How Do I Cash Or Deposit A Non Negotiable Check

Urgent alert: A non-negotiable check doesn't have to mean a dead end. This guide details how to navigate cashing or depositing these tricky instruments.

This article will provide a concise, actionable roadmap for dealing with non-negotiable checks, explaining who might issue them, where you might encounter them, and precisely how to attempt deposit or cash, prioritizing immediate action and clarity.

Understanding Non-Negotiable Checks

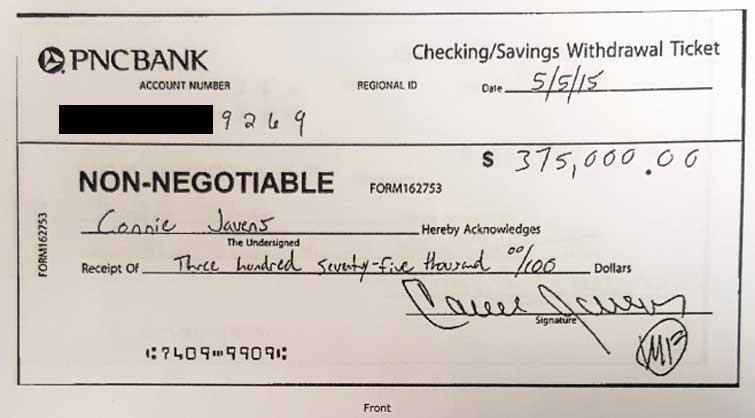

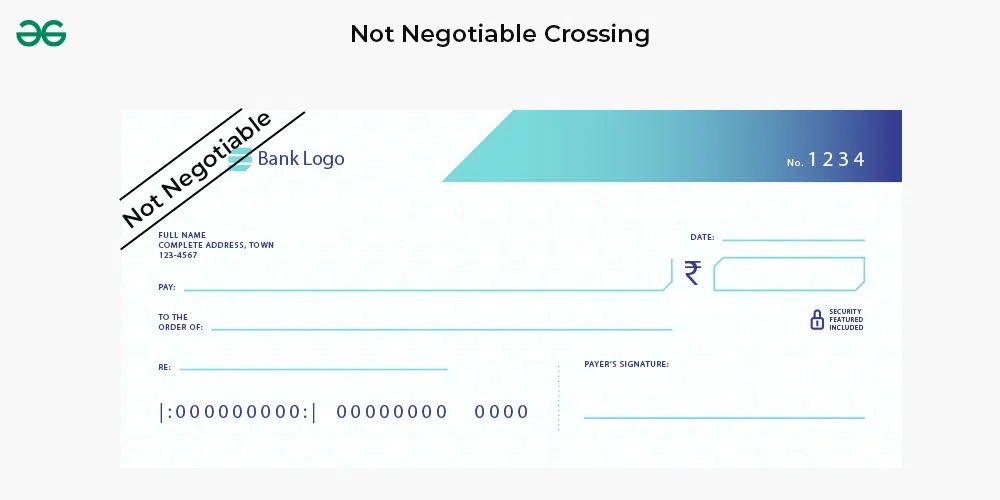

What exactly is a non-negotiable check? Simply put, it's a check marked "non-negotiable," signaling restrictions on its transferability.

This usually means only the named payee can deposit or cash it. It is a measure to protect the payer from fraud.

Who Issues Non-Negotiable Checks?

Government agencies frequently issue non-negotiable checks for benefits or tax refunds.

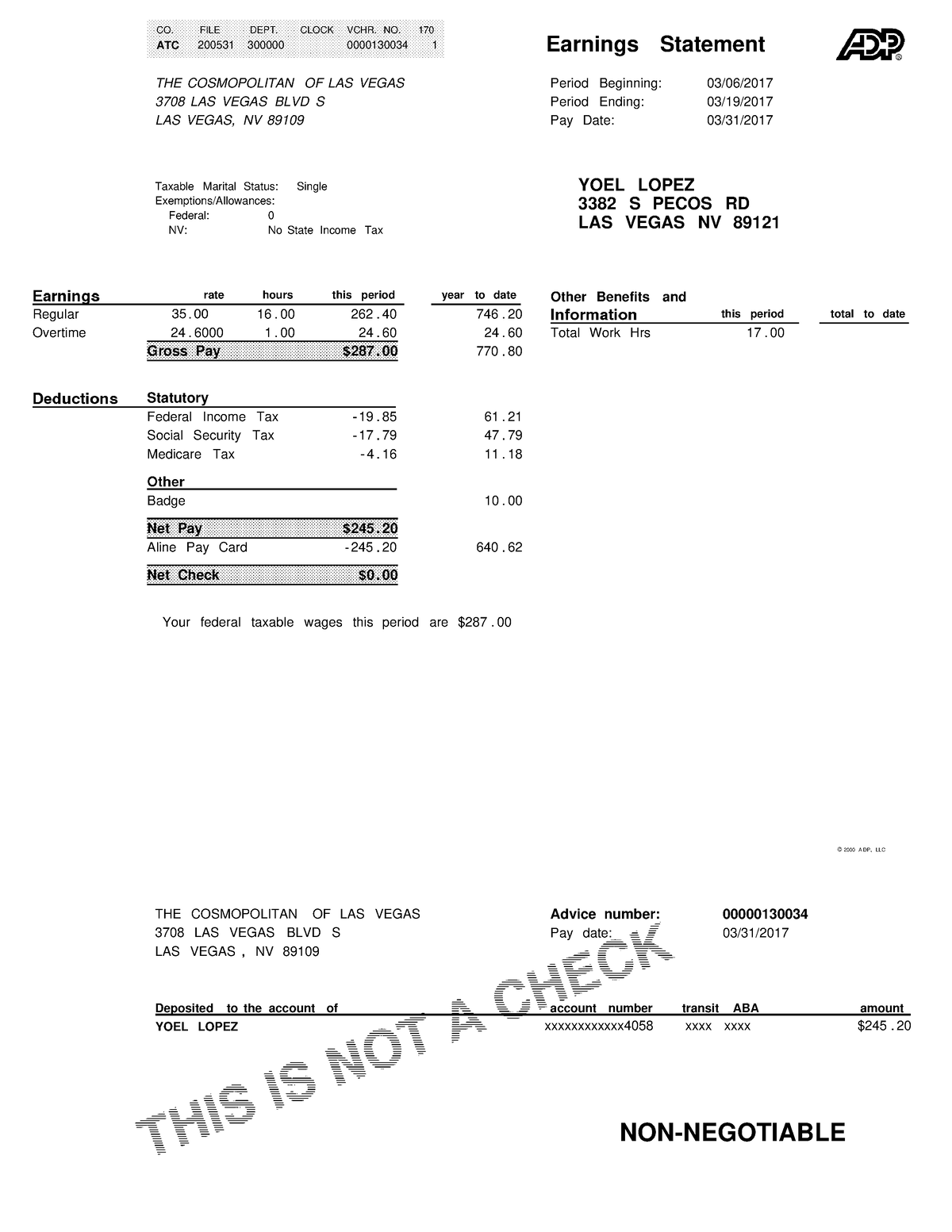

Insurance companies often use them for claim payouts. Businesses may also employ them for payroll or vendor payments, especially for security reasons.

The Deposit Dilemma

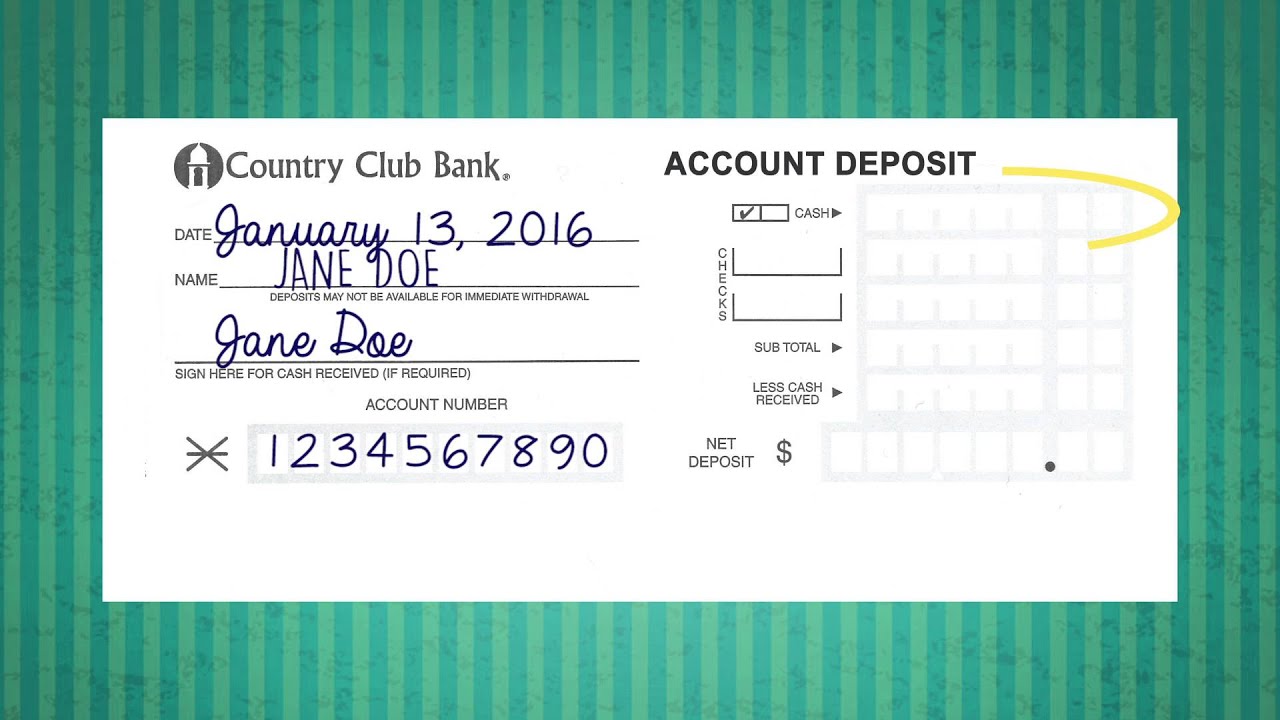

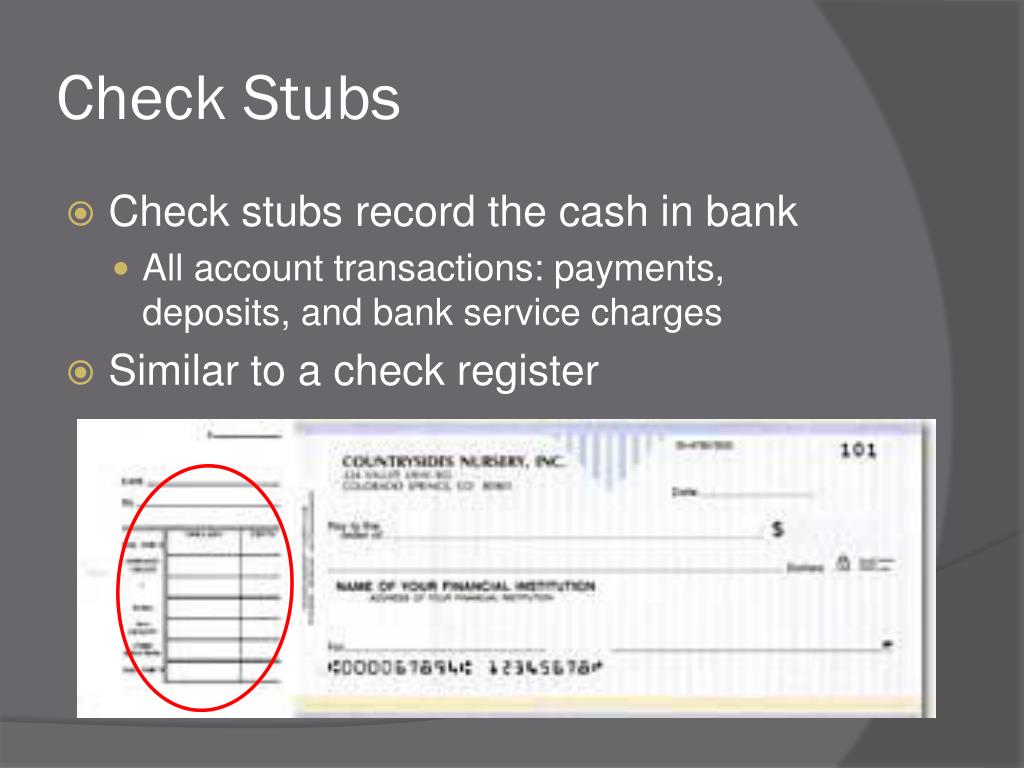

Can you deposit a non-negotiable check? Generally, yes, but only if you are the named payee.

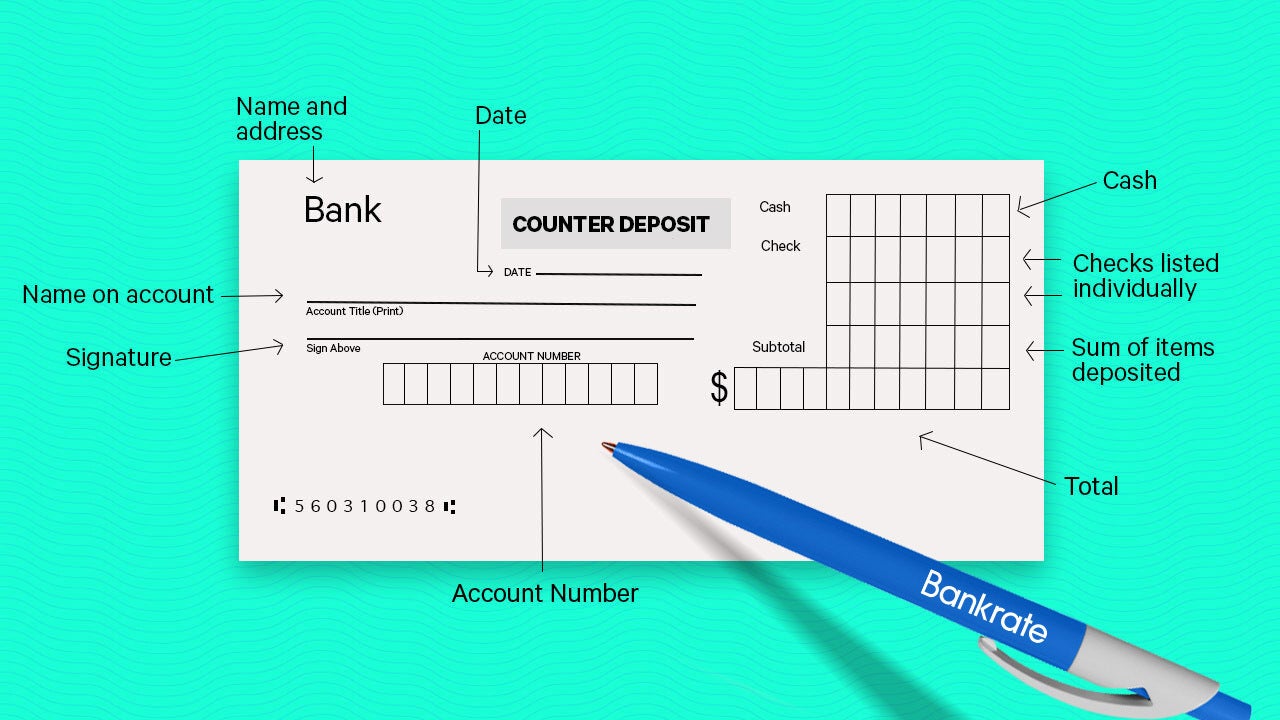

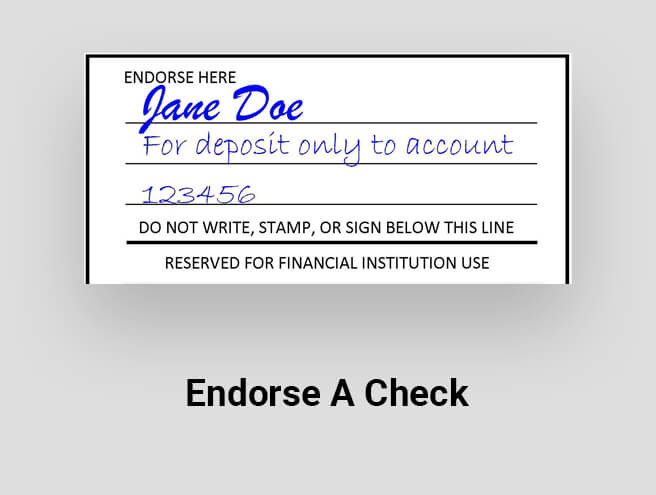

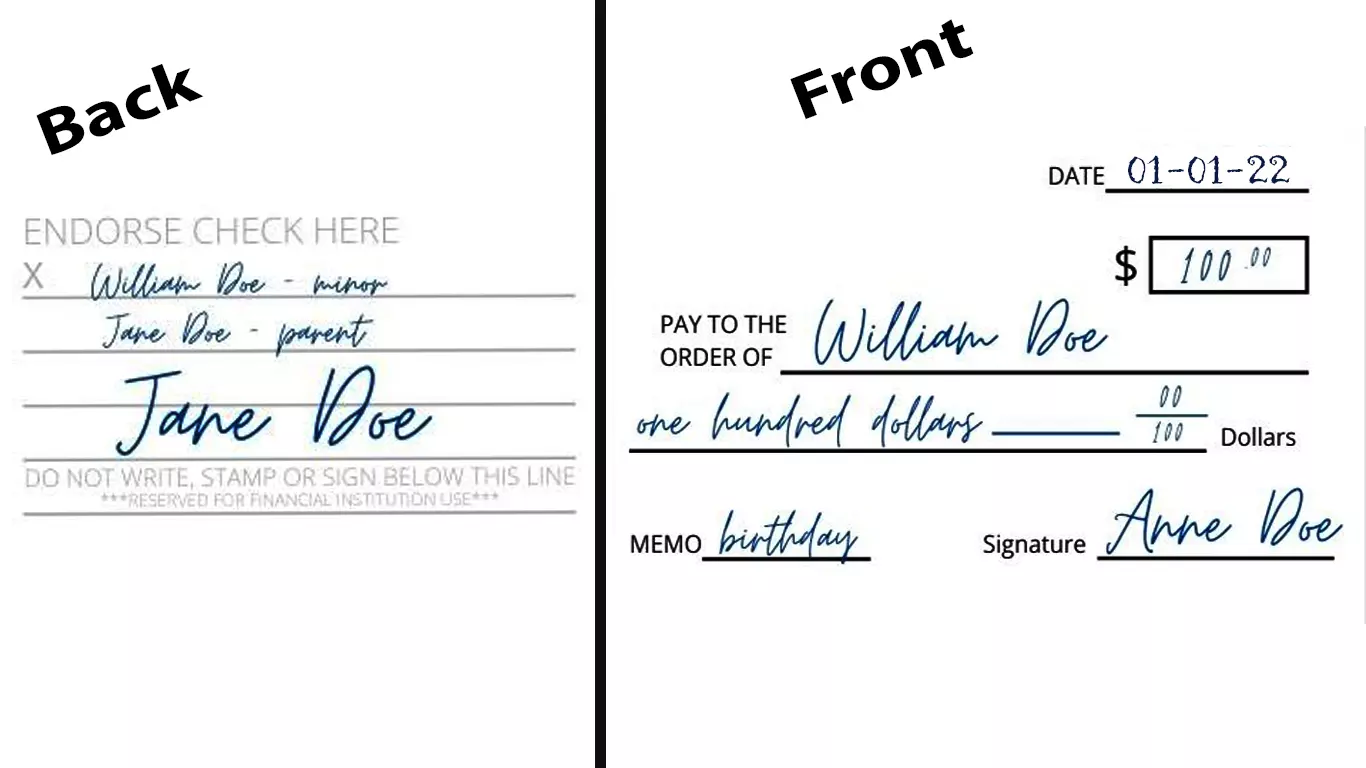

Most banks will refuse deposit if the name on the check doesn’t match the account holder's name. Endorse the back of the check as you normally would before attempting a deposit.

Bank Policies Vary

Bank policies on non-negotiable checks can differ significantly. Call your bank ahead of time to confirm their specific procedures.

Inquire about required documentation or potential holds on the funds. Some banks may require you to present ID or other proof of identity.

Cashing a Non-Negotiable Check: A Challenge

Cashing a non-negotiable check presents a greater hurdle than depositing. Many institutions flat-out refuse to cash them for anyone.

The risk of fraud or improper endorsement is higher when cashing. The issuer's bank is often the best (and sometimes only) place to attempt cashing.

Approaching the Issuer's Bank

Locate the bank name printed on the face of the check. Visit a branch of that bank to inquire about cashing the check.

Be prepared to present valid photo identification. The bank teller will likely verify your identity and may contact the issuer for confirmation.

Third-Party Check Cashing Services

Avoid third-party check cashing services if possible. They often charge exorbitant fees and may not be equipped to handle non-negotiable instruments.

These services sometimes operate with questionable practices. Even if they agree to cash, the fees can significantly diminish the check's value.

Documentation and Verification

Regardless of where you attempt to deposit or cash, proper documentation is crucial.

Always have valid photo identification readily available. Bring any documentation that supports your claim to the funds, such as a benefit statement or payment voucher.

Potential Issues and Delays

Expect potential delays and scrutiny when dealing with non-negotiable checks. Banks are cautious to prevent fraud and ensure proper disbursement.

Be patient and cooperative with bank personnel. Present all requested documentation promptly to expedite the process.

If You're Not the Payee

If you are not the named payee, cashing or depositing is nearly impossible. Contact the check issuer immediately.

Explain the situation and request a new check issued in your name. Do not attempt to forge or alter the check in any way.

Important: Altering a check is illegal and can result in criminal charges.

Alternative Solutions

Consider alternative solutions if cashing or depositing proves difficult. If the check is for a government benefit, contact the issuing agency for assistance.

They may be able to reissue the payment electronically or provide alternative payment options. For insurance payments, contact the insurance company directly.

Contacting the Issuer

The issuer holds the ultimate power to resolve the issue. Explain the problem clearly and politely.

Request a replacement check, an electronic transfer, or another suitable payment method. Document all communications with the issuer, noting dates, times, and contact names.

Next Steps

Immediately contact the check issuer or your bank to explore your options. Delays can complicate the process and potentially lead to lost funds.

Gather all necessary documentation, including identification and proof of entitlement to the funds. Be prepared for potential delays and scrutiny, and remain persistent in your efforts.

For ongoing developments, monitor official government websites or the issuer's communication channels for updates. Stay informed to navigate the process effectively.