How Do I Get My 1099 Form From Doordash

The new year often brings a mix of excitement and administrative tasks, and for millions of DoorDash drivers, that includes navigating tax season. A crucial document for filing taxes as an independent contractor is the 1099-NEC form. Understanding how to access this form correctly is essential for accurate tax reporting and avoiding potential penalties.

This article provides a comprehensive guide on how DoorDash drivers can obtain their 1099-NEC form. It details the processes, potential challenges, and resources available to ensure a smooth tax filing experience. Accurate reporting is not only legally required but also essential for managing personal finances effectively.

Accessing Your 1099-NEC Form

DoorDash primarily distributes the 1099-NEC form electronically. Drivers must meet certain criteria to receive the form, including earning at least $600 during the tax year. It is generally made available through the DasherDirect app or the DoorDash platform itself.

Steps to Access the Form Online:

First, drivers should log into their DasherDirect account or the DoorDash Dasher portal. Look for a section labeled "Tax Information," "Tax Documents," or similar wording. The 1099-NEC form should be available for download as a PDF document.

If accessing through the DoorDash website, navigate to the "Earnings" or "Payment" section. The 1099-NEC form will typically be listed alongside payment summaries. Ensure the pop-up blocker is disabled in the browser to allow the download.

Troubleshooting Access Issues

If a driver cannot locate the form online, the first step is to verify eligibility. Ensure that earnings exceeded $600 and that all personal information, including address and tax identification number (TIN), is accurate in the DoorDash system.

Sometimes, delays can occur due to processing times or system errors. Check the DoorDash help center or community forums for announcements regarding 1099-NEC distribution. Contacting DoorDash support directly is also a viable option if the form remains inaccessible after a reasonable waiting period.

Alternative Methods and Potential Delays

While electronic delivery is the norm, some drivers might be eligible for a paper copy of the 1099-NEC form. This usually applies if the driver did not consent to electronic delivery or if there are specific account settings that trigger a paper form.

Drivers who qualify for a paper form should ensure their mailing address is current in the DoorDash system. Keep in mind that paper forms can take longer to arrive due to postal service delivery times. Any discrepancies or errors on the form should be reported to DoorDash immediately.

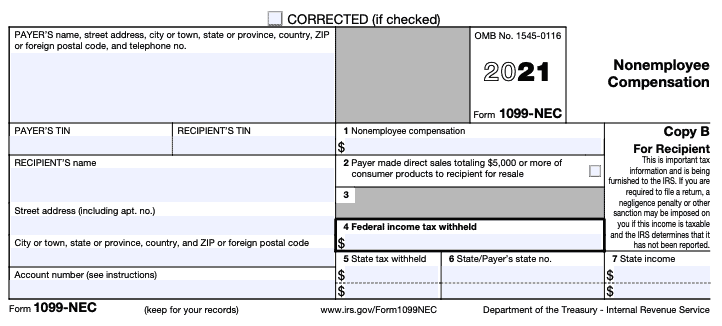

Dealing with Incorrect Information

It is crucial to review the 1099-NEC form for accuracy. Common errors include incorrect names, addresses, or TINs. Any discrepancies should be reported to DoorDash support as soon as possible to request a corrected form, known as a 1099-NEC corrected form.

Filing taxes with incorrect information can lead to delays in processing the tax return or even potential audits. Maintaining accurate records of earnings and expenses throughout the year can help identify errors on the 1099-NEC form more easily.

Resources and Support for Dashers

DoorDash provides several resources to assist drivers with tax-related questions. The DoorDash help center includes articles and FAQs about taxes, 1099-NEC forms, and deductions.

External resources, such as the IRS website and tax preparation software, offer valuable guidance on filing taxes as an independent contractor. Consulting with a tax professional is also recommended, especially for drivers with complex tax situations.

"Accurate tax reporting is essential for all independent contractors, including DoorDash drivers," says a representative from the IRS Small Business/Self-Employed division. "Utilizing available resources and maintaining meticulous records can simplify the tax filing process."

Looking Ahead: Proactive Tax Planning

Tax season can be less stressful with proactive planning. Keeping detailed records of income and deductible expenses throughout the year is crucial. Utilizing accounting apps or spreadsheets can help track finances efficiently.

Furthermore, understanding potential tax deductions available to independent contractors, such as vehicle expenses and business-related costs, can significantly reduce tax liabilities. Engage in ongoing tax planning strategies to optimize financial outcomes.

By understanding the process of obtaining the 1099-NEC form and proactively managing their finances, DoorDash drivers can navigate tax season with confidence. This ensures compliance and maximizes their financial well-being.