How Long Does It Take H&r Block To File Taxes

The annual ritual of tax filing looms large for millions, bringing with it a mix of anxiety and anticipation. For many, H&R Block, a ubiquitous presence in the tax preparation landscape, is the go-to solution. But a burning question remains: how long does it actually take H&R Block to file your taxes?

Understanding the time commitment involved in using H&R Block's services is crucial for effective planning and minimizing tax season stress. This article delves into the factors influencing the filing timeline, exploring the different avenues H&R Block offers, from in-person consultations to online platforms, and providing a realistic expectation of the time required to complete the process.

Factors Influencing Filing Time

The time it takes H&R Block to file taxes is far from a one-size-fits-all scenario. Several key factors contribute to the variability in completion time.

Complexity of Tax Situation: A straightforward return, like one involving only W-2 income and standard deductions, will naturally take less time than a return with multiple income sources, itemized deductions, or business income. H&R Block themselves acknowledge that complex returns require more processing and review.

Method of Filing: The choice between in-person, virtual, or online DIY filing significantly impacts the timeline. In-person consultations often involve scheduled appointments and document preparation beforehand. Online filing, while offering flexibility, still requires meticulous data entry and review.

In-Person Tax Preparation

Opting for in-person tax preparation at an H&R Block office offers the advantage of personalized guidance from a tax professional. The initial appointment typically involves a thorough discussion of your tax situation and document review.

According to various online forums and anecdotal evidence, the appointment itself can range from one to three hours, depending on complexity. However, this doesn't include the time spent gathering necessary documents beforehand, which can add several hours, or even days, to the overall process.

Wait times: During peak season (typically late March and early April), securing an appointment and processing the return might extend the overall timeline.

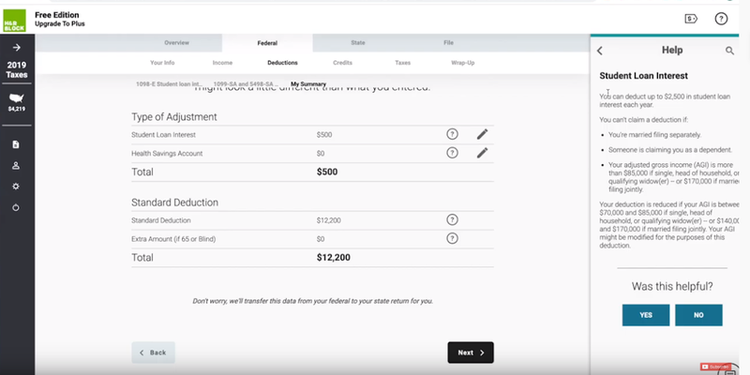

Online Tax Filing

H&R Block's online platform caters to those seeking a more self-directed approach. The process involves creating an account, entering tax information, and utilizing the platform's tools for guidance.

The time required for online filing hinges on the user's familiarity with tax forms and the complexity of their return. Simple returns can potentially be completed in as little as an hour or two, while more intricate situations may demand several hours spread across multiple sessions.

User Skill: The user interface, while generally user-friendly, might pose a challenge for individuals unfamiliar with tax software or terminology.

Virtual Tax Pro

H&R Block also offers a virtual tax pro service, blending the convenience of online filing with the expertise of a tax professional. This option typically involves uploading documents securely and communicating with a tax pro through video conferencing or messaging.

The processing time for virtual tax pro services can vary depending on the pro's availability and the complexity of the return. A crucial factor is the responsiveness and communication between the client and the tax professional.

Communication Delay: Delays in communication or document submission can naturally extend the filing timeline.

Gathering Necessary Documents

Regardless of the chosen method, gathering all necessary tax documents is a fundamental step that significantly impacts the overall filing time. This includes W-2 forms, 1099 forms, receipts for deductible expenses, and any other relevant financial records.

Document Organization: Well-organized documents streamline the process, minimizing the time spent searching for information and reducing the risk of errors. Rushing this phase can result in delays and potentially inaccurate returns.

H&R Block offers checklists and resources to help taxpayers identify the required documents for their specific situation.

Potential Delays and Extensions

Unforeseen circumstances can sometimes lead to delays in filing. Unexpected issues with the software, missing information, or communication barriers can all contribute to extended timelines.

Filing Extension: If unable to file by the deadline, taxpayers can request an extension. However, it's crucial to remember that an extension only provides more time to file, not to pay any taxes owed.

H&R Block can assist with filing for an extension if needed.

Looking Ahead

H&R Block is continuously working on improving its efficiency and streamlining the tax filing process. Investing in technological advancements and enhancing user experience remains a priority for the company.

Taxpayers can proactively minimize filing time by staying organized, gathering necessary documents in advance, and choosing the filing method that best suits their needs and comfort level. Staying informed about tax law changes and utilizing the resources provided by H&R Block can also contribute to a smoother and more efficient filing experience.

Ultimately, the time it takes H&R Block to file taxes is a dynamic process, influenced by a confluence of factors. By understanding these factors and taking proactive steps, taxpayers can navigate the tax season with greater confidence and minimize the stress associated with filing their returns.