How Bad Is A Credit Score Of 550

A credit score of 550 can significantly impact your financial life, limiting access to credit and increasing borrowing costs. Understanding the ramifications of a credit score in this range is crucial for anyone seeking to improve their financial standing.

This article will explore the specific challenges associated with a 550 credit score, outlining the consequences for loans, interest rates, and overall financial opportunities. It will also discuss strategies for rebuilding credit and achieving a healthier financial profile.

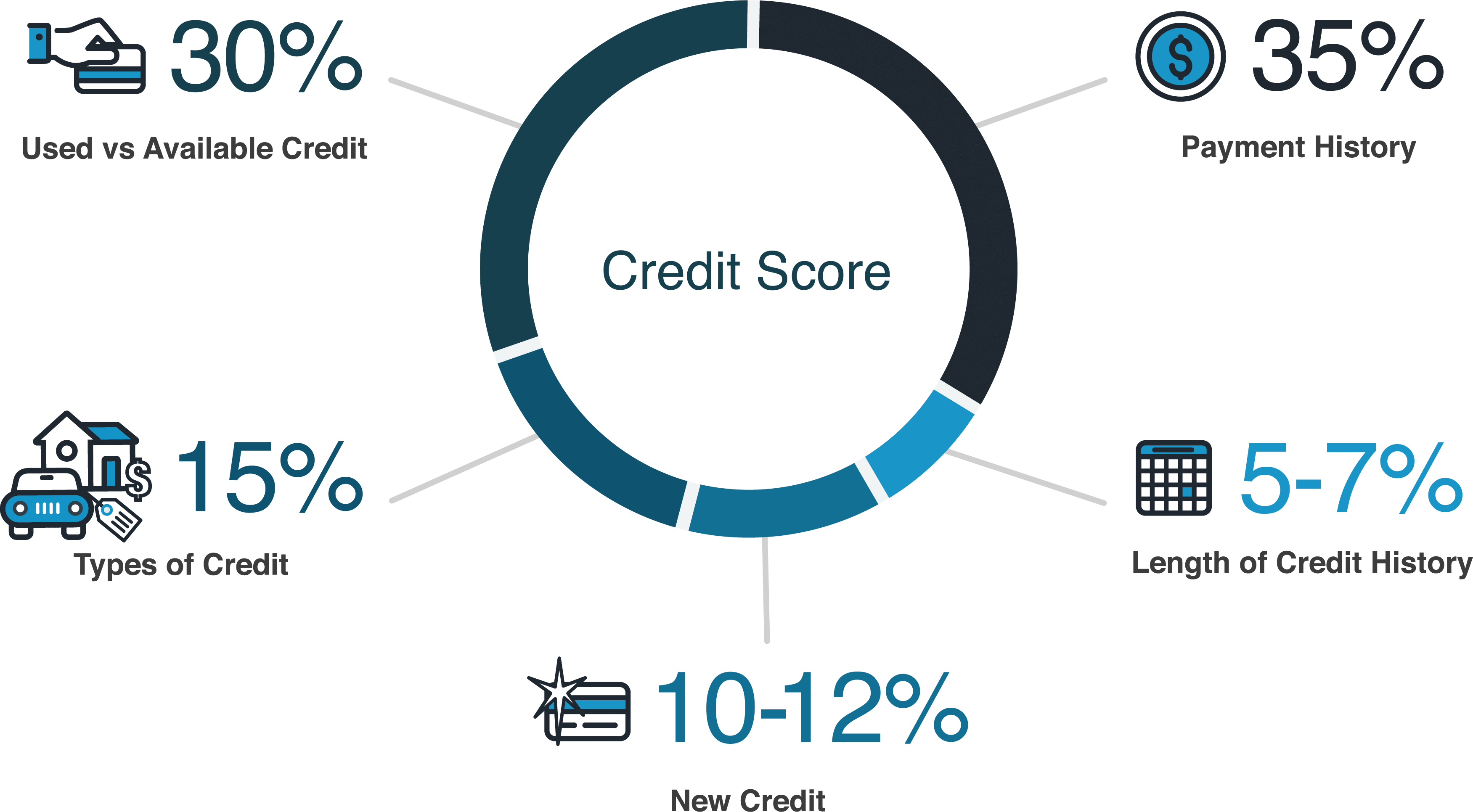

Understanding Credit Score Ranges

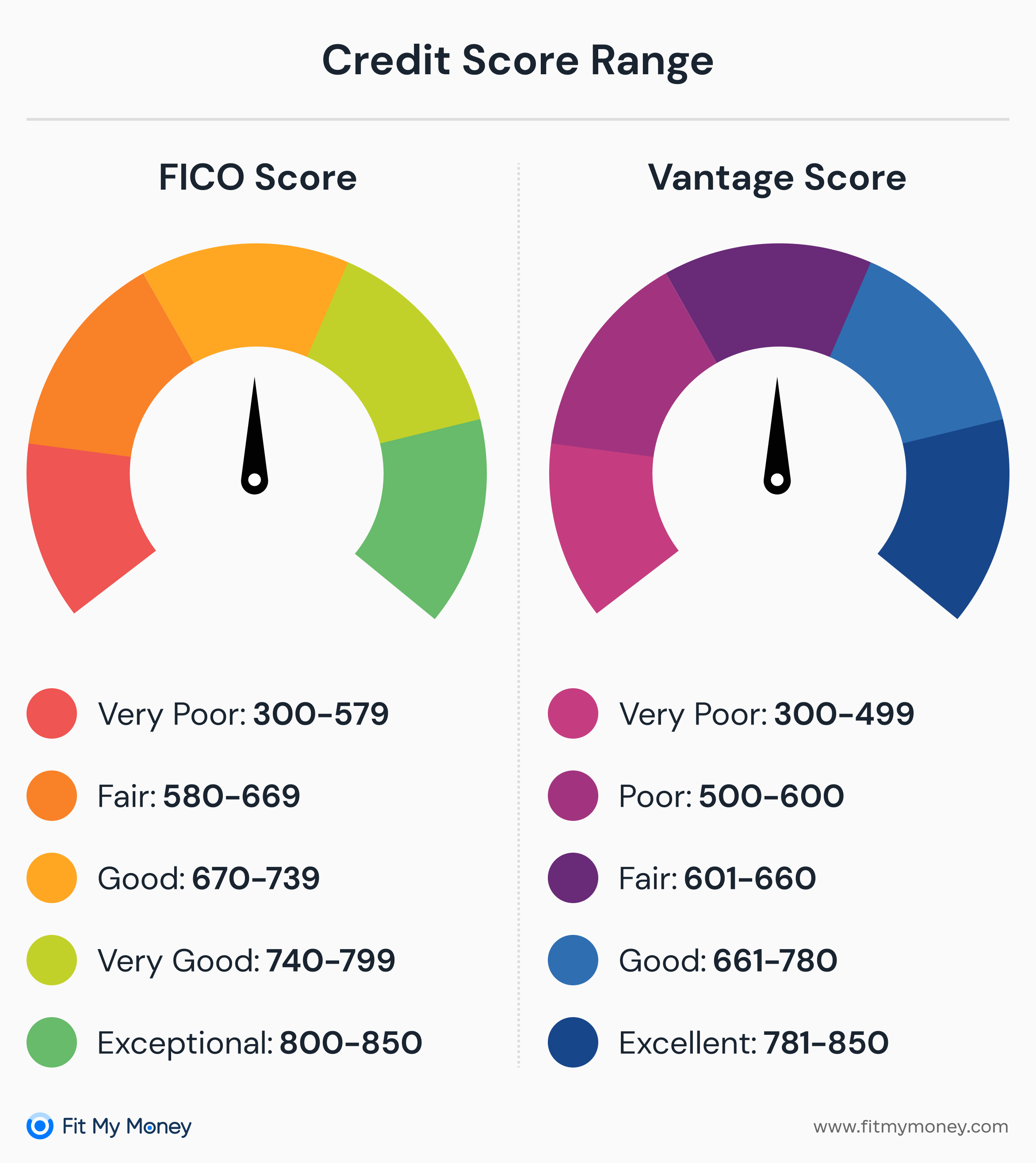

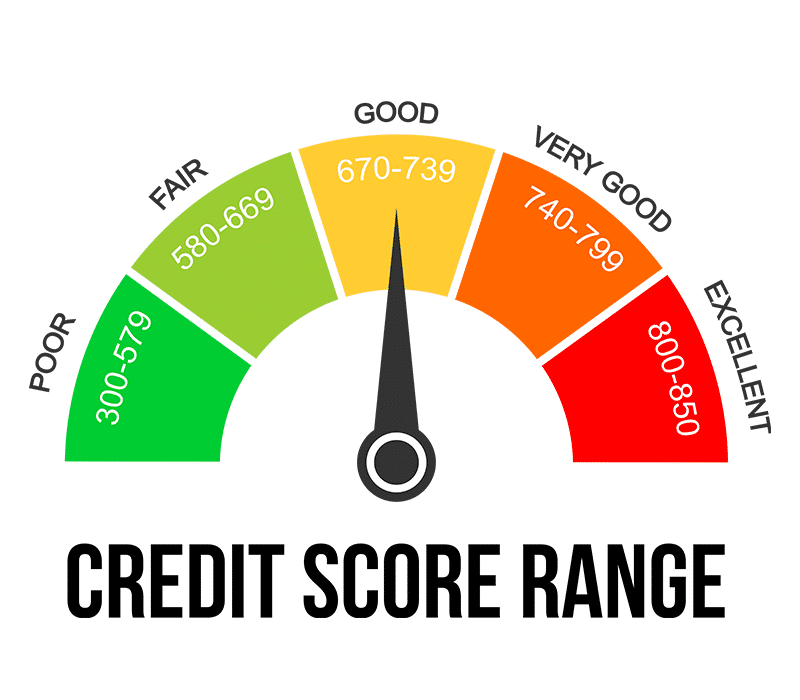

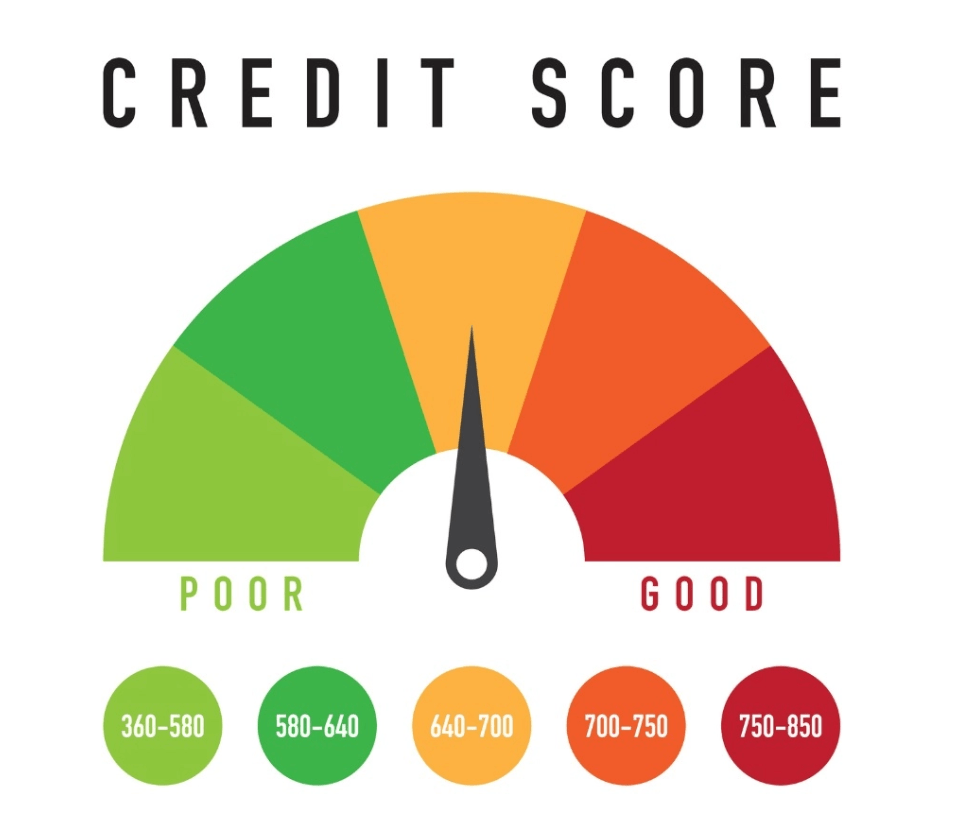

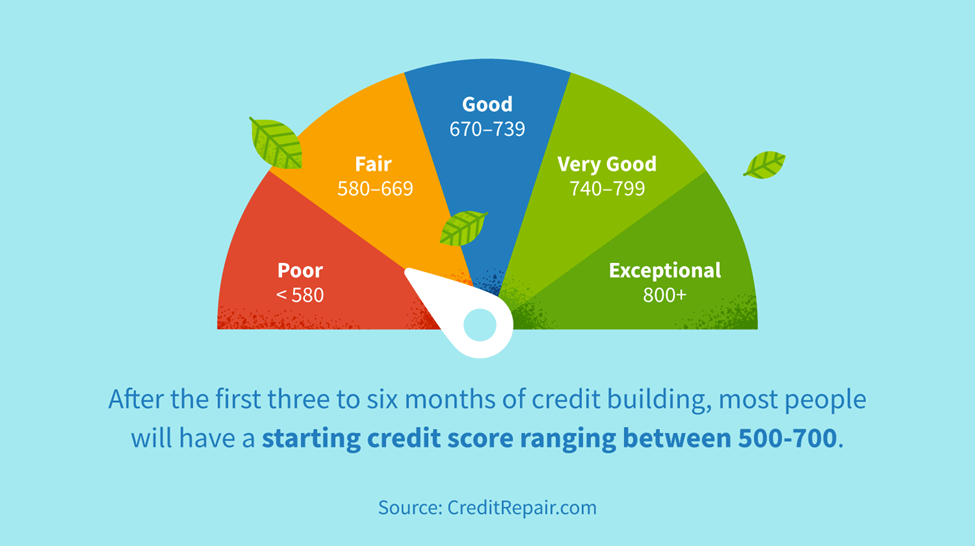

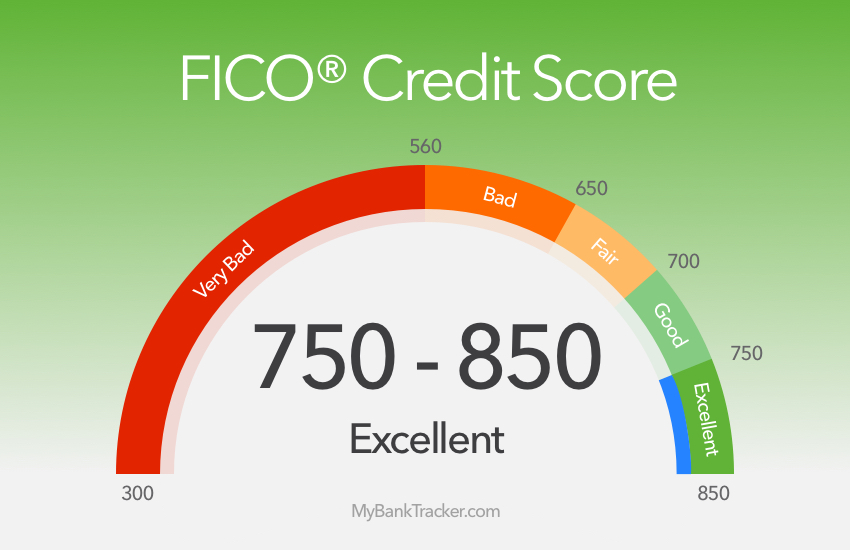

Credit scores, typically ranging from 300 to 850, are a numerical representation of your creditworthiness. These scores are calculated by credit bureaus like Equifax, Experian, and TransUnion, based on your credit history.

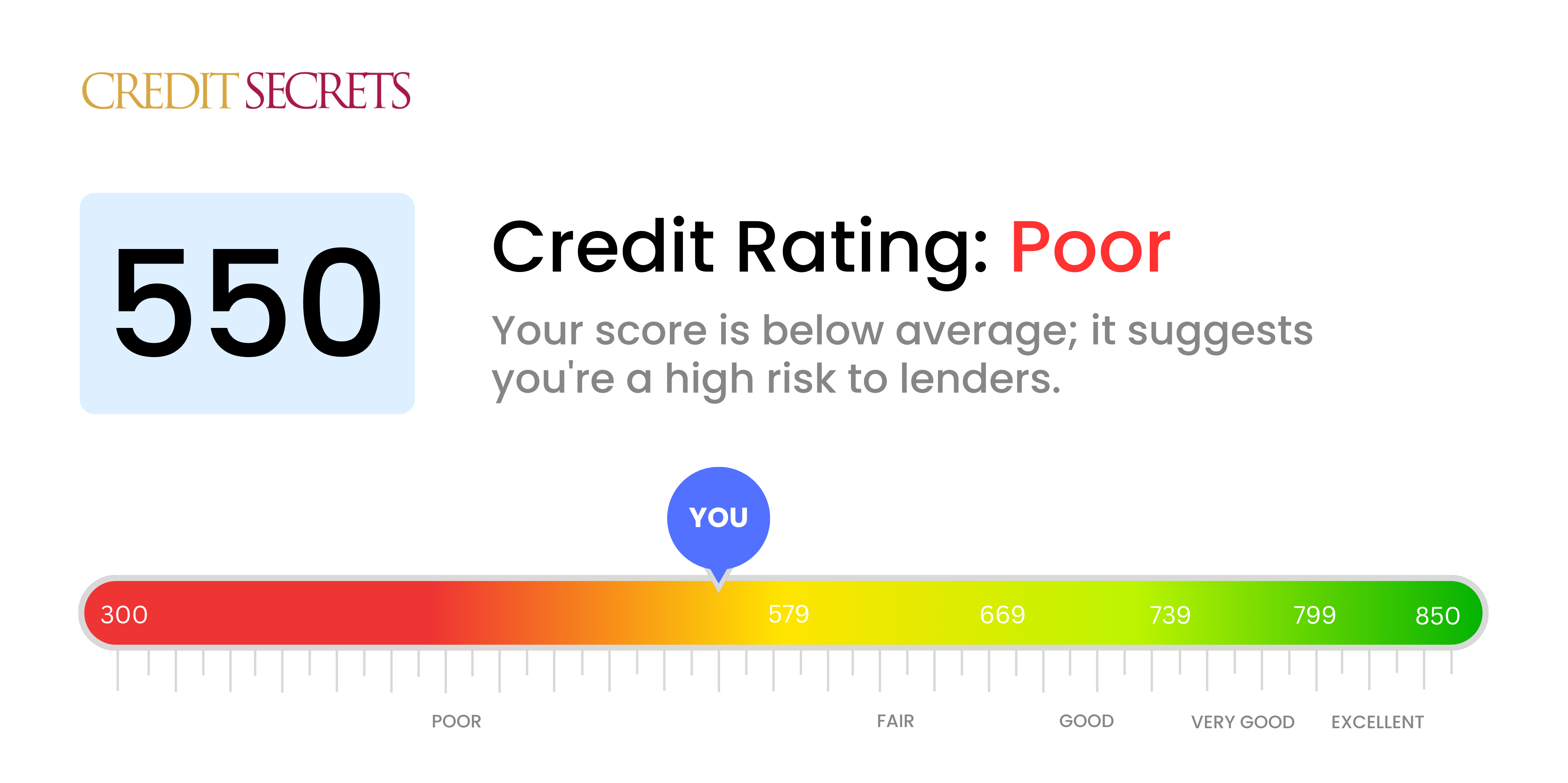

According to FICO, the most widely used credit scoring model, a score of 550 falls within the "poor" range (300-579). This categorization indicates a high risk of defaulting on debt obligations.

Impact on Loan Approval

Individuals with a 550 credit score often face difficulties securing loans. Lenders view them as high-risk borrowers, making them less likely to approve applications for mortgages, auto loans, or personal loans.

Even if approved, the terms are significantly less favorable. This often translates to higher interest rates and stricter repayment terms.

This means that the total cost of borrowing is considerably more expensive, potentially hindering long-term financial goals.

Higher Interest Rates

The most immediate impact of a 550 credit score is the increased cost of borrowing. Lenders compensate for the perceived risk by charging substantially higher interest rates.

For example, a person with a poor credit score seeking an auto loan might face interest rates several percentage points higher than someone with an excellent credit score. This difference can translate to thousands of dollars in extra interest paid over the life of the loan.

Credit cards are also affected. Those with poor credit are often limited to secured credit cards or those with high annual fees and low credit limits.

Limited Credit Options

A low credit score significantly restricts access to various financial products and services. Beyond loans and credit cards, it can affect other areas of life.

For example, landlords may be less likely to rent to individuals with poor credit, requiring larger security deposits or co-signers. Some employers even conduct credit checks as part of their hiring process, potentially impacting job opportunities.

Insurance companies may also charge higher premiums to individuals with lower credit scores, as studies have shown a correlation between creditworthiness and the likelihood of filing a claim.

Strategies for Credit Repair

While a 550 credit score presents challenges, it is not insurmountable. There are several steps individuals can take to rebuild their credit and improve their financial standing.

One of the most important steps is to review your credit reports from all three major credit bureaus. Look for any errors or inaccuracies and dispute them promptly.

Paying bills on time is crucial. Even small improvements in payment history can have a positive impact on your credit score over time. Consider setting up automatic payments to avoid missed deadlines.

Responsible Credit Use

If you have access to a credit card, use it responsibly. Keep your credit utilization ratio low, ideally below 30%. This means only charging a small percentage of your available credit limit.

Consider becoming an authorized user on someone else's credit card, particularly if they have a strong credit history. This can help you build credit without taking on new debt.

However, ensure that the primary cardholder is responsible with their account, as their actions will also affect your credit report.

Seeking Professional Help

For individuals struggling to navigate the complexities of credit repair, seeking professional help can be beneficial. Credit counseling agencies can provide guidance and support in developing a debt management plan.

Be cautious of credit repair companies that promise quick fixes or guaranteed results. These claims are often misleading and may even be illegal.

Focus on legitimate strategies and be patient. Building credit takes time and consistent effort.

Conclusion

A credit score of 550 presents significant challenges, impacting access to credit, increasing borrowing costs, and limiting financial opportunities. However, it is not a permanent situation.

By understanding the factors that contribute to your credit score and implementing responsible financial habits, you can gradually rebuild your credit and achieve a healthier financial future. Taking proactive steps towards credit repair is an investment in your long-term financial well-being.