How Can I Download My Hdfc Car Loan Statement

Accessing your HDFC Bank car loan statement is a crucial part of managing your finances and keeping track of your loan repayment. Borrowers often need these statements for various purposes, including tax filing, financial planning, or simply monitoring their loan account. HDFC Bank provides multiple convenient methods for customers to download their car loan statements, ensuring accessibility and ease of use.

Understanding the Importance of Your Car Loan Statement

The car loan statement is more than just a piece of paper. It is a comprehensive record of your loan activity.

It includes details such as your outstanding loan balance, interest paid, principal paid, EMI amount, and payment history. This information is essential for financial planning and ensuring the accuracy of your loan account.

Methods for Downloading Your HDFC Car Loan Statement

HDFC Bank offers several ways to access your car loan statement.

These methods include online banking, mobile banking, and customer service assistance. Each option provides a secure and efficient way to obtain the necessary information.

Online Banking Portal

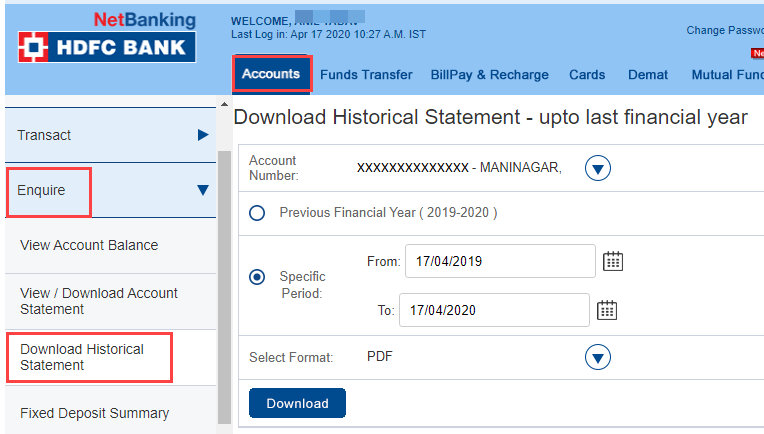

The most common method is through HDFC Bank's online banking portal. This requires you to have an active internet banking account.

Log in using your customer ID and password. Once logged in, navigate to the "Loans" section and select your car loan account.

You should find an option to view or download your statement. You can usually select the period for which you need the statement.

The statement is typically available in PDF format, which you can then save to your device.

Mobile Banking App

HDFC Bank also provides a user-friendly mobile banking app.

This app offers similar functionalities to the online banking portal.

After logging in to the app, locate the "Loans" section and select your car loan. You can then view and download your statement directly to your smartphone or tablet.

Customer Service Assistance

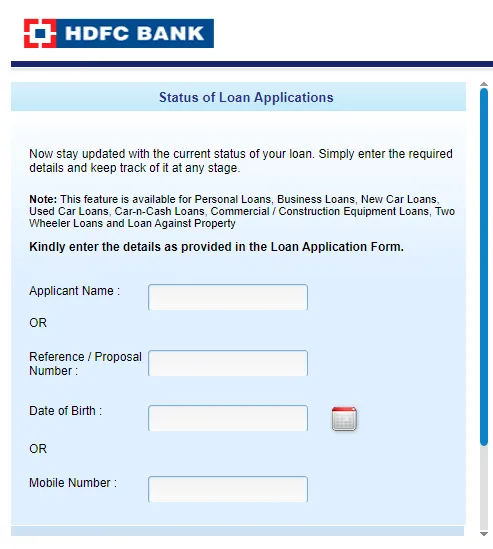

If you are unable to access your statement online or through the mobile app, you can contact HDFC Bank's customer service. You can reach them through phone banking.

A customer service representative can assist you in retrieving and sending the statement to your registered email address or physical address.

When contacting customer service, be prepared to provide your loan account details and identification information for verification purposes.

Email Statement Request

Another option available is to send an email request to HDFC Bank's customer service email address.

In your email, clearly state your request for a car loan statement and include your loan account number, name, and contact details. This method can be useful, but ensure you are sending the email from your registered email address for security reasons.

Security Considerations

When accessing and downloading your car loan statement, it's crucial to prioritize security.

Always use a secure internet connection and avoid using public Wi-Fi for sensitive transactions. Be cautious of phishing attempts and never share your login credentials with anyone.

HDFC Bank will never ask for your password or OTP (One-Time Password) via email or phone. Regularly update your passwords and monitor your account activity for any suspicious transactions.

Benefits of Regularly Checking Your Statement

Regularly reviewing your car loan statement allows you to monitor your loan progress and identify any discrepancies early on. This proactive approach can help you avoid potential issues such as incorrect charges or unauthorized transactions. It also provides a clear picture of your loan repayment schedule and helps you plan your finances effectively.

Conclusion

Downloading your HDFC car loan statement is a straightforward process with multiple options available to suit your preferences. Whether you prefer online banking, mobile banking, or customer service assistance, HDFC Bank provides convenient and secure ways to access your loan information. By regularly checking your statement, you can stay on top of your loan obligations and ensure a smooth repayment journey. Understanding and utilizing these methods empowers borrowers to effectively manage their finances and maintain a clear understanding of their car loan status.