How Can You Get $144 Back From Medicare

Millions of Medicare beneficiaries could be eligible for a refund of up to $144, but time is running out to claim it. This refund stems from overpaid Part B premiums in 2023, and understanding the process is crucial to getting your money back.

Are You Owed Money? The Facts You Need to Know

The Social Security Administration (SSA) identified that certain beneficiaries were overcharged for their Medicare Part B premiums last year. This resulted from a larger-than-expected increase in Social Security benefits due to high inflation.

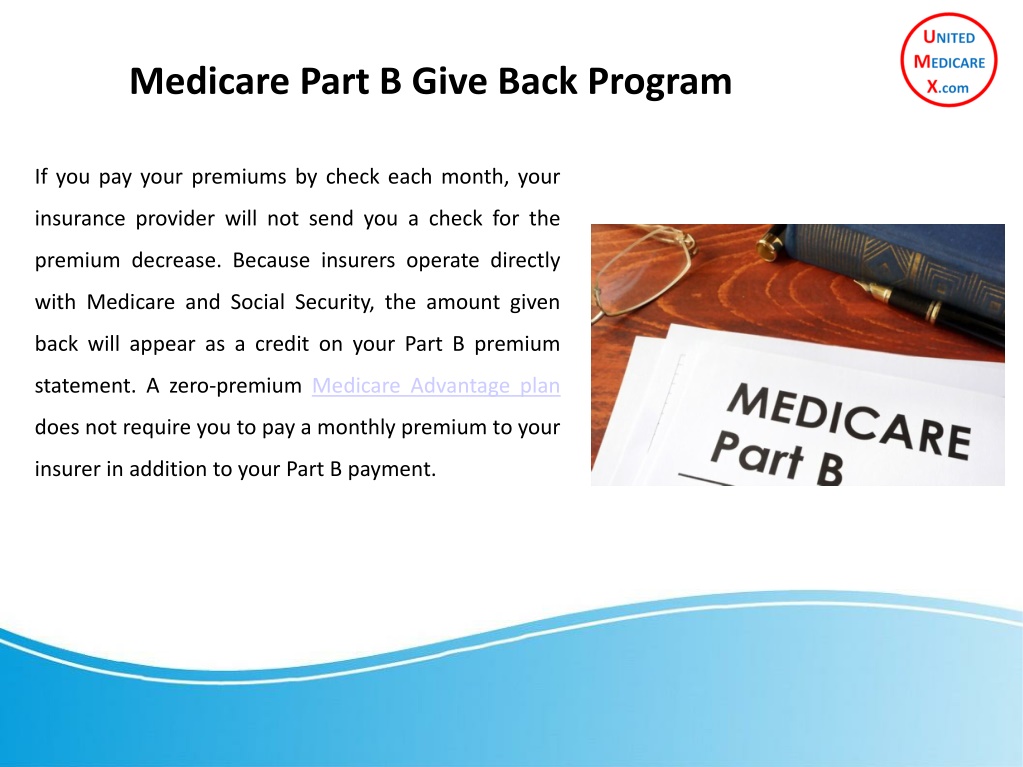

Essentially, the standard Part B premium is automatically deducted from Social Security checks. However, some beneficiaries had their premiums adjusted downward later in the year, leading to an overpayment.

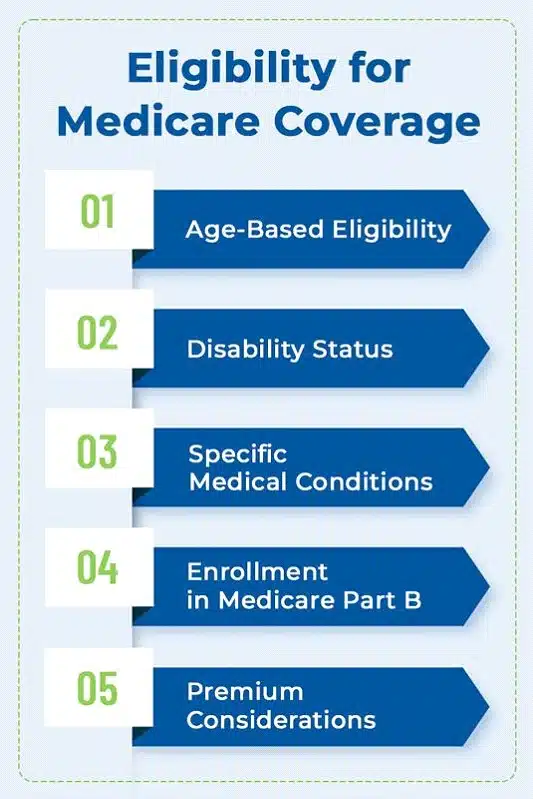

Who is Eligible for the Refund?

You are likely eligible if you had Medicare Part B in 2023 and had your premiums deducted from your Social Security benefits. Specifically, those who experienced a mid-year premium adjustment due to the "hold harmless" provision are most likely affected.

This provision generally prevents Social Security benefit increases from being offset by Medicare premium increases. According to the Centers for Medicare & Medicaid Services (CMS), beneficiaries in this situation saw smaller increases in their Part B premiums initially, followed by a correction.

How Will You Receive the Refund?

The SSA is handling the refund process. Most beneficiaries will receive their refunds automatically, either through their Social Security checks or via direct deposit.

However, some may receive a direct check in the mail. It is crucial to ensure that your contact information is up-to-date with the SSA to avoid delays or missed payments. Contact the SSA as soon as possible.

When Will You Receive the Refund?

The refund distribution began in early 2024 and is ongoing. According to the SSA, the timeline for receiving your refund depends on your specific circumstances and how your benefits are typically paid.

While many have already received their refunds, others are still waiting. Don't delay in following up.

What If You Haven't Received Your Refund?

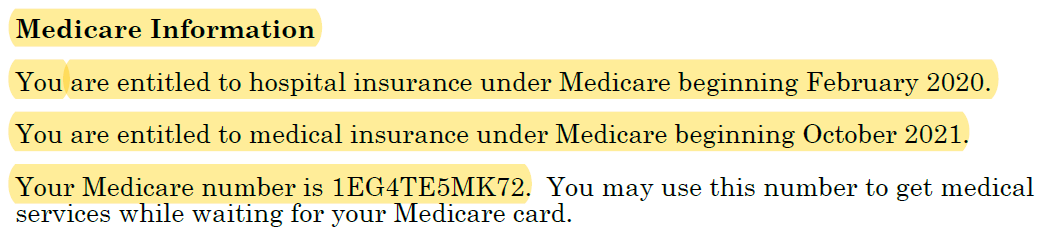

If you believe you are eligible and haven't received your refund, take immediate action. First, check your Social Security statement online at www.ssa.gov for any notifications related to the overpayment.

If you don't see any information there, contact the SSA directly at 1-800-772-1213. Be prepared to provide your Medicare and Social Security information.

Additionally, keep an eye out for any official communications from the SSA or CMS. Be wary of scams asking for personal information; the SSA will never ask for sensitive data over the phone or email.

Act Now: Don't Leave Money on the Table

The deadline to resolve any issues regarding the Part B premium overpayment is approaching, though not yet determined. Taking proactive steps now will ensure you receive any money you're owed.

Contact the SSA, review your statements, and stay informed to claim your refund. Time is of the essence, and this is your money.

.png)