How Accurate Is The Capital One Credit Score

Imagine logging into your Capital One account, eager to see your credit score, a number that feels like a report card for your financial life. You've been diligently paying bills, keeping your credit utilization low, and generally being responsible with your finances. But the number staring back at you doesn’t quite align with your expectations. Is it accurate? Is it telling the whole story?

This article delves into the accuracy of the Capital One CreditWise credit score, examining what it is, how it's calculated, and how it stacks up against other credit scoring models. Understanding the nuances of this score can empower you to better interpret your credit health and make informed financial decisions.

Understanding Capital One CreditWise

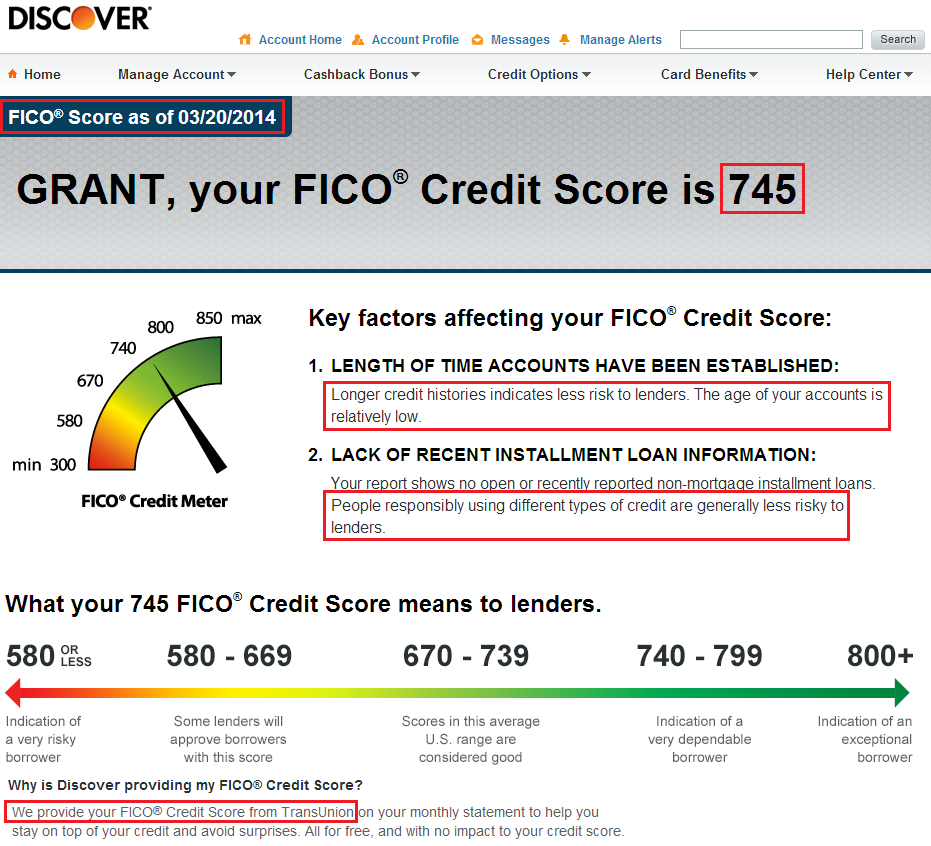

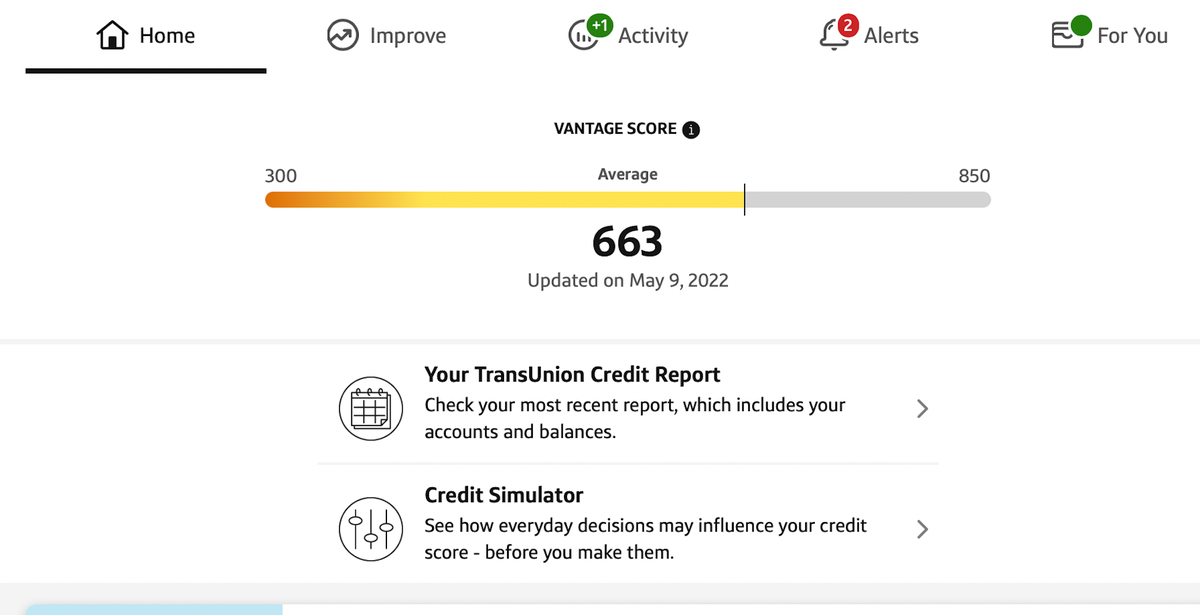

Capital One's CreditWise is a free tool offered to both Capital One customers and non-customers. It provides access to a credit score and report powered by TransUnion, one of the three major credit bureaus. But it’s important to remember that CreditWise uses the VantageScore 3.0 model, not the more widely used FICO score.

VantageScore vs. FICO

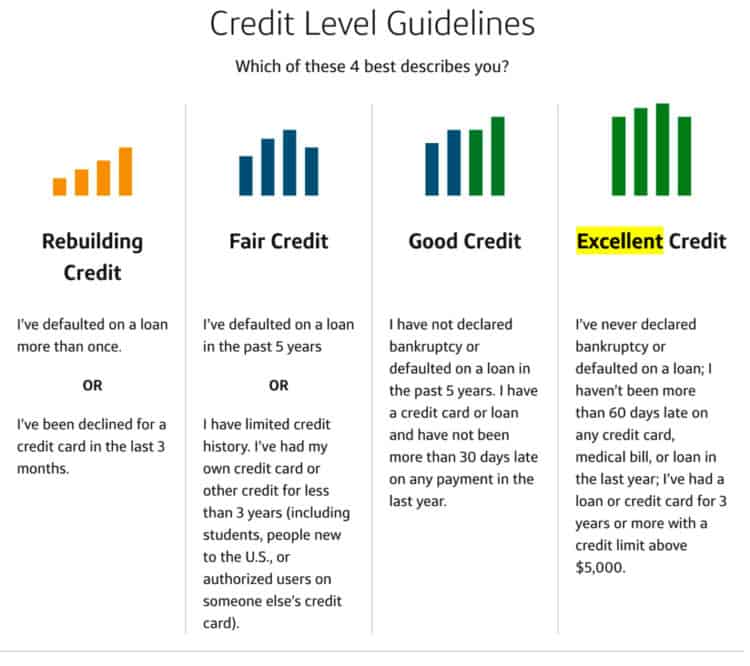

The FICO score is the industry standard, utilized by most lenders when evaluating creditworthiness. VantageScore, on the other hand, was created by the three major credit bureaus (Equifax, Experian, and TransUnion) as an alternative scoring model.

While both models consider similar factors – payment history, credit utilization, age of credit history, new credit, and credit mix – they weigh them differently. This difference in weighting can lead to variations in the scores generated by each model.

Accuracy and Relevance

So, how accurate is the CreditWise score? It’s accurate in the sense that it reflects the information in your TransUnion credit report as interpreted by the VantageScore 3.0 model. However, it's crucial to understand that this score may not be the same score a lender uses when you apply for a loan or credit card.

Many lenders still heavily rely on FICO scores, making it essential to monitor your FICO score alongside your VantageScore. Several services offer free access to your FICO score, allowing you to gain a more comprehensive view of your credit health.

Factors Influencing Your Credit Score

Regardless of the scoring model, several key factors influence your credit score. Payment history is the most significant, so paying your bills on time, every time, is paramount.

Credit utilization, the amount of credit you're using compared to your total available credit, is another crucial factor. Keeping your utilization below 30% is generally recommended. The length of your credit history, the types of credit accounts you have (credit cards, loans, etc.), and any new credit applications also play a role.

Beyond the Number: Understanding Your Credit Report

While a credit score provides a snapshot of your creditworthiness, your credit report offers a detailed history. CreditWise also provides access to your TransUnion credit report, allowing you to review the information that's being used to calculate your score.

Regularly checking your credit report is crucial for identifying and correcting any errors. Even minor inaccuracies can negatively impact your score. You are entitled to a free credit report from each of the three major credit bureaus annually through AnnualCreditReport.com.

"Your credit score is a valuable tool, but it's just one piece of the financial puzzle. Understanding the underlying factors and regularly monitoring your credit report are essential for maintaining a healthy financial profile."

In conclusion, the Capital One CreditWise score provides a useful, free way to monitor your credit health based on the VantageScore 3.0 model. However, it is important to remember that it might not be the exact score used by all lenders. Supplementing this information with access to your FICO score and regularly reviewing your credit reports from all three major bureaus will provide you with a more complete and accurate understanding of your creditworthiness.

Armed with this knowledge, you can confidently navigate the world of credit, build a solid financial foundation, and achieve your long-term financial goals.

![How Accurate Is The Capital One Credit Score Capital One Credit Wise Review: Accurate? [2020] - UponArriving](https://www.uponarriving.com/wp-content/uploads/2019/04/Capital-One-Credit-Wise-2.png)

![How Accurate Is The Capital One Credit Score Capital One Credit Wise Review: Accurate? [2020] - UponArriving](https://www.uponarriving.com/wp-content/uploads/2019/04/Capital-One-Credit-Wise-3.png)