How Do I Find An Accountant For My Business

Small business owners, time is money. Finding the right accountant can make or break your financial health.

A good accountant does more than just taxes; they provide crucial insights into your business’s financial performance. This article gives you the essential steps to find the perfect financial partner, ensuring compliance and maximizing profitability.

Define Your Needs

What exactly do you need from an accountant? Are you looking for someone to handle basic bookkeeping, or do you need strategic financial planning?

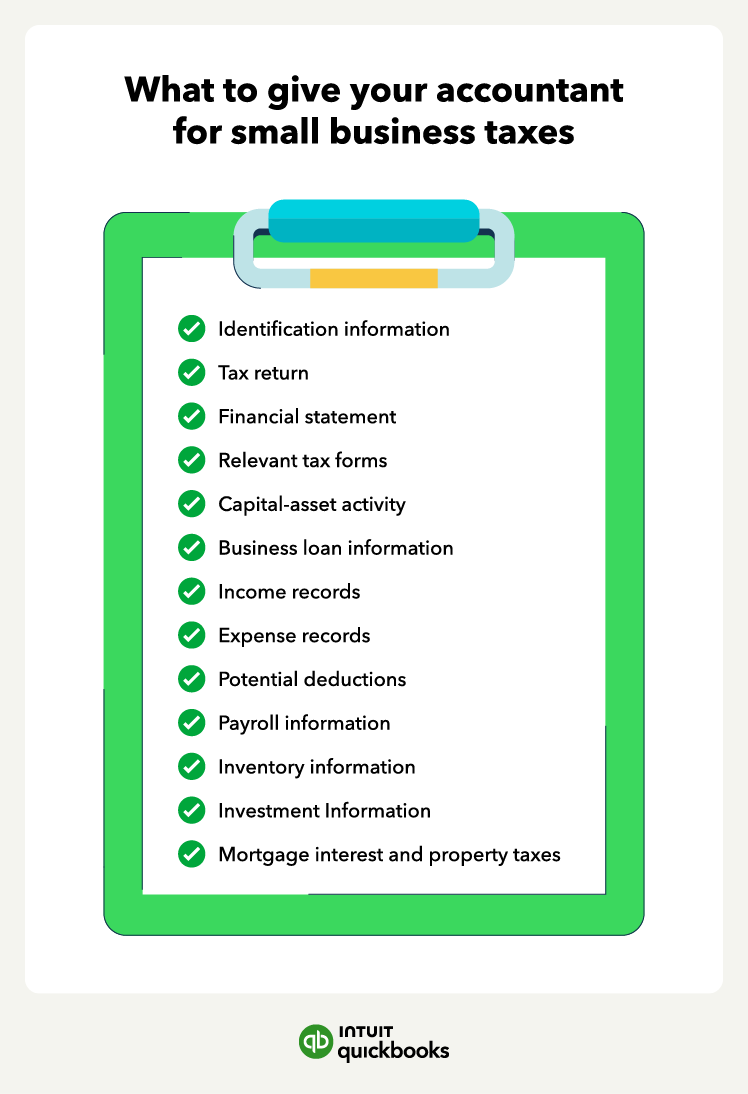

Consider services such as tax preparation, payroll management, and financial forecasting. Determining your specific requirements is the first critical step.

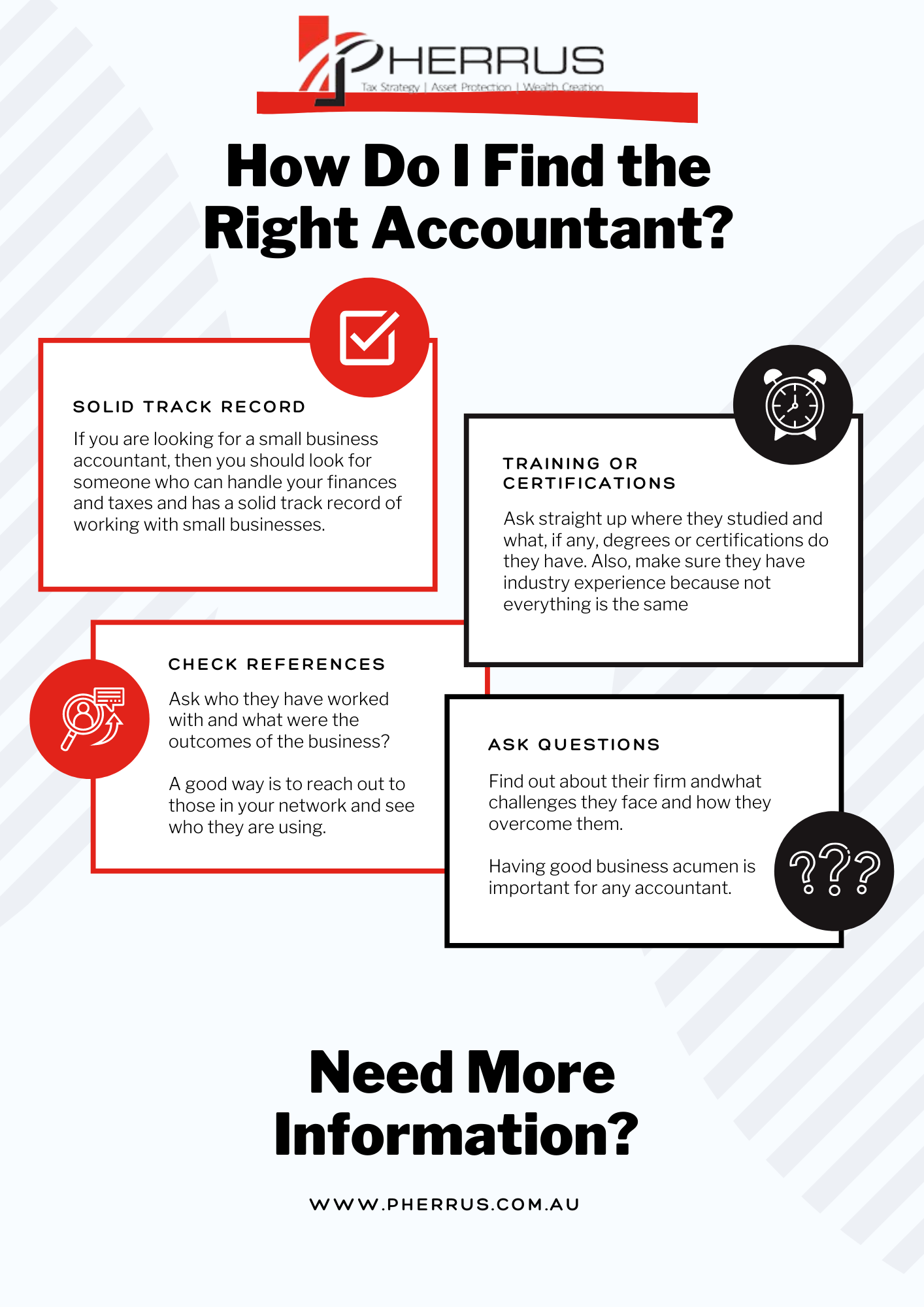

Seek Referrals and Recommendations

Don’t start from scratch. Ask other business owners in your network for referrals.

Personal recommendations often lead to the most reliable professionals. Check online reviews on platforms like Yelp and Google, but prioritize word-of-mouth.

Verify Credentials and Expertise

Ensure your prospective accountant has the necessary qualifications. Look for credentials like Certified Public Accountant (CPA) or Enrolled Agent (EA).

Confirm they have experience working with businesses in your industry. This ensures they understand your specific challenges and opportunities.

Check for Specializations

Does your business require specific accounting expertise? For example, a restaurant needs an accountant familiar with inventory management and sales tax.

An e-commerce business needs someone adept at handling online transactions and multi-state tax compliance. Match the accountant’s specialization to your business model.

Interview Potential Candidates

Meeting potential accountants face-to-face (or virtually) is crucial. Prepare a list of questions regarding their experience, fees, and communication style.

Ask about their approach to problem-solving and their availability. A good accountant should be responsive and proactive.

Understand Their Fee Structure

Accounting fees vary widely. Some accountants charge hourly, while others offer fixed monthly retainers.

Get a clear understanding of their pricing model before committing. Ensure the fees align with your budget and the value they provide.

Assess Communication and Technology

Effective communication is vital. Your accountant should explain complex financial information in a clear and understandable manner.

They should also be proficient in using accounting software like QuickBooks or Xero. This can streamline processes and improve efficiency.

Consider Location (But Don't Prioritize It)

While a local accountant can be convenient, proximity is less important in the age of digital communication.

Focus on finding the best fit for your needs, regardless of location. Many accountants offer remote services and virtual consultations.

Review Contract and Engagement Letter

Before hiring an accountant, carefully review the engagement letter. This document outlines the scope of services, responsibilities, and terms of agreement.

Don’t hesitate to ask questions or negotiate terms. Ensure you are completely comfortable with the arrangement before signing.

Continuously Evaluate Their Performance

Don't just set it and forget it. Regularly assess your accountant's performance.

Are they meeting deadlines, providing valuable insights, and helping you achieve your financial goals? If not, it may be time to reconsider your choice.

The search for the perfect accountant may take time, but it's a worthwhile investment. A skilled accountant can transform your business’s financial outlook.

Start your search today, and take control of your financial future. Don’t wait until tax season to realize you need help; proactive financial management is key to sustained success.