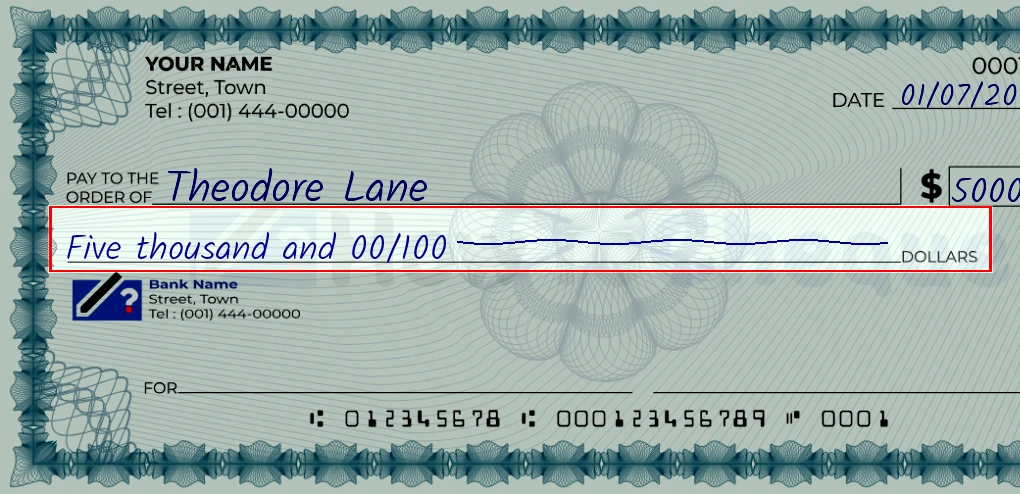

How Can I Turn 5000 Into 10000

Imagine a crisp autumn evening, the scent of woodsmoke drifting through the air as you huddle around a table, poring over numbers and charts. Not because you *have* to, but because you *want* to. You're not chasing a fleeting lottery dream, but plotting a calculated journey toward doubling your money. A humble $5,000 seed, nurtured with knowledge and patience, blossoming into a $10,000 reward. The fire crackles, a symbol of the energy and potential waiting to be unleashed.

This article isn’t about get-rich-quick schemes; it's about exploring realistic, achievable strategies for transforming $5,000 into $10,000. We'll delve into a range of options, from relatively conservative approaches to ventures that demand a higher risk tolerance, equipping you with the information needed to make informed decisions tailored to your individual circumstances. Think of it as a roadmap, highlighting potential paths and offering cautionary advice along the way.

Understanding Your Financial Landscape

Before embarking on any investment journey, it's crucial to understand your current financial situation. This involves a thorough assessment of your income, expenses, debts, and existing assets. Understanding your risk tolerance is also paramount. Are you comfortable with the possibility of losing some or all of your initial investment, or do you prefer a more secure, albeit slower, path to growth?

Consider creating a budget to track your spending and identify areas where you can save more money. Every dollar saved is a dollar that can be invested. You should also pay down any high-interest debt, such as credit card debt, as the interest payments can significantly erode your potential returns. Debt reduction is often the first step toward financial freedom.

Setting Realistic Goals and Timeframes

Doubling your money is an ambitious goal, and the timeframe for achieving it will depend on the investment strategy you choose and the market conditions. Some investments may yield returns within a few years, while others may take considerably longer. It's essential to set realistic expectations and avoid being swayed by unrealistic promises of overnight success. Patience and discipline are your allies.

Be wary of any investment opportunity that guarantees a high return with little or no risk. As the saying goes, if it sounds too good to be true, it probably is. Due diligence is essential. Always research any investment thoroughly before committing your money. Checking with the Better Business Bureau or consulting with a financial advisor can provide valuable insights.

Investment Options: A Diversified Approach

Diversification is a key strategy for mitigating risk. Instead of putting all your eggs in one basket, spread your investments across different asset classes. This could include stocks, bonds, real estate, and alternative investments.

Stocks: Investing in the stock market can offer the potential for significant returns, but it also comes with a higher level of risk. You can invest in individual stocks, but a more diversified approach is to invest in exchange-traded funds (ETFs) or mutual funds that track a broad market index like the S&P 500. This gives you exposure to a wide range of companies, reducing the risk associated with investing in a single stock.

Bonds: Bonds are generally considered less risky than stocks, but they also offer lower returns. Bonds are essentially loans that you make to a government or corporation. In return, you receive regular interest payments and the principal amount at maturity. Bonds can provide stability to your portfolio and help to cushion against market volatility.

Real Estate: Investing in real estate can be a good way to build wealth over the long term, but it requires a significant upfront investment. You could consider investing in a rental property or real estate investment trusts (REITs), which allow you to invest in a portfolio of properties without directly owning them. Real estate can provide both rental income and potential capital appreciation.

Alternative Investments: These can include things like peer-to-peer lending, cryptocurrency, or investing in small businesses. These investments can offer potentially high returns, but they also come with a higher level of risk. Alternative investments should only be considered if you have a high risk tolerance and a good understanding of the market.

High-Yield Savings Accounts and Certificates of Deposit (CDs)

While not offering the potential for exponential growth, high-yield savings accounts and CDs provide a safe and relatively low-risk way to grow your money. These options are ideal for individuals who prioritize safety over high returns.

High-yield savings accounts typically offer interest rates that are significantly higher than traditional savings accounts. CDs are a type of savings account that holds a fixed amount of money for a fixed period of time, and in return, you receive a fixed interest rate. These options are generally FDIC-insured, providing a safety net for your deposits.

Entrepreneurial Ventures: Investing in Yourself

Instead of investing in traditional assets, you could consider investing in yourself by starting a side hustle or small business. This can be a great way to generate additional income and potentially build a valuable asset.

Think about your skills and interests and identify a need in the market that you can fill. This could be anything from freelancing to selling products online. Starting a business requires hard work and dedication, but it can be incredibly rewarding. Research your market, develop a business plan, and be prepared to put in the effort to succeed. Entrepreneurship is a powerful engine for wealth creation.

The Power of Compound Interest

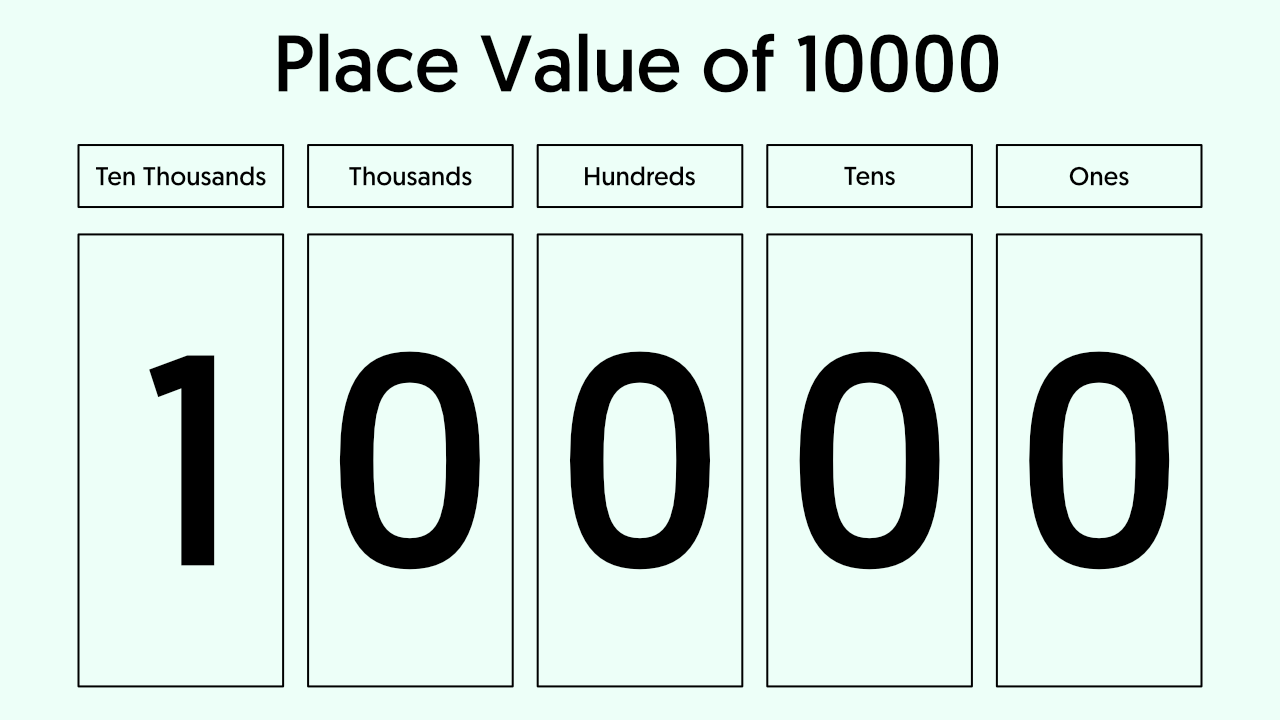

One of the most powerful forces in investing is compound interest. Compound interest is the interest you earn on both your initial investment and the accumulated interest. Over time, this can lead to exponential growth. The earlier you start investing, the more time your money has to grow through the power of compounding.

Even small, consistent contributions can make a significant difference over the long term. Consider setting up automatic transfers from your checking account to your investment account each month. Consistency is key to harnessing the power of compounding.

Seeking Professional Advice

If you're unsure about which investment strategy is right for you, consider consulting with a financial advisor. A financial advisor can help you assess your financial situation, understand your risk tolerance, and develop a personalized investment plan. Look for a fee-only advisor who is obligated to act in your best interest.

Certified Financial Planners (CFPs) are qualified professionals who can provide comprehensive financial advice. Be sure to do your research and choose an advisor who is knowledgeable and trustworthy.

Staying Informed and Adaptable

The financial markets are constantly changing, so it's important to stay informed about current economic trends and investment opportunities. Read financial news, follow reputable financial blogs, and attend investment seminars to stay up-to-date. Be prepared to adjust your investment strategy as needed based on changing market conditions. Adaptability is crucial for long-term success.

Remember, investing is a marathon, not a sprint. There will be ups and downs along the way. Don't get discouraged by short-term market fluctuations. Focus on your long-term goals and stay disciplined with your investment strategy. Success requires patience, perseverance, and a commitment to lifelong learning.

Turning $5,000 into $10,000 is an achievable goal, but it requires careful planning, diligent research, and a willingness to take calculated risks. By understanding your financial landscape, setting realistic goals, and diversifying your investments, you can significantly increase your chances of success. So, stoke the fire within, sharpen your knowledge, and embark on your journey to financial growth. The future awaits.