How Bad Is 550 Credit Score

A credit score is more than just a number; it's a key that unlocks financial opportunities, or slams the door shut. A score of 550, unfortunately, tends to do the latter. It places individuals in a precarious position, severely limiting their access to credit and significantly increasing the cost of borrowing.

The impact of a 550 credit score ripples through various aspects of life, from securing a loan for a car or home to even renting an apartment or obtaining affordable insurance. Understanding the depth and breadth of these consequences is crucial for anyone looking to improve their financial standing.

The Grim Reality of a 550 Credit Score

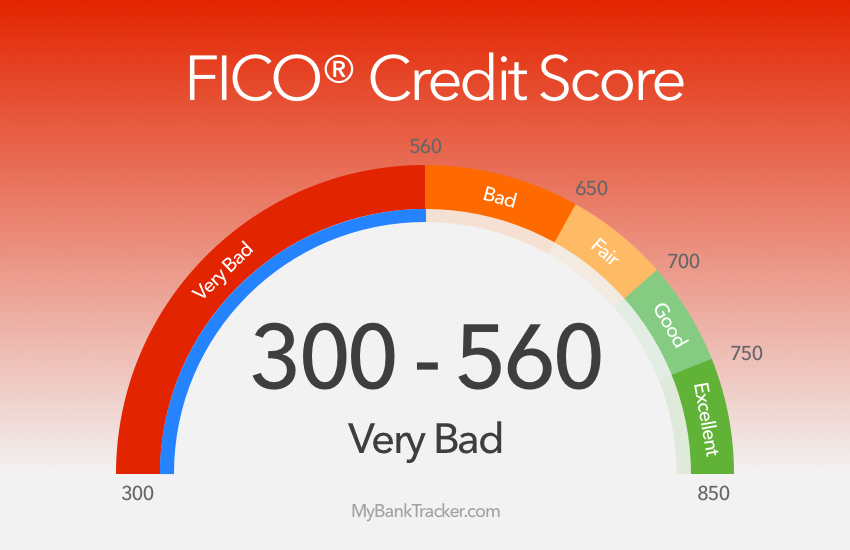

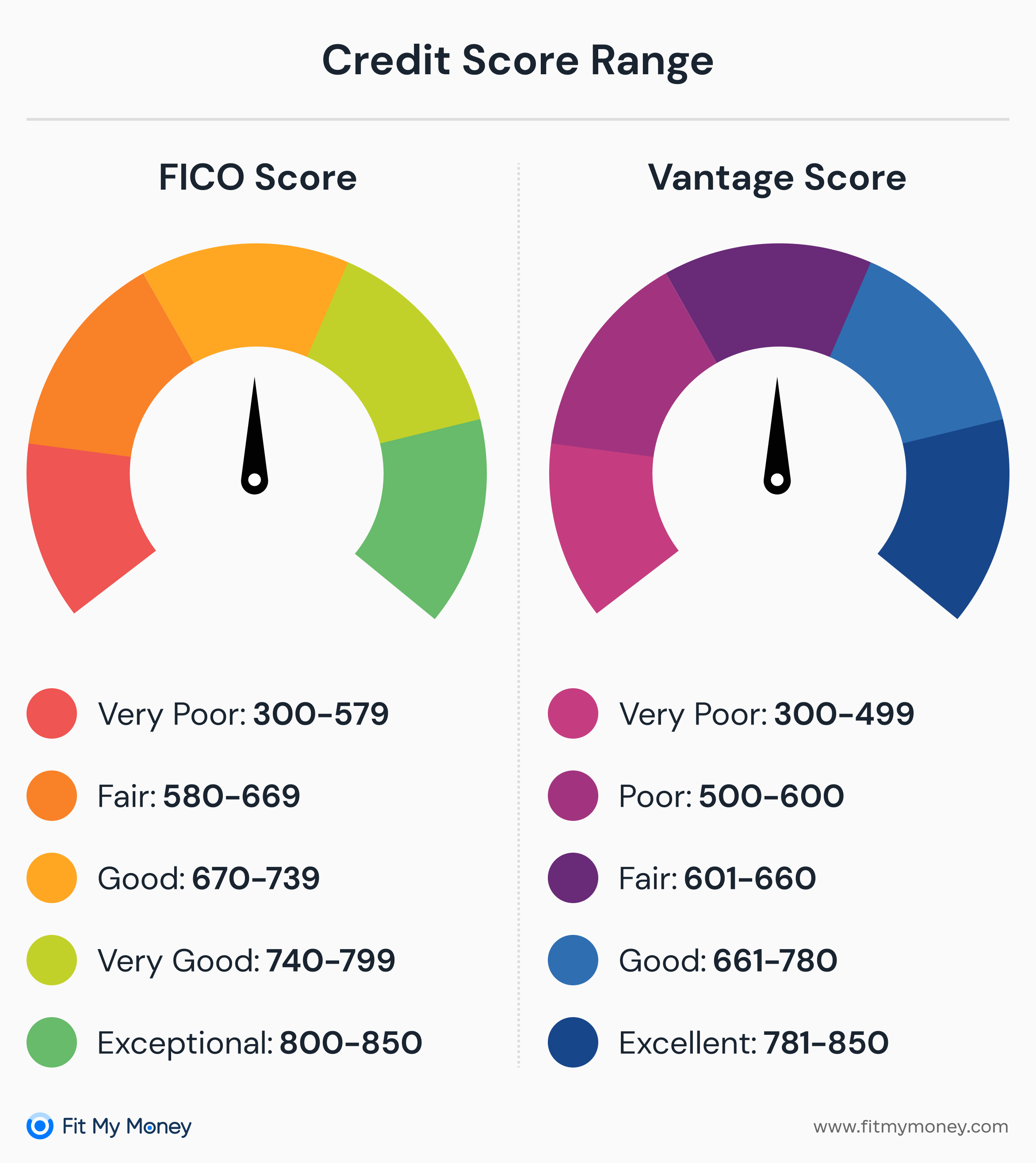

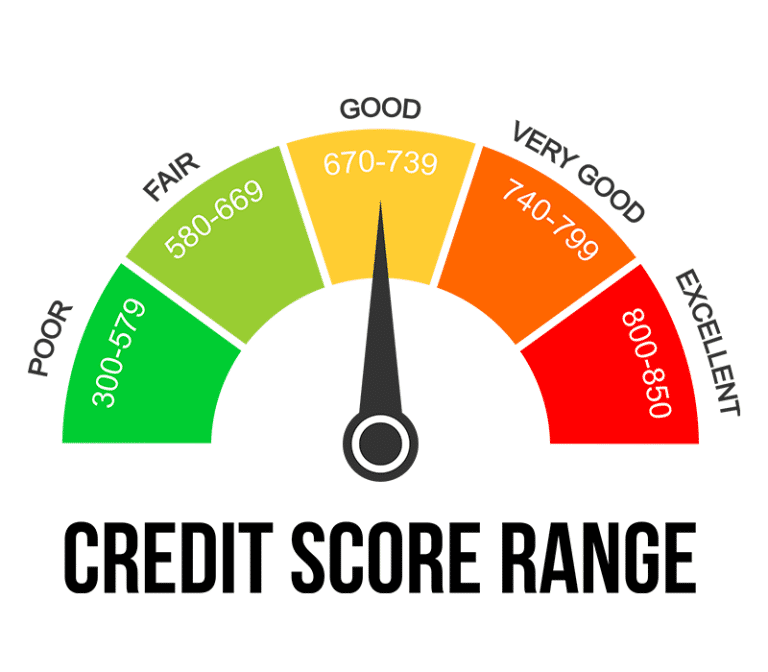

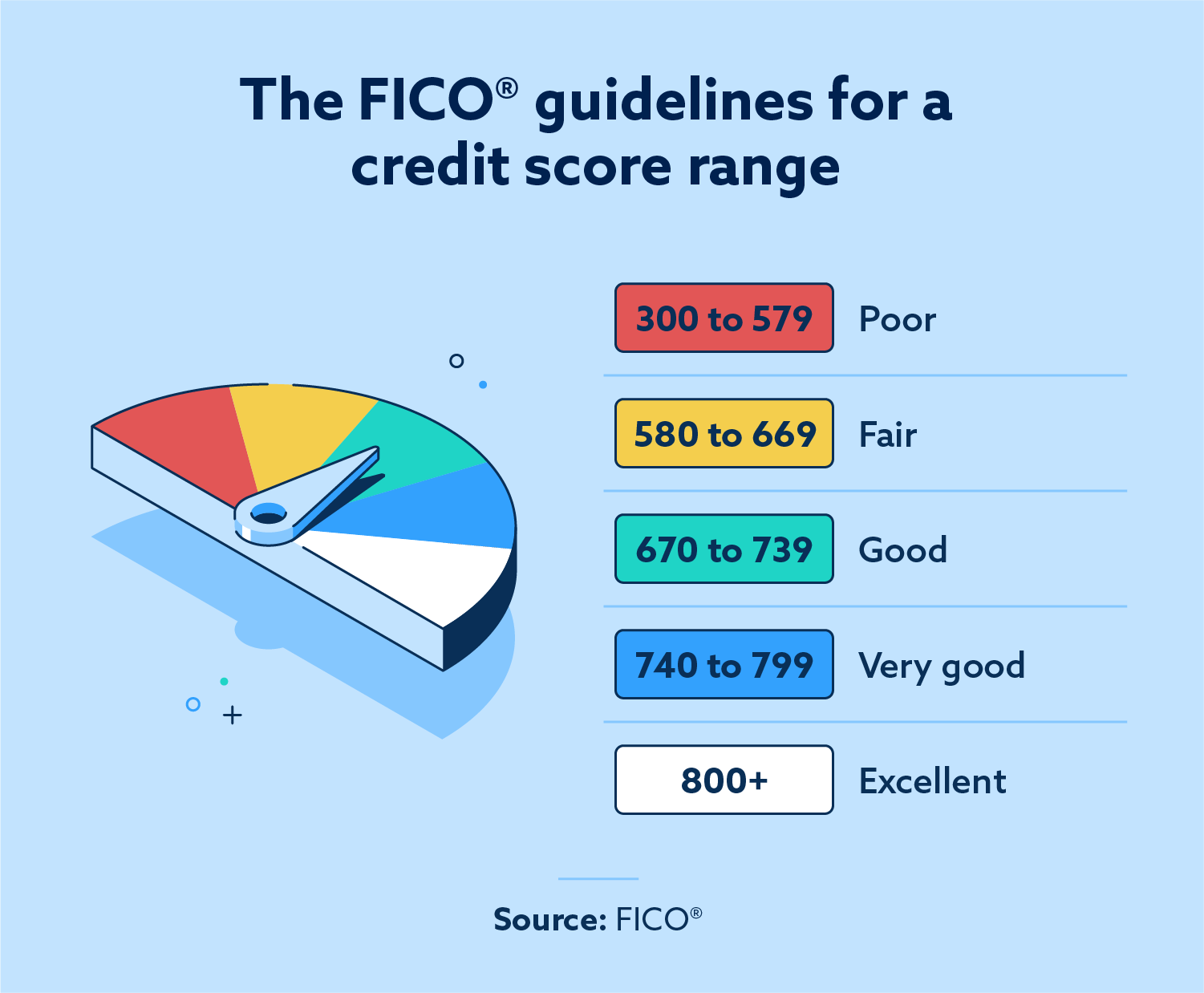

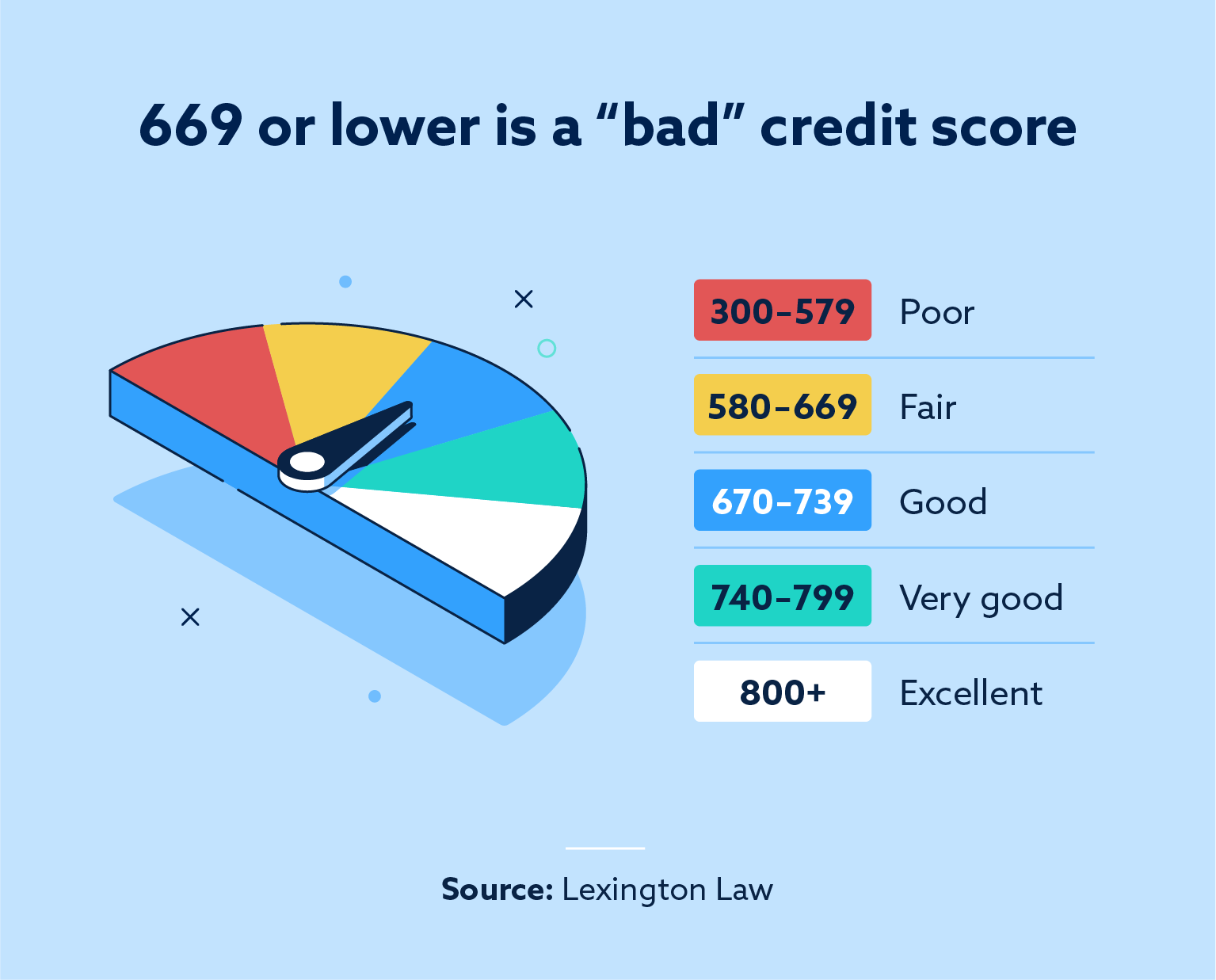

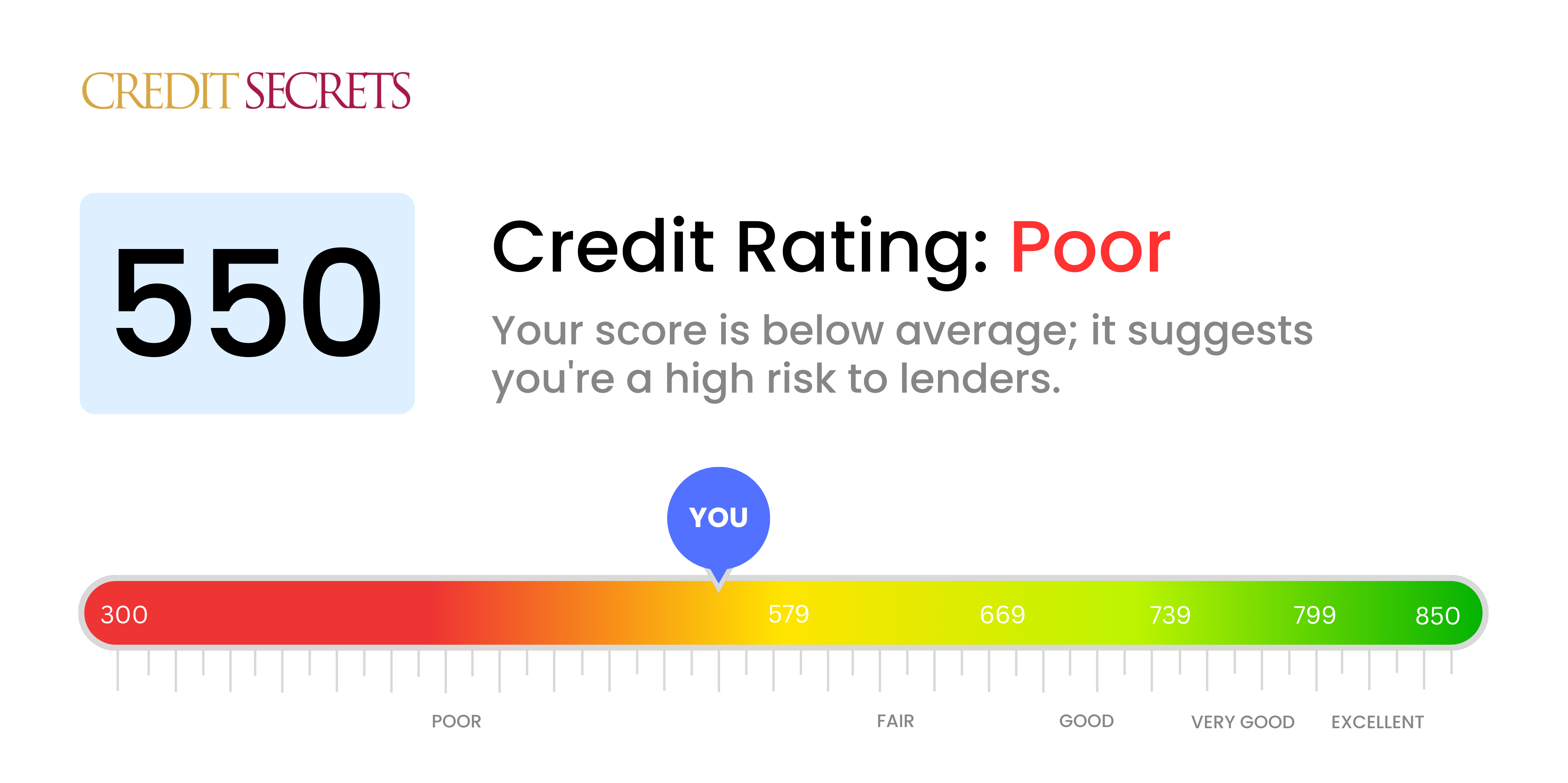

A 550 credit score falls squarely within the "poor" or "very poor" range, depending on the scoring model used. FICO, the most widely used credit scoring system, considers scores between 300 and 579 as "very poor." Experian, another major credit bureau, categorizes scores below 580 as "poor."

This rating signals to lenders that you are a high-risk borrower. It suggests a history of missed payments, defaults, or other credit mismanagement issues.

Limited Access to Credit

Individuals with a 550 credit score will find it extremely difficult to obtain credit from traditional lenders. Banks and credit unions are often hesitant to extend loans or credit cards to those perceived as high-risk.

Even if approved, the terms will be significantly less favorable. Expect much higher interest rates, lower credit limits, and additional fees.

Sky-High Interest Rates

Interest rates are directly correlated with credit risk. Lenders compensate for the increased risk of default by charging higher interest on loans and credit cards.

A 550 credit score can translate into hundreds or even thousands of dollars in extra interest payments over the life of a loan. This added expense can make it challenging to pay off debt and further damage your credit.

Consider, for example, the difference in interest rates for an auto loan. According to data from MyFICO, someone with a "very poor" credit score (500-579) might face interest rates that are significantly higher than someone with an "excellent" credit score (720-850).

Difficulty Renting an Apartment

Landlords often use credit scores as a screening tool for potential tenants. A low score can raise red flags and make it difficult to secure housing.

Many landlords require a minimum credit score for approval, and a 550 score may fall below that threshold. You might be required to pay a larger security deposit or even find a co-signer.

Higher Insurance Premiums

In many states, insurance companies use credit scores to assess risk and determine premiums. Studies have shown a correlation between low credit scores and higher insurance claims.

As a result, individuals with poor credit may pay significantly more for auto and homeowners insurance. This adds another layer of financial burden.

Impact on Employment

While less common, some employers conduct credit checks as part of their hiring process, particularly for positions that involve handling finances or sensitive information. A poor credit score could potentially hinder your job prospects.

However, it's important to note that employers must obtain your consent before running a credit check. They are also required to comply with the Fair Credit Reporting Act (FCRA), which protects your rights regarding credit information.

The Road to Recovery: Improving Your Credit Score

While a 550 credit score presents significant challenges, it's not a life sentence. Credit scores can be improved over time with consistent effort and responsible financial habits.

The first step is to understand what's negatively impacting your score. Obtain copies of your credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion) and carefully review them for errors or inaccuracies.

Dispute Errors and Inaccuracies

If you find any errors on your credit reports, dispute them directly with the credit bureaus. The FCRA requires credit bureaus to investigate and correct inaccurate information.

This can significantly improve your score, especially if the errors are substantial.

Make Timely Payments

Payment history is the most important factor in determining your credit score. Focus on making all payments on time, every time.

Set up automatic payments or reminders to ensure you never miss a due date. Even small improvements in payment history can have a positive impact on your score.

Reduce Credit Card Balances

High credit card balances can negatively affect your credit utilization ratio, which is the amount of credit you're using compared to your total available credit. Aim to keep your credit card balances below 30% of your credit limits.

Consider using the debt snowball or debt avalanche method to pay down your debts more quickly. Even small, consistent payments can make a difference.

Consider a Secured Credit Card

A secured credit card can be a good option for individuals with poor credit. These cards require a cash deposit as collateral, which reduces the risk for the lender.

By using a secured credit card responsibly and making timely payments, you can gradually rebuild your credit history.

Looking Ahead: A Path Towards Financial Stability

Improving a 550 credit score is a marathon, not a sprint. It requires patience, discipline, and a commitment to responsible financial habits.

While the immediate challenges are significant, focusing on long-term strategies can pave the way for a brighter financial future. Seek help from non-profit credit counseling agencies to get personalized advice on debt management and credit repair.

Remember that even incremental improvements in your credit score can unlock new opportunities and alleviate financial stress. A higher credit score leads to lower interest rates, better loan terms, and increased financial flexibility, ultimately contributing to a more secure and prosperous life.