How Do You Get Money To Start A Business

Imagine this: You're sketching designs on a napkin, a brilliant business idea swirling in your head, a fire in your belly, ready to conquer the world. But then, reality hits – how do you turn this dream into a tangible business? The biggest hurdle: Funding. That daunting question: "Where does the money come from?"

Securing startup capital is a challenge for almost every aspiring entrepreneur. This article breaks down the various funding avenues available to help you launch your business, from bootstrapping and loans to angel investors and crowdfunding, providing a comprehensive overview of options to consider.

Bootstrapping: The Self-Funded Route

Many successful businesses start with bootstrapping. This means using your own savings, personal credit, and revenue generated by the business itself to fund its operations.

It demands frugality and resourcefulness, but it allows you to maintain complete control and avoid debt. It also signals to future investors that you're willing to put your own skin in the game, according to the Small Business Administration (SBA).

Friends, Family, and Fools: A Helping Hand

Often the first stop for budding entrepreneurs is their network of friends and family. While they may not offer large sums, these early supporters can provide crucial seed money.

It's vital to treat these investments with the same seriousness as any other, putting everything in writing and establishing clear repayment terms. Remember, mixing business with personal relationships can be tricky, so transparency is key.

Small Business Loans: Traditional Financing

Traditional small business loans remain a popular option. Banks and credit unions offer various loan products tailored to startups.

However, securing a loan often requires a solid business plan, good credit history, and collateral. The SBA often partners with lenders to guarantee portions of loans, making them more accessible to small businesses.

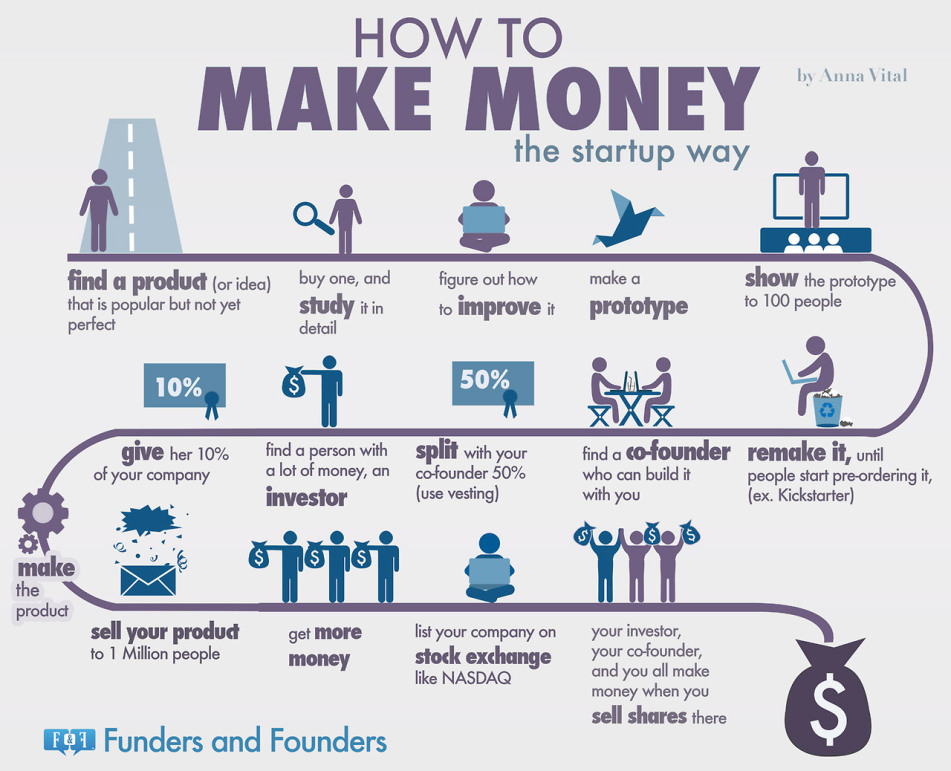

Angel Investors: Strategic Partners

Angel investors are wealthy individuals who invest their own money in startups, typically in exchange for equity. They often provide not only capital but also valuable mentorship and industry connections.

Finding the right angel investor is crucial; look for someone with experience in your industry who can offer strategic guidance. Pitching to angel investors requires a compelling pitch deck and a clear understanding of your business's potential.

Venture Capital: High-Growth Funding

Venture capital (VC) firms invest in high-growth startups with significant potential for return. VC funding is typically larger than angel investments and comes with a greater degree of scrutiny and oversight.

Securing VC funding is a competitive process, requiring a well-developed business model, a strong team, and a clear path to profitability. This option is generally suited for businesses with the potential to scale rapidly.

Crowdfunding: Tapping the Crowd

Crowdfunding platforms like Kickstarter and Indiegogo allow you to raise funds from a large number of people, often in exchange for rewards or pre-orders.

Crowdfunding can be a great way to validate your idea and build a community around your product or service. Successful campaigns require careful planning, a compelling story, and effective marketing.

Government Grants and Programs

Government agencies offer various grants and programs to support small businesses. The SBA provides resources and funding opportunities for entrepreneurs.

Researching and applying for these grants can be time-consuming, but the potential rewards can be significant. Grants often target specific industries or demographics, so ensure your business aligns with the eligibility criteria.

Other Funding Sources to Explore

- Microloans: Smaller loans often available through community organizations.

- Incubators and Accelerators: Programs that provide mentorship, resources, and sometimes funding.

- Revenue-Based Financing: Repayment is based on a percentage of your revenue.

The journey of starting a business is fraught with challenges, but finding the right funding strategy can make all the difference. Whether you choose to bootstrap, seek angel investment, or launch a crowdfunding campaign, remember that perseverance and a compelling vision are essential ingredients for success. It is not just about the money, but how well it is managed and deployed to realize the dreams of the business.

![How Do You Get Money To Start A Business How to Start a Business: A Startup Guide for Entrepreneurs [Template]](https://blog.hubspot.com/hs-fs/hubfs/tips-for-starting-a-business.png?width=1125&name=tips-for-starting-a-business.png)