How Businesses Raise Financial Capital

In the ever-evolving landscape of commerce, securing financial capital stands as a critical determinant of success for businesses of all sizes. From burgeoning startups to established multinational corporations, the ability to raise funds effectively dictates operational capacity, expansion potential, and ultimately, survival. The strategies employed to acquire this crucial capital are diverse, each carrying its own set of advantages, disadvantages, and inherent risks.

This article delves into the multifaceted world of business finance, exploring the primary methods by which companies secure the financial resources necessary to operate and grow. We will examine the intricacies of equity financing, debt financing, and alternative funding sources, providing insights into how businesses navigate this complex terrain to achieve their strategic objectives. Understanding these mechanisms is essential for entrepreneurs, investors, and anyone interested in the dynamics of the modern economy.

Equity Financing: Selling a Piece of the Pie

Equity financing involves selling a portion of ownership in the company in exchange for capital. This is a popular route for startups and high-growth businesses that may lack the collateral required for traditional loans. The primary advantage of equity financing is that it does not create debt, relieving the company from the burden of mandatory repayments and interest charges.

Venture Capital

Venture Capital (VC) firms invest in early-stage companies with high growth potential. These firms provide significant capital infusions in exchange for equity and often take an active role in the management and strategic direction of the companies they invest in. Securing VC funding is highly competitive, requiring a compelling business plan, a strong management team, and a demonstrable path to profitability.

Angel Investors

Angel investors are high-net-worth individuals who invest their personal funds in startups. Often, they provide smaller amounts of capital compared to VC firms, but their early-stage support can be crucial for getting a business off the ground. Angel investors typically seek a higher return on investment than traditional investors, reflecting the increased risk associated with early-stage ventures.

Initial Public Offering (IPO)

An IPO represents a significant milestone for a company, marking its transition from private to public ownership. By offering shares to the public, companies can raise substantial capital to fund expansion, acquisitions, or other strategic initiatives. IPOs are subject to stringent regulatory requirements and require extensive preparation, including financial audits and disclosures.

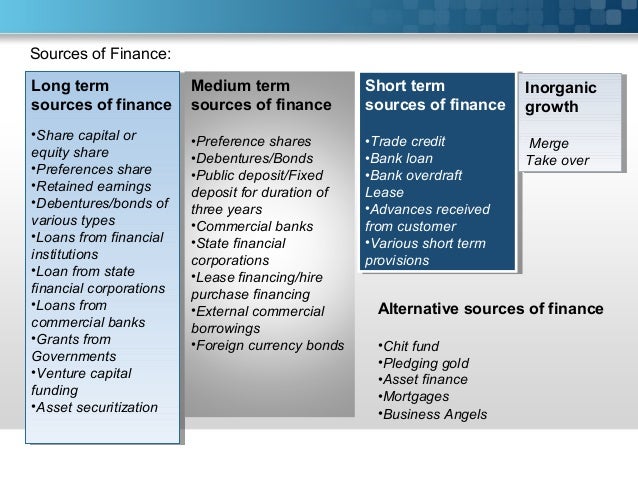

Debt Financing: Borrowing for Growth

Debt financing involves borrowing money that must be repaid over a specified period, typically with interest. This approach provides businesses with access to capital without diluting ownership. However, it also introduces the obligation of regular repayments, which can strain cash flow, especially during periods of economic downturn.

Bank Loans

Bank loans are a traditional form of debt financing, offered by banks and other financial institutions. These loans come in various forms, including term loans, lines of credit, and mortgages, each tailored to specific business needs. Securing a bank loan typically requires a strong credit history, collateral, and a solid business plan demonstrating the ability to repay the loan.

Corporate Bonds

Larger corporations can issue corporate bonds to raise capital directly from investors. Bonds are debt securities that promise to pay a fixed rate of interest over a specified term, with the principal repaid at maturity. Issuing bonds can be a cost-effective way to raise large sums of capital, but it requires a strong credit rating to attract investors.

Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms connect borrowers directly with individual investors, bypassing traditional financial institutions. P2P lending can offer businesses access to capital with potentially lower interest rates and more flexible terms than bank loans. However, the availability of funding may be less certain, as it depends on the willingness of individual investors to lend.

Alternative Funding Sources

In addition to equity and debt financing, businesses can explore alternative funding sources to meet their capital needs. These options often cater to specific types of businesses or projects, offering unique advantages and disadvantages.

Government Grants and Subsidies

Many governments offer grants and subsidies to support specific industries or initiatives, such as research and development, renewable energy, and small business development. These funds do not typically require repayment, but they are highly competitive and often subject to stringent eligibility criteria and reporting requirements. The Small Business Administration (SBA) in the US provides resources and funding options.

Crowdfunding

Crowdfunding involves raising small amounts of capital from a large number of individuals, typically through online platforms. This approach can be particularly effective for startups and businesses with a strong social mission or a compelling product offering. Crowdfunding campaigns often rely on rewards or equity in exchange for contributions.

Bootstrapping

Bootstrapping refers to self-funding a business using personal savings, revenue generated from sales, or loans from friends and family. This approach allows entrepreneurs to maintain complete control over their company, but it can also limit growth potential due to capital constraints. Many successful businesses, including Microsoft in its early days, started with bootstrapping.

Looking Ahead: The Future of Business Finance

The landscape of business finance is constantly evolving, driven by technological innovation, regulatory changes, and shifting investor preferences. The rise of fintech companies and alternative lending platforms is democratizing access to capital, providing businesses with more options than ever before. As the global economy becomes increasingly interconnected, businesses must remain adaptable and informed about the latest financing trends to secure the capital they need to thrive.

Ultimately, the most effective financing strategy depends on the specific circumstances of each business, including its stage of development, industry, and financial goals. By carefully evaluating the available options and seeking expert advice, businesses can navigate the complexities of the capital markets and position themselves for long-term success. Understanding the nuances of financial capital is paramount for any business leader aiming to achieve sustainable growth.