How Does A Business Owner Get Paid

Imagine the aroma of freshly brewed coffee filling the air, the gentle hum of a laptop, and the quiet satisfaction of seeing your brainchild thrive. You've poured your heart and soul into your business, navigating challenges, celebrating milestones, and building something truly special. But as a business owner, a crucial question lingers: How do you actually get paid?

Understanding the intricacies of owner compensation is vital for financial stability and long-term business success. This article explores the various methods business owners use to pay themselves, considering different business structures and their implications.

The Foundation: Business Structure Matters

The way you get paid as a business owner is intrinsically linked to your business structure. Whether you're a sole proprietor, a partner in a partnership, or the owner of a limited liability company (LLC) or corporation, the rules of the game differ significantly. Let's delve into the specifics.

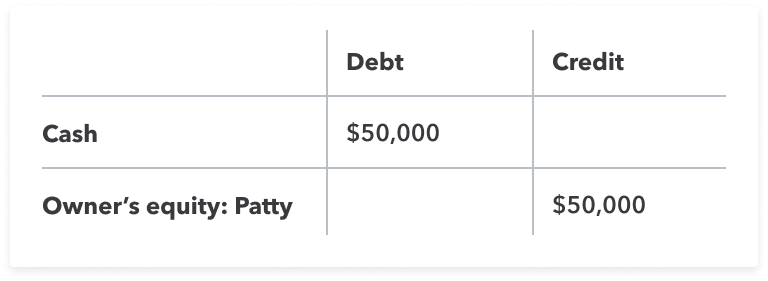

Sole Proprietorship and Partnerships: Direct Draw

For sole proprietorships and partnerships, the process is often the most straightforward. Owners typically take an owner's draw, which is essentially transferring funds from the business account to their personal account. It's not considered a salary, but rather a distribution of profits.

However, it's crucial to remember that even though it's a direct draw, it's still subject to self-employment taxes. According to the Small Business Administration (SBA), understanding your tax obligations is paramount to avoiding penalties and ensuring financial health.

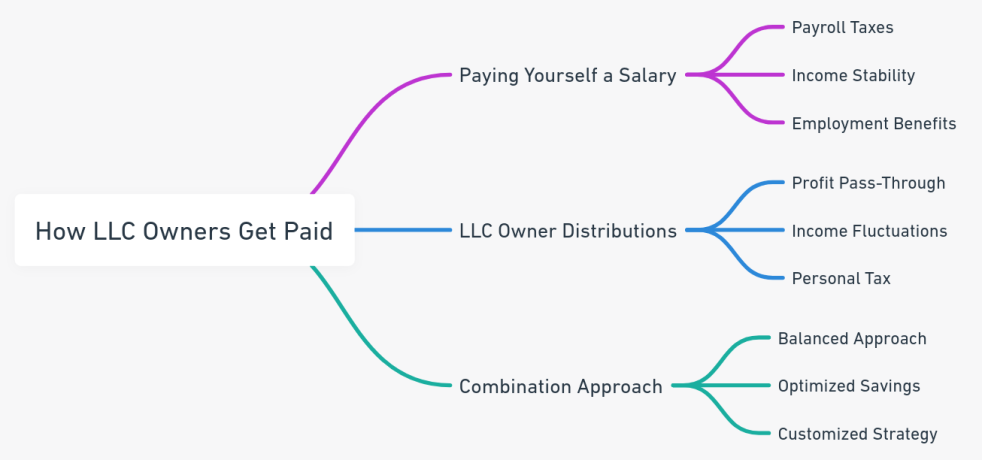

LLCs: Flexibility with Options

LLCs offer more flexibility in how owners are compensated. They can choose to be taxed as a sole proprietorship/partnership, an S corporation, or a C corporation. This election dramatically impacts how owners are paid and taxed.

If taxed as a sole proprietorship or partnership, the owner takes a draw, similar to the structures mentioned earlier. If taxed as an S corporation, the owner can be an employee of their own company and receive a salary.

The IRS emphasizes the importance of paying yourself a “reasonable salary” when taxed as an S corporation. This helps avoid scrutiny and potential reclassification of distributions as wages, subject to payroll taxes.

Corporations (S Corps and C Corps): Salary and Dividends

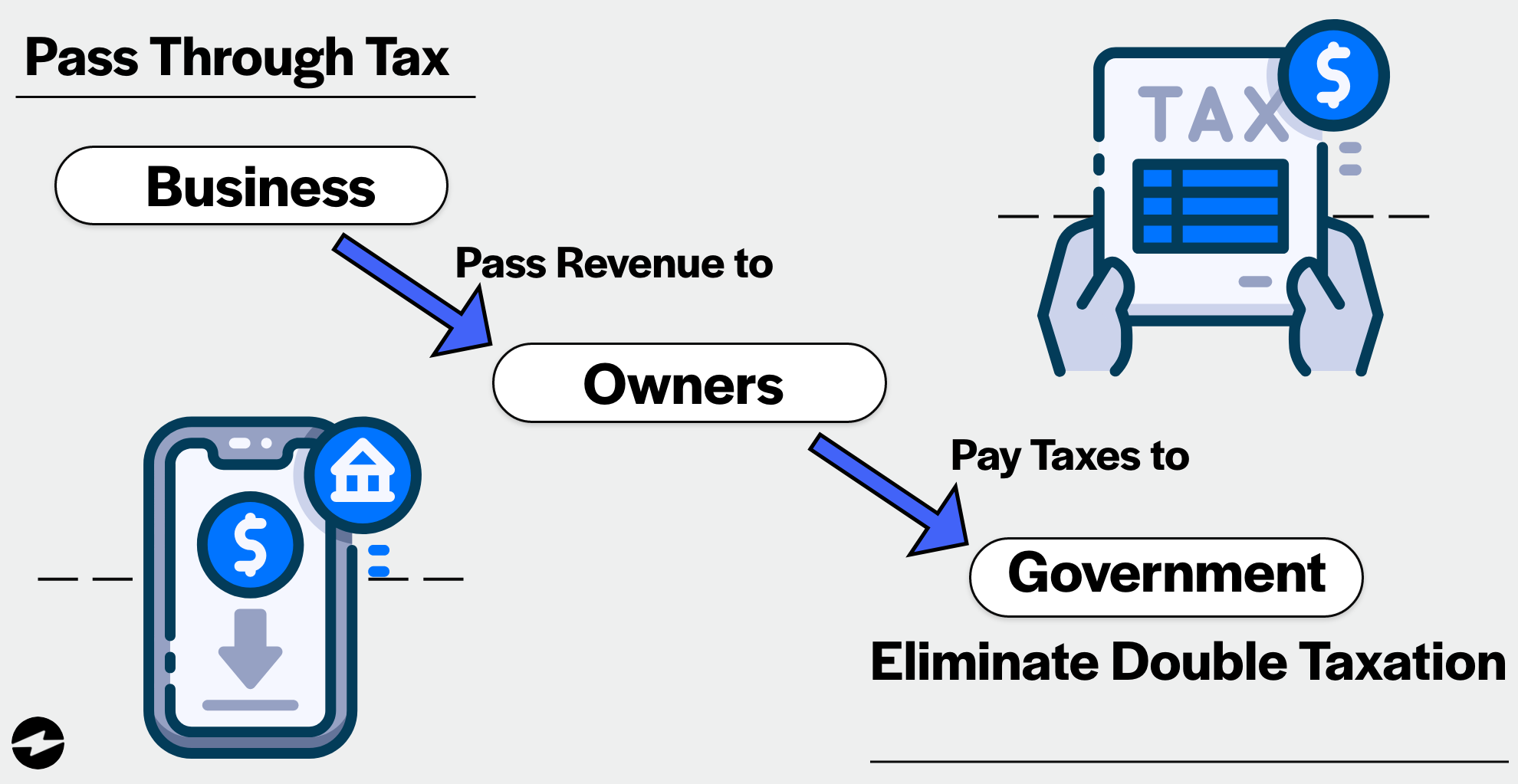

In the corporate world, specifically S corporations and C corporations, owners are typically considered employees. This means they receive a salary, subject to payroll taxes like Social Security and Medicare.

S corporations, as pass-through entities, pass profits and losses directly to the owners' personal income. C corporations, on the other hand, are subject to corporate income tax before profits are distributed to shareholders as dividends, which are then taxed again at the individual level. This is often referred to as "double taxation."

Beyond Salary: Other Forms of Compensation

Beyond the basic salary or draw, business owners can leverage other compensation methods to enhance their financial well-being. This includes benefits and perks.

Benefits like health insurance, retirement contributions (401(k) or SEP IRA), and life insurance can significantly reduce your tax burden while providing valuable security. Consult with a financial advisor to tailor these benefits to your specific needs and business structure.

Furthermore, consider reimbursements for business expenses. Properly documented expenses incurred on behalf of the business, such as travel, meals, and supplies, can be reimbursed without being considered taxable income, according to accounting principles.

The Significance of Careful Planning

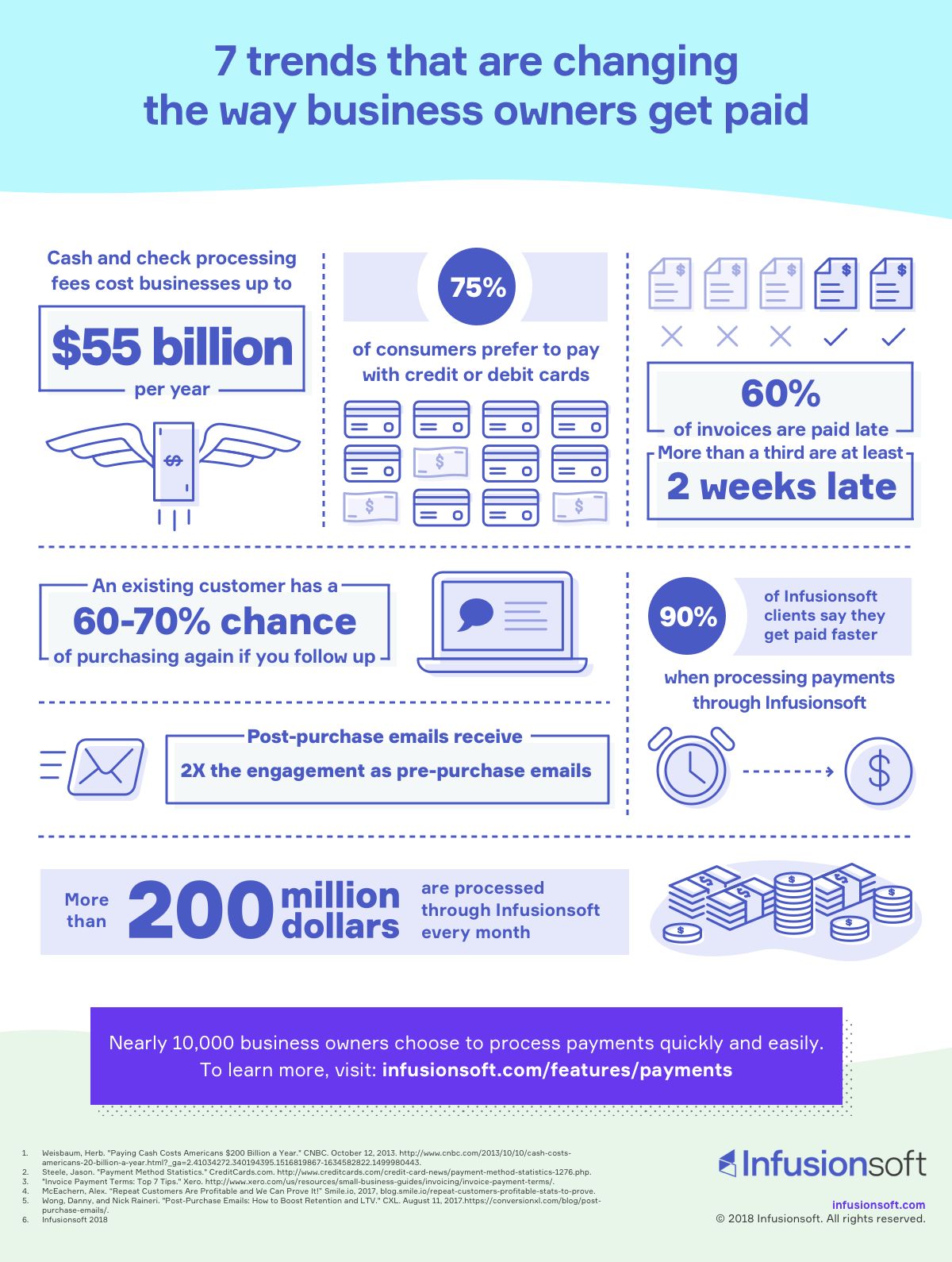

Choosing the right compensation strategy is not just about getting paid; it's about optimizing your financial situation and ensuring the long-term sustainability of your business. Seek professional advice from accountants and financial advisors.

Proper financial planning can help minimize your tax liability, maximize your personal income, and provide a clear roadmap for your business's financial future. Ignoring this aspect can lead to unexpected tax burdens and hinder your business's growth potential.

Remember, the journey of a business owner is one of constant learning and adaptation. Understanding how to pay yourself is a critical piece of the puzzle, enabling you to reap the rewards of your hard work and build a thriving enterprise. It’s a journey of turning passion into prosperity, one paycheck at a time.