How Do I Open A Roth Ira With Vanguard

Imagine a cozy Sunday morning, sunlight streaming through your window as you sip coffee and finally tackle that one financial goal you've been putting off: opening a Roth IRA. It might seem daunting, but taking control of your financial future can be surprisingly empowering. And with a trusted institution like Vanguard, the process is simpler than you might think.

This article will gently guide you through the steps of opening a Roth IRA with Vanguard, demystifying the process and empowering you to take control of your retirement savings. We'll break down the requirements, walk through the online application, and highlight key considerations to ensure a smooth and informed start.

Why Choose Vanguard for Your Roth IRA?

Vanguard has a long and storied history in the investment world. Founded by John C. Bogle, Vanguard is known for its low-cost investment options and its commitment to putting investors first. This is largely due to its unique structure: it is owned by its funds, which in turn are owned by its investors.

This structure translates to lower fees and a broader range of investment choices. When you open a Roth IRA with Vanguard, you’re gaining access to a variety of mutual funds and exchange-traded funds (ETFs) with typically lower expense ratios compared to many other brokerages.

Eligibility and Requirements

Before diving into the application process, ensure you meet the eligibility requirements for a Roth IRA. The most important factor is your income. The IRS sets annual income limits that determine whether you can contribute to a Roth IRA.

For 2024, the maximum Roth IRA contribution is $7,000, or $8,000 if you are age 50 or older. These limits are subject to change annually, so it’s always wise to consult the IRS website or a financial advisor for the most up-to-date information. You'll also need your Social Security number, employer information, and bank account details for funding your account.

Step-by-Step Guide to Opening Your Roth IRA

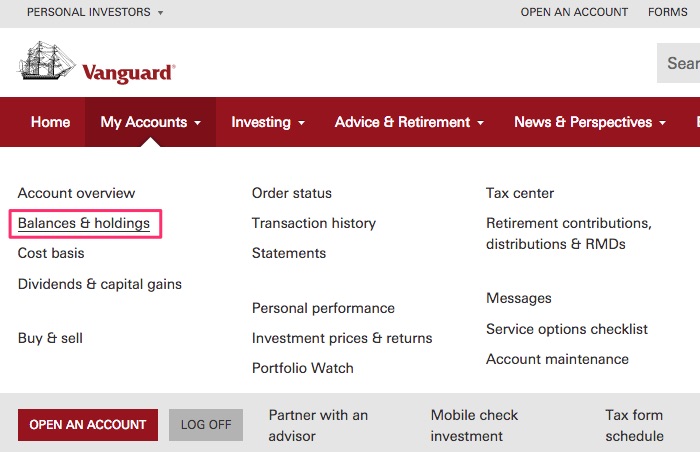

1. Visit the Vanguard Website

Start by navigating to the Vanguard website (vanguard.com). Look for the "Open an Account" or "Retirement Accounts" section. The website is user-friendly, but don't hesitate to explore the resources available if you feel overwhelmed.

2. Choose "Roth IRA"

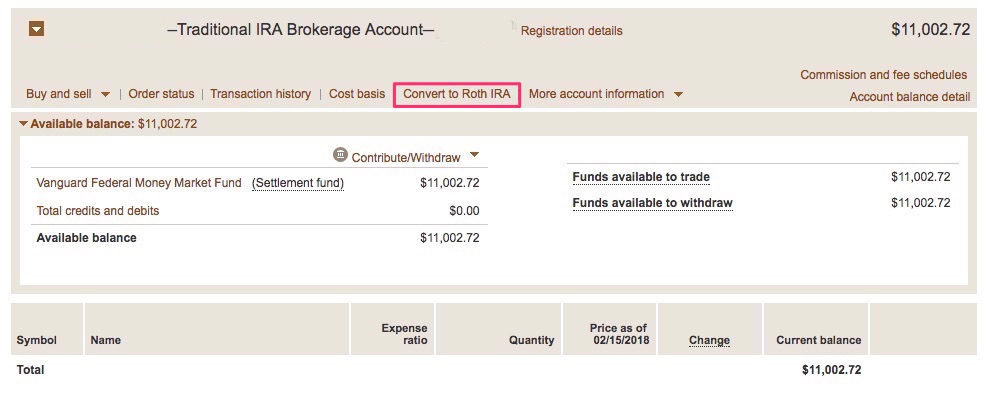

You will be presented with different account options. Select the Roth IRA option. Vanguard will then guide you through a series of questions to determine your eligibility and investment goals.

3. Complete the Online Application

The application will require personal information such as your name, address, date of birth, and Social Security number. You'll also need to provide information about your employment status and income. Answer all questions accurately and honestly.

4. Fund Your Account

Once your account is created, you'll need to fund it. Vanguard offers several ways to fund your Roth IRA, including electronic bank transfers, checks, and wire transfers. Most people find electronic bank transfers the easiest and most convenient method. You will be asked the amount you wish to contribute, keep in mind the annual contribution limits.

5. Choose Your Investments

This is where the fun begins. You can choose from a variety of mutual funds and ETFs. Consider your risk tolerance and investment goals when making your selections. Vanguard offers target retirement funds, which automatically adjust their asset allocation as you get closer to retirement.

“Investing is not about beating others at their game. It's about controlling yourself at your own game.” - Benjamin Graham

Key Considerations

Contribution Limits: Always be mindful of the annual Roth IRA contribution limits set by the IRS.

Investment Choices: Diversify your investments to reduce risk. Vanguard offers a wide array of low-cost options.

Tax Implications: Remember that contributions to a Roth IRA are made with after-tax dollars. However, qualified withdrawals in retirement are tax-free.

Seek Professional Advice: If you're unsure about any aspect of the process, consider consulting a qualified financial advisor.

A Brighter Financial Future

Opening a Roth IRA with Vanguard is a significant step towards securing your financial future. While the process might seem a little complicated at first, Vanguard's user-friendly platform and ample resources make it manageable. Remember, every dollar you save today can make a big difference in your retirement.

So, take a deep breath, gather your information, and start your journey towards a more secure and fulfilling retirement. You've got this!

![How Do I Open A Roth Ira With Vanguard How to Open a Roth IRA at Vanguard [with Screenshots] | White Coat Investor](https://www.whitecoatinvestor.com/wp-content/uploads/2022/07/open-roth-ira-vanguard-img1-768x720.jpg)

![How Do I Open A Roth Ira With Vanguard How to Open a Roth IRA at Vanguard [with Screenshots] | White Coat Investor](https://www.whitecoatinvestor.com/wp-content/uploads/2022/07/open-roth-ira-vanguard-img9.jpg)

![How Do I Open A Roth Ira With Vanguard Vanguard Backdoor Roth Step By Step Guide [Screenshots] | White Coat](https://www.whitecoatinvestor.com/wp-content/uploads/2021/01/Contribute-to-IRA.png)

![How Do I Open A Roth Ira With Vanguard How to Open a Roth IRA at Vanguard [with Screenshots] | White Coat Investor](https://www.whitecoatinvestor.com/wp-content/uploads/2022/07/open-roth-ira-vanguard-img6-768x379.jpg)