How Do You Close Down A Small Business

The scent of freshly brewed coffee no longer wafts from the corner cafe. The once vibrant storefront, its windows filled with quirky, handcrafted goods, now stands quietly, a "For Lease" sign hanging where a "Open" sign once proudly swung. A chapter has closed, but how does one gracefully, and legally, turn the final page on a small business dream?

Closing a small business is a multifaceted process, requiring careful planning, diligent execution, and a healthy dose of emotional fortitude. It's not simply locking the door for the last time, it involves a series of strategic steps, from settling debts to notifying stakeholders, ensuring a smooth transition and minimizing potential legal or financial repercussions.

Understanding the Landscape

For many entrepreneurs, their business is more than just a source of income; it's a passion project, a labor of love etched with countless hours and unwavering dedication. According to the Small Business Administration (SBA), approximately 20% of small businesses fail within their first year, highlighting the inherent risks and challenges in entrepreneurship. This reality underscores the importance of understanding the winding-down process, whether due to financial difficulties, a change in personal circumstances, or simply the pursuit of new ventures.

The Initial Assessment

The first step is a frank and honest self-assessment. Evaluate your financial situation, outstanding debts, and the overall viability of your business. Is there a possibility of salvaging the business through restructuring or attracting investors? Seeking advice from a financial advisor or business consultant can provide valuable insights and objective perspectives.

Legal and Financial Obligations

Once the decision to close is firm, legal and financial obligations take center stage. This involves settling debts with creditors, paying outstanding taxes (both federal and state), and fulfilling any contractual agreements with suppliers or clients. Consult with an attorney and accountant to navigate these complexities and ensure compliance with all applicable regulations.

Properly managing assets is also crucial. This could mean selling inventory, equipment, or other assets to generate funds for settling debts. Consider various options such as liquidation sales, auctions, or selling assets directly to other businesses.

Navigating the Process

Closing a small business involves several key steps that must be handled methodically. Neglecting any of these can lead to future headaches.

Notifying Stakeholders

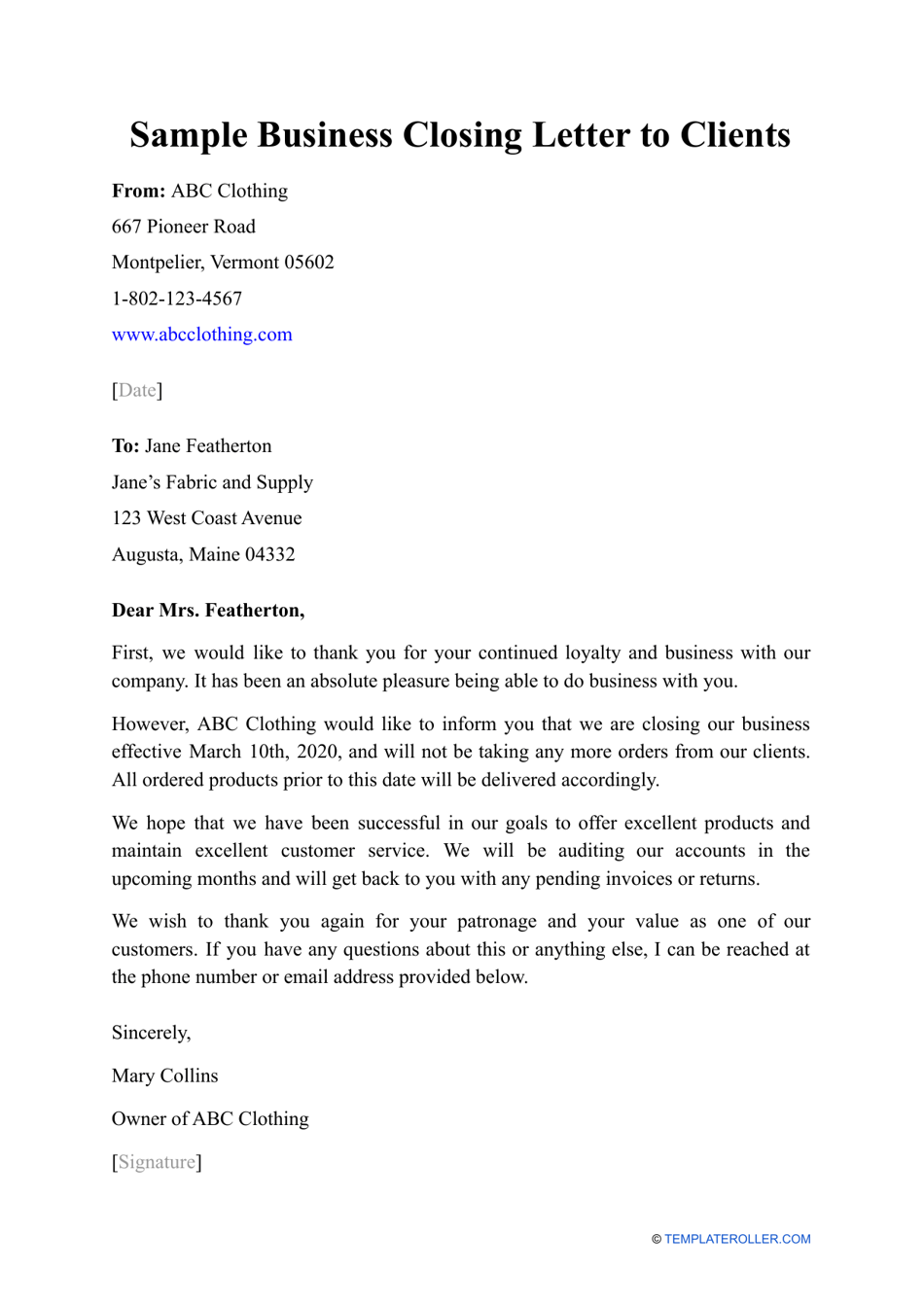

Transparency is paramount. Inform your employees, customers, and suppliers about your decision. Give employees as much notice as possible and provide them with resources to help them find new employment. Handle customer communications with sensitivity, honoring existing commitments and providing alternative solutions where possible.

For suppliers, communicate your intentions clearly and settle any outstanding invoices promptly. Maintaining good relationships, even in closure, can preserve your reputation and prevent future disputes.

Filing the Necessary Paperwork

Formally dissolve your business entity with the state. This typically involves filing articles of dissolution with the relevant state agency. Make sure to cancel any business licenses and permits you hold. This prevents unwanted fees and obligations from accruing.

Taxes and Final Reporting

Prepare and file all necessary tax returns, including your final federal and state income tax returns. You may also need to file payroll tax returns and sales tax returns. Consult with your accountant to ensure accurate reporting and compliance.

"Closing a business is never easy, but doing it right can protect you and your loved ones from unnecessary stress," advises Jane Smith, a certified public accountant specializing in small business closures.

A Reflective Conclusion

Closing a small business is undoubtedly a challenging experience. It can bring feelings of disappointment, regret, and even grief. However, it's also an opportunity for growth, learning, and new beginnings.

Take time to reflect on your journey, celebrating the successes and acknowledging the lessons learned. Remember that closing a business is not a failure but a transition, a chance to apply your knowledge and experience to new endeavors. The entrepreneurial spirit is resilient, and the closing of one chapter can pave the way for an even brighter future.