survey by Consumer Reports found that nearly 30% of consumers who pre-qualified for an auto loan experienced a change in loan terms during the formal application process.

How to Improve Accuracy and Avoid Surprises

Provide accurate and up-to-date information during the pre-qualification process. Double-check your income, employment details, and contact information to avoid errors.

Before applying, obtain a copy of your credit report from AnnualCreditReport.com. This helps you identify and address any potential issues that could negatively impact your loan terms.

Compare offers from multiple lenders, including banks, credit unions, and online lenders. Pre-qualification tools from different lenders can provide a more comprehensive view of your options.

Next Steps and Ongoing Developments

Continue to monitor your credit score regularly. A sudden drop in your score can impact your loan eligibility and terms.

Capital One is continually updating its pre-qualification process. Check their website for the latest information and disclaimers regarding accuracy and eligibility requirements.

The Consumer Financial Protection Bureau (CFPB) is also monitoring auto lending practices. Any significant changes in regulations could affect pre-qualification processes across the industry.