How Do I Correct A Payroll Mistake In Quickbooks

Imagine the sinking feeling: paychecks have landed, but something's amiss. An employee was underpaid, taxes were calculated incorrectly, or perhaps a deduction was missed. Payroll mistakes happen, even with the best intentions and software like QuickBooks. The key is knowing how to navigate these errors swiftly and accurately.

Correcting payroll errors in QuickBooks isn't just about fixing numbers; it's about maintaining employee trust, staying compliant with regulations, and ensuring the financial health of your business. This article will walk you through the steps to remedy payroll mistakes in QuickBooks, helping you turn a potential crisis into a smooth resolution.

Understanding the Significance of Accurate Payroll

Accurate payroll is the backbone of a happy and compliant workforce. When employees are paid correctly and on time, morale soars, and trust deepens.

Payroll errors, on the other hand, can lead to disgruntled employees, legal penalties, and financial instability. It's not just about the numbers; it's about the people behind them.

According to the IRS, even unintentional payroll errors can result in penalties, highlighting the importance of meticulous record-keeping and prompt corrections. Compliance is key.

Steps to Correcting Payroll Errors in QuickBooks

Identify the Error

The first step is pinpointing the exact nature of the mistake. Was it a missed deduction, an incorrect wage rate, or a miscalculated tax amount? Detailed documentation is your best friend here.

Carefully review payroll reports, employee timesheets, and any relevant pay stubs. The more information you gather, the easier the correction process will be.

Determine the Type of Correction Needed

QuickBooks offers different methods for correcting payroll errors, depending on when the error occurred and its severity. You might need to adjust a single paycheck or amend an entire payroll period.

Consult the QuickBooks support documentation to identify the most appropriate correction method for your specific situation. There are resources available for every situation.

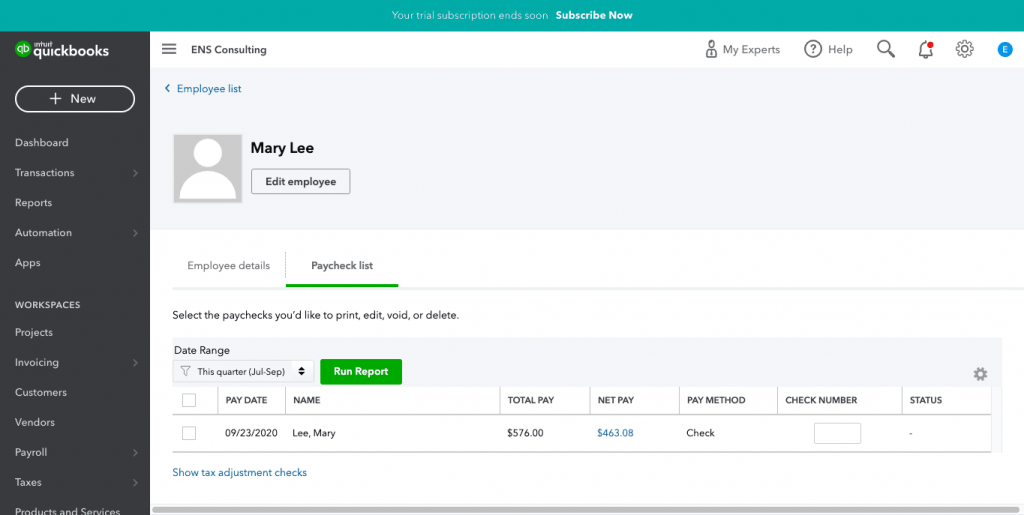

Adjusting a Single Paycheck

If the error is isolated to a single paycheck and discovered before you've filed your payroll taxes, you can often adjust the paycheck directly in QuickBooks. This involves voiding the incorrect paycheck and re-creating it with the correct information.

Navigate to the Employee Center, find the employee, and locate the paycheck. Use the "Void Check" option, and then create a new paycheck with the accurate details.

Amending a Payroll Period

For more significant errors or if you've already filed your payroll taxes, you'll need to amend the payroll period. This involves creating an adjusting entry to correct the financial records and filing amended tax forms with the IRS and state agencies.

QuickBooks provides tools to help you create these adjusting entries and generate the necessary amended tax forms, such as Form 941-X. Don't hesitate to seek professional help if you're unsure about this process.

Document Everything

Meticulous record-keeping is crucial throughout the correction process. Document every step you take, including the original error, the correction method used, and the dates of each action.

This documentation will be invaluable if you ever need to explain the corrections to an auditor or answer questions from employees. Consider this your protection policy.

Communicate with Employees

Transparency is vital when correcting payroll errors. Explain the mistake to the affected employees, apologize for the inconvenience, and assure them that you're taking steps to rectify the situation.

Open communication can help maintain employee trust and prevent misunderstandings. Keep lines of communication open always.

Preventing Future Errors

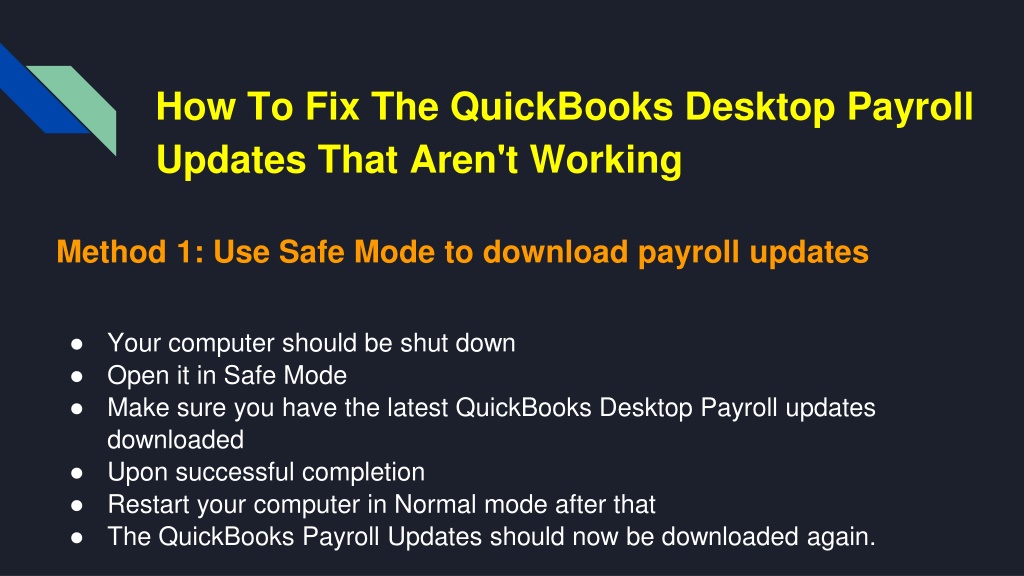

While it's essential to know how to correct payroll errors, preventing them in the first place is even better. Implement robust internal controls, such as double-checking payroll data and regularly reconciling payroll reports.

Consider investing in training for your payroll staff and staying up-to-date on the latest payroll regulations. Proactive measures can save you time, money, and headaches in the long run.

Automating your payroll processes can also reduce the risk of human error. QuickBooks offers features like automated tax calculations and direct deposit, which can streamline your payroll process and improve accuracy.

Seeking Professional Help

If you're unsure about how to correct a payroll error in QuickBooks or if you're dealing with a complex situation, don't hesitate to seek professional help. A certified public accountant (CPA) or payroll specialist can provide expert guidance and ensure that you're complying with all applicable regulations.

Remember, it’s better to ask for help than to risk making further mistakes. The right expert can provide support and clarity.

Correcting payroll errors in QuickBooks can feel daunting, but with careful attention to detail, clear communication, and a willingness to learn, you can navigate these challenges successfully. Embrace the process as an opportunity to strengthen your financial practices and build stronger relationships with your employees.