How Do You Pay Yourself From An Llc

Small business owners, listen up: Misunderstanding how to pay yourself from your LLC can trigger IRS penalties and jeopardize your personal finances. We break down the crucial steps you need to take now.

This guide offers a straightforward explanation on drawing funds from your LLC, tailored for different LLC structures and designed to keep you compliant.

Understanding Your LLC Structure

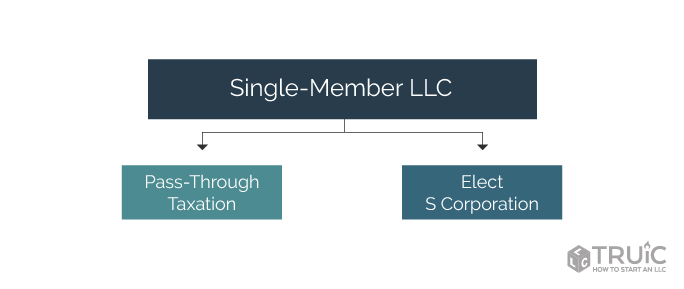

First, identify your LLC's tax classification. Are you a single-member LLC, a multi-member LLC treated as a partnership, or have you elected to be taxed as an S-Corp or C-Corp?

Single-Member LLCs and Partnerships: Owner's Draw

If you're a single-member LLC or a partnership, you'll typically take an owner's draw. This isn't a salary, but rather a direct transfer of funds from the business to yourself.

Crucially, owner's draws are not subject to payroll taxes.

However, these draws are still subject to self-employment taxes (Social Security and Medicare) and income tax.

Accurate record-keeping is paramount to properly calculate your estimated taxes throughout the year.

S-Corp LLCs: Salary and Distributions

If your LLC is taxed as an S-Corp, things change dramatically. The IRS requires you to pay yourself a "reasonable salary" for the work you perform.

This salary is subject to standard payroll taxes (income tax, Social Security, and Medicare). You will also have to pay the employer's share of payroll taxes.

After paying yourself a reasonable salary, you can then take additional distributions, which are not subject to self-employment tax but are still subject to income tax.

What's considered a reasonable salary? The IRS defines it by comparing the job to others of similar expertise in your region.

This means you cannot avoid payroll tax by taking minimal salary and then large distributions. This is a red flag for the IRS.

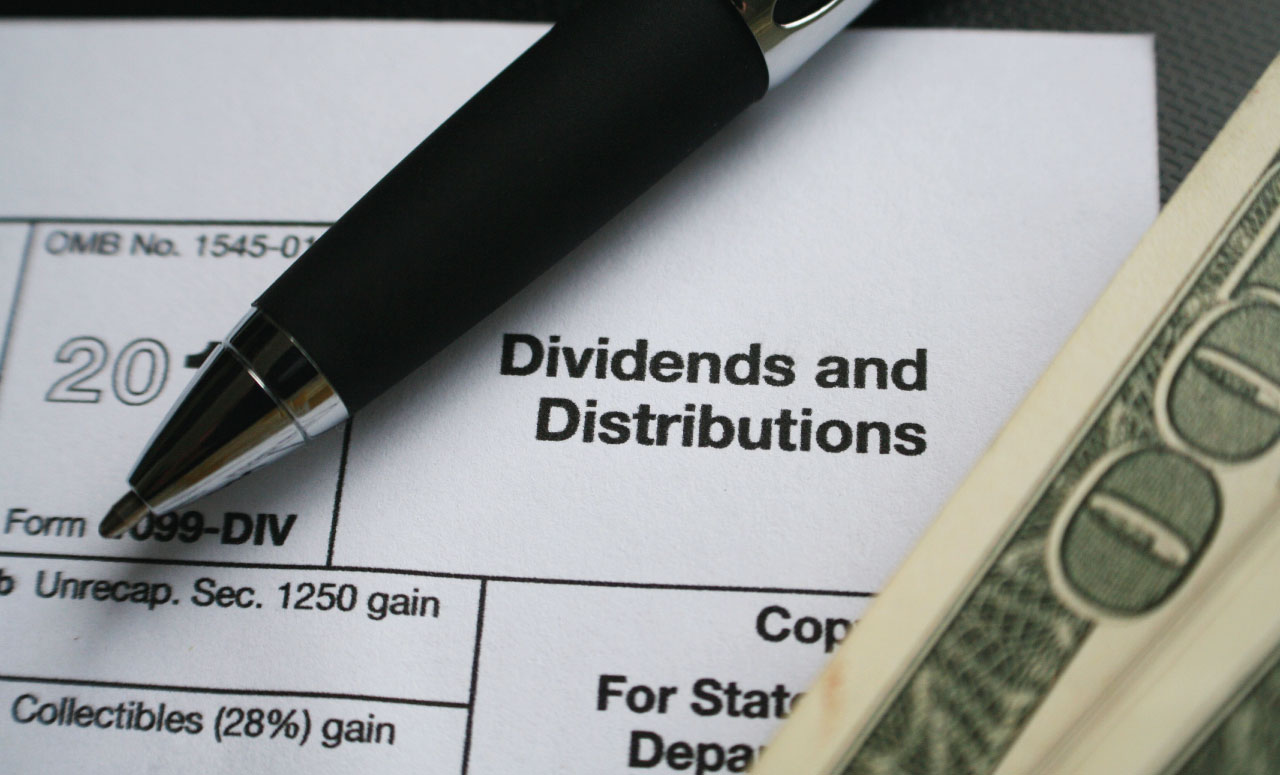

C-Corp LLCs: Salary and Dividends

If taxed as a C-Corp, you can pay yourself a salary, a dividend, or both.

Salaries are taxed similarly to S-Corps, but dividends are taxed twice: once at the corporate level and again at the individual level.

The How-To: Documenting and Executing Payments

Regardless of your LLC structure, document every payment. Use a system that creates a paper trail, whether digital or physical.

Clearly label each transaction as "Owner's Draw," "Salary," or "Distribution" in your accounting system.

Set up a separate business bank account. Never co-mingle personal and business funds; this is vital for maintaining your LLC's liability protection.

For those using payroll, utilize a payroll service or software to ensure accurate tax withholdings and filings.

Tax Implications and Estimated Taxes

All LLC owners, except those under C-corp, need to pay estimated taxes quarterly to the IRS and state tax agencies (if applicable).

Estimated taxes cover income tax and self-employment tax (for single-member LLCs, partnerships, and S-Corps).

Failure to pay estimated taxes can result in penalties.

Compliance is Key: Don't Risk Penalties

Misclassifying payments or failing to keep accurate records can trigger an IRS audit and hefty penalties. Consult with a qualified accountant or tax advisor for personalized guidance tailored to your specific LLC structure and business operations.

Ignoring these steps could cost you significant money and legal trouble. Stay informed and take action today.