How Do I Send Money To Someone In Nigeria

Sending money to Nigeria from abroad has become increasingly common, driven by economic ties, familial support, and business transactions. However, navigating the options and understanding the regulations can be complex. This article provides a comprehensive guide on the various methods available for sending money to Nigeria, highlighting their pros, cons, and key considerations.

The methods for sending money to Nigeria are varied, each catering to different needs and preferences. Understanding these options is crucial to ensuring a smooth and cost-effective transaction.

Popular Money Transfer Methods

Traditional Money Transfer Services

Companies like Western Union and MoneyGram have long been established players in the international money transfer market. They offer widespread accessibility with numerous agent locations in both the sending and receiving countries.

This makes them a convenient option, particularly for those who prefer face-to-face transactions. However, their fees and exchange rates can sometimes be less competitive compared to newer digital alternatives.

Online Money Transfer Platforms

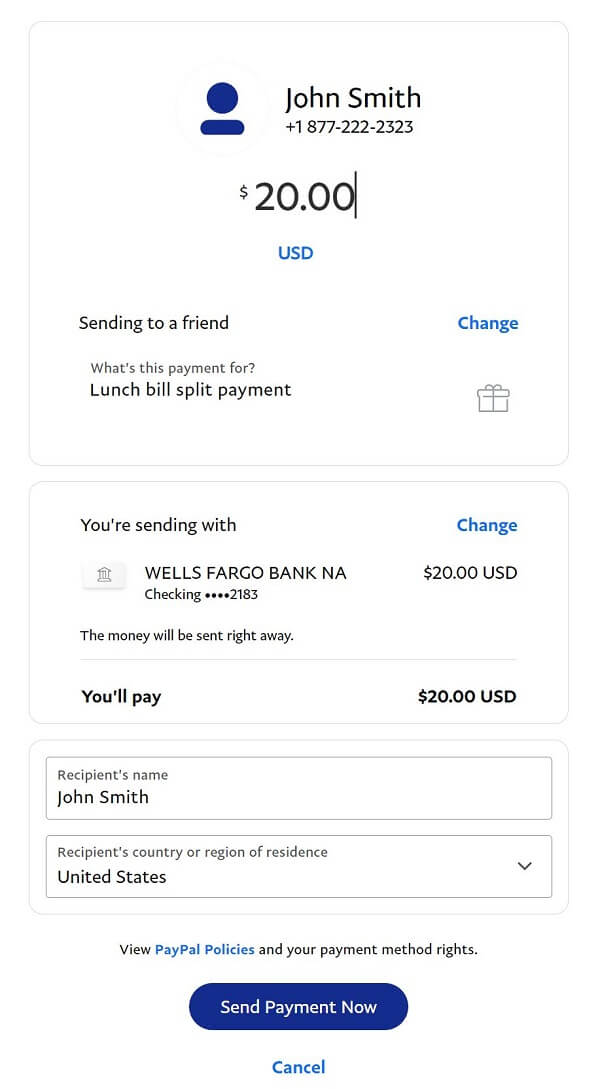

The rise of fintech has led to a surge in online money transfer platforms like Remitly, WorldRemit, and Xoom (a PayPal service). These platforms offer competitive exchange rates and lower fees compared to traditional services.

They typically allow users to send money online or through a mobile app, with recipients able to receive funds directly into their bank accounts, mobile wallets, or at designated pick-up locations. These platforms often feature faster transfer times and greater transparency.

Bank Transfers

Wire transfers through banks are a secure option for sending larger sums of money to Nigeria. However, they generally involve higher fees and can take longer to process compared to other methods.

Banks often require more documentation to comply with international regulations. It’s essential to compare the exchange rates and fees charged by different banks before initiating a transfer.

Mobile Money Services

Mobile money services, such as Flutterwave and Paga (though primarily used within Nigeria), are increasingly facilitating international transfers. These services leverage mobile technology to enable quick and convenient transactions.

Recipients can receive money directly into their mobile wallets and use it for various purposes, including bill payments, purchases, or cash withdrawals. However, availability and functionality may vary depending on the sender's location and the specific service provider.

Key Considerations Before Sending Money

Exchange Rates and Fees

Always compare the exchange rates offered by different providers, as these can fluctuate significantly. Pay close attention to the fees charged, as some providers may have hidden costs that can eat into the amount being sent.

Look for transparent pricing structures and factor in any additional charges, such as receiving fees.

Transfer Limits

Be aware of any transfer limits imposed by the service provider or by Nigerian regulations. Different methods may have varying limits on the amount of money that can be sent per transaction or within a specific time period.

Receiving Options

Consider the recipient's preferences and accessibility when choosing a transfer method. Some recipients may prefer to receive money directly into their bank accounts, while others may find it more convenient to pick up cash at a local agent location.

Ensure that the chosen method aligns with the recipient's needs and circumstances.

Security

Prioritize security when sending money to Nigeria. Use reputable and licensed money transfer providers.

Avoid sending money to unknown individuals or through unverified channels. Protect your personal and financial information by using strong passwords and being cautious of phishing scams.

Regulatory Compliance

Familiarize yourself with the relevant regulations governing international money transfers to Nigeria. Nigerian authorities have implemented various measures to combat money laundering and terrorism financing.

Ensure that your transactions comply with these regulations to avoid any delays or complications.

Potential Impact and Significance

Remittances play a vital role in the Nigerian economy, providing crucial financial support to families and communities. According to data from the World Bank, Nigeria is one of the largest recipients of remittances in Africa.

Understanding the best methods for sending money efficiently and securely can have a significant impact on the well-being of recipients and the overall economy.

Choosing the right method for sending money to Nigeria depends on individual circumstances and priorities. By carefully considering the factors outlined above, senders can ensure that their money reaches its intended recipients safely and efficiently, contributing to both individual livelihoods and the broader Nigerian economy.