How Can I Send Money From Cash App To Chime

Cash App users are facing hurdles transferring funds to Chime accounts. Direct transfers are currently not supported, causing frustration and confusion.

This article provides a clear, step-by-step workaround to get your money from Cash App to your Chime account quickly and safely, mitigating potential delays and complications.

The Problem: Direct Transfers Unavailable

Directly sending money from Cash App to Chime isn't possible due to compatibility limitations between the two platforms.

This means you cannot simply link your Chime account or card to Cash App and initiate a transfer.

Users attempting this will encounter error messages or failed transactions.

The Solution: Using a Third-Party Bank Account

The most reliable method involves using a third-party bank account as an intermediary. This acts as a bridge between Cash App and Chime.

Step 1: Identify a Suitable Bank Account

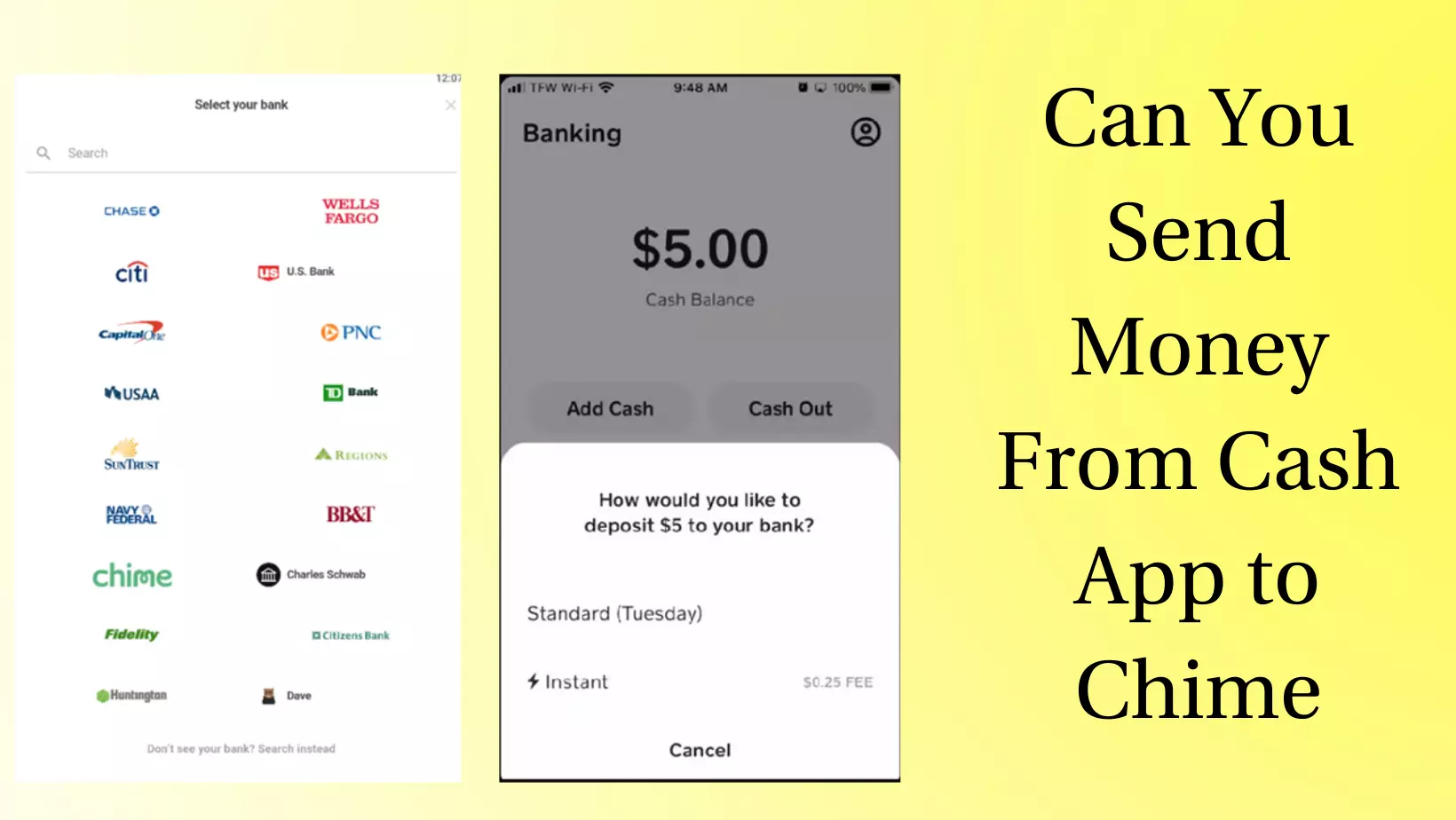

You'll need access to a bank account that is compatible with both Cash App and Chime.

Most major banks like Chase, Bank of America, or Wells Fargo will work. Ensure you have the account and routing numbers readily available.

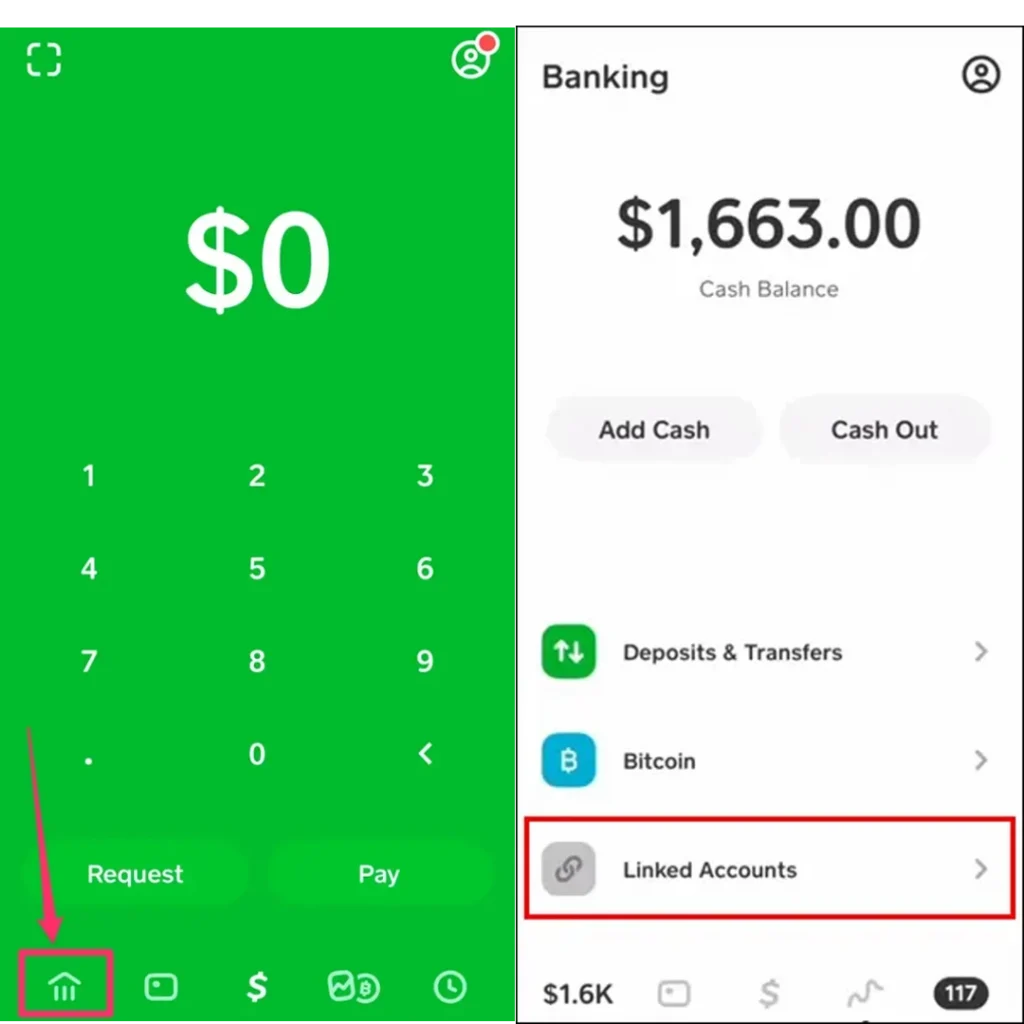

Step 2: Link the Bank Account to Cash App

Open the Cash App and tap the banking tab (house icon).

Select "Link Bank" and follow the on-screen instructions to connect your third-party bank account using your account and routing numbers. Cash App may require verification.

Step 3: Transfer Funds from Cash App to the Bank Account

Once linked, transfer the desired amount from your Cash App balance to your linked bank account.

This usually takes 1-3 business days for standard transfers; instant transfers are available for a fee.

Step 4: Link the Same Bank Account to Chime

Open the Chime app and navigate to the settings or account section.

Look for the option to "Link a Bank Account" or "Add External Account." Enter the same bank account details you used for Cash App.

Step 5: Transfer Funds from the Bank Account to Chime

After linking the bank account to Chime, initiate a transfer from the bank account to your Chime account.

The transfer time can vary, typically taking 1-3 business days. Check the Chime app for confirmation and estimated arrival time.

Important Considerations

Fees: Be aware of potential fees associated with instant transfers on Cash App and any transfer fees your bank might charge.

Limits: Cash App has sending and receiving limits that may affect your transfer amount. Check your account settings for details.

Verification: Ensure both your Cash App and Chime accounts are fully verified to avoid transfer delays or restrictions.

Security: Always double-check account numbers and transfer amounts before confirming any transaction.

Alternative Options (Less Reliable)

While the third-party bank account method is the most reliable, some users have reported success using workarounds like requesting a Cash App card and then using that card to add funds to Chime. However, this method is not officially supported and may not always work.

Another option is using a mutual friend with accounts on both platforms as an intermediary, but this involves entrusting your money to someone else and carries inherent risks.

Ongoing Developments

There have been no official announcements from Cash App or Chime regarding direct transfer compatibility. Users are encouraged to contact customer support for both platforms to voice their concerns and request this feature.

This situation is subject to change. Monitor official announcements from Cash App and Chime for any updates on direct transfer options.

For now, the third-party bank account method remains the most dependable solution.